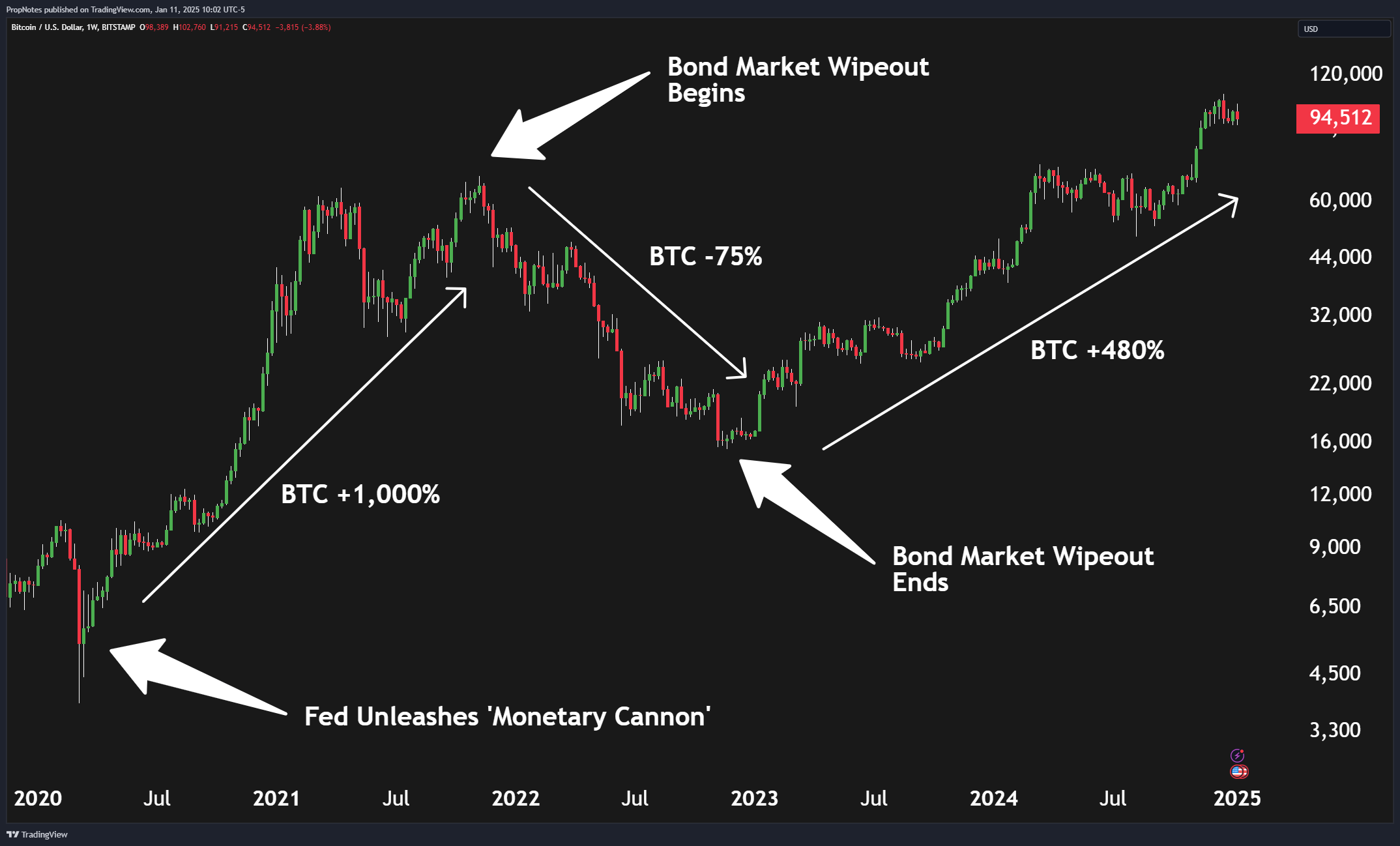

Bitcoin’s relentless momentum has once again redefined the crypto landscape. On July 11,2025, Bitcoin shattered expectations by hitting a new all-time high of $117,851.00. This milestone is more than a headline – it’s a clear indicator of how institutional adoption and regulatory shifts are rewriting the rules for crypto investors. The rapid ascent is powered by surging demand from both Wall Street and Main Street, with ETFs now making it easier than ever to gain exposure to Bitcoin without navigating the complexities of direct ownership.

