For years, crypto holders have found themselves locked out of one of the most traditional avenues of wealth building: homeownership. But that’s changing fast. In a landmark move, the Federal Housing Finance Agency (FHFA) has directed Fannie Mae and Freddie Mac to recognize cryptocurrency assets held on U. S. -regulated centralized exchanges as part of your financial reserves when applying for a mortgage. If you’ve ever wondered whether your Bitcoin or Ethereum stash could help you buy a house, the answer is now a resounding yes, provided you follow the new rules.

How the New Crypto Asset Policy Works

This isn’t just another headline in real estate crypto news. As of June 25, 2025, Fannie Mae and Freddie Mac are required to factor in eligible crypto assets when assessing mortgage applications. That means if you’re applying for a loan backed by these mortgage giants, your digital coins may finally count toward your financial strength, without forcing you to liquidate them into cash.

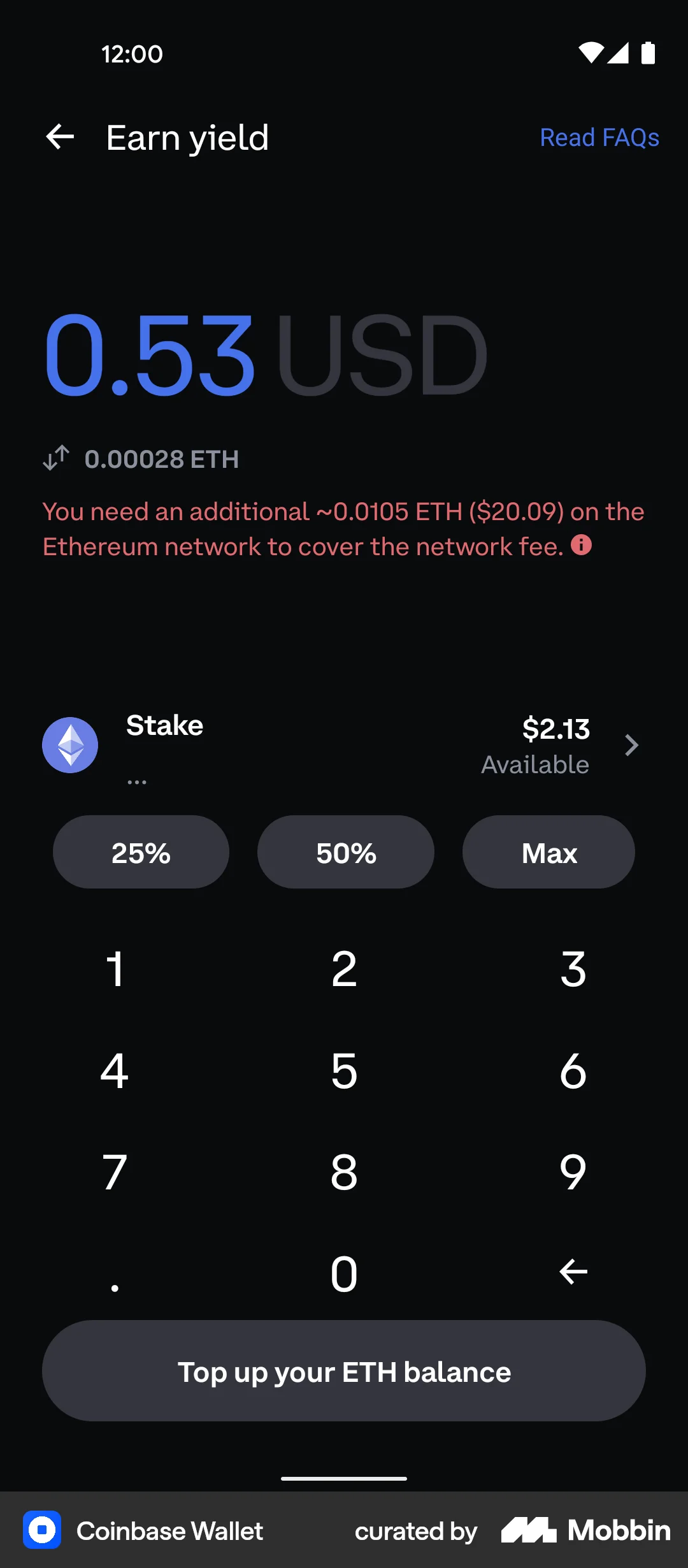

The policy is clear: only cryptocurrencies stored on U. S. -regulated centralized exchanges qualify. Self-custody wallets or assets held on unregulated platforms won’t make the cut. This requirement aims to ensure compliance and provide lenders with verifiable documentation.

