It’s official: Bitcoin has smashed through the $120,000 barrier, and as of July 16,2025, it’s holding steady at $118,187. For first-time crypto buyers, this isn’t just another headline – it’s a call to adventure. The surge is fueled by record-breaking ETF inflows and a wave of positive regulation out of Washington. But with all this hype and volatility, how do you actually buy Bitcoin safely and smartly right now?

Bitcoin’s $120,000 Surge: What Does It Mean for New Buyers?

Let’s set the scene. In just the past week, Bitcoin ETFs saw their biggest single-day inflows ever – $1.18 billion on July 14. Meanwhile, Congress is rolling out the red carpet for crypto with new legislation aimed at making digital assets safer and more accessible. This bullish momentum has drawn in a fresh wave of first-timers eager to grab their slice of Bitcoin before it rockets higher.

If you’re new to the party, here’s the reality: buying at all-time highs can feel risky. The market is volatile. FOMO (fear of missing out) is real – but so is the risk of buying at a local top. That’s why having a strategy is absolutely crucial.

Strategy #1: Use Dollar-Cost Averaging (DCA) to Tame Volatility

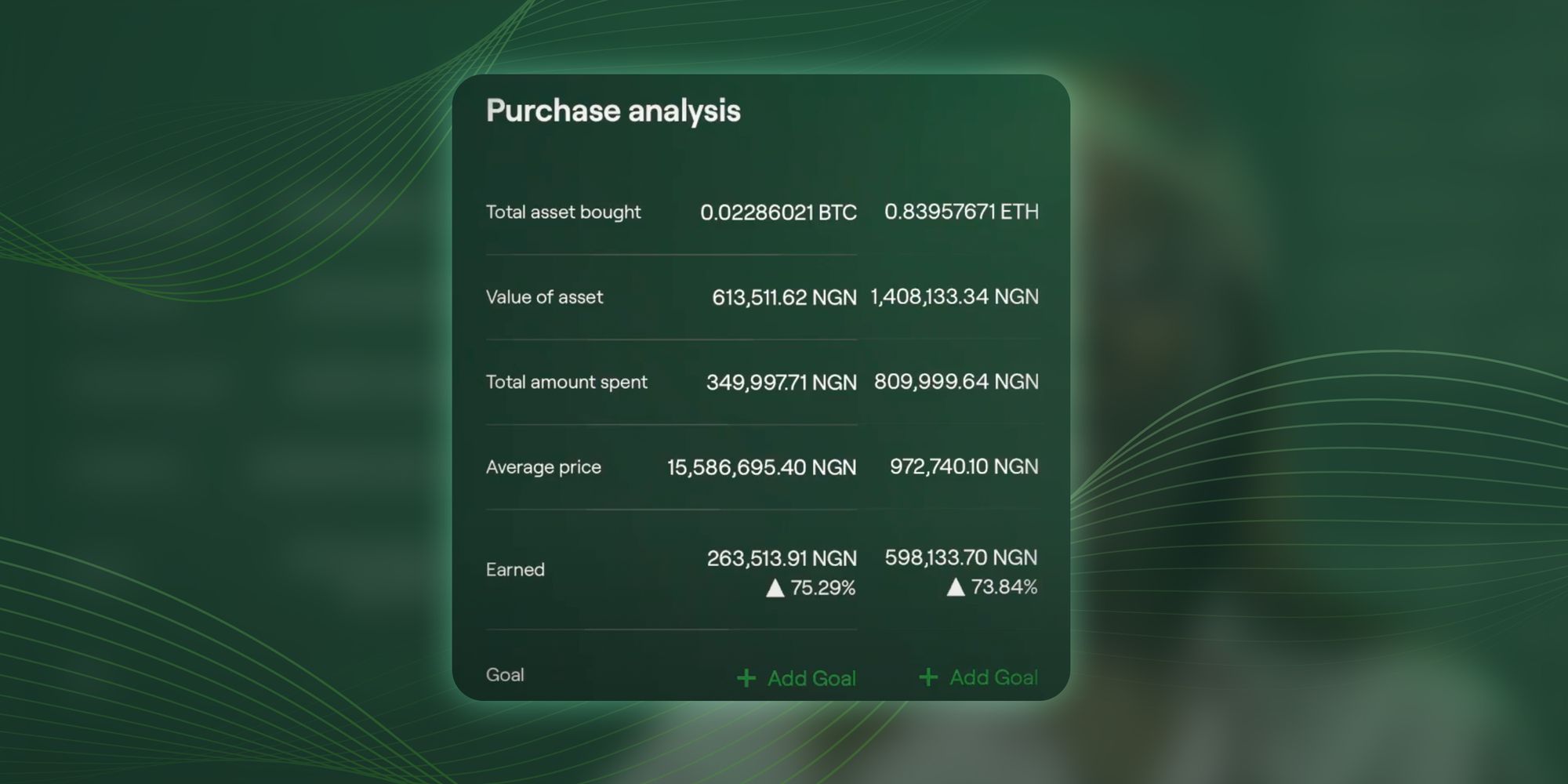

DCA isn’t just a buzzword – it’s your best friend when entering a wild market like this. Instead of throwing all your cash in at once (and potentially catching a short-term peak), set up automatic recurring buys on your chosen exchange. Whether that’s weekly or monthly purchases, DCA spreads your entry price over time and helps smooth out those heart-stopping dips.

