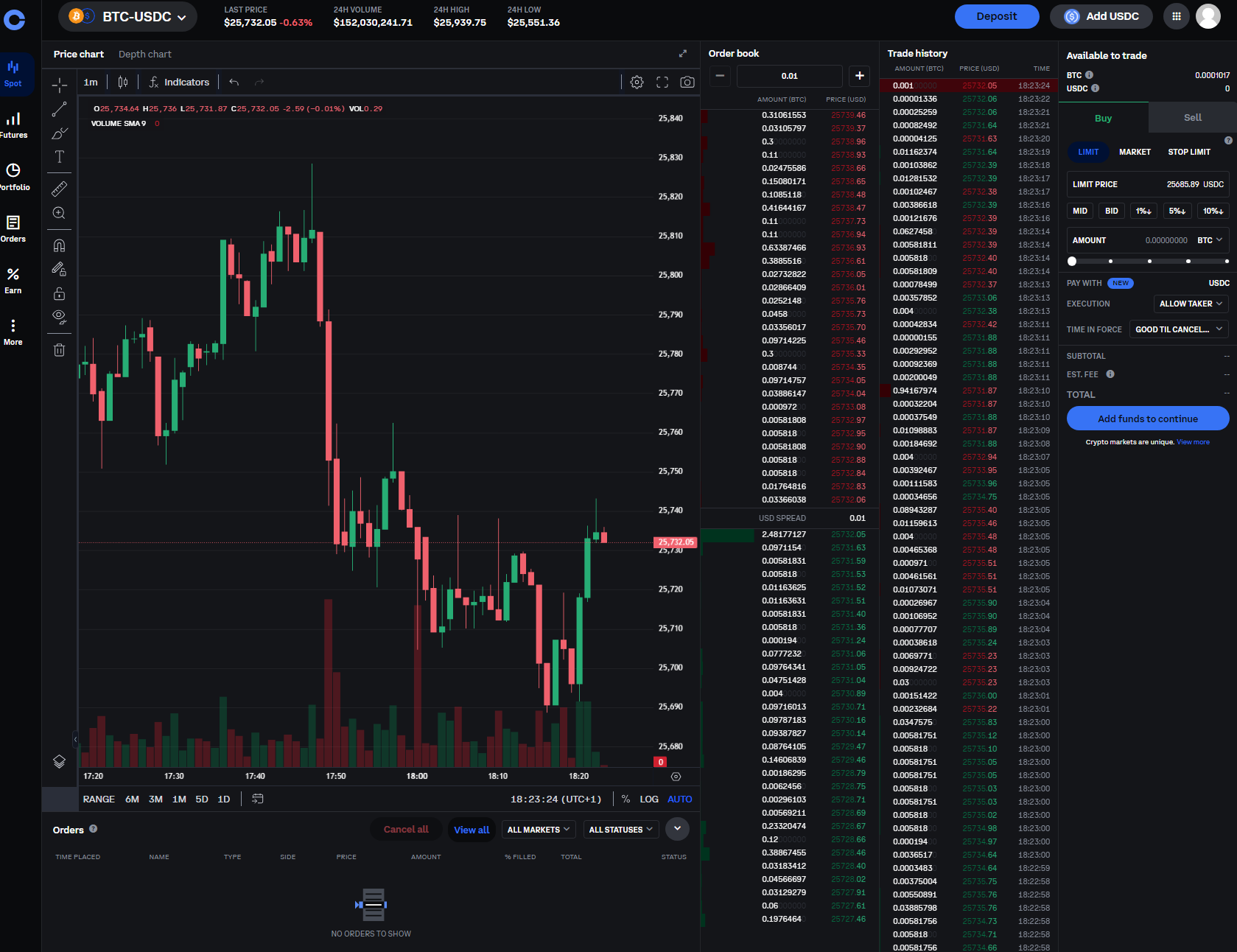

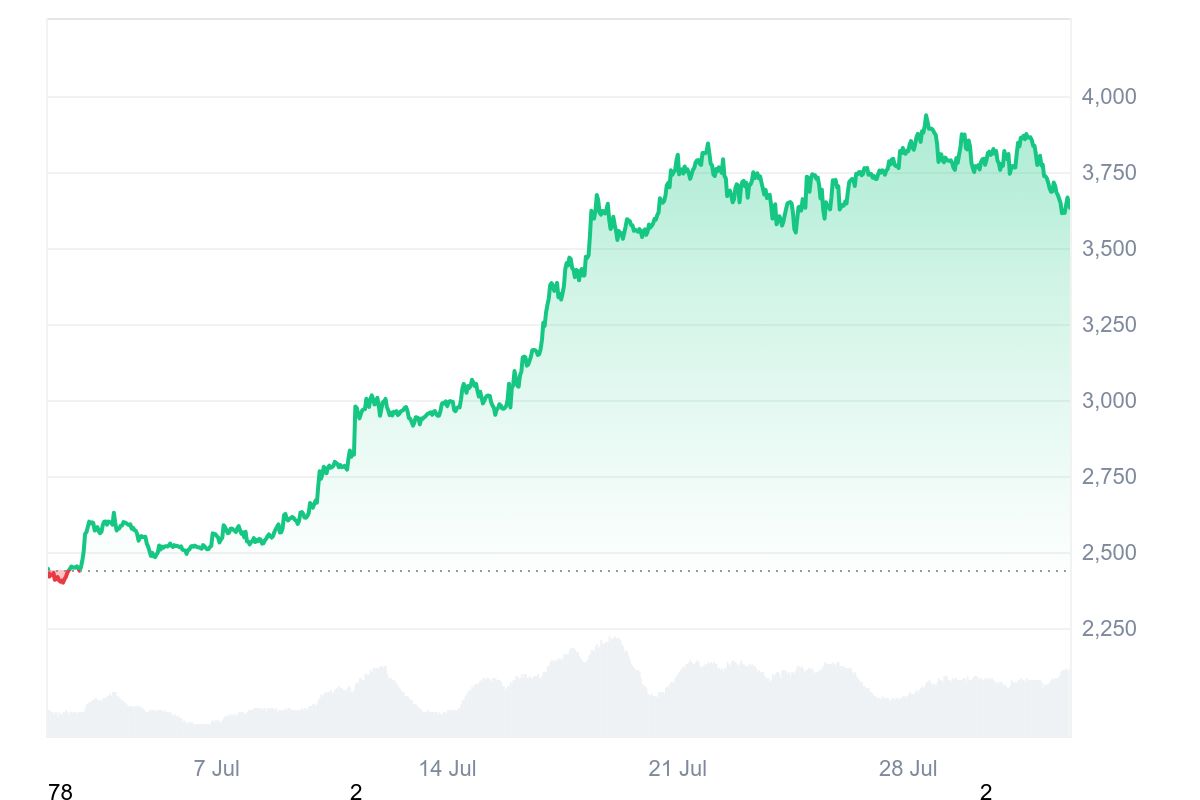

Ethereum’s sharp drop in exchange reserves has become one of 2025’s defining crypto stories. As of August 4,2025, Ethereum (ETH) is trading at $3,558.07, up 3.25% in the past 24 hours. But it’s not just the price that’s making headlines – it’s the fact that ETH reserves on centralized exchanges have hit a nine-year low, falling from 20.2 million to 18.7 million over just five months (source). This trend signals a dramatic shift in investor behavior and has direct implications for anyone looking to buy Ethereum securely in the evolving landscape of 2025.

Ethereum Exchange Reserves Plunge to Nine-Year Low

The numbers are clear: Ethereum held on centralized trading platforms is at its lowest since July 2016 (Cointelegraph). This isn’t just a statistic; it reflects a fundamental transformation in how both retail and institutional investors approach crypto security and liquidity.

Several forces are driving this exodus from exchanges:

- Whale Accumulation: On-chain data reveals that large holders have scooped up over $2.6 billion worth of ETH recently, moving coins into cold storage or decentralized protocols.

