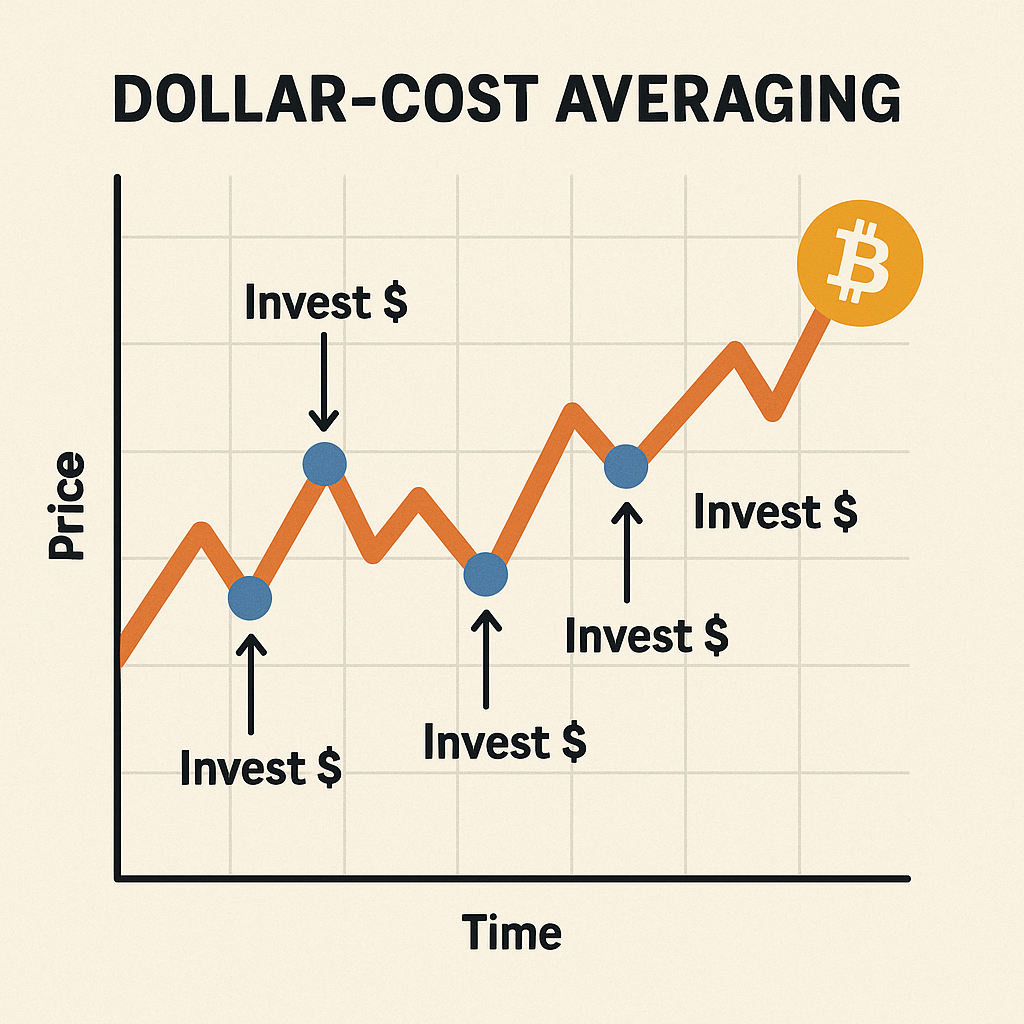

Imagine setting your crypto investments on autopilot—no more second-guessing market timing or stressing over short-term volatility. This is the promise of recurring crypto purchases, a strategy that leverages the power of dollar-cost averaging (DCA) through automated buying. Whether you’re a seasoned trader or just entering the world of digital assets, understanding how to automate your buys can be a game-changer for building wealth with less emotional baggage.

What is Crypto Auto-Buy and Why Should You Care?