Bitcoin Maintains Position Above $117,000: What’s Fueling the Rally?

The current rally isn’t just another speculative bubble. Several key forces are converging to drive this breakout:

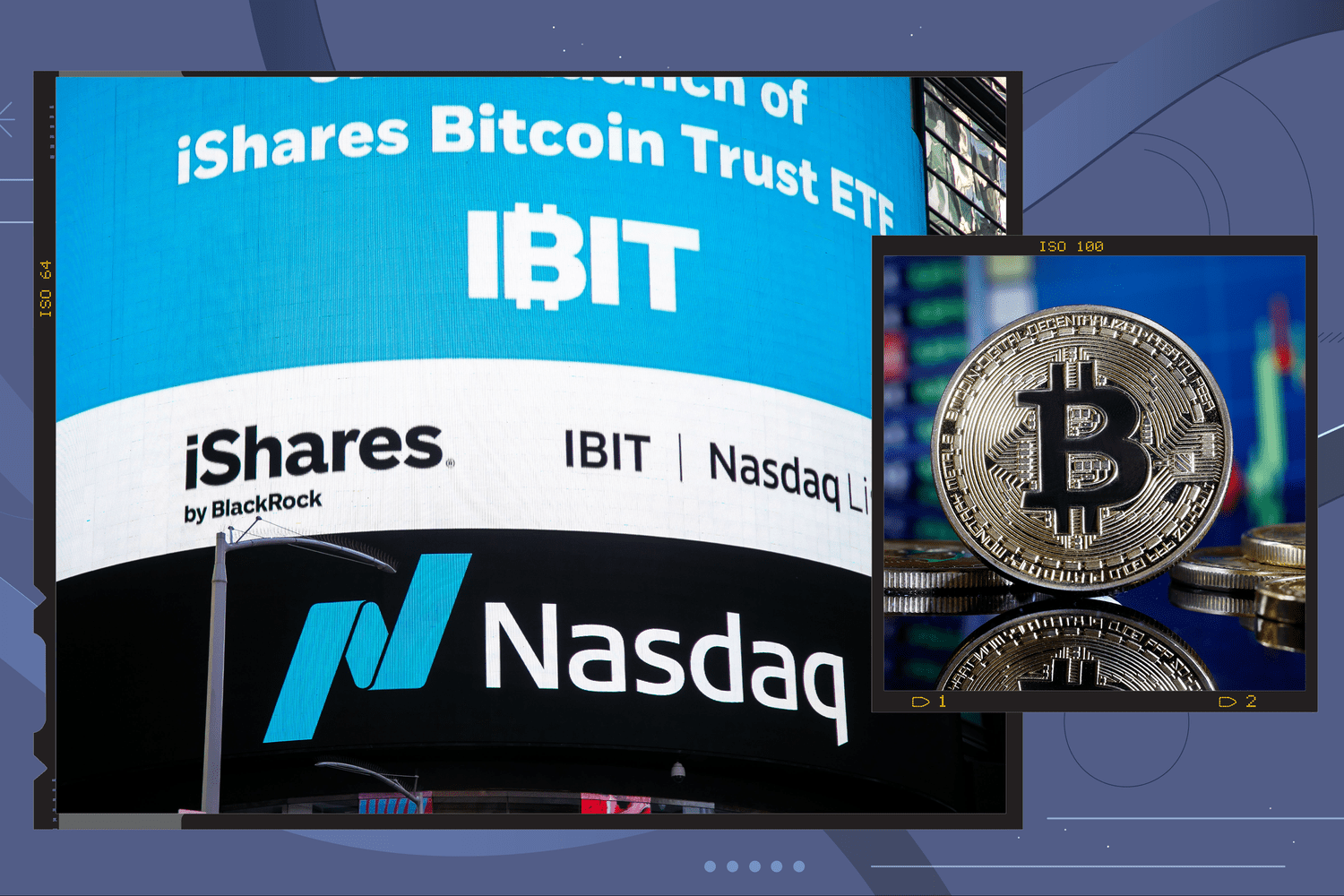

- ETF Approval: The arrival of spot Bitcoin ETFs in major U. S. markets has opened the floodgates for institutional capital and retirement accounts seeking regulated exposure.

