In August 2025, the Philippines Securities and Exchange Commission (SEC) took decisive action against unregistered cryptocurrency exchanges, marking a pivotal moment for crypto regulation in Southeast Asia. With the issuance of SEC Memorandum Circulars No. 4 and No. 5, which became effective on July 5, authorities identified ten major platforms, including industry giants like OKX, Bybit, KuCoin, and Kraken, for operating without proper authorization. This regulatory push is not just about compliance; it’s fundamentally reshaping what safe crypto buying means for millions of investors across the region.

Why Is the Philippines SEC Cracking Down Now?

The timing of this crackdown is no coincidence. The rapid adoption of digital assets in the Philippines has outpaced regulatory frameworks, exposing retail investors to significant risks. According to Cointelegraph, these exchanges have been targeting Filipino users despite lacking registration under new local laws. The SEC’s concern extends beyond financial losses; unregistered platforms can facilitate money laundering, terrorist financing, identity theft, and market manipulation, posing threats not only to individuals but also to national security.

SEC Assistant Director Paolo Ong summed it up: “The rules were issued to support local players and go after those unregistered ones. ” This approach aims at both protecting consumers and nurturing a compliant crypto ecosystem in the country.

The Ripple Effect: How Crackdowns Shape Safe Crypto Buying in Southeast Asia

The Philippines isn’t acting in isolation. Across Southeast Asia, regulators are tightening oversight on digital asset platforms. For instance, Thailand’s SEC recently announced plans to block unlicensed exchanges, directly inspired by moves in Manila and New Delhi (BitPinas). As these regulatory frameworks mature, they’re setting new standards for what constitutes a “safe” exchange.

For everyday buyers, this means that using licensed platforms is no longer just best practice, it’s rapidly becoming non-negotiable. Investors who stick with authorized exchanges benefit from legal protections such as dispute resolution mechanisms and enhanced transparency around trading practices.

Key Risks of Using Unregistered vs. Licensed Crypto Exchanges

-

Lack of Investor Protection: Unregistered exchanges like OKX, Bybit, KuCoin, and Kraken do not provide the legal safeguards required by the Philippines SEC Memorandum Circulars No. 4 and No. 5. Users have limited recourse if funds are lost or stolen.

-

Exposure to Fraud and Scams: Without regulatory oversight, unlicensed platforms may be more susceptible to fraudulent activities, market manipulation, or exit scams, putting user assets at significant risk.

-

Risk of Account Freezing or Loss: The SEC can order local ISPs and banks to block access to unregistered exchanges, potentially freezing user accounts or making withdrawals impossible without warning.

-

Increased Vulnerability to Identity Theft: Unregulated exchanges may lack robust Know-Your-Customer (KYC) and data protection protocols, increasing the risk of personal information being compromised or misused.

-

Potential for Money Laundering and Illicit Use: The SEC has flagged unregistered platforms as possible channels for money laundering and terrorist financing, exposing users to legal and reputational risks.

-

No Access to Dispute Resolution: Licensed exchanges are required to comply with local dispute resolution mechanisms, while users of unregistered platforms have little to no legal recourse in case of transaction issues or service failures.

-

Regulatory Crackdowns Can Lead to Sudden Service Disruptions: Ongoing enforcement actions, like those announced by the Philippines SEC in August 2025, can force unregistered exchanges to halt operations abruptly, leaving users unable to access their funds.

What Are the Risks of Using Unregistered Crypto Exchanges?

The allure of global platforms offering hundreds of tokens can be strong, but so are the dangers if those platforms aren’t registered locally. Here are some critical risks highlighted by the Philippine SEC:

- Lack of investor protection: Users have limited recourse if funds are lost or stolen.

- No enforcement of anti-money laundering (AML) standards: Unregulated sites may become conduits for illicit activity.

- Exposure to fraud and scams: Without oversight, market manipulation is more likely.

- Identity theft: Weak KYC processes put personal data at risk.

