In June 2025, headlines across Atlanta and beyond blared a cautionary tale: an Atlanta couple lost their $800, 000 life savings to a WhatsApp crypto scam. Their devastating experience is just one example of how cryptocurrency scams have evolved, targeting both seasoned investors and newcomers with increasingly sophisticated tactics. As digital assets surge in popularity, so do the risks, especially for those unaware of the latest fraud trends.

Crypto Scams in 2025: More Sophisticated Than Ever

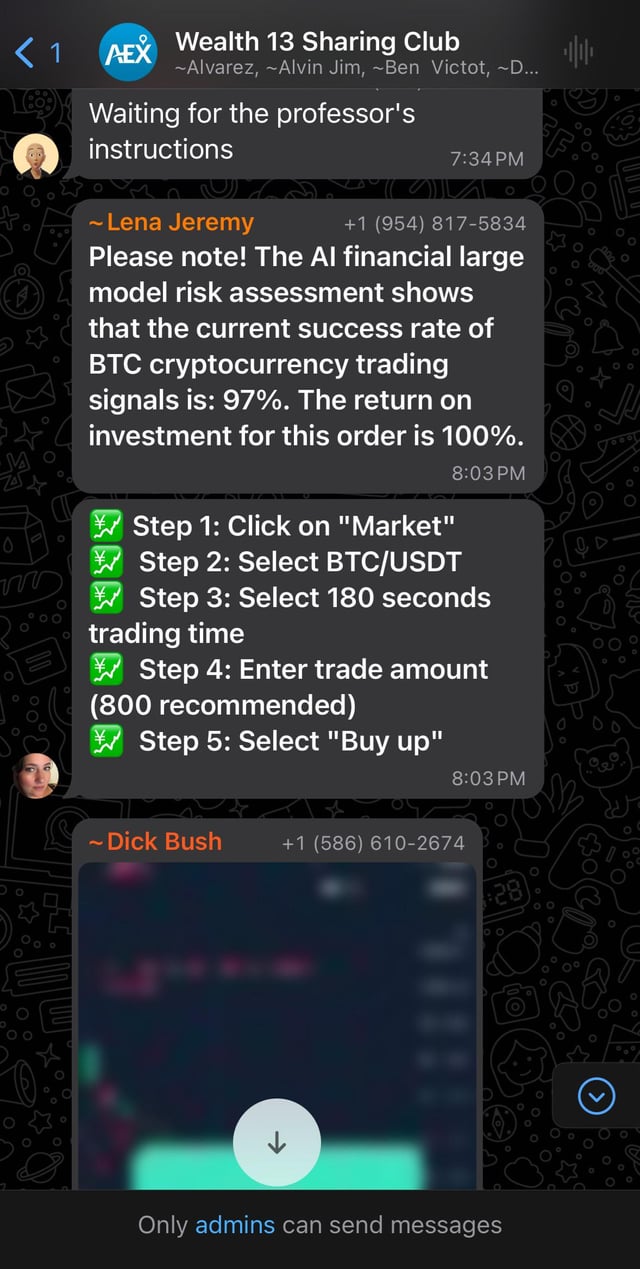

The days of crude phishing emails are long gone. Modern crypto scams exploit advanced technologies like AI-driven deepfakes, personalized social engineering, and expertly crafted fake platforms. In the Atlanta case, scammers initiated contact through WhatsApp, posing as trusted individuals and luring victims into bogus investment opportunities. The result? An $800, 000 loss that wiped out years of hard-earned savings.

This isn’t an isolated incident. According to recent data, fraudsters are leveraging deepfake videos and audio to impersonate CEOs or influencers, convincing unsuspecting users to invest in fake projects. “Pig butchering” scams, where criminals build relationships over weeks or months before soliciting funds, now account for over 33% of recorded crypto fraud cases. And fake wallets or exchanges continue to siphon millions from unwary buyers every month (source).

Five Essential Strategies to Avoid Crypto Scams in 2025

5 Proven Strategies to Avoid Crypto Scams in 2025

-

Never engage with unsolicited investment offers on messaging apps: If you receive unexpected messages or calls about crypto investments—especially from strangers or casual acquaintances—disengage immediately and do not share personal or financial information. Scammers often use platforms like WhatsApp to initiate contact, as seen in the recent $800,000 Atlanta fraud case.

-

Verify identities and platforms independently: Always confirm the legitimacy of any investment opportunity by researching the company, checking regulatory registrations, and contacting official customer support through verified channels—not links or contacts provided in messages. Beware of deepfake impersonations and fake websites.

-

Use only regulated exchanges and secure wallets: Buy cryptocurrency exclusively through reputable, regulated exchanges such as Coinbase, Kraken, or Gemini that implement strong security measures (such as two-factor authentication). Store your assets in wallets where you control the private keys, like Ledger or Trezor hardware wallets.

-

Stay updated on evolving scam tactics: Regularly educate yourself about new fraud trends, such as deepfake video calls, fake investment apps, and social engineering schemes targeting crypto buyers in 2025. Follow trusted sources like CoinDesk, Chainalysis, and official exchange blogs for the latest alerts.

