The cryptocurrency market just got a major jolt of mainstream attention: Trump Media and Technology Group (TMTG) has filed with the SEC to launch a ‘Crypto Blue Chip ETF’: a move that could reshape how everyday investors access digital assets. With Bitcoin currently trading at $111,099.00 and Ethereum at $2,778.32, this ETF proposal lands at a time when crypto prices are both headline-grabbing and highly volatile.

What Is the Crypto Blue Chip ETF?

TMTG’s proposed ETF is designed to offer exposure to a basket of leading cryptocurrencies, allocating 70% to Bitcoin, 15% to Ethereum, 8% to Solana, 5% to Cronos, and 2% to Ripple’s XRP. This isn’t just another single-asset Bitcoin ETF; it’s a diversified vehicle that mirrors traditional blue-chip stock ETFs but for digital assets. The fund will be managed by TMTG with Crypto. com as its designated custodian. According to the Nasdaq press release, this structure aims to provide both professional oversight and streamlined access for retail investors.

“The filing of the S-1 registration statement is a significant step towards the potential launch of the Crypto Blue Chip ETF. “

Opportunities: Simpler Access and Diversification

For most individuals considering crypto investment in 2025, managing multiple wallets or navigating decentralized exchanges can be daunting or even risky. The proposed ETF offers several advantages:

- Simplified Access: Investors can buy shares through traditional brokerage accounts without setting up wallets or worrying about private keys.

- Diversification: Exposure isn’t limited to one coin; risk is spread across five major cryptocurrencies in carefully chosen proportions.

- Professional Management: Oversight by TMTG (with Crypto. com as custodian) means asset security protocols are likely more robust than DIY storage solutions.

Risks: Regulatory Uncertainty and Market Volatility Remain High

No investment product is without risk, especially in crypto. While ETFs offer convenience and institutional-grade management, buyers should consider key challenges:

- Regulatory Hurdles: The SEC hasn’t approved the fund yet, and future regulations could impact operations or even force changes in asset allocation.

- Market Volatility: Even with diversification, cryptocurrencies remain highly volatile. For example, Bitcoin’s price has recently surged past $111,000, a level unthinkable just two years ago, but such gains can reverse quickly.

- Custodial Risk: Relying on third-party custodians like Crypto. com introduces counterparty risk; if something goes wrong on their end, investor assets could be at risk.

Bitcoin (BTC) Price Prediction 2026-2031

Professional forecast based on current market trends, regulatory context, and technical analysis (Post-Trump ‘Crypto Blue Chip ETF’ filing, July 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $88,000 | $120,000 | $155,000 | +8% | Volatility expected post-ETF launch; possible regulatory hurdles may dampen upside; strong ETF inflows if SEC approval is smooth. |

| 2027 | $102,000 | $137,000 | $182,000 | +14% | ETF adoption boosts institutional demand; halving effects from 2024 cycle support upward trend; macroeconomic headwinds may cause mid-year dips. |

| 2028 | $110,000 | $155,000 | $210,000 | +13% | Wider mainstream and ETF acceptance; potential for new regulatory frameworks; Bitcoin’s scarcity narrative strengthens. |

| 2029 | $128,000 | $175,000 | $240,000 | +13% | Next Bitcoin halving (2028) impacts supply; institutional allocation grows; tech integration (e.g., Layer 2) aids scalability. |

| 2030 | $150,000 | $200,000 | $280,000 | +14% | Global financial adoption milestones; potential for central bank digital currency (CBDC) competition; ETF market matures. |

| 2031 | $170,000 | $225,000 | $320,000 | +12% | Bitcoin seen as digital gold; geopolitical events or further U.S. regulatory clarity could drive sharp moves. |

Price Prediction Summary

Bitcoin is projected to see steady growth through 2031, driven by institutional adoption via the new ETF, periodic supply shocks from halvings, and increasing global recognition as a store of value. However, price paths remain subject to regulatory outcomes and broader market cycles, with significant volatility possible in both directions.