- Strategic Bitcoin Reserve: Recent U. S. policy moves, including the establishment of a Strategic Bitcoin Reserve, have signaled official confidence in crypto as part of national financial strategy (source).

- Global Economic Uncertainty: Ongoing inflation concerns and currency instability worldwide are prompting investors to diversify into digital assets as a hedge against traditional risks.

This perfect storm has made Bitcoin not just a speculative asset but an increasingly mainstream component of diversified portfolios.

How Crypto ETFs Are Shifting Buying Strategies in 2025

The approval and explosive growth of crypto ETFs have fundamentally changed how both new and experienced investors approach the market. Previously, buying Bitcoin meant navigating private wallets, seed phrases, and security risks – barriers that kept many on the sidelines. Now, with ETFs holding actual BTC on behalf of shareholders, it’s possible to add exposure through traditional brokerages or retirement accounts.

Top 3 Ways Crypto ETFs Are Shaping 2025 Investment Strategies

-

1. Easier Portfolio Diversification with Bitcoin ETFsWith the approval of Bitcoin ETFs, investors can now add Bitcoin exposure to traditional portfolios without directly holding crypto. This integration allows for seamless diversification alongside stocks and bonds, especially as Bitcoin trades at $117,851 (as of July 11, 2025).

-

2. Increased Institutional Participation and LiquidityMajor asset managers like BlackRock and Fidelity have launched spot Bitcoin ETFs, attracting institutional investors. This has boosted market liquidity and stability, supporting Bitcoin’s new all-time high above $117,000.

-

3. Shift Toward Long-Term Holding StrategiesCrypto ETFs make it easier for investors to adopt buy-and-hold strategies, similar to traditional index funds. With U.S. policies supporting a Strategic Bitcoin Reserve, more investors are integrating Bitcoin into long-term retirement and wealth plans.

This shift has introduced new buying behaviors:

- Diversification within Portfolios: Investors can now allocate specific percentages to Bitcoin alongside stocks and bonds without needing technical expertise.

- Smoother Entry Points: Dollar-cost averaging into ETF shares lets buyers participate in market upside while minimizing timing risk.

- Tighter Security and Compliance: Institutional-grade custody solutions reduce fears around hacks or lost keys that previously plagued self-custody models.

The bottom line? Crypto investing is no longer reserved for early adopters or tech-savvy users – it’s now fully integrated into mainstream financial planning.

The Impact of Institutional Adoption on Long-Term Crypto Strategies

The influx of institutional players isn’t just boosting prices; it’s also encouraging longer-term thinking among retail investors. With major funds and corporations now treating Bitcoin as a treasury asset (as highlighted by Investopedia), volatility is dampened compared to previous cycles – though wild swings remain part of the territory. Investors are increasingly adopting strategies like HODLing (holding long term), periodic rebalancing, and using ETFs as core positions rather than speculative punts.

Bitcoin Price Prediction 2026-2031

Professional Bitcoin (BTC) Price Forecasts Post-2025 All-Time Highs and ETF Surge

| Year | Minimum Price | Average Price | Maximum Price | Potential Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $89,000 | $124,000 | $156,000 | +5% | Potential post-ATH correction or consolidation in early 2026, with institutional support maintaining higher average levels. |

| 2027 | $103,000 | $137,000 | $175,000 | +10% | ETF inflows and further global adoption drive new highs; volatility remains amid possible regulatory changes. |

| 2028 | $119,000 | $152,000 | $198,000 | +11% | Next Bitcoin halving cycle expected; increased scarcity and further integration into financial products. |

| 2029 | $129,000 | $167,000 | $225,000 | +10% | Continued institutional adoption and possible central bank engagement; tech upgrades improve scalability and security. |

| 2030 | $140,000 | $185,000 | $255,000 | +11% | Mature ETF market, global regulatory clarity, and Bitcoin as a treasury asset in more countries. |

| 2031 | $155,000 | $205,000 | $290,000 | +11% | Potential for mainstream adoption as a global store of value; competition from CBDCs and altcoins may influence range. |

Price Prediction Summary

Following Bitcoin’s record high above $117,000 in July 2025, BTC is expected to consolidate and then gradually rise over the next six years. Institutional demand, ETF accessibility, and favorable regulatory climates are likely to support higher average prices. However, periods of volatility and corrections remain probable, especially after major rallies. The outlook is bullish long-term, with significant upside potential if adoption trends and regulatory support persist.

