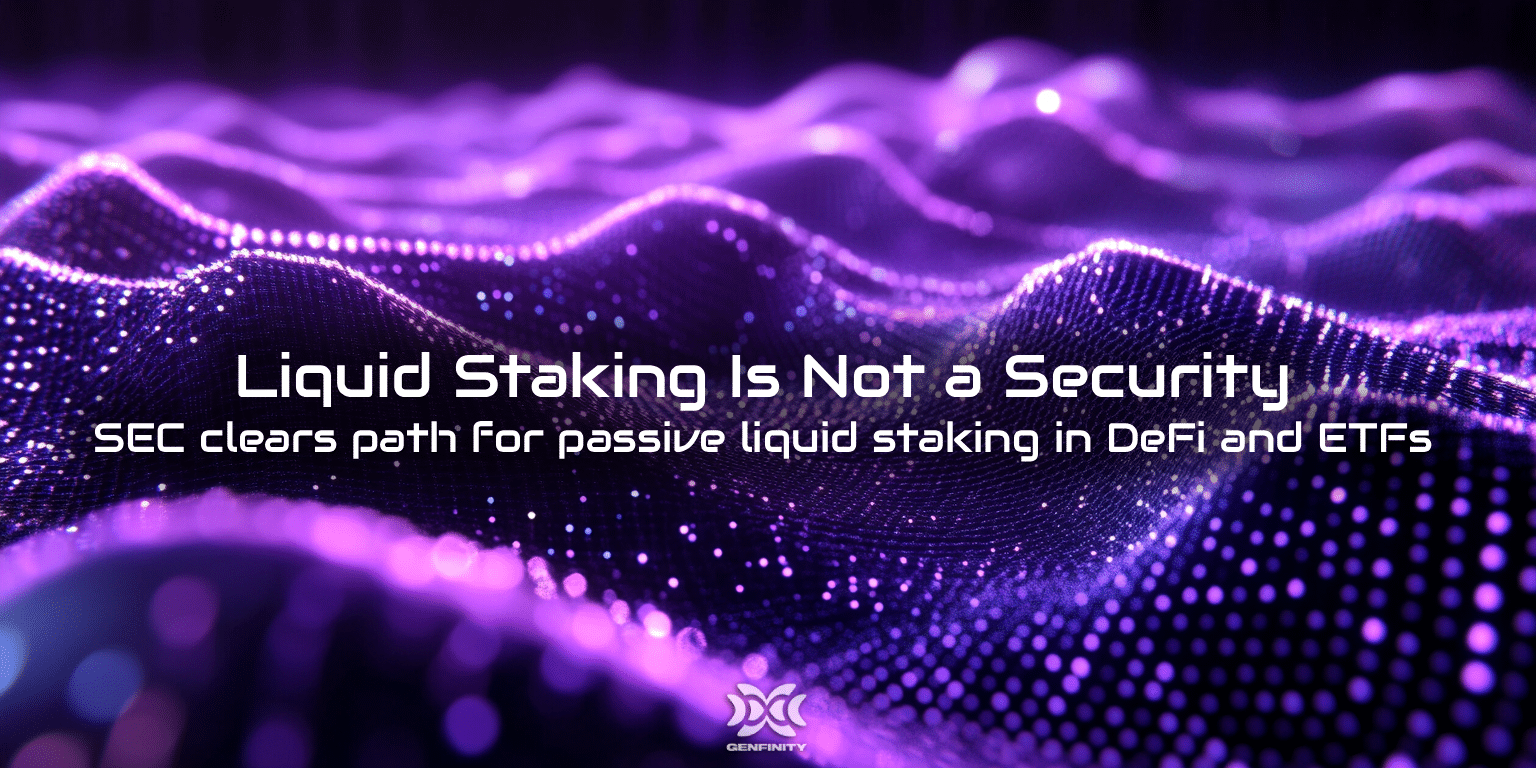

On August 5,2025, the U. S. Securities and Exchange Commission (SEC) delivered a pivotal update for crypto buyers: certain liquid staking activities are not considered securities offerings under federal law. For investors and institutions navigating the fast-evolving world of decentralized finance (DeFi), this regulatory signal is more than a technical footnote. It marks a fundamental shift in how capital can engage with blockchain networks and opens new doors for those seeking yield without sacrificing liquidity.

