The crypto industry is at a pivotal moment as mainstream financial giants and blockchain innovators increasingly join forces. One of the most talked-about potential collaborations is the Chainlink Mastercard crypto partnership, which promises to make it easier and safer for billions to buy cryptocurrency with Mastercard. While some headlines have suggested a direct partnership, the reality is more nuanced – but no less significant for the future of secure, easy crypto purchases.

What the Headlines Get Right (and Wrong) About Chainlink and Mastercard

Recent news cycles have been flooded with reports about Mastercard cardholders gaining direct access to crypto assets on platforms like Uniswap, thanks to Chainlink’s technology. While these stories capture the spirit of ongoing innovation, as of June 25, 2025, there is no official public partnership between Chainlink and Mastercard specifically aimed at transforming cryptocurrency purchases for all users.

So why all the excitement? Both companies are independently driving major changes that are lowering barriers between traditional finance and decentralized assets. Mastercard’s recent moves include:

- Expanding stablecoin payment options through partnerships with Nuvei, Circle, and Paxos – reaching up to 150 million merchants globally

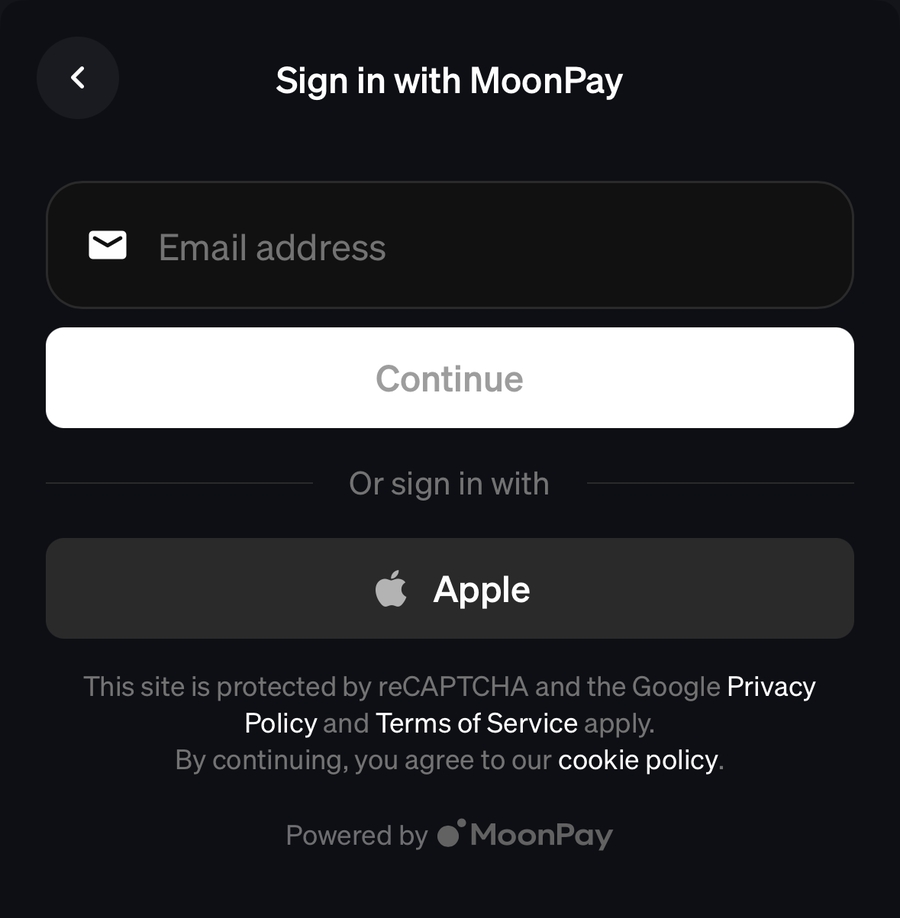

- Launching a payment card with MoonPay that allows stablecoin transactions at millions of locations

Meanwhile, Chainlink has been working closely with heavyweights like UBS Asset Management and Swift to power secure data transfer between blockchains and existing financial systems. These efforts are critical in enabling seamless fiat-to-crypto conversions that comply with regulatory standards.