Key Factors Affecting Bitcoin Price

- Ongoing institutional adoption and treasury allocations

- Growth and acceptance of Bitcoin ETFs in global markets

- Regulatory clarity and government policy (e.g., Strategic Bitcoin Reserve)

- Next Bitcoin halving cycle (2028) reducing supply issuance

- Integration of Bitcoin into traditional and digital financial products

- Potential macroeconomic events (inflation, monetary policy)

- Technological upgrades improving security and scalability

- Emergence of competitive digital assets, including CBDCs

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This paradigm shift is prompting more people to ask: What does smart crypto investing look like after ETF approval and record highs?

As Bitcoin cements its place above $117,851.00, the playbook for crypto investors is evolving rapidly. The lines between traditional and digital finance are blurring, and the strategies that worked in the past may need a serious rethink. Let’s explore how both seasoned and first-time buyers are adapting to this new era.

Smart Buying Strategies for Bitcoin and Crypto in 2025

With mainstream access via ETFs and growing institutional confidence, the focus has shifted from speculative short-term gains to sustainable, risk-adjusted growth. Here’s how investors are recalibrating:

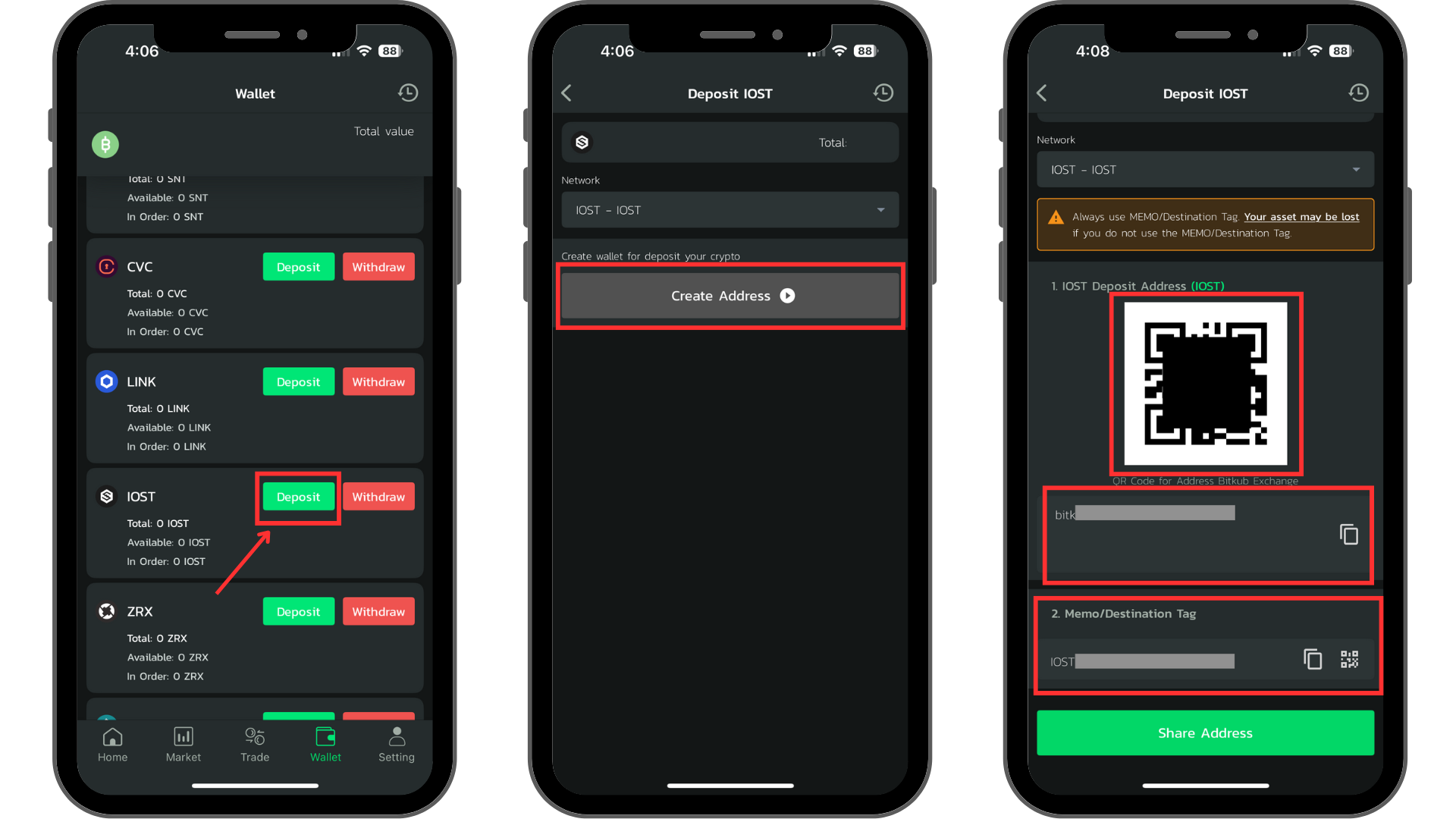