What Is Liquid Staking? Why Does SEC Clarity Matter?

Liquid staking lets you deposit your crypto assets – like Ethereum or Solana – with a third-party provider or protocol. In exchange, you receive a staking receipt token (SRT), which represents your claim on the original asset plus any earned rewards. The breakthrough? You can trade, use, or collateralize these SRTs without having to unstake your underlying coins, giving you both yield and flexibility.

Until now, U. S. investors faced regulatory fog. Was participating in liquid staking exposing them to securities law risks? Would major platforms need to register with the SEC? This uncertainty has kept some institutions on the sidelines and made retail buyers wary.

The SEC’s latest guidance cuts through that ambiguity. When liquid staking is purely administrative (no extra bells and whistles) and SRTs are issued one-to-one with the deposited assets, these activities do not trigger securities regulations (source). That’s a green light for compliant providers – and for buyers who want to stake their crypto securely.

The Immediate Impact: Lower Risk, Higher Confidence

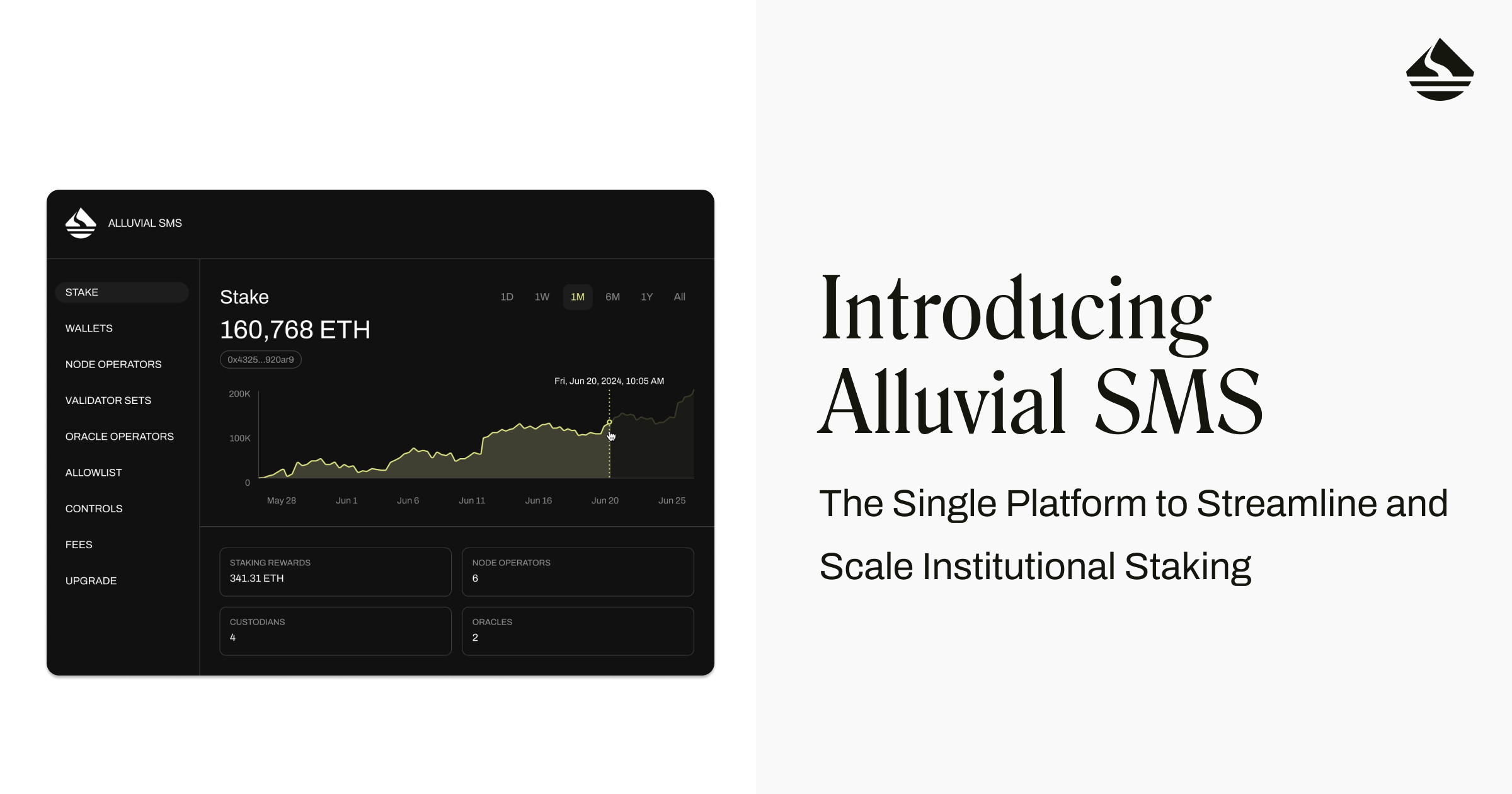

This isn’t just legal fine print; it’s a catalyst for change in 2025’s crypto landscape. As Mara Schmiedt, CEO of Alluvial, put it: “Institutions can now confidently integrate liquid staking tokens into their products. ” The $31 billion liquid staking industry suddenly looks more accessible to both Wall Street giants and everyday investors.

What does this mean for you as a crypto buyer?

How SEC’s Liquid Staking Clarification Benefits Crypto Buyers

-

Reduced Regulatory Uncertainty: The SEC’s August 2025 statement clarifies that certain liquid staking activities do not constitute securities offerings, allowing crypto buyers to participate in liquid staking with increased confidence about compliance risks.

-

Enhanced Access to DeFi Platforms: With regulatory clarity, major DeFi protocols like Lido and Rocket Pool can offer liquid staking tokens (LSTs) to U.S. users more freely, expanding participation opportunities for buyers.

-

Greater Liquidity for Staked Assets: Buyers can stake assets and receive staking receipt tokens (SRTs) that maintain liquidity, enabling trading or collateralization without waiting periods for unstaking.

-

Institutional Adoption and Product Innovation: Industry leaders such as Alluvial have welcomed the SEC’s stance, paving the way for new institutional-grade staking products and broader integration of LSTs into mainstream investment portfolios.