The Real Impact: Secure Fiat-to-Crypto Conversion for Billions

The promise behind all this activity isn’t just about convenience; it’s about security and compliance at scale. For years, buying cryptocurrency easily was hindered by technical hurdles, regulatory uncertainty, and security risks. Now, thanks to innovations from both Mastercard and Chainlink (even if not in direct partnership), we’re seeing:

Key Benefits of Secure Fiat-to-Crypto Conversion

-

Broader Access via Mastercard and Partners: With Mastercard’s collaborations with Nuvei, Circle, Paxos, and MoonPay, over 150 million merchants worldwide can now accept stablecoin payments, making crypto purchases accessible to mainstream users.

-

Enhanced Security Through Established Networks: Mastercard’s integration of stablecoins leverages its trusted payment infrastructure, providing robust fraud protection and regulatory compliance for fiat-to-crypto transactions.

-

Simplified User Experience: Consumers can use familiar payment methods, such as Mastercard cards, to buy crypto or pay with stablecoins, removing technical barriers and making the process as easy as traditional card purchases.

-

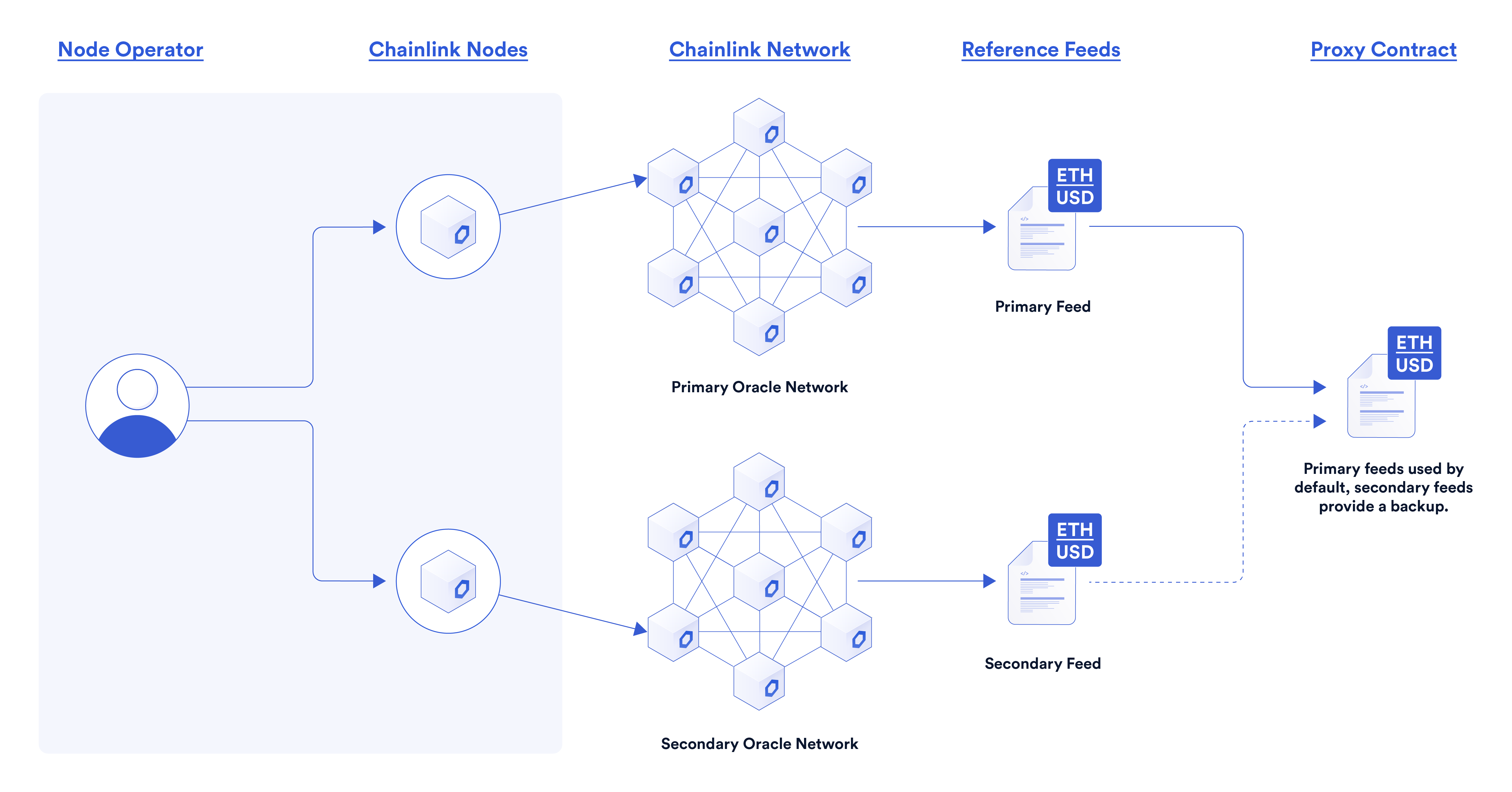

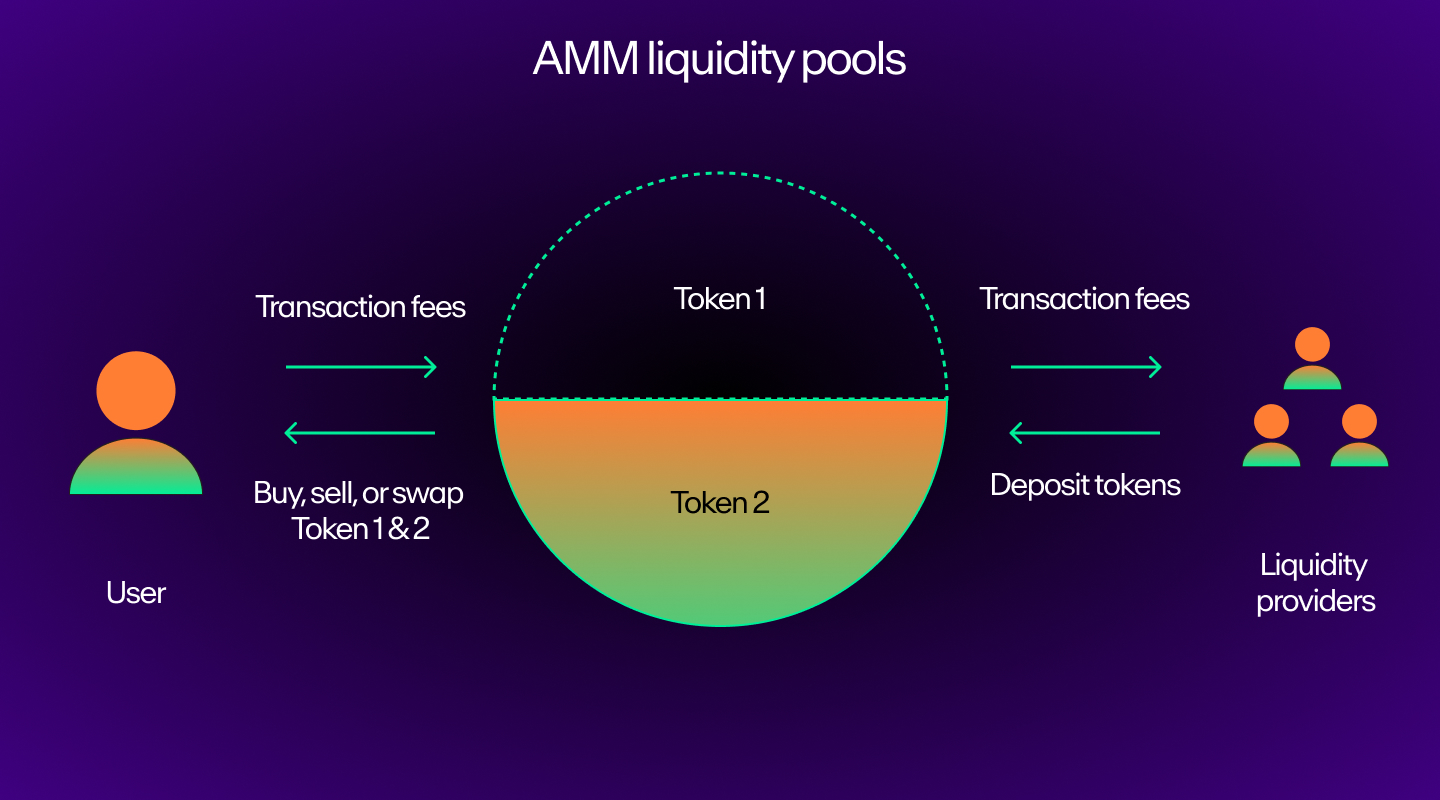

Faster and More Efficient Settlements: Chainlink’s partnerships with financial institutions like UBS Asset Management and Swift enable off-chain fiat settlements for digital assets, speeding up transaction times and reducing costs.