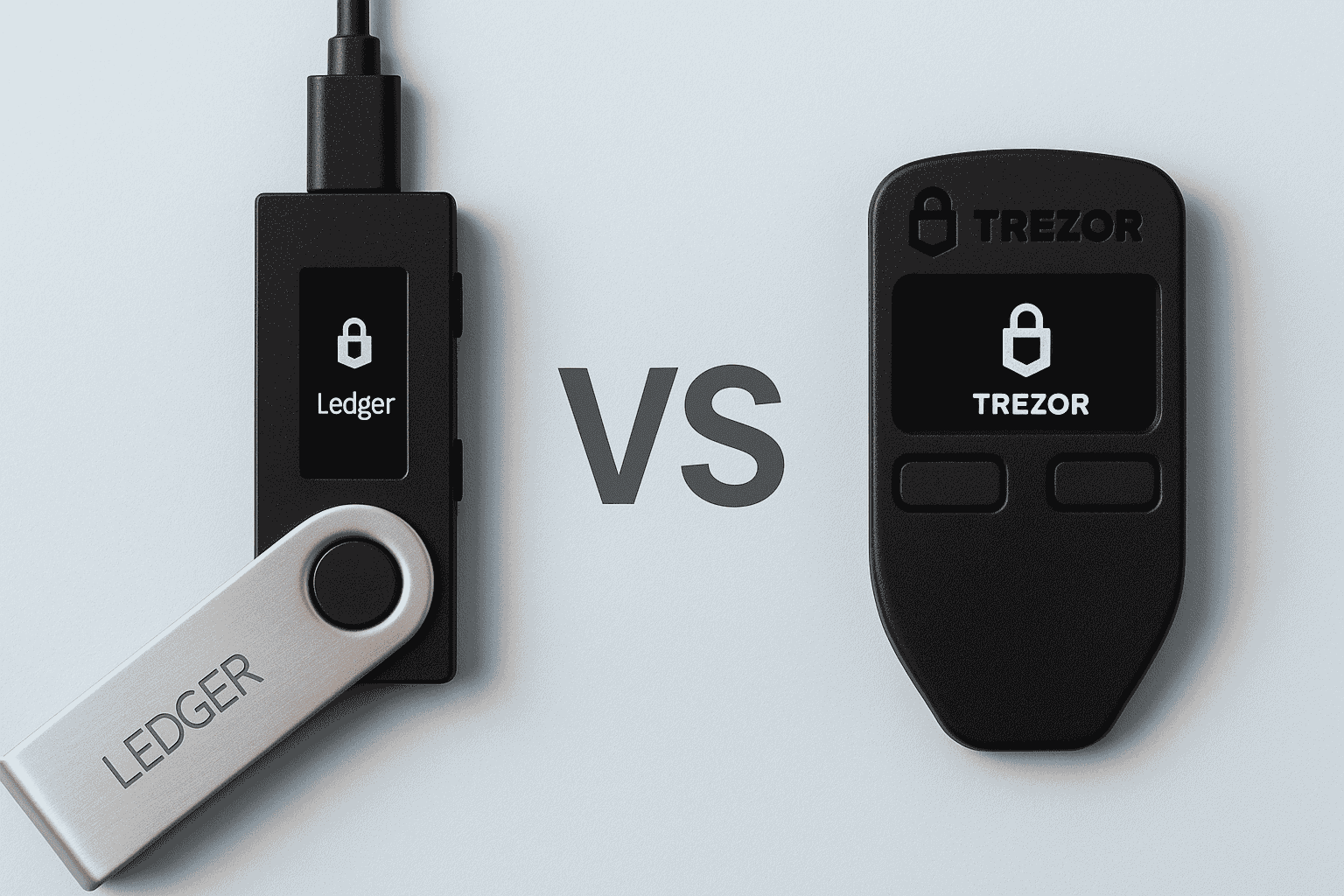

- Prioritizing Security: Even with ETFs minimizing direct custody risks, those who buy Bitcoin directly continue to demand best-in-class security practices. Hardware wallets, multi-factor authentication, and reputable exchanges remain essential for anyone holding their own coins.

- Portfolio Integration: Rather than treating crypto as a moonshot side bet, many are now assigning it a fixed allocation within a diversified portfolio, often between 3% and 10% depending on risk tolerance.

- Rebalancing Discipline: As Bitcoin’s price surges, rebalancing ensures that gains don’t overweight a portfolio’s exposure beyond comfortable levels. This disciplined approach helps lock in profits during rallies like the current one.

Navigating Volatility: Lessons from the Current Cycle

The recent rally demonstrates that volatility remains an inherent part of crypto investing. While ETF flows have brought some stability, sharp swings, both up and down, are still common. The key lesson? Avoid emotional trading decisions driven by short-term price movements.

Diversification is also top of mind. Investors are using ETFs not just for Bitcoin but also for other leading cryptocurrencies as they become available on regulated markets. This helps spread risk while capturing upside across multiple assets.