-

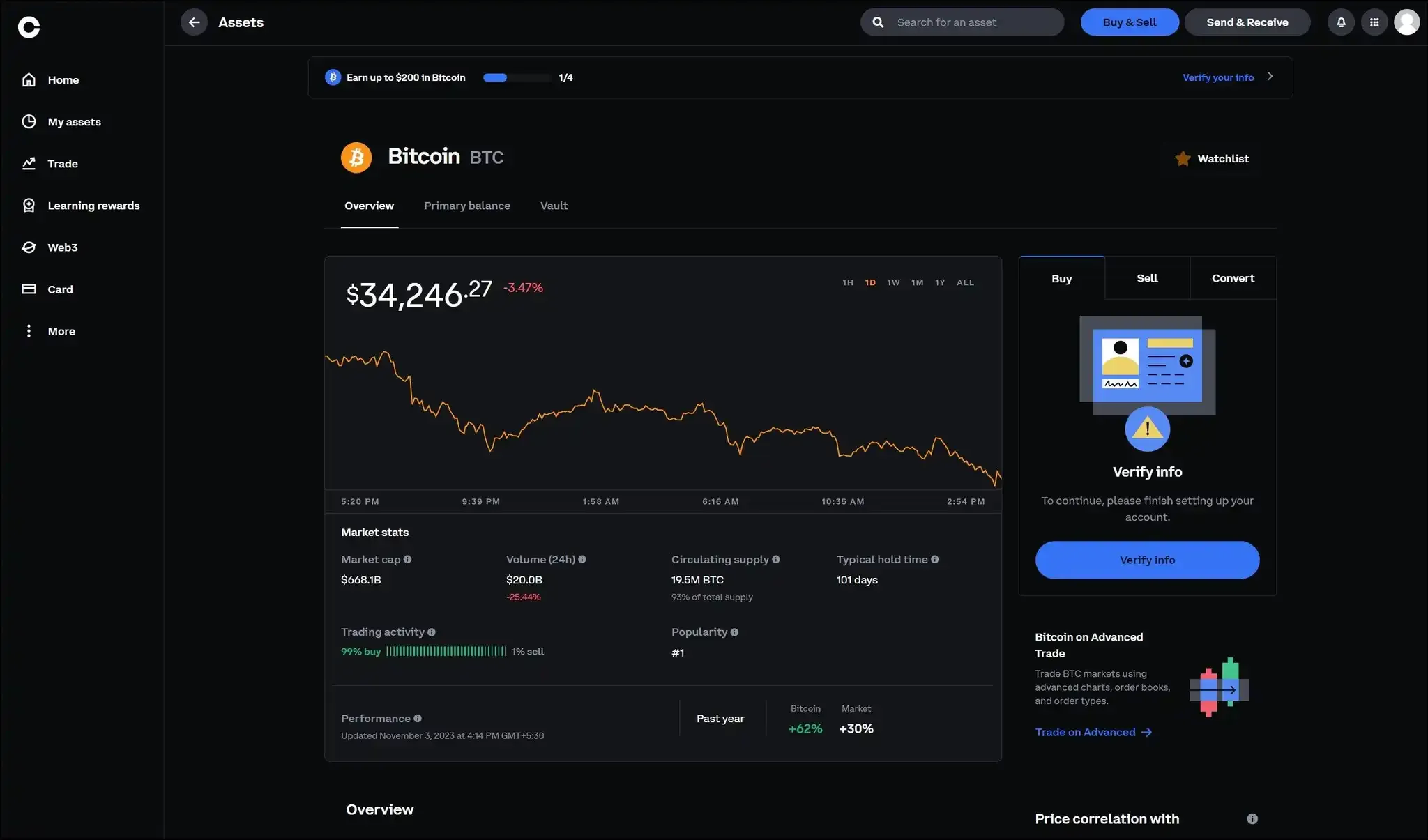

Streamlined Compliance for Platforms: Major exchanges and staking providers like Coinbase and Kraken can now offer compliant liquid staking services without triggering registration requirements under the Securities Act or Investment Company Act, making access easier for buyers.

The reduction in regulatory uncertainty could accelerate innovation across DeFi protocols. Expect more exchanges and wallet providers to offer secure access to liquid staking products – potentially with clearer disclosures around risks, rewards, and compliance protocols.

Navigating Nuance: Not All Liquid Staking Is Created Equal

This new clarity doesn’t mean all forms of liquid staking are automatically risk-free or outside SEC scrutiny. Commissioner Caroline A. Crenshaw cautioned that the statement relies on specific factual assumptions that may not reflect every provider’s practices (source). For example, if SRTs come bundled with additional rights or profit-sharing features beyond simple asset representation, they could still fall under securities rules.

This is where due diligence becomes essential for every investor – novice or seasoned pro alike. Each opportunity must be assessed on its own merits:

- Does the provider issue SRTs strictly one-to-one?

- Are there extra features that could complicate compliance?

- Is there transparency about how rewards are calculated and distributed?

The upshot: While SEC guidance makes mainstream participation safer than before, it doesn’t eliminate all regulatory or operational risks.