How DCA Works for New Bitcoin Buyers in 2025

-

Use Dollar-Cost Averaging (DCA) to Mitigate Volatility: Instead of putting all your funds into Bitcoin at once—especially with prices around $118,187—set up automatic, recurring buys (weekly or monthly) on a regulated exchange. DCA helps you average out your entry price and reduces the risk of buying at a short-term peak during wild market swings.

-

Prioritize Security with Hardware Wallets: After purchasing Bitcoin, transfer your holdings to a trusted hardware wallet like Ledger or Trezor. This step keeps your crypto safe from exchange hacks and gives you full control over your private keys—an essential move for first-timers in today’s fast-paced market.

-

Select Reputable, Regulated Crypto Exchanges with Transparent Fees: Choose established platforms such as Coinbase, Kraken, or Gemini, all registered with financial authorities. Before buying, review their fee structures and security features to dodge hidden costs and ensure your transactions are safe and compliant.

Most regulated exchanges like Coinbase or Kraken let you automate these recurring buys in just a few clicks. This way, you don’t have to stress over timing the market perfectly – which even pros rarely get right.

Strategy #2: Prioritize Security With Hardware Wallets

The next step after buying? Get your coins off the exchange ASAP. Even top-rated platforms aren’t immune from hacks or outages. That’s why seasoned crypto adventurers swear by hardware wallets like Ledger or Trezor.

Transferring your Bitcoin to your own hardware wallet means you control your private keys. No third party can freeze or access your funds without your permission. Think of it as putting your treasure in a vault only you can open.

Strategy #3: Pick Reputable Exchanges With Transparent Fees

This part trips up tons of newcomers! Not all exchanges are created equal – some charge sneaky fees or lack proper regulation. For peace of mind (and lower costs), stick with well-known names like Coinbase, Kraken, or Gemini that are registered with financial authorities in your country.

Before you buy, take five minutes to review their fee structures and security features. It’ll save you headaches later and help ensure you’re not paying more than you need to get started.

The bottom line? With prices hovering around $118,187, entering the Bitcoin market in 2025 requires more than just guts – it takes strategy and attention to detail.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Professional Forecast Based on 2025 Market Surge, Institutional Adoption, and Regulatory Developments

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $96,000 | $125,000 | $165,000 | +5.8% | Post-ETF rally consolidation; possible volatility as regulations take effect |

| 2027 | $110,000 | $140,000 | $190,000 | +12.0% | Mainstream adoption grows; clearer global regulatory framework |

| 2028 | $130,000 | $160,000 | $225,000 | +14.3% | Next Bitcoin halving (early/mid 2028) triggers new cycle; supply shock potential |

| 2029 | $120,000 | $175,000 | $260,000 | +9.4% | Market matures; increased institutional presence; more stable growth |

| 2030 | $145,000 | $195,000 | $295,000 | +11.4% | Wider integration in payment systems; possible CBDC interplay |

| 2031 | $160,000 | $215,000 | $330,000 | +10.3% | Bitcoin seen as digital gold; advanced use cases in DeFi and remittances |

Price Prediction Summary

Bitcoin is projected to maintain strong momentum following its 2025 all-time high, with average annual price increases between 6-14% through 2031. While short-term volatility is expected, especially in response to regulatory shifts and market cycles, the long-term outlook remains bullish with new highs likely post-2028 halving. Maximum price targets reflect bullish scenarios driven by institutional adoption, while minimums account for potential corrections or regulatory headwinds.

Key Factors Affecting Bitcoin Price

- Institutional adoption and ETF inflows continuing to drive demand

- Impact of U.S. and global regulatory clarity (e.g., GENIUS Act)

- Bitcoin halving in 2028 reducing new supply

- Mainstream adoption in payments and DeFi

- Potential macroeconomic shocks or competition from other digital assets

- Integration with traditional finance and payment systems

- Market sentiment and global economic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

But don’t let the price tag or the headlines intimidate you. The fact that Bitcoin is holding near $118,187 after its recent all-time high is a sign of serious institutional confidence and growing mainstream adoption. For first-timers, this is both an opportunity and a reminder: the rules of the crypto jungle haven’t changed, but the stakes are higher than ever.

