Choosing the right crypto exchange is one of the most important decisions you’ll make as an investor or trader. The marketplace is crowded, with platforms catering to every possible experience level and investment strategy. Whether you’re after low fees, a wide selection of coins, or ironclad security, your choice will shape your entire crypto journey. Let’s break down the key factors that separate the top exchanges—and help you zero in on what matters most for your goals.

What Kind of Crypto User Are You?

Before diving into features and fees, take a moment to consider your own needs. Are you a beginner looking for simplicity and educational resources? An active trader needing advanced charting tools? Or maybe you want to stake coins or earn yield on idle assets? There’s no one-size-fits-all answer, so start by matching your platform to your priorities.

Types of Crypto Users Explained

-

Beginner: New to crypto, values simplicity and easy onboarding. Seeks intuitive platforms with strong customer support.

-

Trader: Focused on fast transactions and advanced tools. Looks for exchanges with real-time charts, low fees, and high liquidity.

-

Investor: Prioritizes security and long-term storage. Prefers platforms with robust asset protection and diverse coin offerings.

-

Yield-Seeker: Seeks passive income through staking, lending, or DeFi. Chooses exchanges with high-yield opportunities and transparent rewards.

Security should always be non-negotiable. Look for exchanges with robust two-factor authentication (2FA), cold storage for digital assets, and transparent proof-of-reserves audits. For more on security best practices, check out our guide to crypto wallet safety.

Key Features That Matter

Here’s where exchanges really start to differentiate themselves. Consider these core aspects:

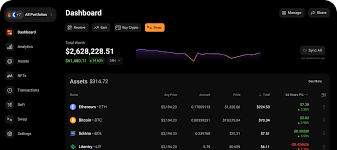

- Supported Cryptocurrencies: Some platforms offer just a handful of major coins like Bitcoin and Ethereum; others list hundreds of altcoins—great if you want portfolio diversity.

- User Experience: Is the interface intuitive? Are there mobile apps? Does customer support respond quickly?

- Trading Fees: Look beyond flashy sign-up bonuses—low trading fees add up over time. Check if they use a maker-taker model or flat rates.

- Deposit & Withdrawal Options: Can you fund with fiat (USD/EUR/GBP), bank transfers, or only crypto?

- KYC Requirements: Some exchanges require full identity verification; others let you trade anonymously up to certain limits.

If you’re curious about how different exchanges stack up by these criteria, explore our comprehensive best crypto exchanges roundup.

The Big Names: Pros & Cons

The market leaders—like Binance, Coinbase, Kraken, and Gemini—each have their own strengths and quirks. Here’s a quick snapshot comparing some top contenders:

| Exchange 🏦 | Main Strength 💪 | Main Weakness ⚠️ |

|---|---|---|

| Binance | Diverse altcoins & low fees | User interface can overwhelm beginners |

| Coinbase | User-friendly & high liquidity | Higher fees than competitors |

| Kraken | Strong security & fiat options | KYC process can be slow |

| Gemini | Tight US regulation compliance | Narrower coin selection than Binance/Coinbase |

If privacy is your top concern—or if you’re trading from outside major Western markets—you might want to investigate decentralized exchanges (DEXs) like Uniswap or PancakeSwap. For an in-depth comparison between centralized vs decentralized platforms, see our article on the differences between DEXs and CEXs.

Your needs will evolve as you gain experience in the space. Many seasoned investors keep accounts at two or more exchanges: one for buying/selling major coins with fiat currency (a “fiat ramp” like Coinbase or Kraken) and another for accessing niche tokens or advanced trading tools.

This approach not only increases flexibility but can also help mitigate risks should one platform experience downtime or technical issues. To stay updated on exchange outages and real-time status reports, bookmark our live tracker page.

Regulation is another crucial factor, especially if you’re investing significant amounts or planning to use crypto as part of a broader portfolio. Exchanges registered with financial authorities in your country offer stronger consumer protections and clearer tax reporting. However, they may limit access to certain coins or features due to local laws. Always check the latest regulatory updates for your region before committing funds.

Advanced Tools and Ecosystem Perks

For those looking beyond simple buy-and-hold strategies, some exchanges stand out by offering advanced trading features like margin, futures, and options. Others provide integrated staking, lending, or even NFT marketplaces. Ask yourself:

- Do you want to automate trades with bots or APIs?

- Is earning passive income via staking or savings accounts a priority?

- Are you interested in early access to new coin listings or launchpads?

If so, make sure your chosen platform supports these extras—and read the fine print on fees and lock-up periods.

“I started on Coinbase for ease of use but moved to Kraken for better trading tools and lower fees. Don’t be afraid to try a few platforms until you find your fit.” — A BuyingCryptoToday reader

Hidden Costs and Real-World Friction

Don’t overlook withdrawal limits, fiat conversion fees, or slow customer support. Many exchanges advertise zero trading fees but make up for it with higher spreads or costly withdrawals. Read user reviews on Reddit and Trustpilot before depositing large sums—sometimes the difference between a smooth experience and a headache is buried in the details.

A Quick Checklist Before You Commit

To help narrow down your choices and avoid costly mistakes, run through this checklist before signing up:

If you’re still deciding between two or three options, try them out with small deposits first. Most major exchanges let you register without funding immediately—use this as an opportunity to test their interface and support response times.

The Community Speaks: What Matters Most?

Your priorities may differ from other investors’. To get a sense of what matters most across our reader base—and where opinions diverge—we invite you to weigh in below:

What matters most to you when picking a crypto exchange?

Everyone has different priorities when choosing a crypto platform. Tell us what’s most important for you!

The crypto landscape shifts fast—new exchanges rise (and sometimes fall) every year. Staying informed is your best defense against lost funds or missed opportunities. For ongoing updates on the most reliable platforms worldwide, bookmark our crypto exchange news hub.

Final Thoughts: Your Exchange Is Just the Start

No matter which platform you pick today, remember that an exchange is just one piece of your overall crypto strategy. The real key is staying flexible—ready to pivot as regulations shift or new opportunities emerge. As always, never keep more funds on an exchange than you’re willing to lose; consider moving long-term holdings into secure wallets after purchase (see our wallet recommendations here). With smart research and clear priorities, you can find an exchange that fits not just where you are now—but where you want your crypto journey to take you next.