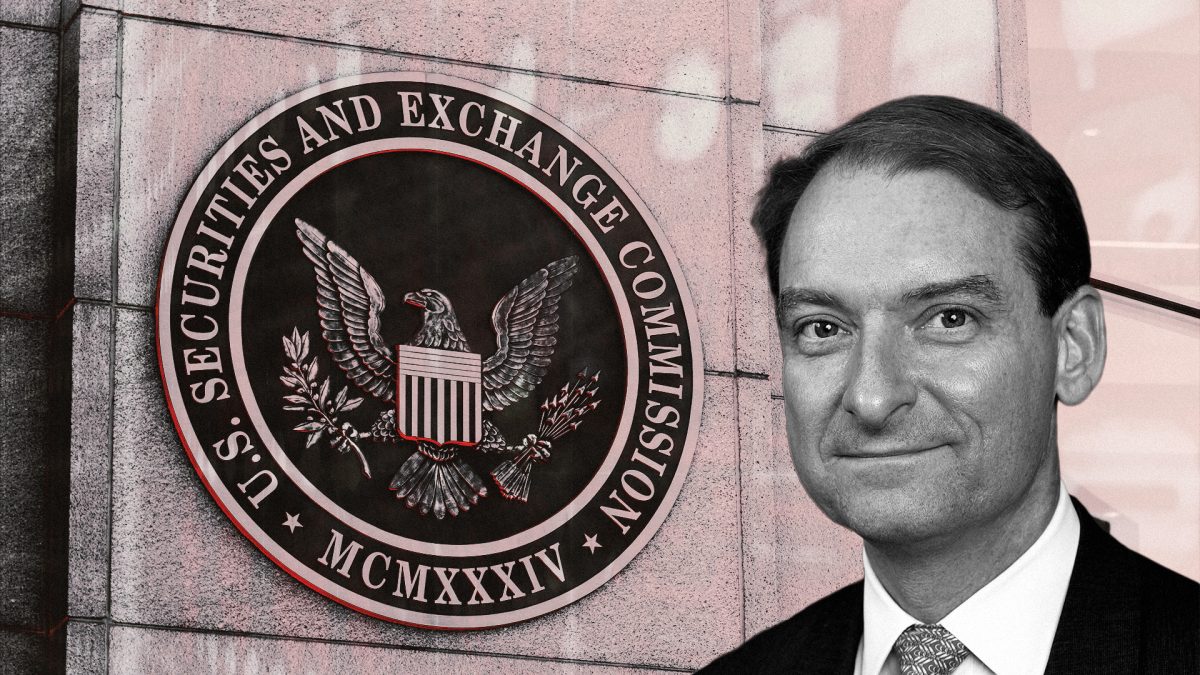

- Regulatory Clarity: The U. S. SEC’s sweeping crypto-friendly agenda and new White House policy signals have emboldened long-term holders to self-custody their assets (Reuters, Axios).

- ETF Dynamics: While Bitcoin and Ethereum ETFs experienced volatility, they’ve also brought new waves of institutional interest and reduced immediate selling pressure on spot markets.

What Low Exchange Reserves Mean for Crypto Liquidity Trends

This rapid depletion of exchange-held ETH is more than a bullish signal; it directly impacts market liquidity. With fewer coins available for instant sale, sell-side pressure diminishes – often paving the way for price surges during periods of strong demand.

The current environment is marked by:

- Tighter supply on exchanges: Making large-scale dumps less likely and reducing volatility risk for buyers.

- A shift toward self-custody: Investors are prioritizing security via hardware wallets or decentralized finance (DeFi) protocols.

- Bullish divergence signals: As noted by analysts, whale accumulation often precedes major rallies – which we’re already seeing with ETH jumping 25% in a week (Yellow.com).

$3,558.07 ETH: How This Price Level Reflects Secure Buying Opportunities in 2025

The current price of $3,558.07 isn’t just a number – it encapsulates months of shifting sentiment, regulatory progress, and treasury accumulation by major players. For those looking to safely purchase ETH, these dynamics offer both opportunity and caution.

Ethereum (ETH) Price Prediction 2026-2031

Based on 2025 market context: 9-year low exchange reserves, regulatory clarity, institutional adoption, and strong on-chain trends.

| Year | Minimum Price | Average Price | Maximum Price | Potential YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $2,950 | $4,200 | $5,300 | +18% | Consolidation phase as regulatory frameworks settle; increased institutional adoption. Possible volatility from macroeconomic factors. |

| 2027 | $3,450 | $5,100 | $6,500 | +21% | Ethereum scaling upgrades (Danksharding, L2 adoption) drive network activity. ETF inflows and retail adoption accelerate. |

| 2028 | $3,900 | $5,850 | $7,900 | +14% | Regulatory clarity and mainstream DeFi/NFT use cases. Competition from other L1s persists, but ETH maintains lead. |

| 2029 | $4,250 | $6,800 | $9,200 | +16% | Global crypto adoption surges. ETH used in tokenized assets and real-world applications. Cyclical bull run possible. |

| 2030 | $5,000 | $7,750 | $11,000 | +14% | Ethereum cements role in digital economy. Major upgrades (Quantum resistance, privacy features) could boost confidence. |

| 2031 | $5,800 | $8,650 | $13,000 | +12% | Broader economic integration, stable regulatory environment. ETH potentially viewed as a digital reserve asset. |

