Buying low cap crypto tokens can be a gateway to outsized returns—but it’s also where scams, illiquidity, and technical pitfalls are most rampant. With new tokens launching daily and hype cycles fueled by social media, the risk of falling for a rug pull or buying worthless assets is high. To navigate this volatile landscape safely, you need to combine rigorous research with practical tools and a keen eye for red flags.

Essential Tools for Low Cap Crypto Discovery

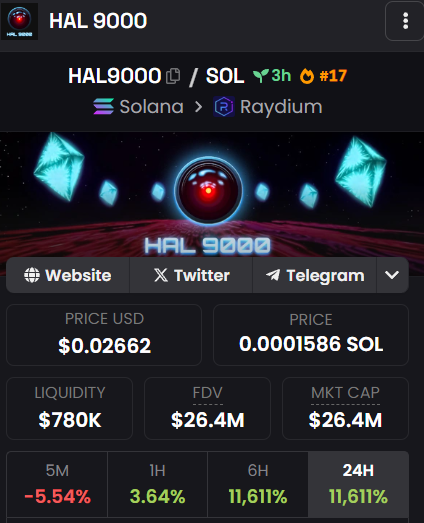

Your first line of defense is verifying token legitimacy before you even consider making a purchase. The two gold-standard platforms for this are CoinGecko and CoinMarketCap. Both aggregate real-time data on thousands of cryptocurrencies—including low cap coins—and offer critical information like market cap, trading volume, and exchange listings.

When you spot an interesting new token:

Essential Tools, Tips, and Risks for Low Cap Crypto

-

Use CoinGecko or CoinMarketCap to verify token legitimacy and find exchanges with the highest liquidity for low cap coins. Both platforms provide comprehensive data, including contract addresses, trading volumes, and exchange listings, helping you avoid scams and identify the most liquid trading venues.

