Texas has made history by becoming the first U. S. state to establish a publicly funded Bitcoin reserve, marking a turning point for state-level Bitcoin adoption and sending ripples through the broader cryptocurrency market. With Governor Greg Abbott’s signature on Senate Bill 21 (SB 21), Texas is not just experimenting with digital assets – it’s institutionalizing them. For everyday crypto buyers, this move signals both opportunity and complexity.

Inside Texas’s Strategic Bitcoin Reserve: Structure and Safeguards

The newly enacted SB 21 sets up a Texas Strategic Bitcoin Reserve, managed by the Texas Comptroller of Public Accounts. The reserve will be financed through legislative appropriations, dedicated revenue streams, investment proceeds, and even voluntary crypto donations. This approach positions Texas as a pioneer in exploring Bitcoin treasury strategies at the state level.

The law is highly selective about its holdings: only cryptocurrencies with an average market capitalization of at least $500 billion over the prior 12 months are eligible for inclusion. In practice, that means only Bitcoin currently qualifies, cementing its status as digital gold in the eyes of policymakers.

To address concerns over security and transparency, SB 21 authorizes the Comptroller to contract with third-party custodians and liquidity providers based within Texas. An advisory committee will guide asset valuation and investment policies, aiming to ensure robust oversight as the state navigates this new financial frontier.

Why Is Texas Building a Bitcoin Reserve?

The rationale behind this bold move is multifaceted. Supporters argue that integrating Bitcoin into state reserves helps hedge against inflation and enhances financial resilience – particularly relevant given recent macroeconomic volatility. By diversifying assets beyond traditional instruments like cash or bonds, Texas aims to future-proof its balance sheet while signaling support for blockchain innovation.

This decision also reflects growing confidence in buying cryptocurrency securely at an institutional scale. The explicit requirement for large-cap assets mitigates risk while leveraging Bitcoin’s established liquidity and global recognition.

Key Benefits and Risks for Crypto Buyers in Texas

-

Enhanced Legitimacy: Texas’s state-level adoption of Bitcoin through the Texas Strategic Bitcoin Reserve may boost public confidence and encourage wider acceptance of cryptocurrencies among individual investors.

-

Potential for Regulatory Clarity: The creation of a state-managed Bitcoin reserve signals a proactive regulatory approach, which could lead to clearer guidelines and increased protections for everyday crypto buyers in Texas.