-

Increased Trust and Transparency: Chainlink’s secure data transfer technology ensures accurate, real-time price feeds and transaction data between blockchains and traditional systems, building user trust in fiat-to-crypto conversions.

This matters because billions of people already trust their banks and payment cards. Integrating crypto directly into these familiar systems reduces friction and risk – two critical factors holding back mainstream adoption.

Mainstream Crypto Adoption: Removing Barriers Without Compromising Security

The combined effect of these developments is profound: everyday consumers can now explore digital assets without needing deep technical knowledge or exposure to unregulated platforms. By leveraging established networks like Mastercard’s – which serves over 3 billion cardholders worldwide – new doors open for those previously excluded from Web3 opportunities.

Security remains paramount. Both companies prioritize rigorous KYC checks, fraud prevention tools, and smart contract automation to ensure only legitimate transactions go through. This approach helps keep bad actors out while letting compliant users participate freely.

For those eager to buy crypto with Mastercard, these advances signal a new era of accessibility. Instead of navigating complicated exchanges, users can leverage familiar payment infrastructure, making the process as straightforward as any online purchase. The underlying technology, often powered by Chainlink’s secure oracles and Mastercard’s robust payment rails, ensures that transactions are not only fast but also verifiable and transparent.

However, it’s important to set realistic expectations. Despite the hype, direct on-chain purchases for all Mastercard holders via Chainlink are not yet universally available. Most integrations currently focus on stablecoin payments and tokenized asset settlements, which are significant but still just the beginning. The regulatory landscape continues to evolve rapidly; compliance remains a moving target as authorities worldwide refine their approach to digital assets.

What Should Consumers Know Before Buying Crypto with Mastercard?

While these technical leaps are promising, consumers should remain vigilant:

Key Tips for Secure Crypto Purchases with Payment Cards

-

Use Trusted Payment Networks: Only purchase cryptocurrency through established payment networks like Mastercard, which partners with regulated providers such as Nuvei, Circle, and Paxos to enable secure stablecoin transactions at millions of merchants.

-

Choose Reputable Crypto Platforms: Select well-known platforms like MoonPay or Coinbase that support direct card payments and adhere to strict security and compliance standards.

