So, you’ve heard the siren call of “buy the dip!” echoing across Crypto Twitter, and your inner bargain hunter is salivating. But before you throw your hard-earned cash at a plummeting chart like it’s Black Friday at the Bitcoin store, let’s pause for a sanity check. Because not every dip is a discount—sometimes it’s just the appetizer before a three-course meal of financial regret. The crypto world is full of opportunities to buy low and sell high, but it’s also littered with death spirals and rug pulls that can turn your portfolio into a digital graveyard faster than you can say “LUNA collapse.”

The Fine Line Between Buying the Dip and Catching a Falling Knife

Let’s get one thing straight: safe crypto dip buying isn’t about heroically diving into every red candle like you’re auditioning for an action movie. There’s a crucial difference between buying the dip and what Redditors affectionately call catching a falling knife. The latter usually ends with your hands (and portfolio) in bandages.

Buying the dip means scooping up assets when they’re temporarily undervalued—think of it as snagging avocados on sale because they’re slightly soft, not because they’ve turned into guacamole in the produce aisle. On the other hand, catching a falling knife is pouring all your funds into something that’s still in freefall, hoping for a bounce that may never come. Spoiler: Sometimes gravity wins.

The Death Spiral: When Dips Turn Deadly

If you’re wondering what separates a juicy dip from an impending disaster, let me introduce you to everyone’s least favorite crypto phenomenon—the death spiral. This isn’t just another scary-sounding buzzword; it’s what happens when confidence collapses so hard that even diamond hands start sweating.

The most infamous example? The Terra/LUNA implosion, where an algorithmic stablecoin went from “the next big thing” to “cautionary tale” faster than you could refresh CoinMarketCap. Once panic sets in and automated selling kicks off, prices can spiral downwards in an unstoppable cascade—a literal death spiral.

- Warning signs: Sudden loss of confidence, depegged stablecoins, or project founders suddenly developing laryngitis on social media.

- What to do: Don’t try to be a hero. If everyone is running for the exits (and especially if withdrawals are paused), this isn’t bargain hunting—it’s disaster tourism.

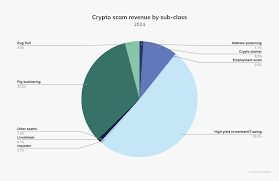

Avoiding Rug Pulls: Not Every Dip Is Your Friend

You know what’s worse than buying into a death spiral? Getting rugged so hard your wallet needs therapy. For newcomers: A rug pull is when developers or insiders drain liquidity from their own project after hyping it up, leaving everyone else holding bags emptier than their promises.

Top Warning Signs of Crypto Rug Pulls

-

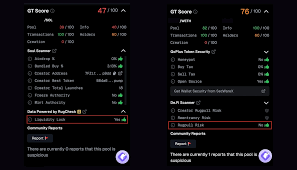

Anonymous Founders: If the team is as mysterious as Bigfoot, run! No faces, no LinkedIns, just cartoon avatars? Red flag!

-

Too-Good-To-Be-True Yields: Promising 10,000% APY? Even your grandma’s cookie recipe isn’t that sweet. Beware of sugar-coated scams!

-

Locked Liquidity? Nope! If the project’s liquidity isn’t locked, your funds could vanish faster than your last Tinder match. Always check those locks!

-

Zero Audit Evidence: No audit, no entry! If their code hasn’t been checked by pros, your money might be checked out forever.

-

Sudden Social Hype: If influencers are shilling harder than a used car salesman, and the project appeared overnight, it’s probably a pump-and-dump party.

-

Suspicious Tokenomics: If the team holds more tokens than a toddler with Halloween candy, expect a sugar crash soon!

The difference between dip and rug pull? In one scenario, there might be hope for recovery; in the other, hope left town with your ETH. So how do you spot these traps before they snap shut?

- Lack of transparency: Anonymous teams or vague whitepapers are red flags waving frantically at you.

- No locked liquidity: If liquidity can vanish overnight—so can your investment.

- Pump-and-dump patterns: If price charts look like heart monitors after six cups of coffee, beware.

- Do your own research (DYOR): Always check community sentiment and audit reports before clicking ‘buy’ on anything promising 1000% APY.

If all this sounds overwhelming—good! Healthy skepticism is what keeps your portfolio alive during bear markets (and helps avoid starring in future cautionary YouTube documentaries). Stay tuned as we break down actionable steps for how to buy the dip safely without becoming another statistic on Crypto Twitter’s Wall of Regret…

But wait—how do you actually separate a healthy discount from a one-way ticket to Rektsville? If you’re thinking, “Surely there’s a checklist for this,” congratulations, you’re smarter than 97% of people who FOMO into meme coins at 3 AM. The reality is, the crypto market is full of mirages: what looks like a refreshing dip might just be the quicksand beneath a collapsing project. Let’s get tactical and talk about how to spot the difference between a temporary markdown and an irreversible markdown (a.k.a. when your coin’s price chart starts to resemble a ski slope).

Spotting Safe Dips: Your Crypto Survival Toolkit

If you want to master how to buy the dip safely, it’s time to channel your inner detective. Forget Sherlock Holmes’ deerstalker hat—what you need is data, skepticism, and maybe a bit of caffeine.

- Check the fundamentals: Is this just normal volatility or has something fundamentally broken? Did Bitcoin drop because Elon Musk tweeted something cryptic, or did your altcoin’s entire team vanish into thin air?

- Volume tells all: Healthy dips are usually accompanied by increased trading volume as buyers step in. If volume dries up faster than your optimism during tax season, beware—a lack of buyers means no one wants to catch that knife.