What This Means for Crypto-Savvy Homebuyers

The implications are huge for anyone with substantial digital holdings. Under this change:

Top Benefits for Homebuyers Using Crypto Under New Policy

-

Expanded Mortgage Eligibility: Homebuyers can now count cryptocurrency holdings as part of their financial reserves when applying for Fannie Mae or Freddie Mac-backed mortgages, making it easier to qualify if much of their wealth is in digital assets.

-

No Need to Liquidate Crypto Investments: Borrowers aren’t required to convert crypto into U.S. dollars to use it as proof of assets, allowing them to maintain their investment positions while securing a mortgage.

-

Recognition of Major Crypto Platforms: Only cryptocurrencies held on U.S.-regulated centralized exchanges like Coinbase or Kraken are eligible, providing both security and clear documentation for lenders and buyers.

-

Streamlined Documentation Process: The policy provides a clear path for verifying and documenting crypto assets, making it simpler for buyers to prove their financial strength during the mortgage process.

-

Broader Financial Inclusion: The change opens homeownership opportunities to a more diverse pool of buyers, especially those who have built significant savings in crypto rather than traditional bank accounts.

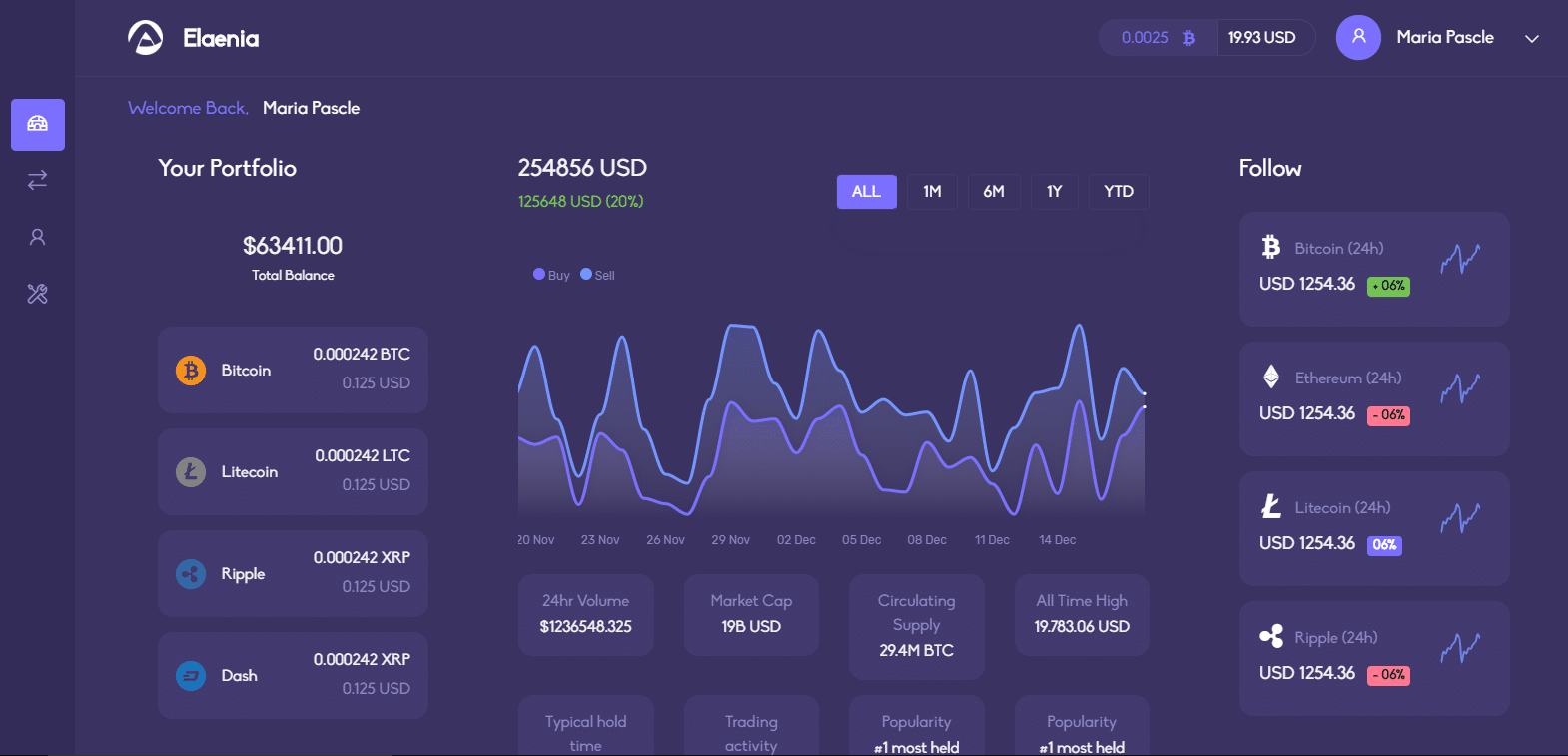

You can now include your verified crypto balances as part of your asset profile when seeking approval for a conventional home loan. This is especially meaningful if much of your net worth is tied up in digital currencies like Bitcoin or Ethereum, which previously went unrecognized by most lenders.

No longer do you need to sell off your investments just to prove you have sufficient reserves, a move that often meant missing out on potential gains or triggering tax events. Instead, you can keep your coins where they are while still leveraging them as proof of financial stability.

Eligibility Requirements and Compliance Considerations

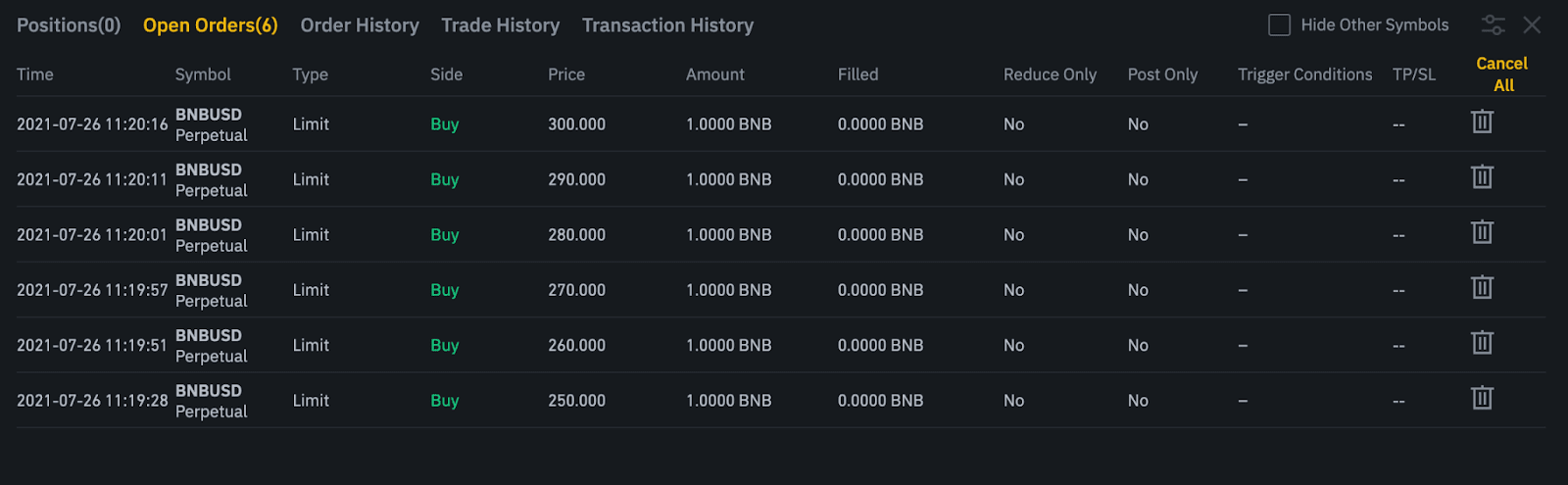

Before you rush out to submit an application, it’s important to understand what counts, and what doesn’t, under this new framework for crypto mortgage eligibility. Only assets held on compliant U. S. -regulated exchanges are eligible. You’ll need to provide documentation verifying both ownership and value at the time of application.