-

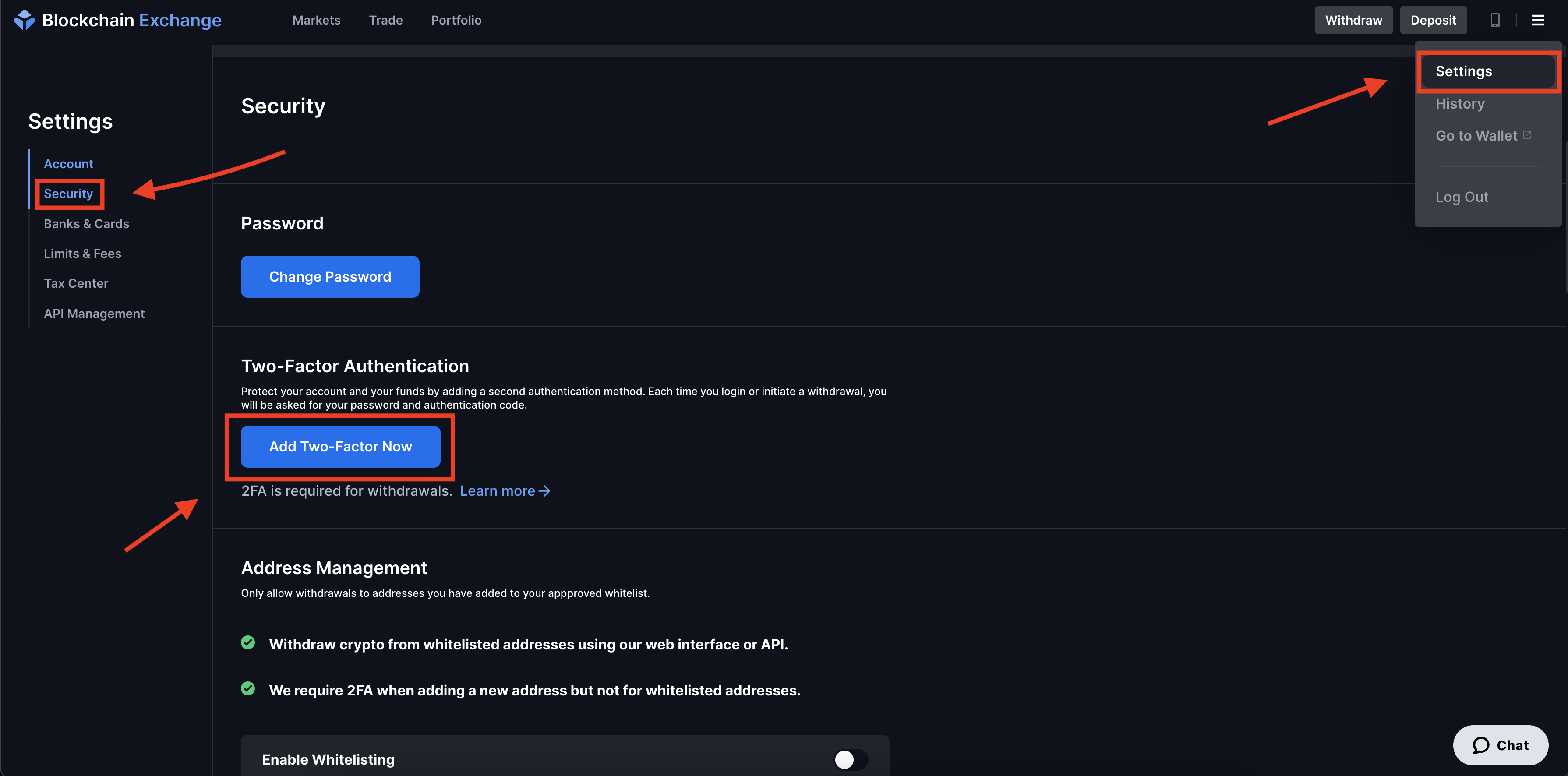

Enable Two-Factor Authentication (2FA): Always activate 2FA on your crypto accounts to add an extra layer of protection against unauthorized access.

-

Verify Regulatory Compliance: Ensure the service you use complies with local regulations and performs KYC (Know Your Customer) checks to help prevent fraud and money laundering.

-

Monitor for Transaction Fees: Be aware of potential fees when buying crypto with a payment card; platforms like Coinbase and MoonPay clearly display these costs before you confirm your purchase.

-

Secure Your Private Keys: After purchase, transfer your cryptocurrency to a secure wallet where you control the private keys, such as a Ledger or Trezor hardware wallet.

It’s crucial to verify that any platform offering crypto purchases with Mastercard is both regulated and transparent about fees, privacy policies, and security protocols. As always in crypto, if an offer seems too good to be true or lacks clear licensing information, proceed with caution.

Looking Ahead: The Road to Seamless Crypto Payments

The ultimate goal is frictionless movement between fiat and digital currencies for billions of people. As Mainstream crypto adoption accelerates, expect further partnerships between payment giants and blockchain innovators, whether through direct collaborations or parallel initiatives. Every step toward secure fiat-to-crypto conversion brings us closer to a world where digital assets are as easy (and safe) to use as traditional money.

The intersection of established finance and decentralized technology is no longer speculative, it’s happening now in real time. For consumers willing to do their homework and choose reputable services, the barriers to entry into crypto are lower than ever before.

For more details on recent industry moves by Mastercard, including its partnerships expanding stablecoin payments, read the official coverage at Imperial Wealth. To track ongoing blockchain integration efforts by Chainlink with major financial players like Swift and UBS Asset Management, visit the Chainlink blog.