Ethereum is on an absolute tear in 2025, standing out as the crypto to watch for investors who want to ride the next big wave. With Ethereum (ETH) trading at $3,721.17 as of July 26,2025, and Bitcoin (BTC) at $117,439, the narrative is shifting fast. The ETH/BTC ratio has surged over 36% in just one month, and institutional demand is pouring in like never before. If you’re debating between buying Ethereum vs Bitcoin this year, pay attention, major players are betting big on ETH’s next leg up.

Wall Street’s New Darling: BlackRock’s Ethereum ETF Surge

BlackRock’s iShares Ethereum ETF (ETHA) is rewriting the playbook for crypto adoption on Wall Street. ETHA just smashed through $10 billion in assets under management in a record-setting 251 trading days, outpacing all but two ETFs in history. In just the last six trading sessions, spot Ether ETFs attracted nearly $2.4 billion in net inflows, almost triple what Bitcoin ETFs brought in during that same period (source). This isn’t just a headline, it’s a tidal shift of capital that could drive ETH into an explosive price discovery phase.

Why does this matter? When institutions move billions into an asset class, retail traders tend to follow, and momentum snowballs. BlackRock’s success with ETHA signals that Ethereum is becoming the preferred vehicle for both institutional and sophisticated retail exposure to crypto markets.

Why Mike Novogratz Thinks Ethereum Will Outperform Bitcoin Next

Galaxy Digital CEO Mike Novogratz isn’t shy with his conviction: he predicts Ethereum will not only breach $4,000 soon but also significantly outperform Bitcoin over the next three to six months (source). Novogratz points to three key drivers:

- Explosive ETF inflows: The numbers say it all, ETH ETFs are seeing rare dominance over BTC ETFs.

- Tightening supply: With staking and reduced issuance post-Merge, fewer ETH are hitting exchanges.

- Catalytic use cases: DeFi and NFTs continue to run primarily on Ethereum’s rails.