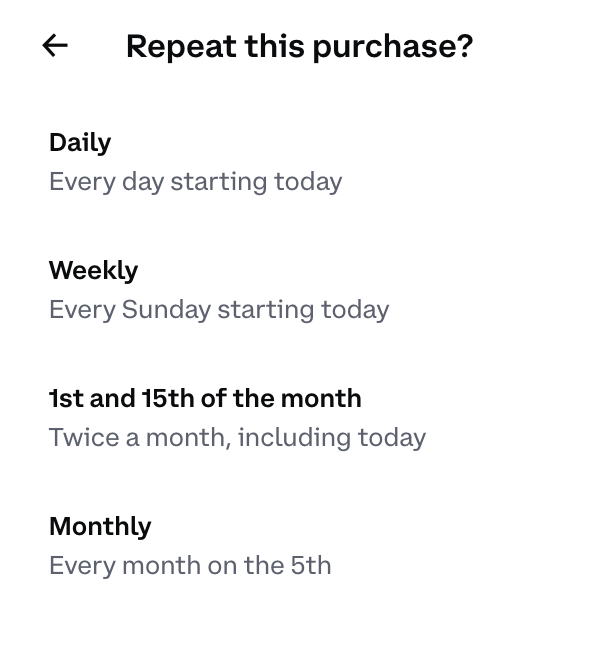

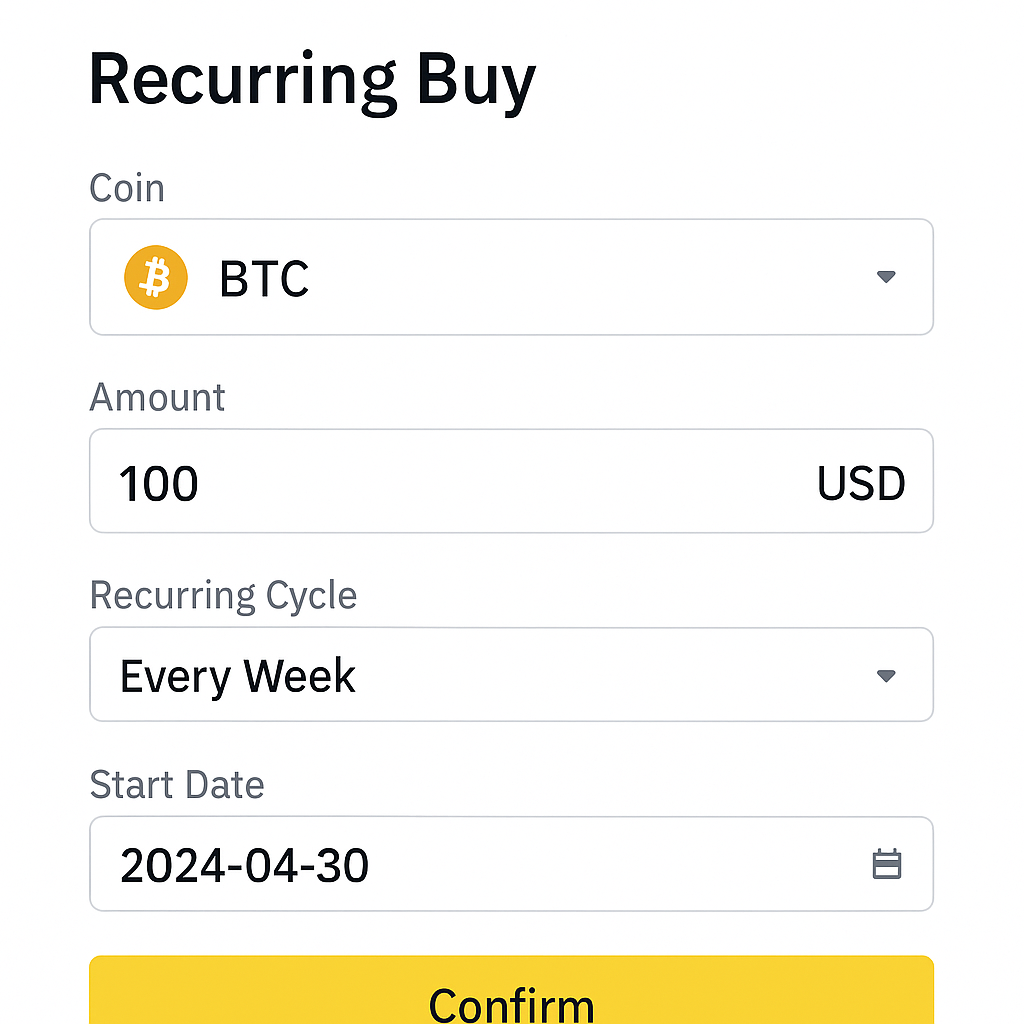

Crypto auto-buy is exactly what it sounds like: you schedule recurring purchases of your favorite cryptocurrencies at set intervals—daily, weekly, or monthly. Platforms like Coinbase, Binance, and Kraken have made this process seamless, allowing users to link their bank accounts or cards and automate their investments. The goal? To take advantage of crypto dollar cost averaging, smoothing out the price you pay over time and reducing the impact of sudden market swings.

“The best thing about DCA in crypto is that it removes fear and greed from the equation. You’re investing consistently, regardless of market noise.”

Have recurring crypto purchases helped you feel less stressed about market ups and downs?

Dollar-cost averaging (DCA) with auto-buy can smooth out the impact of market swings. We’re curious about your experience!

The Benefits of Automated Crypto Buying

Top 5 Benefits of Recurring Crypto Purchases

-

Reduces the impact of volatility: By investing set amounts at regular intervals, you automatically buy more when prices are low and less when prices are high, smoothing out market fluctuations. This is the core principle of dollar-cost averaging (DCA).

-

Removes emotional decision-making: Automated purchases on platforms like Coinbase or Kraken help investors avoid impulsive buying or selling, leading to more disciplined and consistent investing.

-

Convenient and time-saving: Setting up recurring buys on exchanges such as Binance or Gemini eliminates the need to manually time the market, making crypto investing accessible for busy professionals.

-

Accessible entry for beginners: Recurring purchases lower the barrier to entry, allowing new investors to start with small amounts on user-friendly platforms like PayPal and Revolut.

-

Supports long-term wealth building: Consistent investing over time, as enabled by recurring buys on platforms like Bitstamp or eToro, can compound gains and foster a strong savings habit.

The psychological relief from not having to “time the market” is just one perk. Automated buying also helps you stick to your investment plan, avoid FOMO-driven mistakes, and potentially capture better long-term returns by buying both highs and lows. For those new to crypto, it’s an ideal way to get started without feeling overwhelmed by price charts.

Best DCA Crypto Platforms: What Features Matter?

Choosing where to set up your recurring purchase plan matters. The best DCA crypto platforms offer flexible scheduling (daily/weekly/monthly), low fees, reliable automation, and robust security features. Some even allow you to diversify across multiple coins in one go. Look for exchanges that make editing or pausing your auto-buy schedule simple—a must as your strategy evolves.

As we dive deeper into how to set up your first automated purchase and optimize your strategy for different market conditions, remember that consistency beats perfection in this space. Your future self will thank you for automating good habits today.