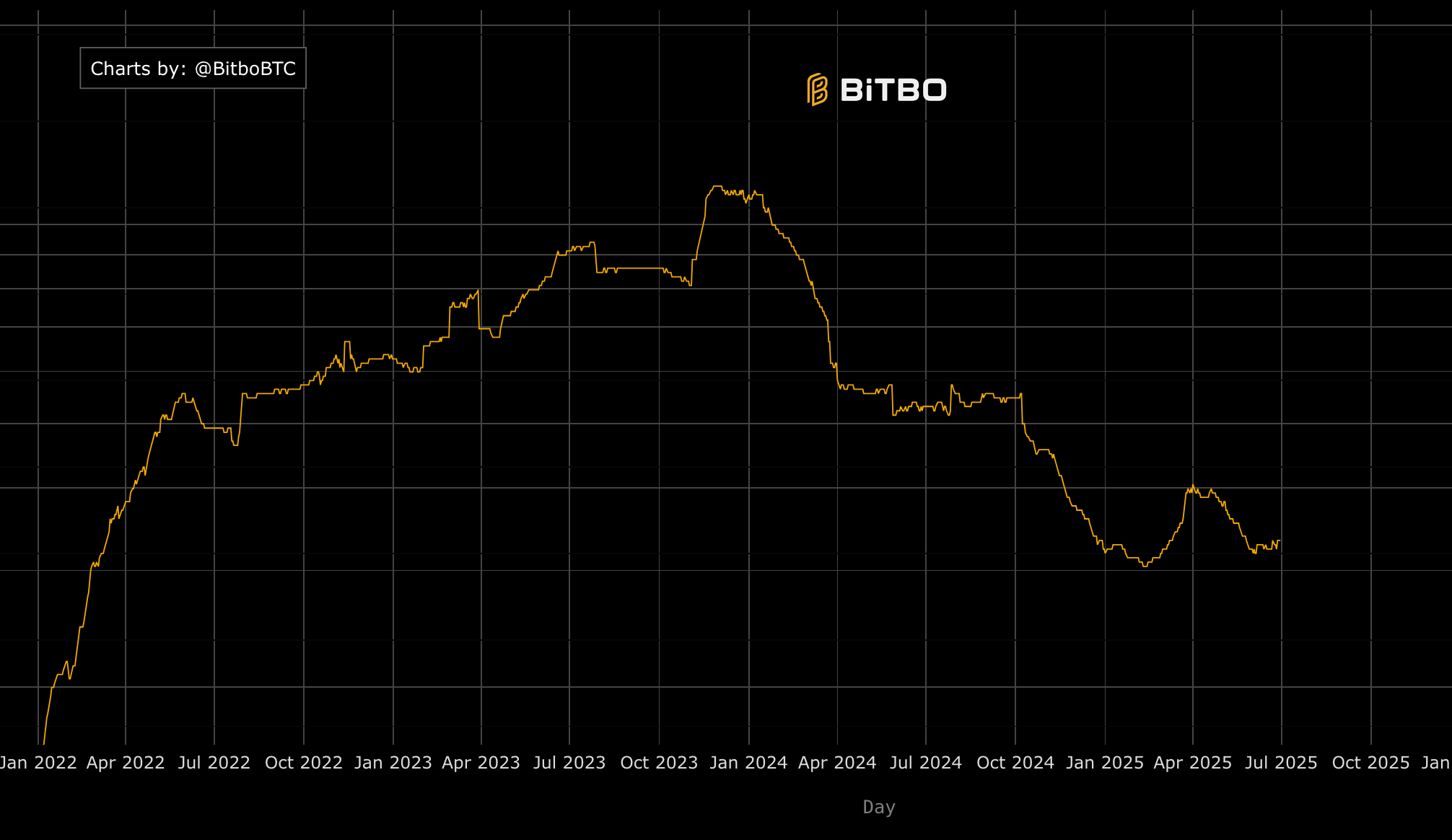

Bitcoin’s price dynamics in 2025 are being shaped less by speculative retail trading and more by the bold moves of public companies. While ETFs have long been considered the institutional gateway to crypto, recent data flips that narrative: in Q2 2025, public firms acquired approximately 131, 000 BTC, outpacing ETFs and marking an 18% surge in corporate accumulation (FT. com). This trend is turbocharged by the playbook pioneered by MicroStrategy, now rebranded as Strategy, which has made Bitcoin not just a speculative asset but a core treasury reserve. What can individual buyers learn from this seismic shift?