Price Prediction Summary

Ethereum is expected to experience significant growth from 2026 through 2031, driven by record-low exchange reserves, strong on-chain accumulation, and maturing regulatory clarity. While short-term volatility remains possible due to macroeconomic shifts, the long-term trajectory is bullish as institutional and retail adoption accelerate, and Ethereum’s technological roadmap unfolds. The minimum price predictions reflect possible bearish scenarios such as market corrections or stiff competition, while maximums account for strong adoption cycles and technological breakthroughs.

Key Factors Affecting Ethereum Price

- Record-low exchange reserves reducing sell pressure and increasing scarcity.

- Regulatory clarity in the U.S. and globally, fostering institutional investment.

- Ethereum technology upgrades (scaling, staking, privacy, quantum resistance).

- Growing adoption in DeFi, NFTs, and real-world asset tokenization.

- Potential competition from alternative L1 blockchains and macroeconomic headwinds.

- Adoption of Ethereum ETFs and integration into traditional finance.

- Increased security and consumer confidence due to regulatory and technological advances.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re considering entering the market now, understanding how low reserves affect both short-term volatility and long-term value is crucial. With increased adoption across banking, taxation, and even retirement planning as highlighted by recent White House initiatives (Axios), buying Ethereum securely today means more than just picking an exchange – it means staying informed about liquidity trends and custody best practices.

For buyers in 2025, the game has changed. Ethereum exchange reserves are at a nine-year low, and with ETH trading at $3,558.07, the interplay between scarcity, security, and institutional adoption is front and center. This new paradigm rewards those who adapt their strategies to the evolving landscape of crypto liquidity trends.