-

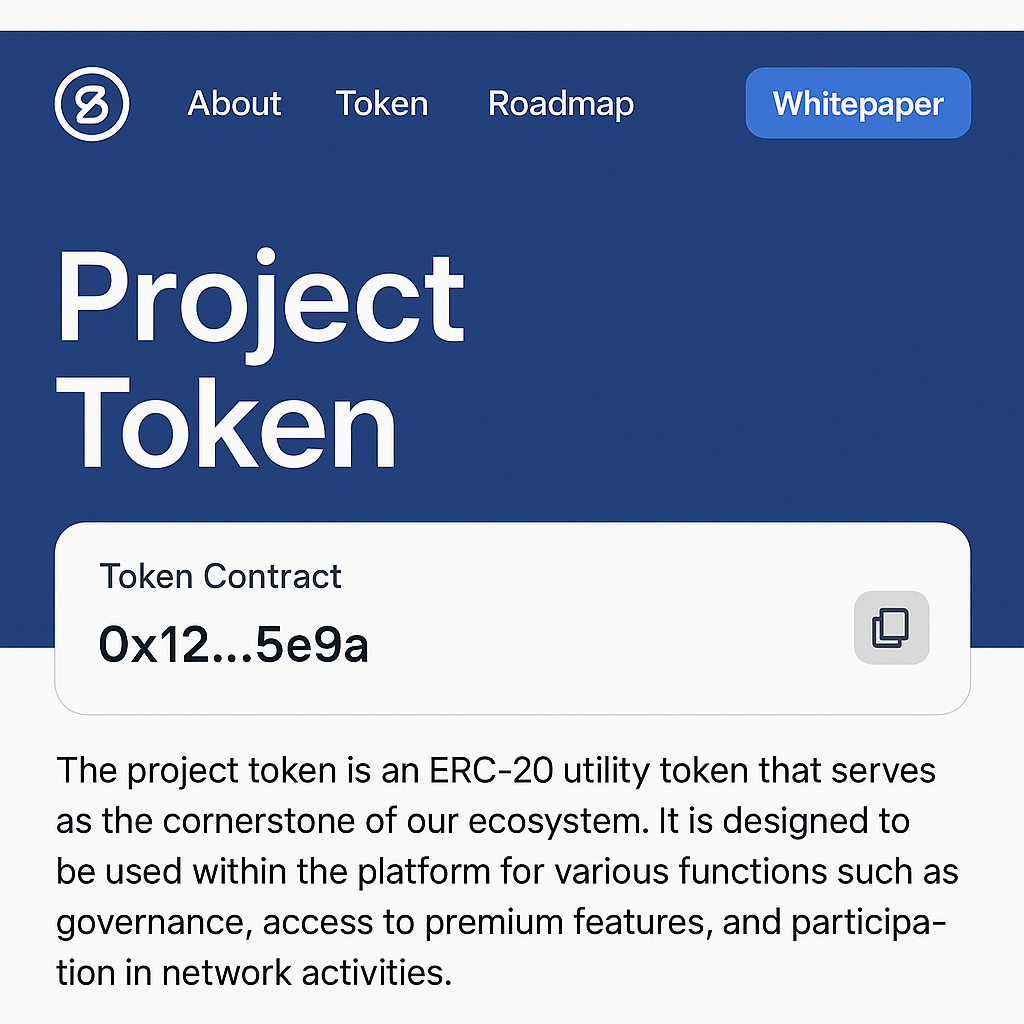

Always check token contract addresses directly from official project channels before purchasing, especially when using decentralized exchanges like Uniswap or PancakeSwap. Scammers often create fake tokens with similar names, so confirm the contract address from the project’s verified website or social media.

-

Beware of rug pulls and liquidity risks—avoid tokens with anonymous teams, locked or low liquidity, and no third-party audits. Conduct due diligence on the project’s team transparency, liquidity lock status, and audit history to minimize exposure to fraud and sudden liquidity withdrawals.

Liquidity matters: always check which exchange has the highest trading volume for your chosen token. Thinly traded pairs can result in high slippage or getting stuck with unsellable bags. Use the “Markets” tab on these platforms to identify where liquidity is deepest.

Actionable Tips for Safe Token Purchases

The next step is ensuring you’re buying the real token, not a copycat contract or scam. This is especially crucial when using decentralized exchanges (DEXs) like Uniswap or PancakeSwap, where anyone can list any token contract.

Always obtain the contract address from official project channels:

- The project’s verified Twitter account or official website

- Their announcement channel on Telegram or Discord

- The “Info” section on CoinGecko/CoinMarketCap (which often links to official sources)

Pasting random contract addresses from forums or chat groups is risky—scammers frequently promote fake contracts that look nearly identical to legitimate ones. Double-check every character before executing any trade.

Critical Risks: Rug Pulls, Liquidity Traps & Anonymous Teams

No matter how promising a low cap coin appears, you must evaluate its underlying risks. The three biggest red flags are:

Essential Tools, Tips, and Risks for Low Cap Crypto

-

Use CoinGecko or CoinMarketCap to verify token legitimacy and find exchanges with the highest liquidity for low cap coins. These platforms provide real-time data on trading volumes, contract addresses, and exchange listings, helping you avoid scams and illiquid tokens.

-

Always check token contract addresses directly from official project channels before purchasing, especially when using decentralized exchanges like Uniswap or PancakeSwap. This reduces the risk of buying counterfeit or scam tokens that mimic legitimate projects.

-

Beware of rug pulls and liquidity risks—avoid tokens with anonymous teams, locked or low liquidity, and no third-party audits. Lack of transparency and insufficient liquidity are major red flags that can lead to significant financial losses.

Avoid projects where the team hides behind pseudonyms without any verifiable track record—these are prime candidates for rug pulls. Similarly, if liquidity is locked only for a short period (or not at all), exit quickly; once unlocked, developers can drain funds instantly. Finally, absence of third-party audits means smart contract bugs—or malicious backdoors—can go undetected until it’s too late.