Key Factors Affecting Bitcoin Price

- SEC approval and success of the Trump ‘Crypto Blue Chip ETF’

- Broader regulatory clarity and institutional adoption

- Bitcoin halving events and their impact on supply

- Competition from other digital assets and ETFs

- Macroeconomic conditions and global risk appetite

- Technological advances (e.g., scalability, security)

- Market sentiment and major geopolitical events

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Current State of Major Cryptocurrencies

The timing of this ETF proposal coincides with significant momentum in top crypto assets:

- Bitcoin (BTC): $111,099.00 (up $2,328.00/and 2.14%)

- Ethereum (ETH): $2,778.32 (up $166.55/and 6.38%)

- Solana (SOL): $45.67 (up $3.21/and 7.56%)

- Cronos (CRO): $0.12 (up $0.01/and 9.09%)

- XRP: $2.45 (up $0.11/and 4.70%)

This data underscores why diversified exposure matters, each token moves independently based on its own network activity and investor sentiment.

For those new to crypto, the idea of owning a piece of several major coins with a single purchase is compelling. Yet, the underlying dynamics of these assets can differ sharply. Bitcoin, at $111,099.00, continues to dominate headlines with its sheer price momentum and institutional adoption. Ethereum at $2,778.32 remains the backbone for decentralized applications and smart contracts. Meanwhile, Solana ($45.67), Cronos ($0.12), and XRP ($2.45) each bring unique utility and risk profiles.

How Does Buying Crypto With an ETF Compare to Direct Ownership?

If you’re weighing whether to buy crypto directly or via an ETF like TMTG’s, consider your priorities:

Pros & Cons: Crypto ETFs vs. Direct Exchange Purchases

-

Pro: Simplified Access & Diversification — Buying the Crypto Blue Chip ETF gives investors exposure to Bitcoin, Ethereum, Solana, Cronos, and XRP in a single trade, eliminating the need to manage multiple wallets or accounts across exchanges.

-

Pro: Institutional Oversight & Security — The ETF is managed by Trump Media & Technology Group with Crypto.com as custodian, offering professional asset management and enhanced security protocols compared to self-custody.

-

Pro: Regulated Investment Structure — ETFs are subject to SEC oversight and regulatory standards, providing an additional layer of investor protection not present on many global crypto exchanges.

-

Con: Limited Control & Flexibility — ETF holders cannot transfer, stake, or use the underlying crypto assets directly, unlike owning coins via exchanges or wallets.

-

Con: Management Fees — ETFs typically charge annual management fees, which can reduce net returns compared to holding crypto directly on an exchange, where fees are generally limited to trading and withdrawal costs.

-

Con: Regulatory & Counterparty Risks — The ETF’s launch and ongoing operations depend on SEC approval and the reliability of third-party custodians like Crypto.com, introducing regulatory and counterparty risks not present in self-custody.

-

Con: Market Hours & Liquidity Constraints — ETFs trade during regular stock market hours, while crypto exchanges operate 24/7, potentially limiting the ability to react instantly to price swings (e.g., Bitcoin at $111,099.00, Ethereum at $2,778.32).

Direct ownership lets you interact with blockchains natively, staking, voting, using DeFi protocols, but requires technical know-how and puts security squarely on your shoulders. ETFs abstract away that complexity but also limit your ability to use tokens in decentralized ecosystems.

What Should Everyday Buyers Watch For?

The biggest wildcard is still regulation. The SEC’s evolving stance could affect everything from what assets are included in ETFs to how they’re taxed or reported by brokers. If you’re considering investing when (and if) the Crypto Blue Chip ETF launches, stay tuned for updates on regulatory progress.

Fees are another consideration, ETF management costs can eat into returns over time compared to holding assets directly in a wallet.