This environment underscores why regulators are pushing back so hard, and why investors must prioritize safety over convenience or token variety when choosing where to buy cryptocurrency in Southeast Asia.

With the regulatory landscape evolving rapidly, Southeast Asian investors are increasingly scrutinizing the platforms they use. The crackdown by the Philippines SEC is not just a warning to unregistered exchanges but a signal to users: the onus is shifting toward individual responsibility and due diligence. As authorities in countries like Thailand and Indonesia follow suit, we’re witnessing a region-wide recalibration of how crypto buying is approached.

Licensed exchanges are now required to comply with stricter know-your-customer (KYC) and anti-money laundering (AML) protocols. This means more robust identity verification, transaction monitoring, and transparent reporting, features that directly benefit retail buyers seeking security and recourse. The days of anonymous trading on global platforms without local oversight are quickly fading.

How Can You Buy Cryptocurrency Safely in the Philippines?

If you’re looking to enter or continue participating in the crypto market, here’s what you need to prioritize:

Checklist for Safe Crypto Buying in Southeast Asia

-

Verify Exchange Registration with Local Regulators: Always check if the crypto exchange is registered with your country’s financial regulator, such as the Philippines SEC or Thailand SEC. Avoid platforms recently flagged as unregistered, like OKX, Bybit, KuCoin, and Kraken in the Philippines.

-

Use Only Licensed and Regulated Platforms: Choose exchanges that have secured the necessary licenses under current regulations (e.g., SEC Memorandum Circulars No. 4 and No. 5 in the Philippines). Licensed exchanges offer greater investor protection and legal recourse.

