Jumping into the world of crypto can feel like stepping into a wild frontier—exciting, but also full of hidden traps. Before you buy any token, it’s crucial to do your homework. A few smart checks can mean the difference between a solid investment and falling for a cleverly disguised scam. Let’s break down the three most important steps to analyze a token before buying, focusing on contract security, token distribution, and those all-important red flags.

1. Perform a Smart Contract Scan for Vulnerabilities and Ownership

Every crypto token is powered by a smart contract—the code that defines how it works on the blockchain. But not all contracts are created equal! Some contain critical flaws or sneaky backdoors that allow creators to drain funds or change rules after launch. That’s why your first step should always be to run a crypto contract scan.

Tools like Token Sniffer or RugDoc make this easy, providing automated audits that flag common vulnerabilities:

- Is the contract owner able to mint unlimited tokens?

- Can trading be paused at any time?

- Are there hidden fees or tax structures?

If the scan reveals that one wallet controls the contract (especially if it’s not renounced), or if there are critical issues like unrestricted minting, consider this a major warning sign!

2. Analyze Token Distribution to Ensure No Single Wallet Holds Excessive Supply

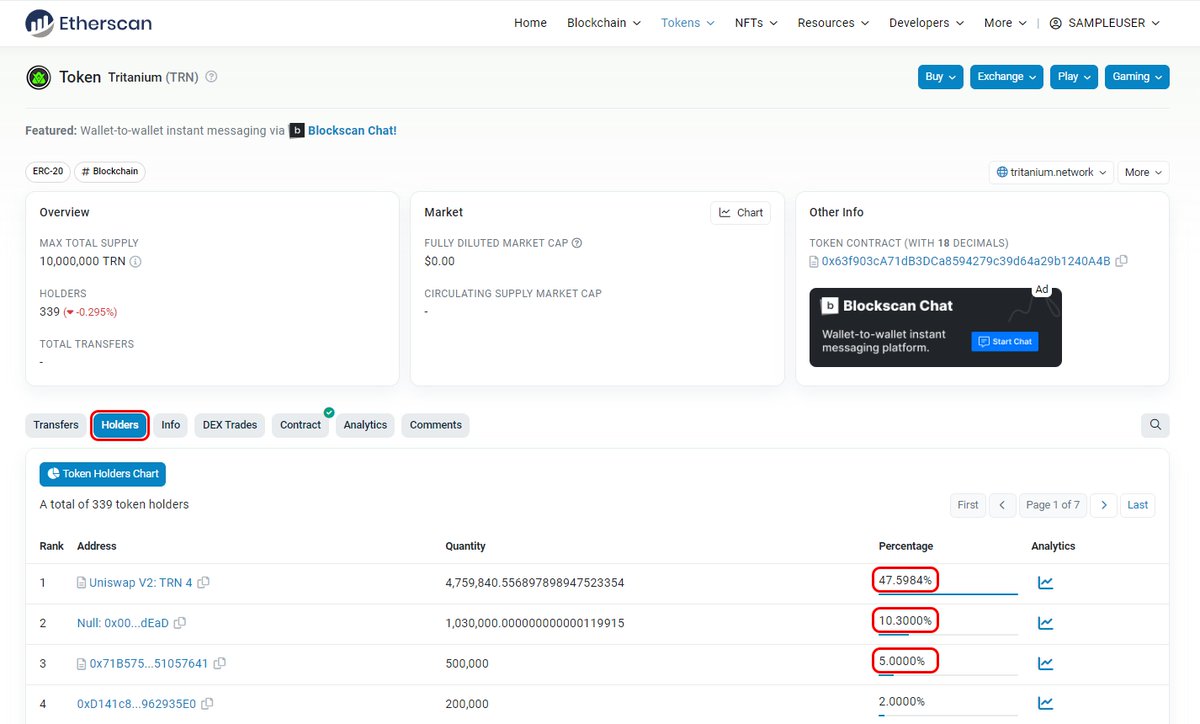

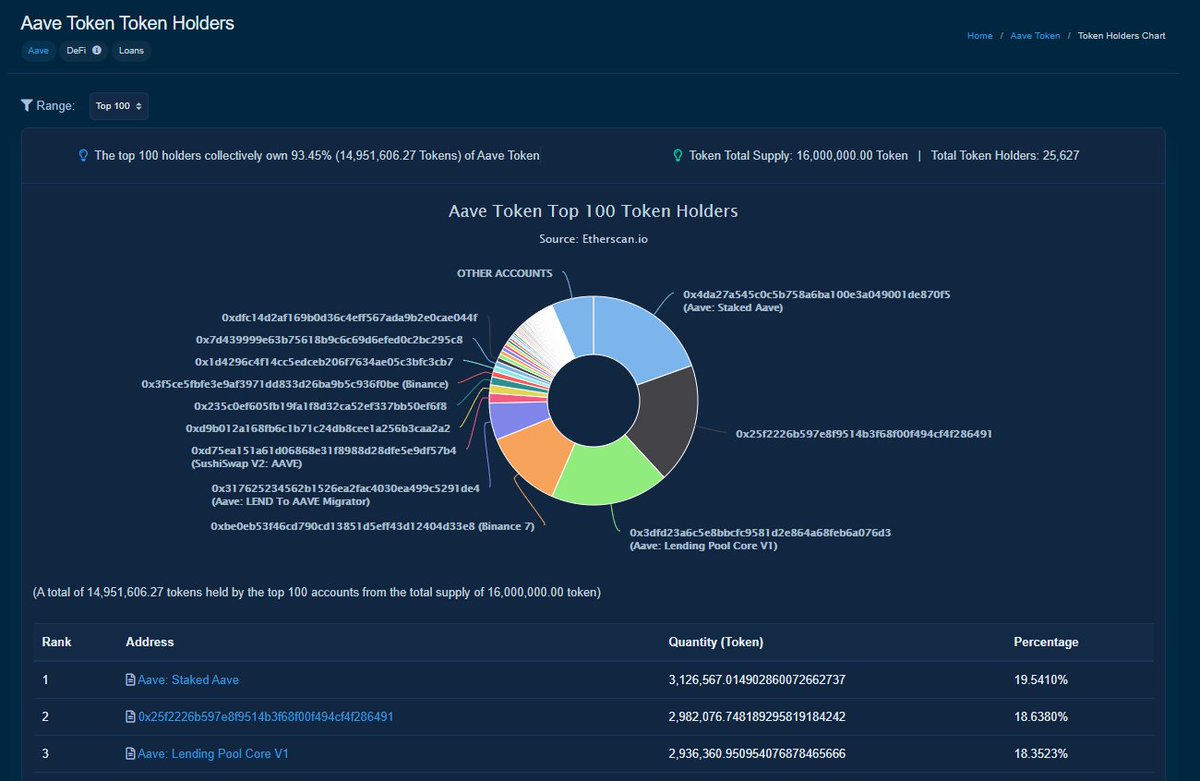

A healthy project spreads its tokens widely among many holders. If you spot one or two wallets holding more than 10% each—especially if they belong to the team—be cautious! These so-called “whales” can crash the price by dumping their holdings at any time.

You can check distribution using blockchain explorers like Etherscan or BscScan:

- Look for team wallets: Are they labeled? Are their allocations locked up with vesting contracts?

- Avoid tokens where whales dominate: More than 10% in one wallet is risky; over 20% is almost always bad news.

This simple check helps you avoid pump-and-dump schemes and ensures you’re not buying into an ecosystem controlled by just a handful of people.

3 Essential Steps to Analyze a Token

-

Perform a Smart Contract Scan for Vulnerabilities and OwnershipUse trusted tools like Token Sniffer or RugDoc to check the token’s smart contract for potential vulnerabilities, backdoors, or signs of centralized control. These platforms help you spot contract risks before you buy.

-

Analyze Token Distribution to Ensure No Single Wallet Holds Excessive SupplyVisit Etherscan and review the token’s holders tab. Make sure no single wallet (including team or developer wallets) holds more than 10% of the total supply, which could indicate risk of price manipulation by whales.

-

Identify Red Flags Such as Anonymous Teams, Missing Whitepapers, or Suspicious Transaction PatternsLook for transparency: check if the team is public, if there’s a detailed whitepaper, and monitor the transaction history for unusual activity. Absence of these can signal scams or rug pulls.

3. Identify Red Flags: Anonymous Teams, Missing Whitepapers & Suspicious Patterns