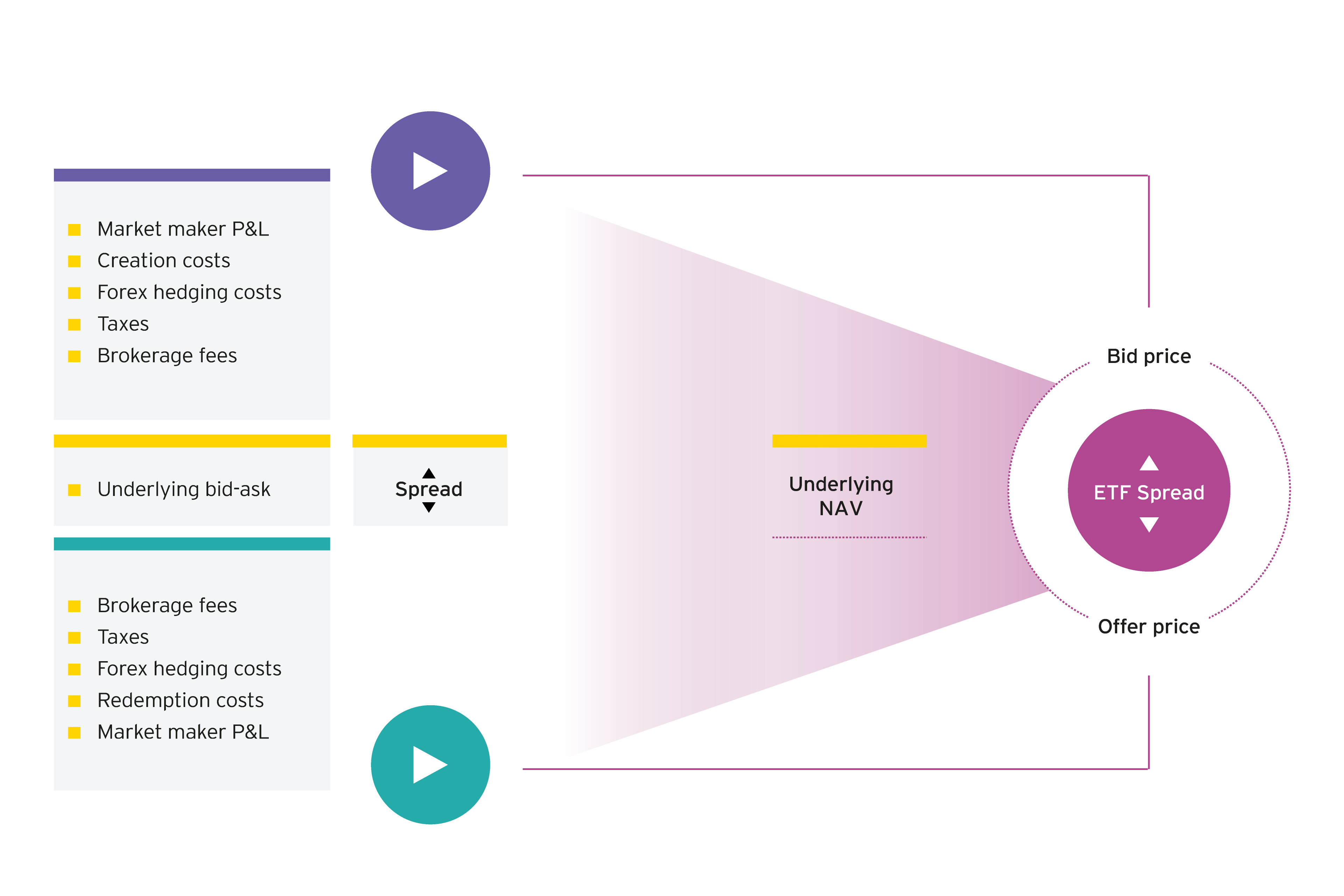

Liquidity is a double-edged sword: ETFs offer easy entry and exit through stock exchanges, but during periods of high volatility (which crypto sees often), ETF prices can diverge from underlying asset values.

Why This Matters for Crypto Investment Opportunities in 2025

The arrival of blue-chip crypto ETFs signals a maturation point for digital assets as investable securities. For everyday buyers, this means easier access, but also more competition from institutional players who may influence price trends or even drive short-term volatility higher.

If you’re seeking secure ways to buy cryptocurrency in 2025 without navigating private keys or complex exchanges, products like this ETF could be game changers, provided you understand their limitations and risks.

Key Takeaways for Potential Investors

- Diversification: The proposed allocation gives heavy weight to Bitcoin but still offers exposure to fast-moving altcoins.

- Simplicity: No wallets or seed phrases required, just your brokerage account.

- Regulatory Watch: SEC approval isn’t guaranteed; track developments closely before committing funds.

- Market Awareness: Crypto remains volatile; even diversified ETFs can experience sharp swings in value.

- Security Tradeoffs: Institutional custody reduces some risks but introduces reliance on third parties like Crypto. com.

The bottom line? Trump Media’s ‘Crypto Blue Chip ETF’ could lower barriers for mainstream investors eager to participate in the next wave of digital asset growth, if it receives regulatory approval and delivers on its promise of secure, diversified exposure at a time when Bitcoin is trading above $111,000. As always in crypto: do your own research and never invest more than you can afford to lose.

Leave a Reply