Imagine walking into your favorite GameStop and buying a rare trading card with Bitcoin. Not a far-off fantasy anymore! GameStop has made headlines again, this time by diving head-first into the crypto pool. In May 2025, the gaming giant purchased 4,710 Bitcoin, a move worth over $500 million at the time, according to Wikipedia. With Bitcoin currently holding steady at $118,933 (as of July 17,2025), this bold step is more than just a corporate flex – it’s a signal that crypto is moving from niche investment to everyday payment option.

GameStop’s Crypto Payments: A New Chapter for Retail Adoption

The news that GameStop is considering accepting cryptocurrency payments for trading cards and other products has set the crypto world abuzz. For years, retail crypto adoption felt like a distant dream. But now, with major players like GameStop making moves to integrate digital assets into their business model, we’re seeing that dream inch closer to reality.

This shift isn’t just about hype or headlines. It’s about offering customers more flexible and secure payment options. As reported by AInvest and Cointelegraph, GameStop’s leadership sees Bitcoin as both an inflation hedge and a way to future-proof their business in an unpredictable economy. CEO Ryan Cohen hasn’t been shy about his ambitions either – he’s talked publicly about building out a Bitcoin treasury strategy and exploring practical crypto payment solutions for regular shoppers.

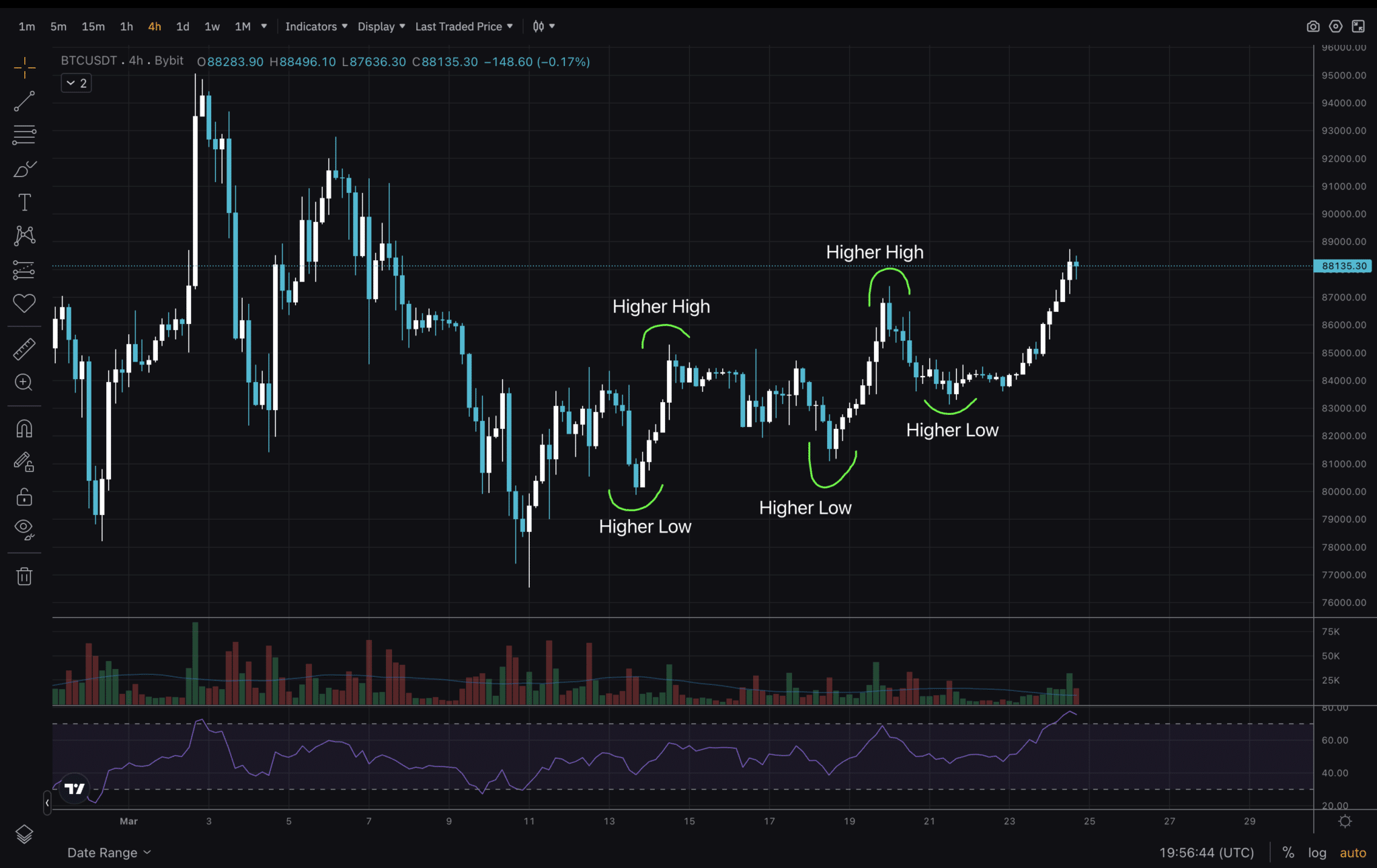

Bitcoin Price Surge in 2025: What Does It Mean for Everyday Buyers?