This is where your detective skills really come into play! Even if everything looks good technically, social factors matter just as much for trustworthiness.

- The team: Is there any information about who’s behind the project? Fully anonymous teams aren’t always scams—but they’re much riskier than transparent ones.

- The whitepaper: Does one exist? Is it detailed and specific, or vague and generic?

- Suspicious transaction patterns: Are there lots of small transfers (possibly wash trading) or sudden volume spikes without news?

If you see multiple red flags—especially when combined with poor contract security or lopsided distribution—it’s wise to walk away.

Staying vigilant for these red flags can save you from costly mistakes. Crypto Twitter is full of cautionary tales where investors ignored warning signs, only to watch their tokens become worthless overnight. Always remember: if something feels off, it’s better to skip a project than to gamble with your hard-earned money.

Practical Tools & Tips for Your Token Analysis

Let’s recap the essentials and add some practical advice for your next deep dive:

3 Key Steps to Analyze a Token Before Buying

-

Perform a Smart Contract Scan for Vulnerabilities and OwnershipUse trusted tools like Token Sniffer or RugDoc to check the token’s smart contract for potential vulnerabilities, backdoors, or signs of the contract owner retaining too much control.

-

Analyze Token Distribution to Ensure No Single Wallet Holds Excessive SupplyVisit Etherscan to review the token’s holder distribution. Be wary if a single wallet or a small group of wallets (often called “whales” or team wallets) holds more than 10% of the total supply, as this could lead to price manipulation.

-

Identify Red Flags Such as Anonymous Teams, Missing Whitepapers, or Suspicious Transaction PatternsLook out for warning signs like a lack of team transparency, no accessible whitepaper, or unusual transaction activity on blockchain explorers. These are common indicators of potential scams or unreliable projects.

- Bookmark audit tools: Sites like Token Sniffer and RugDoc are your first line of defense. Always check the latest scan results before even considering a buy.

- Use blockchain explorers: Don’t just trust what the project says about their tokenomics—verify it yourself by viewing the top holders on Etherscan or BscScan.

- Research the team and documentation: Search for interviews, LinkedIn profiles, or past projects. Lack of transparency is rarely a good sign in crypto.

Quick Checklist Before You Buy Any Token

If you’re ever unsure about a token’s legitimacy, take a step back and consult the community. There are countless forums and Discord groups where experienced users share insights about new projects—don’t be afraid to ask questions!

The Bottom Line: Stay Curious, Stay Safe

The crypto space rewards curiosity and caution in equal measure. By following these three steps—smart contract scans, distribution analysis, and red flag detection—you’ll dramatically reduce your risk of falling victim to scams or poorly designed tokens.

No investment is ever risk-free—but knowledge is your best defense against crypto’s wild west moments.