-

Report suspicious activity and enable security features: Immediately block and report suspicious contacts to both the platform (e.g., WhatsApp) and relevant authorities. Always enable advanced security settings like biometric authentication and withdrawal whitelists on your exchange and wallet accounts.

Learning from the Atlanta WhatsApp scam, and the latest global trends, these five strategies can help you protect your assets:

- Never engage with unsolicited investment offers on messaging apps: If you receive unexpected messages or calls about crypto investments, especially from strangers or casual acquaintances, disengage immediately and do not share personal or financial information.

- Verify identities and platforms independently: Always confirm the legitimacy of any investment opportunity by researching the company, checking regulatory registrations, and contacting official customer support through verified channels, not links or contacts provided in messages.

- Use only regulated exchanges and secure wallets: Buy cryptocurrency exclusively through reputable, regulated exchanges that implement strong security measures (such as two-factor authentication) and store your assets in wallets where you control the private keys.

- Stay updated on evolving scam tactics: Regularly educate yourself about new fraud trends, such as deepfake video calls, fake investment apps, and social engineering schemes targeting crypto buyers in 2025.

- Report suspicious activity and enable security features: Immediately block and report suspicious contacts to both the platform (e. g. , WhatsApp) and relevant authorities; always enable advanced security settings like biometric authentication and withdrawal whitelists.

The First Line of Defense: Don’t Engage With Unsolicited Offers

The most important step in crypto scam prevention for 2025? Never interact with unsolicited offers on messaging apps like WhatsApp. This was the critical first mistake made by the Atlanta couple, and it’s one criminals rely on time after time. If someone reaches out unexpectedly promising high returns or exclusive opportunities, your safest move is simple: disengage immediately. Don’t click links. Don’t share details. And definitely don’t send money.

This tip may sound basic, but it’s shockingly effective at shutting down some of today’s most cunning schemes before they start (more info here). Remember: legitimate investment opportunities never arrive via random DMs from strangers or casual acquaintances.

Why Verification Matters More Than Ever

If you’re ever tempted by an opportunity, even if it comes from someone you know, the next crucial step is independent verification. In 2025’s landscape of AI-powered impersonations and cloned websites, trust must be earned through rigorous checks:

- Research companies thoroughly using official channels, not links sent via chat apps

- Check regulatory registrations for exchanges or advisors

- If in doubt, call official customer support numbers listed on verified websites, not those provided by unknown contacts

This approach could have saved countless victims, including those caught up in pig butchering scams, from losing everything. Vigilance is your best friend when navigating today’s digital asset markets.

Once you’ve verified the legitimacy of an opportunity, don’t let your guard down. The next step is to ensure you’re only transacting on regulated exchanges and using secure wallets. In 2025, reputable platforms go beyond basic security, they offer robust two-factor authentication, withdrawal whitelists, and give you full control over your private keys. If an exchange or wallet doesn’t check these boxes, walk away. Remember: if you don’t hold the keys, you don’t truly own the crypto.

It’s also essential to stay informed about evolving scam tactics. The techniques scammers use are changing at breakneck speed. Deepfake video calls from supposed “crypto advisors, ” fake investment apps that mimic real ones perfectly, and social engineering attacks tailored to your online behavior are now commonplace. Subscribe to trustworthy crypto news sources, participate in online communities, and talk with other investors regularly, what fooled someone else yesterday could target you tomorrow.

Active Defense: Report and Secure

If something feels off, whether it’s a suspicious message or a too-good-to-be-true investment offer, act fast. Block and report the contact immediately, both on the platform (like WhatsApp) and with law enforcement or financial authorities. This not only protects you but also helps prevent future victims from falling into the same trap.

Don’t forget to enable advanced security features on every account linked to your crypto activity. Use biometric authentication where possible, set up withdrawal whitelists so funds can only be sent to pre-approved addresses, and regularly review your account activity for anything unusual.

Why These Five Strategies Work, And What’s At Stake

The Atlanta couple’s loss is heartbreaking, but their story isn’t unique. With over $380 million lost to AI-driven impersonation scams last year alone (source), there’s no room for complacency. Each of these five strategies tackles a specific vulnerability exploited by modern scammers:

- Unsolicited offers are often the entry point, ignore them and most scams die before they start.

- Independent verification exposes fake identities and platforms before any money changes hands.

- Regulated exchanges and secure wallets make it much harder for criminals to access your funds, even if they get past initial defenses.

- Staying updated on scam tactics means you’ll recognize new schemes before they catch you off guard.

- Reporting and enabling security features creates a hostile environment for scammers, and a safer one for everyone else.

If you’re serious about how to buy cryptocurrency safely, these habits aren’t optional, they’re essential. As digital assets become mainstream in 2025, protecting yourself means being proactive rather than reactive. Don’t let headlines like Atlanta’s become your reality; make these strategies part of your crypto routine today.