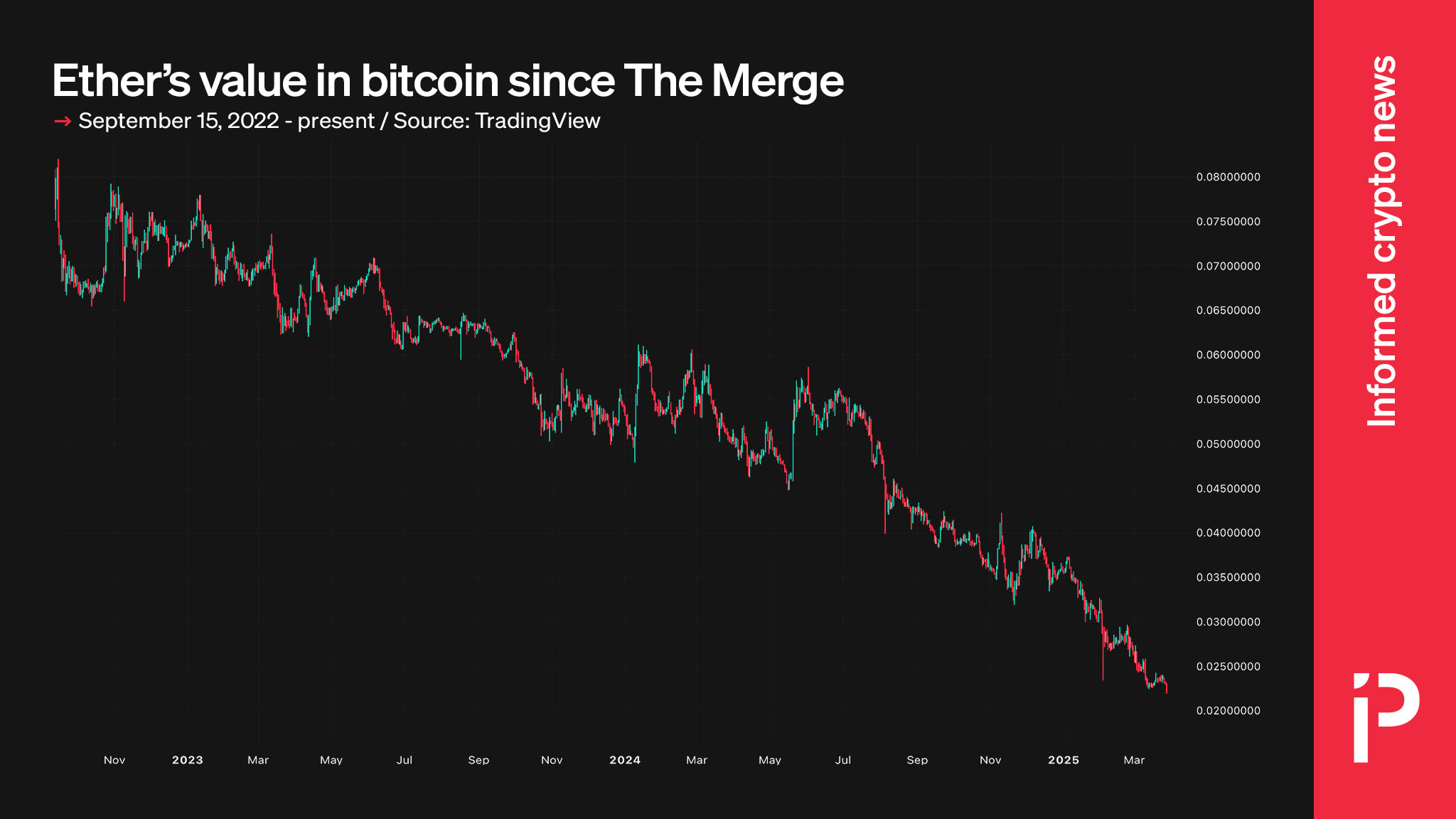

The market is listening: The ETH/BTC ratio has jumped by more than 36% in just one month according to TradingView data (source). That’s real momentum, and it matters for anyone considering their crypto investment strategies for 2025.

The Numbers Game: Real-Time Price Action and Analyst Targets

The current price action backs up the bullish thesis. As of now:

- Ethereum (ETH): $3,721.17 ( and $56.85/and 0.0155%) today

- Bitcoin (BTC): $117,439

- 24h High/Low for ETH: $3,739.31/$3,585.77

Bulls like Novogratz see this as just the beginning, with predictions that Ethereum could hit $15,937 by May 2025. What’s fueling these targets? It comes down to three words: scalability, sustainability, and utility.

Ethereum (ETH) Price Prediction vs Bitcoin: 2026–2031

Analyst projections based on institutional adoption, ETF inflows, and technology trends (baseline: $3,721.17 as of July 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Highlights |

|---|---|---|---|---|---|

| 2026 | $4,200 | $6,800 | $12,000 | +83% | Bullish ETF inflows continue; ETH outpaces BTC as institutions diversify. Bearish scenario: macro tightening limits upside. |

| 2027 | $5,100 | $8,900 | $17,000 | +31% | Ethereum 2.0 scaling boosts DeFi/NFTs. Regulatory clarity attracts more funds. Bearish: global recession tempers growth. |

| 2028 | $6,000 | $11,200 | $23,000 | +26% | Layer-2 adoption, mainstream DeFi, and tokenization drive demand. Bearish: Competition from alternative L1s, regulatory headwinds. |

| 2029 | $7,100 | $13,800 | $30,000 | +23% | ETH solidifies as global settlement layer; real-world assets on-chain surge. Bearish: Major security incident or tech setback. |

| 2030 | $8,500 | $16,500 | $38,000 | +20% | CBDC integrations and institutional DeFi spur new highs. Bearish: Regulatory crackdowns or tech plateau. |

| 2031 | $10,000 | $19,500 | $45,000 | +18% | Ethereum captures critical financial infrastructure share. Bearish: Strong competition or paradigm shift in crypto sector. |

Price Prediction Summary

Ethereum is positioned to outperform Bitcoin through the remainder of the decade, fueled by sustained institutional demand, successful ETF launches, and continuous technological innovation. Average prices are projected to nearly triple by 2031, with significant upside potential in bullish scenarios. However, volatility remains high, and downside risks persist from regulatory, macroeconomic, or competitive threats.