If you’re new to crypto or just watching from the sidelines, you might be wondering what all this means for you. Let’s break it down: Bitcoin recently hit an all-time high of over $123,000, before settling back to its current price of $118,933. This surge is being driven by institutional interest (think big companies like GameStop), positive U. S. policy signals (such as anticipated Federal Reserve rate cuts), and ongoing concerns about inflation.

For regular buyers, these developments are more than just numbers on a chart. They represent a growing sense of legitimacy around buying cryptocurrency securely – not just as an investment but increasingly as something you might use in your day-to-day life. The fact that retailers are considering accepting crypto means there could soon be more places to spend your digital coins without jumping through hoops.

Bitcoin (BTC) Price Prediction 2026–2031

Professional outlook based on current market data, institutional adoption trends, and regulatory landscape as of July 2025.

| Year | Minimum Price | Average Price | Maximum Price | Potential YoY Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $97,000 | $130,000 | $170,000 | -18% to +43% | Possible correction after 2025 ATH; consolidation with strong institutional support. Regulatory clarity in the US may limit downside. |

| 2027 | $110,000 | $148,000 | $205,000 | +13% to +21% | Renewed uptrend as next Bitcoin halving approaches (expected Q1 2028); increased adoption in payment networks and ETFs. |

| 2028 | $125,000 | $180,000 | $270,000 | +16% to +36% | Bullish momentum post-halving; potential for new ATHs driven by scarcity narrative and tech upgrades (e.g., Layer 2 scaling). |

| 2029 | $120,000 | $165,000 | $250,000 | -4% to -8% avg | Market cycle peaks in 2028 may result in retracement; regulatory tightening or macro headwinds could limit upside. |

| 2030 | $140,000 | $210,000 | $320,000 | +15% to +27% | Renewed growth as global adoption rises; potential for Bitcoin as a reserve asset among more corporations. |

| 2031 | $160,000 | $245,000 | $400,000 | +14% to +25% | Widespread institutional integration, further mainstream use cases, and improved interoperability with TradFi. |

Price Prediction Summary

Bitcoin is expected to experience continued volatility but remains in a long-term uptrend, with periods of strong growth around halving cycles and temporary corrections in between. Institutional adoption, favorable regulation, and technological advancements are likely to drive value, while regulatory uncertainty and market cycles could create temporary setbacks. By 2031, BTC could realistically trade in the $160,000–$400,000 range, with an average price around $245,000.

Key Factors Affecting Bitcoin Price

- Institutional adoption (e.g., treasuries like GameStop, ETFs, corporate reserves)

- Regulatory developments in major markets (US, EU, Asia)

- Macroeconomic environment (inflation, interest rates, global liquidity)

- Bitcoin halving cycles (next: 2028) and supply constraints

- Technological improvements (Layer 2, security, scalability)

- Mainstream payment integration and real-world use cases

- Competitive landscape from other digital assets and stablecoins

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating the Risks: Why Some Companies Still Hesitate

But let’s keep it real – not every company is rushing headlong into crypto payments. In fact, GameStop itself has had a complicated relationship with digital assets. After launching an NFT marketplace in 2022, they wound down those services by August 2023 due to regulatory uncertainties and finally closed their NFT marketplace in February 2024 (Wikipedia). This stop-and-start approach highlights one of the biggest hurdles facing retail crypto adoption: regulation.

The rules around digital assets are still evolving rapidly in the U. S. , which makes some businesses cautious about fully embracing cryptocurrencies as payment methods. Even so, the overall trend remains clear – more companies are exploring how they can integrate blockchain technology while keeping customer security front and center.

For everyday buyers, this means both opportunity and responsibility. As crypto becomes more mainstream, it’s crucial to educate yourself about how to buy cryptocurrency securely and understand the risks involved. With Bitcoin’s price now at $118,933, the stakes are higher than ever for both seasoned investors and newcomers alike. The volatility that drives excitement can also lead to anxiety if you’re not prepared or informed.