-

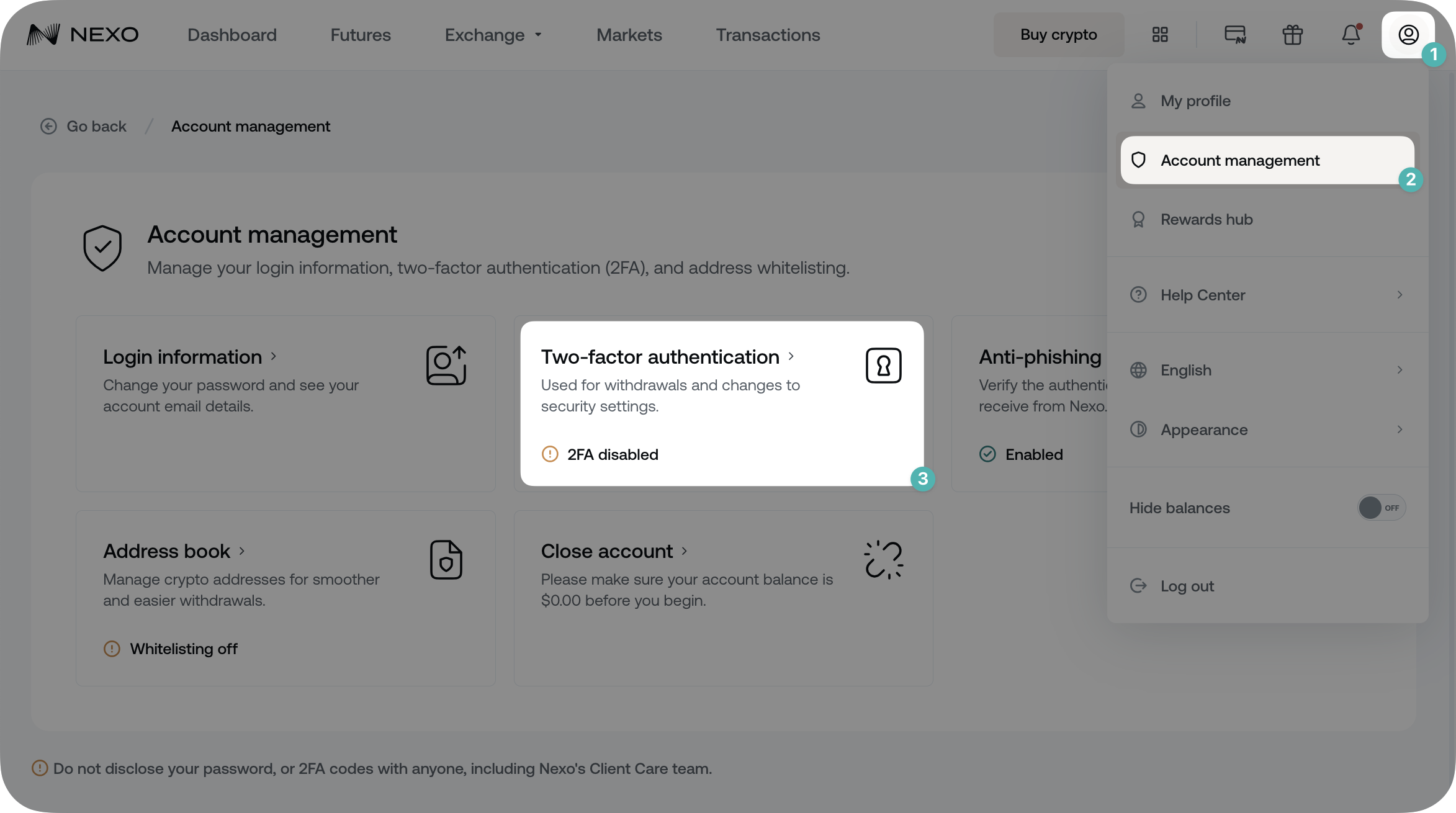

Enable Strong Security Features: Activate two-factor authentication (2FA), withdrawal whitelists, and biometric logins where available. These features are standard on major platforms like Binance and Coinbase.

-

Research Platform Reputation and Compliance History: Look up recent news, user reviews, and regulatory actions against the exchange. Avoid platforms with a history of non-compliance or recent regulatory warnings.

-

Understand Local Crypto Regulations: Stay updated on new regulations, such as the Philippines SEC’s 2025 circulars, to ensure your trading activities remain legal and protected.

-

Beware of Unsolicited Offers and Promotions: Be cautious of platforms or individuals offering guaranteed returns or aggressive promotions, especially if they are not registered with local authorities.

-

Keep Personal and Financial Data Secure: Never share sensitive information via unofficial channels. Use strong, unique passwords and update them regularly to prevent identity theft and fraud.

-

Monitor for Regulatory Updates and Platform Advisories: Follow official channels of your country’s SEC or central bank for advisories on safe platforms and new risks.

Start by verifying an exchange’s registration status with the Philippine SEC or your country’s financial regulator. Stick with platforms that provide clear information about their licenses and compliance measures. When possible, enable two-factor authentication, use hardware wallets for long-term storage, and avoid sharing personal information on social media or suspicious sites.

The recent enforcement actions highlight another crucial point: market access may become restricted if you rely on unlicensed providers. Regulators have already begun blocking IP addresses associated with non-compliant exchanges (BitPinas). This could leave users unable to withdraw funds or resolve disputes, an outcome best avoided by choosing regulated alternatives from the outset.

What’s Next for Crypto Regulation in Southeast Asia?

The Philippines SEC has made it clear that its approach differs from that of U. S. regulators, aiming for a balanced framework rather than blanket crackdowns (Cointelegraph). Expect further guidance as Memorandum Circulars No. 4 and No. 5 are implemented in practice, and as neighboring countries harmonize their rules for cross-border consistency.

For investors, this means ongoing education is essential. Regulatory clarity brings both challenges and opportunities; those who adapt early will benefit from greater safety, access to dispute resolution, and participation in a maturing digital asset market.

Bottom line: The SEC’s crackdown marks a turning point for safe crypto buying in Southeast Asia. By prioritizing licensed platforms and vigilant self-protection measures, investors can navigate this new era with confidence, and help shape a more resilient regional market.