-

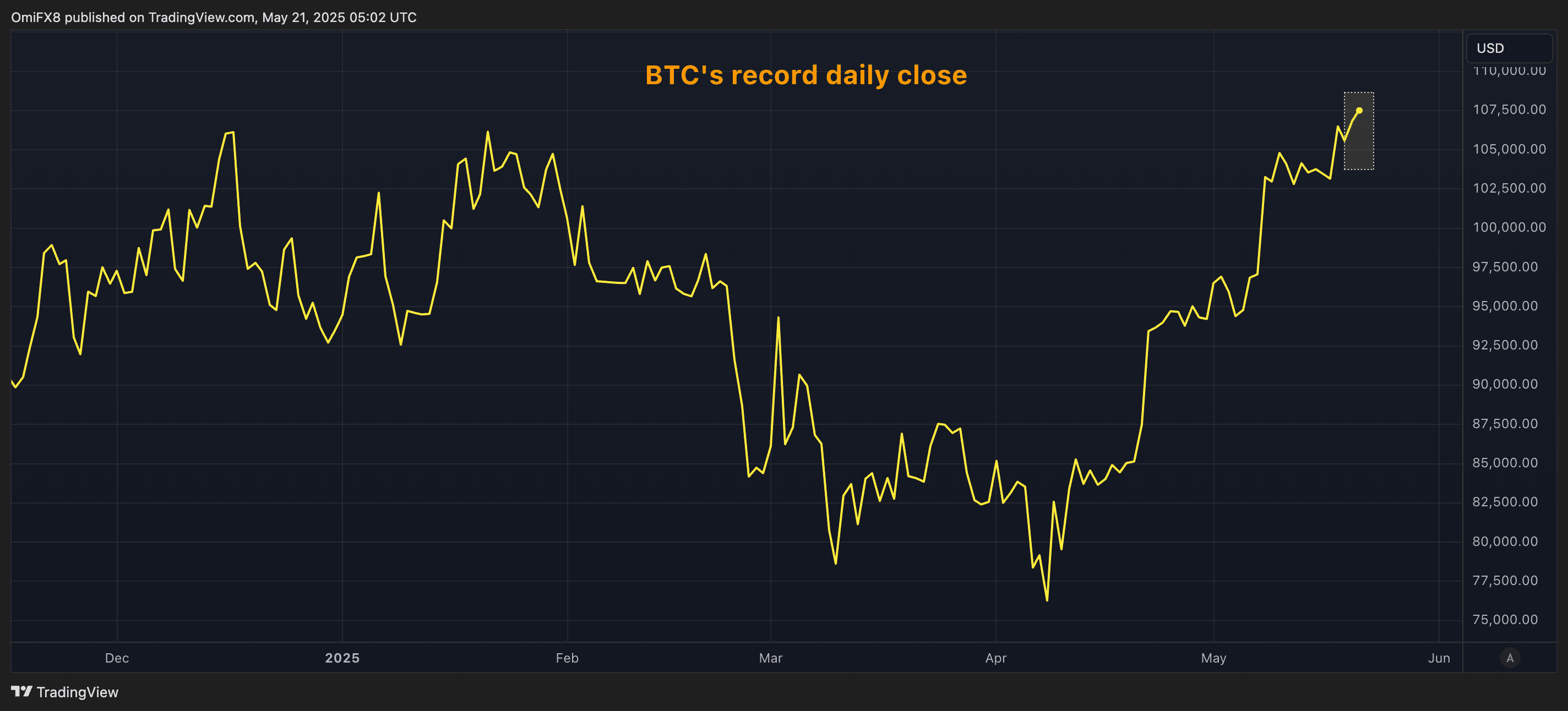

Market Impact and Price Stability: Institutional participation by Texas could help stabilize Bitcoin markets over time, but volatility remains a significant risk for individual investors, as highlighted by recent market fluctuations.

-

Inflation Hedge Opportunities: By treating Bitcoin as a reserve asset, Texas positions it as a potential hedge against inflation, which may appeal to retail investors seeking diversification beyond traditional assets.

-

Custody and Security Considerations: The law mandates secure storage via third-party custodians based in Texas, emphasizing the importance of robust security practices—an ongoing concern for individual crypto holders.

Implications for Everyday Crypto Buyers

For retail investors, Texas’s adoption of a strategic Bitcoin reserve could be a game-changer. First, it brings significant legitimacy to cryptocurrency as an asset class; when a state government treats Bitcoin as worthy of public funds, it challenges lingering skepticism in mainstream finance circles.

This move may also help catalyze clearer regulatory frameworks nationwide. As noted by industry analysts, proactive legislation like SB 21 could prompt other states or even federal authorities to provide more transparent guidelines for crypto investing – potentially making it safer and easier for individuals to participate (source).

However, volatility remains an ever-present factor in crypto markets. While institutional adoption can add stability over time, individual investors should remain vigilant about risk management strategies when buying cryptocurrency in 2025.

What Texas’s Bitcoin Reserve Means for the Broader Market

The ripple effects of Texas’s Bitcoin reserve extend far beyond state borders. By integrating Bitcoin into its treasury operations, Texas is sending a powerful signal to both institutional and retail investors: digital assets are not just speculative instruments but can serve as strategic reserves for major governmental entities. This could accelerate mainstream adoption, potentially prompting other states or even federal agencies to consider similar measures.

Market participants are already watching closely. The precedent set by SB 21 may encourage other jurisdictions to explore their own crypto investment news in 2025, especially as traditional financial systems grapple with inflation and evolving monetary policies. If more states follow suit, the cumulative buying power could contribute to greater liquidity and, paradoxically, both increased stability and new volatility triggers in the short term.

Navigating Opportunities and Risks

For everyday buyers, the most immediate benefit is enhanced legitimacy. As Texas moves forward with its $10 million Bitcoin purchase (source), retail investors may feel more confident about entering or expanding their positions in the market. However, it’s crucial not to overlook the risks that come with increased institutional involvement.

Texas’s reserve structure is designed with security and oversight in mind, features that individual investors should also prioritize when buying cryptocurrency securely. Choosing reputable exchanges, utilizing hardware wallets, and staying informed about regulatory changes remain best practices for safeguarding your assets. The state’s commitment to transparency through third-party custodians sets a bar that private investors can emulate on a smaller scale.

Will Other States Follow?

The big question now is whether Texas’s bold experiment will spark a broader movement toward state-level Bitcoin adoption across the U. S. While political will and regulatory environments vary widely from state to state, the success or failure of Texas’s initiative will be closely scrutinized by policymakers nationwide.

If the reserve proves effective at hedging inflation and diversifying assets without significant downsides, it could serve as a model for others looking to modernize their own treasury strategies. On the other hand, any missteps, such as security breaches or adverse price swings, could fuel critics who argue that cryptocurrencies remain too volatile for public funds.

How Should Individual Investors Respond?