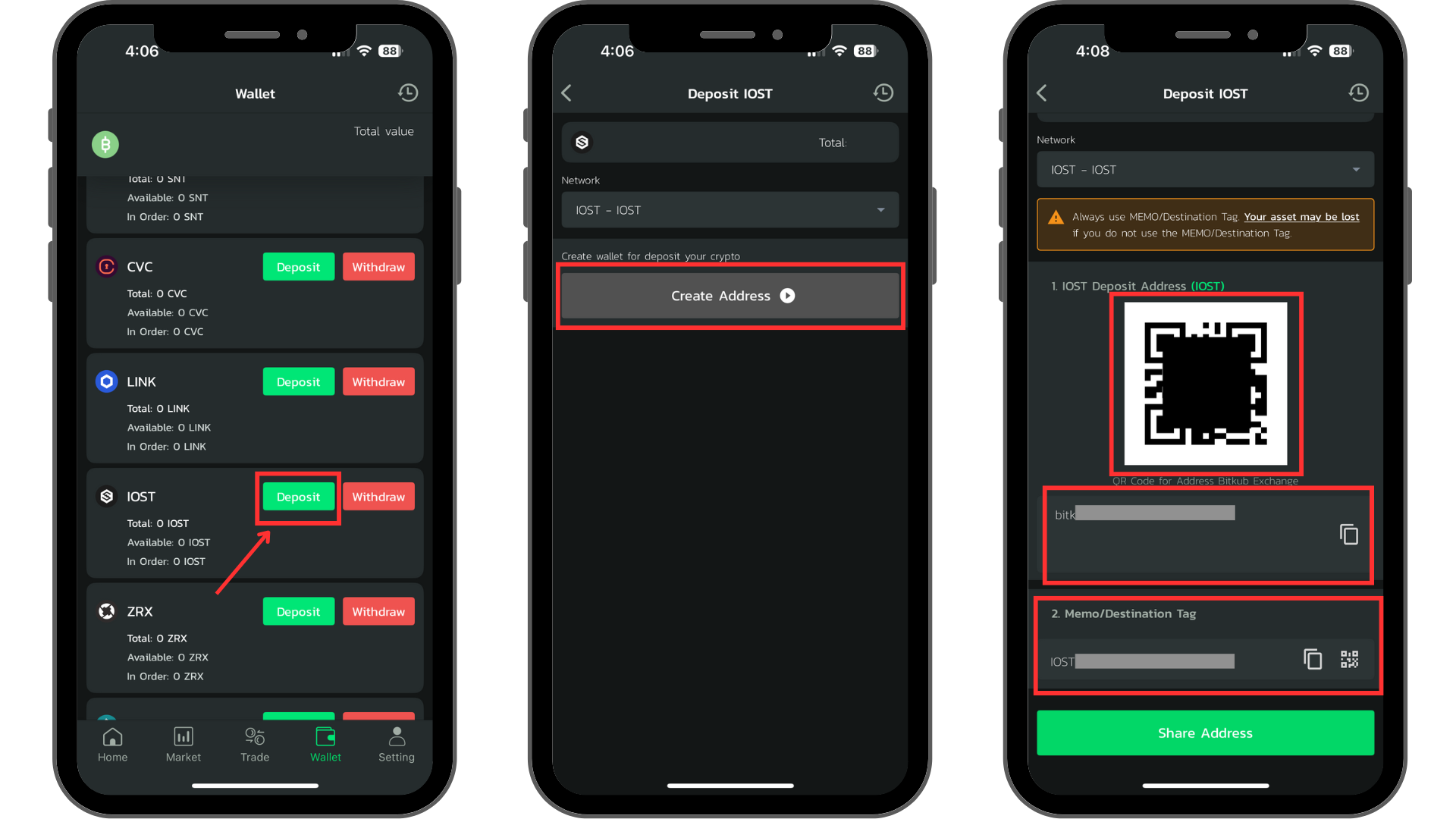

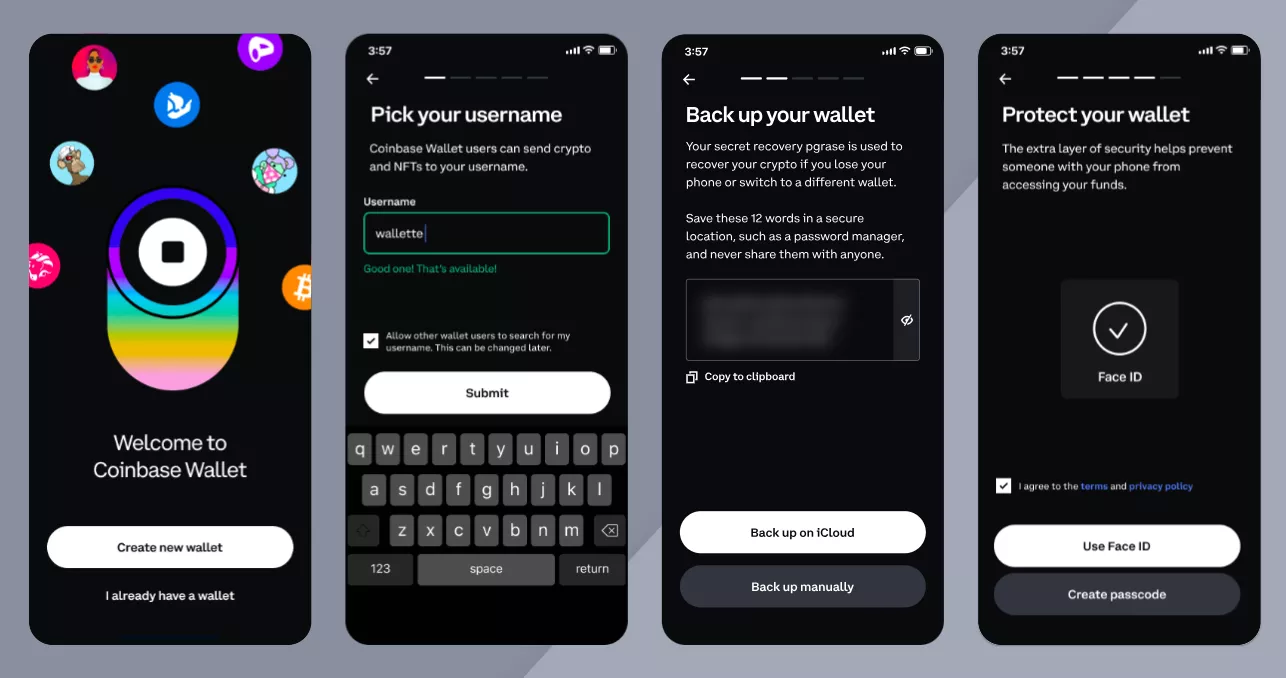

How to Buy Crypto Safely: Practical Tips for Beginners

Thinking of joining the wave? Here are some actionable steps to help you get started with buying cryptocurrency securely, especially in a landscape where retail acceptance is growing but regulatory clarity is still catching up:

Beginner Tips for Buying Crypto Securely

-

Enable two-factor authentication (2FA) on your accounts. Adding 2FA through apps like Authy or Google Authenticator helps protect your funds even if your password is compromised.

-

Double-check wallet addresses before sending crypto. Always verify the address character-by-character to avoid costly mistakes or falling victim to scams.

-

Stay updated on market prices and news from trusted sources. For example, as of July 17, 2025, Bitcoin is trading at $118,933 (AP News). Reliable information helps you make informed decisions.

-

Beware of phishing scams and fake websites. Only access exchanges and wallets by typing their official URLs directly into your browser, and never share your private keys or recovery phrases.

-

Start small and diversify your investments. Begin with amounts you’re comfortable with and consider spreading your funds across established cryptocurrencies like Bitcoin and Ethereum to manage risk.

Don’t forget: Even as companies like GameStop flirt with crypto payments, you’re your own best advocate when it comes to security. Use reputable exchanges, set strong passwords, enable two-factor authentication, and consider cold storage for larger holdings. If it sounds too good to be true, whether it’s a new coin or a “guaranteed” investment, it probably is.

What’s Next for Retail Crypto Adoption? The Road Ahead

The intersection of GameStop’s crypto ambitions and Bitcoin’s meteoric rise is just the beginning. As more retailers test the waters, and as payment technology evolves, expect shopping with your digital wallet to become increasingly normal. Still, don’t overlook the ongoing challenges: regulatory uncertainty isn’t going away overnight, and every business will have its own risk tolerance.

Yet, there’s real momentum here. The combination of institutional adoption (like GameStop’s 4,710-BTC purchase), policy tailwinds in the U. S. , and growing consumer interest means we’re on the cusp of something big. Whether you’re inspired by Robert Kiyosaki’s Bitcoin advice or simply want more control over your money in an inflationary world, now is a great time to learn and get involved.

Join the Conversation

How do you feel about using crypto at your favorite stores? Would you trust paying for your next gaming haul with Bitcoin or another coin? Share your thoughts below!

Would you use cryptocurrency to pay at major retailers like GameStop?

With Bitcoin trading at $118,933 and GameStop considering crypto payments for products like trading cards, the idea of using digital assets for everyday purchases is gaining traction. Would you feel comfortable paying with crypto at your favorite stores?

Leave a Reply