Key Factors Affecting Ethereum Price

- Institutional adoption and ETF inflows (BlackRock, Galaxy, etc.)

- Ethereum network upgrades (scalability, security, staking)

- Regulatory environment for crypto and DeFi

- Competition from other smart contract platforms (e.g., Solana, Avalanche)

- Macro trends: global liquidity, risk appetite, and monetary policy

- Growth of DeFi, NFTs, and real-world asset tokenization on Ethereum

- Supply dynamics post-merge and staking incentives

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The transition to proof-of-stake slashed energy costs and set up scalable upgrades that Bitcoin simply can’t match right now. Plus, every major DeFi protocol and NFT marketplace still calls Ethereum home, meaning real-world demand keeps growing even as supply tightens further due to staking incentives.

Ethereum’s dominance isn’t just about hype, it’s about fundamentals and the rapid evolution of the blockchain landscape. With ETH staking locking up substantial portions of supply, less Ethereum is available for trading, amplifying any demand spikes. Meanwhile, Bitcoin’s narrative remains strong as a store of value, but its use cases haven’t expanded at the same pace as Ethereum’s.

ETH/BTC Ratio Analysis: Momentum Favors ETH

The ETH/BTC ratio is one of the sharpest signals in crypto right now. Up over 36% in just 30 days, this metric shows that capital is rotating into Ethereum at an accelerated pace. For traders and investors looking to maximize upside, watching this ratio can provide a crucial edge.

Top Reasons Institutions Are Choosing Ethereum Over Bitcoin in 2025

-

Record-Breaking ETF Inflows: BlackRock’s iShares Ethereum ETF (ETHA) amassed $1.79 billion in net inflows, helping spot Ether ETFs attract nearly $2.4 billion in just six days—almost triple the inflows of Bitcoin ETFs in the same period.

-

Rapid Institutional Adoption: Major financial players like BlackRock and Galaxy Digital are publicly backing Ethereum, with Galaxy CEO Mike Novogratz predicting ETH will outperform BTC in the next 3–6 months due to surging demand.

-

Technological Edge: Proof-of-Stake: Ethereum’s shift to a proof-of-stake consensus mechanism slashed energy consumption and improved scalability, making it more attractive for ESG-focused institutions.

-

Core Role in DeFi and NFTs: Ethereum powers the largest decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, offering unmatched utility and growth potential for institutional portfolios.

-

Supply Constraints Fueling Price Momentum: With ETH trading at $3,721.17 and a 36% gain in the ETH/BTC ratio over the past month, institutions are drawn by Ethereum’s tightening supply and strong upward momentum.

-

Analyst Projections of Massive Upside: Leading analysts forecast Ethereum could reach $15,937 by May 2025, citing institutional demand, ETF inflows, and expanding use cases as key drivers.

And it isn’t just numbers on a chart, it’s real capital flows. The fact that spot Ether ETFs pulled nearly $2.4 billion in net inflows over six days, while Bitcoin ETFs lagged far behind, shows that the smart money is betting on ETH to lead the next leg up.

Crypto Investment Strategies: Buying Ethereum vs Bitcoin in 2025

If you’re weighing your next move, here are some actionable strategies:

- Follow institutional footprints: When giants like BlackRock and Galaxy Digital are loading up on ETH, it pays to pay attention.

- Diversify with purpose: While Bitcoin remains a core holding for many portfolios, increasing exposure to Ethereum could capture outsized gains if Novogratz’s thesis plays out.

- Watch supply dynamics: Monitor staking rates and ETF inflows as leading indicators for price surges.

The bottom line? The momentum behind Ethereum is real, and growing. With current prices at $3,721.17 for ETH and $117,439 for BTC, the risk/reward profile favors those nimble enough to adapt quickly to new market realities.

If you want to surf the next crypto bull wave rather than watch from shore, keep your eyes glued to these institutional flows and price ratios. Speed matters, but so does conviction when the world’s biggest money managers are making their move.