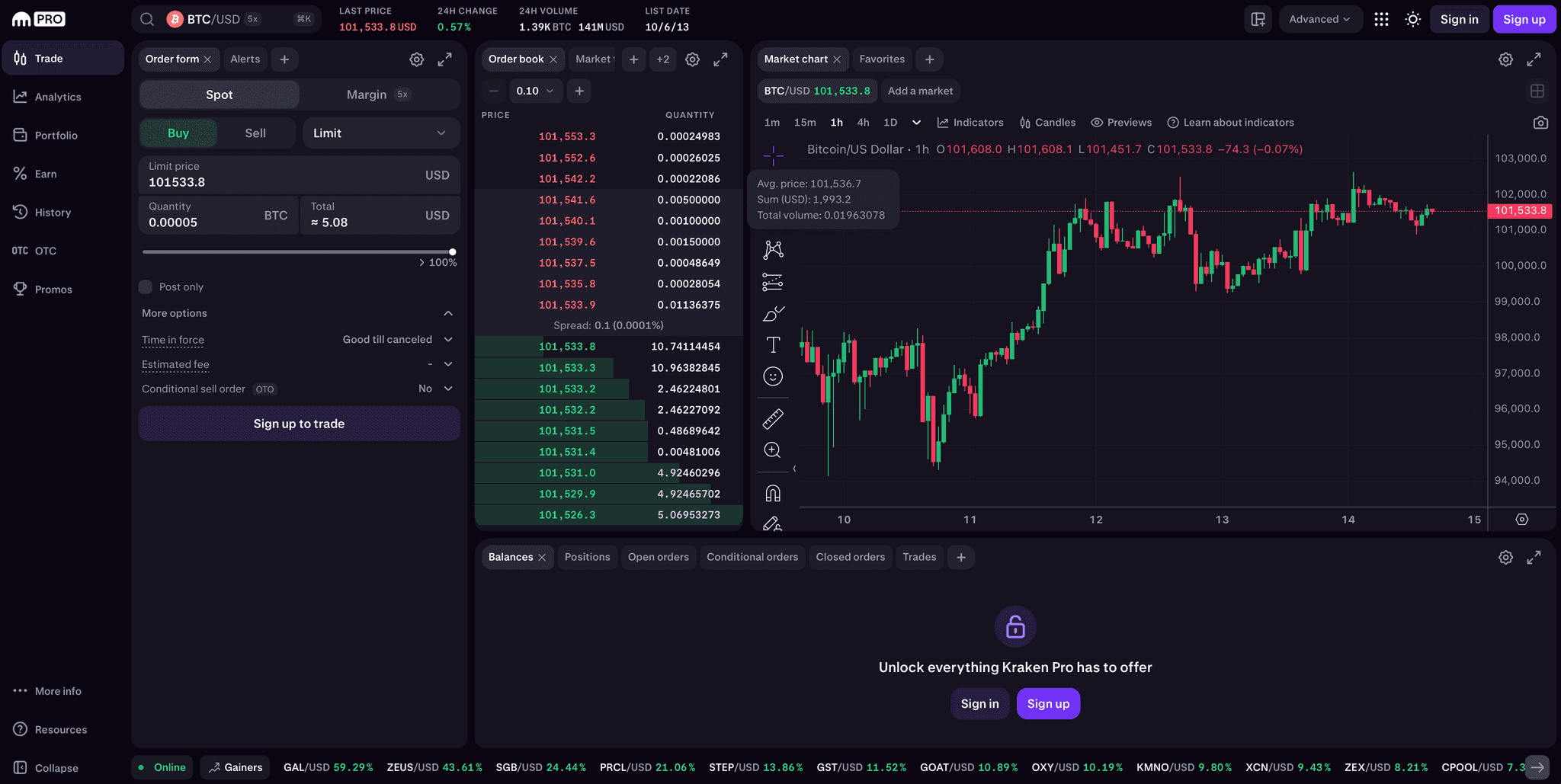

How to Buy Bitcoin Securely in 2025

If you’re looking to enter at these historic highs, or add to your existing holdings, it’s more important than ever to prioritize secure buying methods:

Essential Steps for Buying Bitcoin Securely in 2025

-

Enable Two-Factor Authentication (2FA): Always activate 2FA on your exchange account using trusted apps like Authy or Google Authenticator to protect against unauthorized access.

-

Consider Regulated Bitcoin ETFs: Explore approved Bitcoin ETFs such as iShares Bitcoin Trust ETF (IBIT) or VanEck Bitcoin Trust ETF (HODL) for exposure without direct custody risks.

-

Verify Transaction Details: Double-check wallet addresses and transaction amounts before confirming any transfer to avoid irreversible mistakes.

-

Stay Informed on Regulatory Updates: Regularly check official sources like the U.S. Securities and Exchange Commission (SEC) and FinCEN for the latest regulations affecting Bitcoin ownership and trading.

-

Monitor Bitcoin’s Market Price: Track real-time prices from reliable sources such as CoinDesk or CoinMarketCap. As of July 11, 2025, Bitcoin is trading at $117,851.00.

-

Beware of Scams and Phishing Attempts: Only use official exchange websites and never share your private keys or recovery phrases. Watch for phishing emails and fake apps.

Whether you choose an ETF or direct purchase through an exchange, always verify platform credentials and enable all available security features. For larger sums or long-term storage, consider splitting holdings between ETF shares (for liquidity) and cold storage wallets (for maximum security).

The Role of Regulation: Friend or Foe?