With institutional adoption on the rise and regulatory frameworks evolving rapidly, individual investors should adopt a proactive approach:

How to Securely Buy Crypto in Texas After SB 21

-

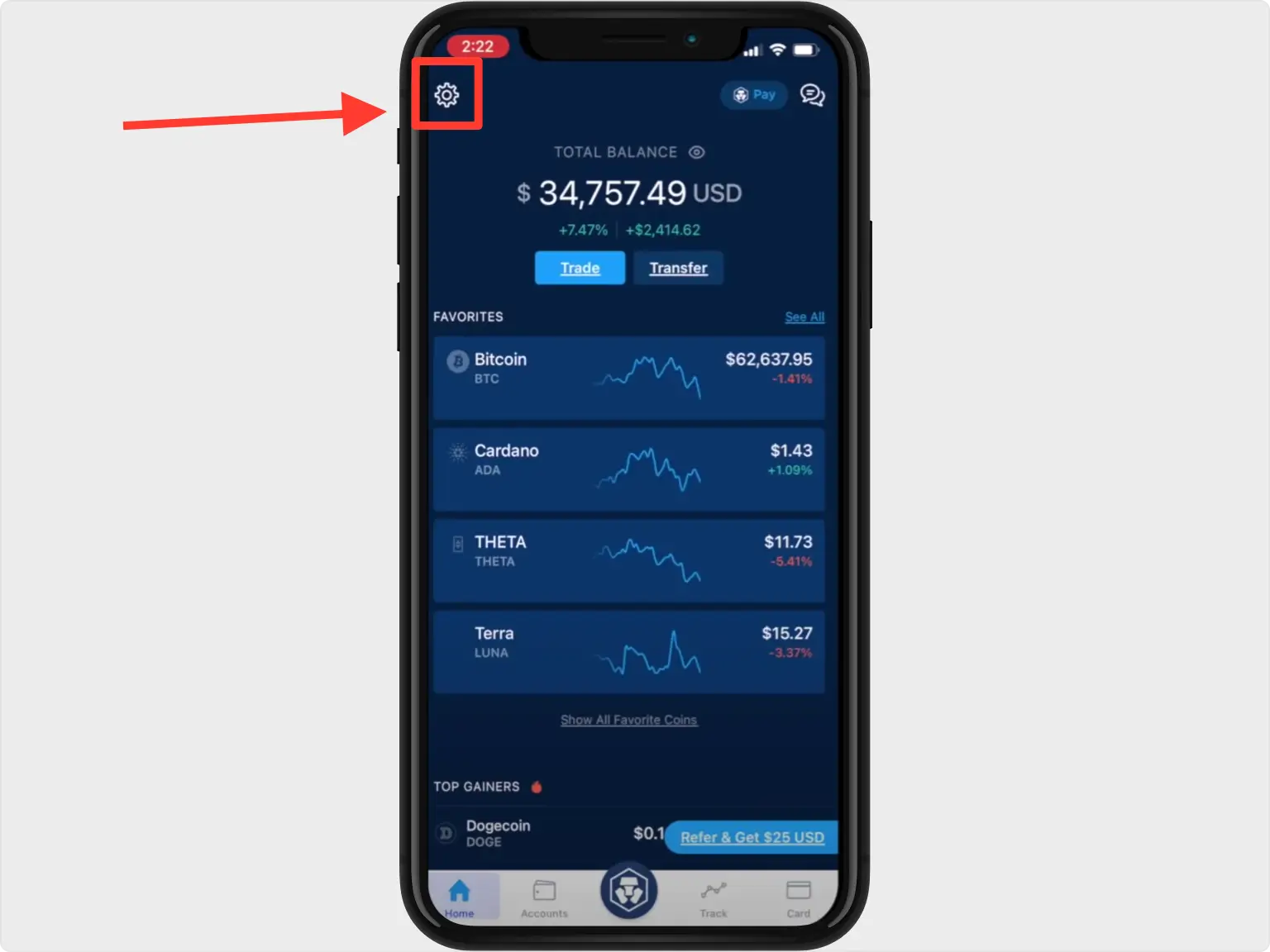

Verify Your Identity and Enable Security Features: Complete KYC (Know Your Customer) verification and activate two-factor authentication (2FA) to protect your account from unauthorized access.

-

Fund Your Account Using Secure, Traceable Methods: Deposit funds via linked bank accounts or wire transfers for added security and compliance with state and federal guidelines.

-

Purchase Bitcoin or Other Eligible Cryptocurrencies: Texas’s reserve law currently focuses on Bitcoin, so prioritize purchasing Bitcoin (BTC) for maximum alignment with state-backed assets.

-

Stay Informed on Texas Regulations and Tax Obligations: Monitor updates from the Texas Comptroller of Public Accounts and consult with a tax professional to ensure compliance with evolving state policies.

Staying informed is more important than ever. Monitor developments around SB 21 through trusted sources such as Texas Policy Research, watch out for updates from reputable crypto news outlets, and consider how changing regulations might impact your investment strategy.

Ultimately, Texas’s move into strategic Bitcoin reserves marks a milestone for both public finance and private investment landscapes. For those navigating this evolving market, combining vigilance with data-driven decisions remains key to capitalizing on new opportunities while managing inherent risks.