How to Buy Ethereum Securely in a Low-Liquidity Era

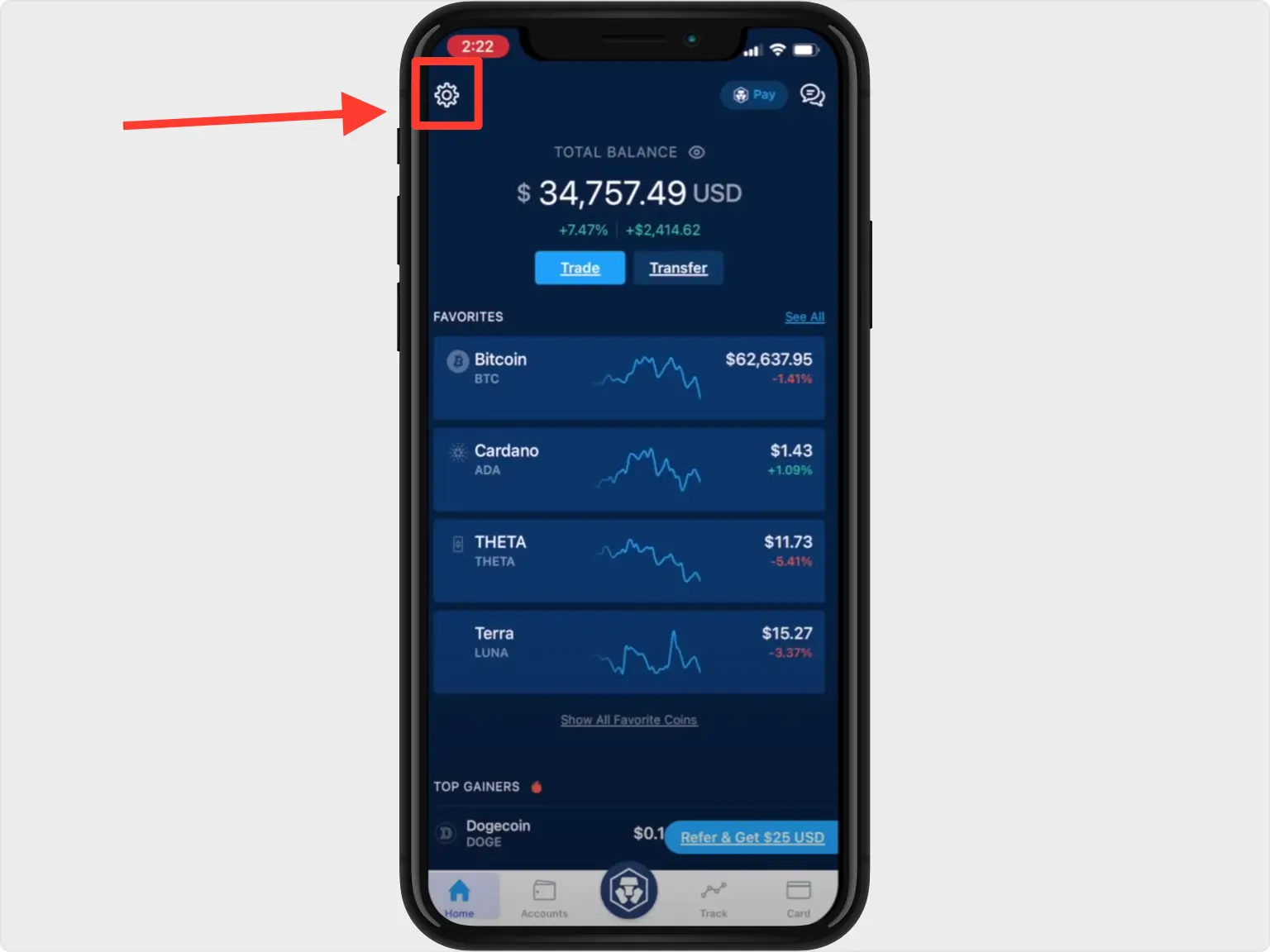

As self-custody becomes the norm and exchange liquidity thins out, safe ETH acquisition requires a more nuanced approach:

Key Steps for Securely Buying Ethereum in 2025

-

Enable Two-Factor Authentication (2FA)Always activate 2FA on your exchange account using trusted apps like Authy or Google Authenticator to add an extra layer of protection against unauthorized access.

-

Verify Ethereum Price and Market TrendsCheck real-time data—Ethereum (ETH) is currently trading at $3,558.07 (as of August 4, 2025). Use platforms like CoinMarketCap or CoinGecko for accurate price tracking and market analysis.

-

Stay Informed on Regulatory ChangesMonitor updates from the U.S. Securities and Exchange Commission (SEC) and reliable crypto news sources to ensure your buying practices align with the latest legal requirements.

1. Prioritize reputable platforms: Only use exchanges with robust security records and transparent reserve audits. Look for proof-of-reserves reports as standard practice.

2. Move quickly: Lower reserves mean less ETH available on exchanges, delays can impact price slippage, especially during rallies.

3. Embrace self-custody: Once purchased, transfer your ETH to a hardware wallet or trusted DeFi vault to minimize counterparty risk.

4. Monitor on-chain activity: Whale movements and treasury accumulation can foreshadow price swings; on-chain analytics tools are essential for modern buyers.

What Institutional Moves Reveal About Long-Term Value

The sharp drawdown in exchange-held ETH isn’t just about retail investors seeking safety, it’s also about institutions quietly building treasuries off-exchange. This trend is reinforced by ETF inflows and regulatory clarity, which together suggest that major players are betting on Ethereum’s long-term utility rather than quick flips.

This institutional confidence often acts as an anchor during volatile periods, providing both price stability and a vote of confidence in Ethereum’s future role across finance, banking, and even retirement portfolios (Axios). For individuals looking to buy Ethereum securely in 2025, aligning with these long-term trends may offer a strategic edge.

What’s Next? Crypto Security and Adoption Outlook for Late 2025

The market’s current structure, with $3,558.07 ETH prices and dwindling exchange supplies, suggests continued upward pressure if demand persists. However, it also means buyers must be more proactive about security than ever before.

- Tighter regulation is making entry safer but also more scrutinized, expect enhanced KYC/AML procedures across top platforms.

- The rise of DeFi custody solutions offers alternatives to traditional exchanges but requires careful due diligence.

- Look for further integration of crypto in mainstream financial products as government policy shifts take hold.

Do you feel safer buying Ethereum (ETH) now compared to previous years?

With Ethereum exchange reserves at a 9-year low, ETH trading at $3,558.07, and new regulatory clarity in 2025, the crypto landscape is changing fast. Are you more confident in the security and stability of buying ETH today?

The bottom line: As Ethereum exchange reserves hit historic lows and $3,558.07 becomes the new reference point for secure crypto buying in 2025, success will favor those who blend vigilance with adaptability, staying informed about liquidity trends while leveraging both centralized and decentralized custody options for maximum safety.