Public Companies Are Setting the Pace for Bitcoin Accumulation

It’s no exaggeration to say that public companies are quietly building massive Bitcoin reserves. The numbers speak volumes: according to Bitcoin Treasuries data, publicly traded firms acquired about 131, 000 BTC in Q2 2025 alone (FT. com). That’s more than most spot ETFs managed during the same period. Corporate confidence is growing as regulatory environments become more crypto-friendly, with at least nine UK-listed companies recently announcing their own Bitcoin treasury strategies.

The impact on price is direct and measurable. When large entities buy and hold, they reduce circulating supply, putting upward pressure on price while signaling long-term conviction. In turn, this attracts further interest from both institutions and retail participants who recognize that these are not short-term speculators but committed holders.

Inside Strategy’s Playbook: How Corporate Treasury Moves Affect Markets

Strategy (formerly MicroStrategy) stands as the archetype for this new era of corporate finance. As of December 2024, the company held roughly 423, 650 BTC, valued at $42. 43 billion, making it the single largest corporate holder of Bitcoin (Wikipedia). Their method is aggressive yet calculated: issuing convertible bonds and equity offerings to raise capital specifically earmarked for buying more Bitcoin (CoinRank. io).

This approach allows Strategy to leverage low-interest debt against a deflationary asset. If Bitcoin appreciates, as it has historically, shareholder value can increase dramatically without diluting equity too heavily or risking operational capital. However, this high-conviction strategy comes with risks: if Bitcoin’s price falls sharply or remains stagnant for extended periods, debt obligations could strain even large balance sheets.

Key Lessons from Public Company Bitcoin Strategies

-

Adopt a Long-Term Investment Perspective: Public companies like Strategy (formerly MicroStrategy) have demonstrated the importance of holding Bitcoin for the long term, weathering short-term volatility to potentially realize significant gains over time.

-

Utilize Dollar-Cost Averaging (DCA): By consistently purchasing Bitcoin at regular intervals, regardless of market price, companies reduce the impact of volatility. Individual investors can apply this approach to smooth out entry points and lower average purchase costs.

-

Understand and Manage Risk: Strategy’s use of convertible bonds and equity offerings to fund Bitcoin purchases highlights both the potential rewards and the risks of leveraging assets. Individual investors should carefully assess their risk tolerance and avoid over-leveraging in volatile markets.

-

Consider Diversification: While Strategy has focused heavily on Bitcoin, individual investors should diversify across different asset classes to balance risk and potential returns.

-

Monitor Market and Regulatory Trends: The recent surge in public company Bitcoin acquisitions has been supported by a more crypto-friendly regulatory environment. Staying informed about regulatory changes and market sentiment can help individual investors make better decisions.

Lessons for Individual Buyers: Adapting Institutional Tactics Securely

You don’t need billions in capital or access to convertible bonds to apply some of these principles to your own portfolio. Here are several actionable insights drawn directly from Strategy’s playbook:

- Long-Term Perspective: Holding through volatility has paid off for major corporates; patience remains a key advantage.

- Dollar-Cost Averaging (DCA): Regularly buying fixed amounts reduces exposure to short-term swings, a tactic used by both individuals and institutions.

- Risk Management: Understand your leverage; avoid overextending yourself even if you’re bullish on long-term prospects.

- Diversification: Unlike some public firms with concentrated bets, spread risk across assets where possible.

The rise of public company accumulation also means increased scrutiny, and potentially greater stability, for the broader market. For those looking to make secure cryptocurrency purchases or refine their bitcoin buying strategies, studying these corporate moves provides a valuable roadmap.

One of the most important takeaways from the current market environment is that institutional vs retail crypto buying is no longer a simple dichotomy. The line has blurred as more public companies adopt sophisticated treasury strategies, directly influencing Bitcoin’s liquidity and volatility profile. For individual investors, this means that price dips are increasingly met with corporate buy-ins, providing a potential floor and signaling long-term confidence.

But this also introduces new risks. When a handful of large players control significant portions of the circulating supply, their actions can have outsized effects on price momentum. If a major holder like Strategy were to liquidate part of its position, the resulting volatility could be severe. This is why understanding the motivations and financial health of these companies becomes almost as important as tracking Bitcoin’s technical indicators.