- Community pulse: Is the project still active on social media? Are devs posting updates, or has their Discord turned into a ghost town?

- Exchange health: Are major exchanges pausing withdrawals or delisting tokens? That’s not just smoke—it’s an inferno.

The secret sauce here is context. A sudden dip during an overall bull market might be a juicy opportunity; that same dip in the middle of cascading liquidations could be financial self-sabotage with extra steps. Remember: bear markets can make even solid projects look like they’ve been left out in the rain too long.

Red Flags That Scream “Run!” (Or At Least Walk Briskly Away)

If you spot any of these death spiral warning signs, it’s time to reconsider your “buy-the-dip” ambitions:

- Stablecoins losing their peg: If your so-called “stable” asset suddenly isn’t so stable (ahem, UST), run don’t walk.

- Panic selling with no bottom in sight: When everyone is dumping and nobody is buying except bots and thrill-seekers.

- Lack of transparency from project leaders: If founders go radio silent or start speaking only in riddles on Twitter Spaces.

- Price action breaking multi-year support levels: That’s not just a dip—it could be structural failure.

Have you ever mistaken a crypto death spiral for a buying opportunity?

Sometimes a price dip looks like a bargain, but it could be a sign of deeper trouble. Share your experience!

DYOR: The Only Acronym That Could Save Your Wallet

If there’s one piece of advice that never goes out of style—besides “don’t eat yellow snow”—it’s DYOR (Do Your Own Research). Before you ape into any coin because someone on TikTok did a dance about it, take some time to dig deeper. Read whitepapers (or at least skim them while pretending), check for third-party audits, and see if there are any recent news stories about hacks or exploits related to your target token.

The bottom line? You want dips that are caused by irrational fear or short-term news—not by catastrophic flaws or criminal intent. If you see warning signs stacking up like bad Tinder dates, pass on that “deal.” There will always be another opportunity—crypto isn’t going anywhere (unless it gets rugged again).

If you’re still not sure whether you’re staring at an undervalued gem or another tragic rug pull waiting to happen, remember: sometimes sitting on your hands is the best investment strategy of all. Or as one wise trader put it…

Buckle up—the next section will walk through actionable steps for safe crypto dip buying without turning your portfolio into digital confetti!

And now, you’re armed with the knowledge to sidestep the worst crypto disasters—no more buying “dips” that turn out to be bottomless pits. But let’s not get cocky; even the most seasoned traders can mistake a classic dip for a death spiral if they’re running on caffeine and hopium alone. The market is always ready to humble you, especially when FOMO is whispering sweet nothings in your ear at 2 AM.

Action Steps: How to Buy the Dip Without Getting Dipped On

Ready to buy that glorious dip? Not so fast, cowboy. Here’s your safe crypto dip buying playbook—because if you’re going to dance with volatility, you’d better know the steps.

- Set a budget (and stick to it): Never invest more than you can afford to lose. That means no YOLOing your rent money into Dogecoin because “it looks cheap.”

- Use limit orders: Don’t just market buy into freefalling prices. Set strategic limit orders at support levels—think of it as leaving cheese for the price mouse instead of chasing it around the kitchen.

- Diversify, don’t double down: If your favorite coin is dipping, consider spreading risk across multiple assets instead of going all-in on one potential disasterpiece.

- Secure your assets: Use reputable exchanges and wallets; avoid sketchy platforms promising miracle returns.

- Avoid leverage unless you enjoy high-stakes stress: Leverage can turn a small dip into a margin call faster than you can say “rekt.” Unless you like living dangerously (and losing sleep), steer clear.

If this feels like a lot of work, good! Crypto isn’t supposed to be easy money (unless you’re Satoshi Nakamoto). It pays—literally—to be methodical and skeptical. Remember: every time someone gets rugged, an angel loses its wings… or at least its seed phrase.

Don’t Go It Alone: Community Wisdom and Real-Time Research

The crypto crowd is many things—loud, passionate, occasionally meme-obsessed—but they’re also a great early warning system for impending doom. Before you buy any dip, check in with community forums or Crypto Twitter for real-time vibes checks. Is everyone panicking? Are mods deleting posts faster than tokens are vanishing from liquidity pools? That’s your cue to step away and reevaluate.

You can also use tools like CoinGecko or CoinMarketCap for price history and volume analysis—or just stalk Discord servers until someone leaks inside info (kidding… mostly).

A Quick Reality Check Before You Click “Buy”

If your hands are sweating and your heart is racing before making that purchase… pause! Take five minutes to run through this sanity checklist:

- Has there been an official update from project devs?

- Is trading volume healthy—or has everyone left the party?

- Are major exchanges still supporting deposits and withdrawals?

- Has the project passed any recent audits?

If everything checks out—and only then—you might have found yourself an honest-to-goodness discount instead of another ticket on the S.S. Sunk Cost Fallacy.

The Final Word: Survive Today, Thrive Tomorrow

The truth is, there’s no shame in missing out on one “opportunity” if it means dodging ten disasters. The best investors aren’t those who catch every falling knife—they’re the ones who keep their fingers intact long enough to see another bull run. So next time someone shouts “buy the dip!” ask yourself: Is this really a bargain… or am I about to star in my own personal episode of Crypto Fails?

Have you ever mistaken a crypto ‘death spiral’ for a buying opportunity?

Sometimes it’s hard to tell a genuine discount dip from a dangerous death spiral. Share your experience!

If nothing else, remember this golden rule: There will always be another dip. But there’s only one you—and hopefully only one wallet password you haven’t forgotten yet.

Buckle up out there—and may all your dips be deliciously recoverable!