Lenders will also take steps to account for cryptocurrency’s notorious volatility. Expect risk mitigation measures such as discounts applied to the value of your holdings or requirements for additional reserves if needed. The goal is clear: balance expanded access with responsible lending standards.

The Bigger Picture: Integrating Crypto Into Traditional Finance

This policy shift signals something even bigger, a growing willingness among regulators and major financial institutions to bridge the gap between traditional finance and digital assets. By allowing borrowers to use crypto as part of their mortgage application, Fannie Mae and Freddie Mac are helping pave the way toward broader acceptance and utility for digital currencies within everyday financial life.

For crypto-first buyers, this is a real breakthrough. It means you can approach the mortgage process on a more level playing field with traditional investors, especially if your portfolio skews digital. But it also means being organized: meticulous record-keeping and up-to-date statements from your exchange accounts are now essential for proving eligibility.

Keep in mind that not all cryptocurrencies or exchanges will qualify. Only assets held on U. S. -regulated centralized platforms are eligible, so if you’re storing coins on decentralized or offshore exchanges, they won’t count toward your application. This focus on regulation is designed to protect both borrowers and lenders by ensuring transparency and compliance with U. S. financial laws.

Potential Risks and Lender Safeguards

While the move is widely celebrated, it’s not without caveats. The volatility of cryptocurrency markets remains a major concern for lenders, sharp price swings could affect the value of your reserves overnight. As a result, expect lenders to apply conservative calculations when assessing your crypto assets’ contribution to your overall financial picture.

Lenders may discount the reported value of your holdings or require you to maintain higher reserves if a significant portion of your assets are in crypto. These risk mitigation strategies are meant to ensure that both borrowers and banks remain protected if the market turns sour.

What Homebuyers Should Do Next

If you’re considering using crypto to buy a house, now’s the time to get proactive:

How to Prepare Crypto Assets for Your Mortgage Application

-

Gather official account statements showing your crypto balances. Download and save monthly statements or official balance reports from your exchange account to verify your holdings and provide clear documentation to lenders.

-

Ensure your crypto assets are in eligible cryptocurrencies. Focus on major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), which are widely supported by U.S.-regulated exchanges and recognized by lenders.

-

Review your transaction history for compliance. Make sure your crypto funds are not linked to unregulated platforms or self-custody wallets, as only assets on compliant exchanges qualify.

-

Monitor crypto market volatility and maintain extra reserves if possible. Because lenders may discount crypto values to account for price swings, holding additional reserves can help strengthen your application.

-

Consult with your lender about specific documentation requirements. Each lender may have unique forms or verification steps for crypto assets—contact them early to understand what’s needed.

Start by reviewing where your assets are held and transferring them to eligible exchanges if necessary. Gather detailed account statements showing balances, transaction history, and proof of ownership, all documentation that lenders will require under the new guidelines.

Consult with both your lender and a tax advisor before moving forward. While this policy removes some hurdles, there may still be tax implications depending on how you structure your finances or if you need to liquidate any portion of your holdings during the process.

Looking Ahead: Crypto’s Expanding Role in Real Estate

This change isn’t just about today’s homebuyers, it sets a precedent for future integration of digital assets into mainstream finance. As Fannie Mae and Freddie Mac adapt their policies, other institutions may follow suit, potentially opening doors for broader use cases like direct down payments in crypto or blockchain-based title transfers.

The bottom line? Crypto is no longer an outsider in the world of homeownership. If you’re ready to leverage your digital wealth toward buying a house, this policy shift could be just what you’ve been waiting for.