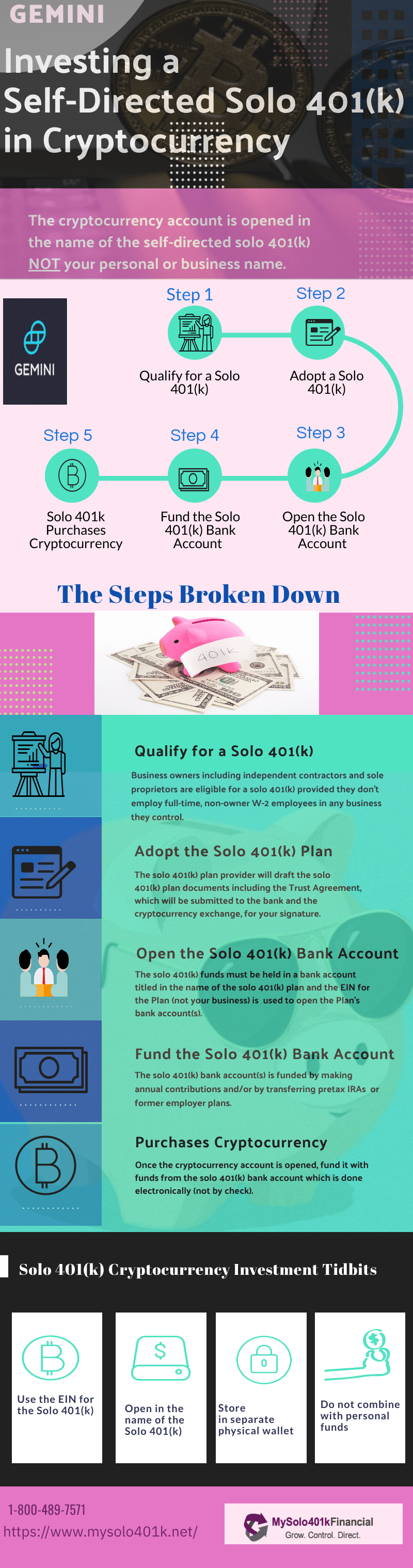

How to Buy Bitcoin Securely in a Corporate-Driven Market

With public companies ramping up their Bitcoin holdings, secure cryptocurrency purchase methods are more crucial than ever for individuals. Always use reputable exchanges with robust security features such as two-factor authentication and cold storage options. Consider self-custody solutions like hardware wallets for long-term holdings, especially if you aim to mirror the conviction seen in corporate treasuries.

An additional layer of security comes from education: stay informed about regulatory changes and best practices for wallet management. As more companies publicly disclose their Bitcoin strategies, transparency in reporting and auditing will likely improve, benefiting both institutional and retail participants by setting higher standards across the industry.

Key Questions Before Adopting a Bitcoin Playbook

-

What is your investment time horizon? Strategy’s approach is built on a long-term commitment to Bitcoin, holding through market cycles. Are you prepared to withstand potential volatility for years, as Strategy has done?

-

How will you manage volatility and risk? Bitcoin’s price can swing dramatically. Strategy uses risk management tactics, but as an individual, do you have a plan for drawdowns or sudden price drops?

-

What portion of your portfolio will Bitcoin represent? Unlike Strategy’s concentrated bet, most individuals benefit from diversification. Have you determined an allocation that fits your risk tolerance and financial goals?

-

How will you acquire Bitcoin—lump sum or dollar-cost averaging (DCA)? Strategy often buys in large tranches, but DCA can help individuals smooth out entry prices over time. Which method aligns with your resources and discipline?

-

Are you prepared for regulatory and tax implications? Public companies like Strategy navigate complex regulations and reporting requirements. Do you understand the tax treatment and legal obligations for your own Bitcoin holdings?

-

What is your source of capital for Bitcoin purchases? Strategy leverages convertible bonds and equity offerings. As an individual, will you use savings, income, or leverage—and what risks does each entail?

What’s Next? The Ongoing Impact on Bitcoin Price

The current market data paints a compelling picture: with Strategy (MSTR) priced at $385. 38 (24h change: and $12. 08), and over 131, 000 BTC added by public firms in Q2 2025 alone, we’re witnessing an era where corporate action sets the tone for price discovery. This doesn’t mean retail buyers are sidelined; rather, they have an opportunity to study institutional behavior for cues on timing, risk management, and conviction levels.

As more companies announce acquisitions or signal intent to add Bitcoin to their balance sheets, like Tao Alpha and Panther Metals in the UK, the network effect strengthens. Each new entrant increases demand pressure while reducing available supply on exchanges. This dynamic could lead to higher baseline prices over time but also sharper corrections when sentiment shifts.

Building Your Own Playbook

If you’re considering following elements of the MicroStrategy playbook, remember that size isn’t everything, discipline is key. Start small with DCA or periodic buys, set clear risk thresholds, and keep your portfolio diversified even if you’re bullish on Bitcoin’s long-term prospects.

The rise of public company accumulation offers both opportunities and cautionary tales for individual buyers. By staying agile, informed, and security-minded, as well as learning from institutional tactics, you can navigate this new landscape with greater confidence.