Navigating Your First Purchase: Practical Tips for 2025

Ready to take the plunge? Here’s how you can put these strategies into action and start your Bitcoin journey on solid footing:

Quick-Start Strategies for First-Time Bitcoin Buyers in 2025

-

Use Dollar-Cost Averaging (DCA) to Mitigate Volatility: Rather than investing a lump sum at Bitcoin’s current all-time highs (around $118,187 as of July 16, 2025), set up automatic, recurring purchases—like weekly or monthly buys—through a regulated exchange. This spreads your entry price over time and helps reduce the risk of buying at a short-term peak.

-

Prioritize Security with Hardware Wallets: After purchasing Bitcoin on an exchange, promptly transfer your holdings to a personal hardware wallet (such as Ledger or Trezor). This step protects your assets from exchange hacks and ensures you have full control over your private keys.

-

Select Reputable, Regulated Crypto Exchanges with Transparent Fees: Choose top-rated platforms like Coinbase, Kraken, or Gemini that are registered with financial authorities in your country. Review their fee structures and security features before making your first purchase to avoid hidden costs and ensure compliance.

- Start Small, Learn Fast: You don’t need to buy a whole Bitcoin, fractional purchases are easy. This lets you get comfortable with the process before committing more funds.

- Double-Check Security: Enable two-factor authentication (2FA) on your exchange account and never share your recovery phrases.

- Stay Informed: Follow reputable crypto news outlets and keep an eye on legislative updates like those coming out of Congress’s ‘Crypto Week. ‘ Regulatory clarity is making things safer for everyone.

If you’re feeling overwhelmed by choices, remember that sticking to regulated exchanges with transparent fees (like Coinbase, Kraken, or Gemini) will make your life much easier. These platforms have streamlined onboarding processes for new users and plenty of educational resources to boot.

The Power of Patience: Why DCA Wins in Volatile Markets

The beauty of dollar-cost averaging is that it transforms wild price swings from something scary into something useful. When prices dip, even temporarily, your recurring buys scoop up more satoshis for the same dollar amount. Over time, this can lower your average cost per coin and help smooth out those emotional rollercoasters that come with market volatility.

It’s no accident that “hodling” (holding long-term) remains one of the most popular strategies among veteran crypto users in 2025. By combining DCA with secure storage and smart exchange choices, you’re setting yourself up to weather whatever storms come next, and enjoy any future rallies with less stress.

Your Next Steps: Becoming a Confident Crypto Owner

The surge above $120,000 has put Bitcoin firmly in the global spotlight, but it’s also made security more important than ever. Once you’ve made your first purchase using DCA, prioritize moving your coins to a hardware wallet like Ledger or Trezor. Think of it as locking up your digital passport before heading out on an adventure, peace of mind goes a long way!

If you’re still curious about what comes next for Bitcoin prices or want to compare expert predictions for late 2025, check out our pro forecast below:

Bitcoin Price Prediction 2026-2031

Professional outlook based on current market momentum, institutional adoption, and regulatory trends as of July 2025

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $82,000 | $116,000 | $145,000 | -1.9% | Post-ETF rally consolidation; potential volatility after 2025 surge |

| 2027 | $94,000 | $129,000 | $168,000 | +11.2% | Renewed institutional accumulation, regulatory clarity boosts sentiment |

| 2028 | $110,000 | $145,000 | $192,000 | +12.4% | Halving year; supply shock plus mainstream integration |

| 2029 | $125,000 | $164,000 | $220,000 | +13.1% | Continued adoption, potential for new all-time highs if macro conditions favorable |

| 2030 | $135,000 | $182,000 | $245,000 | +11.0% | Maturing market, integration with global finance, potential new entrants |

| 2031 | $148,000 | $201,000 | $271,000 | +10.4% | Decentralized finance growth, Bitcoin as digital gold narrative strengthens |

Price Prediction Summary

Bitcoin is expected to enter a period of consolidation after the 2025 surge, with the potential for another strong multi-year bull cycle as institutional adoption, regulatory clarity, and technological advancements continue. While short-term corrections are likely, the long-term trajectory remains upward, with average prices projected to nearly double by 2031. Volatility will persist, but the maturing market and increasing use cases support a positive outlook.

Key Factors Affecting Bitcoin Price

- Institutional investment and ETF inflows

- Regulatory clarity, especially in the U.S. and EU (e.g., GENIUS Act)

- Bitcoin halving cycles impacting supply

- Macroeconomic trends (inflation, interest rates, global liquidity)

- Adoption by corporations and integration into traditional finance

- Competition from other cryptocurrencies and blockchain platforms

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

No matter where Bitcoin heads next, whether it cools off or rockets past its current level, the best approach is always informed, secure, and steady. The market may be unpredictable but with these strategies in hand, you’ll be ready to navigate every twist and turn like a seasoned traveler.