The regulatory environment in 2025 is markedly more supportive than just a few years ago. The U. S. Strategic Bitcoin Reserve has lent legitimacy to crypto as an asset class (source). That said, global differences persist, so always stay informed about local rules on taxation and reporting requirements before making significant moves.

The rapid evolution of policy means today’s best practices could change tomorrow, keep learning, stay nimble, and never risk more than you can afford to lose.

The Road Ahead: What Could Come Next?

No one can predict with certainty where prices will head after smashing through $117,851.00. However, most analysts agree that institutional adoption has fundamentally altered market dynamics, from deeper liquidity to greater resilience against shocks.

If you’re planning your next move:

- Don’t chase pumps: Stick to your investment plan rather than reacting emotionally to headlines or social media hype.

- Review your allocations regularly: As prices move quickly, ensure your portfolio reflects your goals, not just recent gains.

- Diversify across assets and strategies: Don’t put all your eggs in one basket, even within crypto itself.

Are you buying more Bitcoin after the $117,851 all-time high breakout?

With Bitcoin reaching a new all-time high of $117,851, fueled by ETF momentum and rising institutional demand, many investors are rethinking their strategies. Are you increasing your BTC holdings, holding steady, or taking profits?

The world of crypto investing in 2025 is both more accessible, and more sophisticated, than ever before. Whether you’re using ETFs or holding coins directly, knowledge remains your most valuable asset as this new chapter unfolds.

Leave a Reply