Crypto buyers in 2025 are now operating in a more mature, transparent environment, but the onus is still on each participant to understand what they’re buying into. Not all staking tokens are created equal. The SEC’s position is clear: as long as the liquid staking process remains administrative and SRTs are issued one-to-one, it’s not a securities issue. But if platforms start adding profit-sharing, governance rights, or other complex features to these tokens, they may trigger entirely different regulatory requirements.

The market’s immediate response has been largely positive. Institutions and DeFi projects alike see this as an invitation to innovate and expand without the shadow of imminent enforcement actions. As liquidity deepens and new products roll out, buyers have more options than ever to earn staking rewards without locking up their coins for months or years.

How Crypto Buyers Can Act Securely in 2025

For individuals looking to participate in liquid staking after the SEC’s update, a few principles stand out:

Secure Steps for Buying Crypto & Liquid Staking Post-SEC

-

Choose a Reputable Exchange: Start by selecting a well-established crypto exchange such as Coinbase, Kraken, or Binance US. These platforms offer robust security, regulatory compliance, and user-friendly interfaces for purchasing cryptocurrencies.

-

Enable Strong Security Measures: Protect your account by enabling two-factor authentication (2FA), using strong, unique passwords, and considering hardware security keys like YubiKey for added protection.

-

Purchase a Supported Staking Asset: Acquire a cryptocurrency that is eligible for liquid staking, such as Ethereum (ETH), Solana (SOL), or Polygon (MATIC). Confirm that your chosen asset is supported by major liquid staking protocols.

-

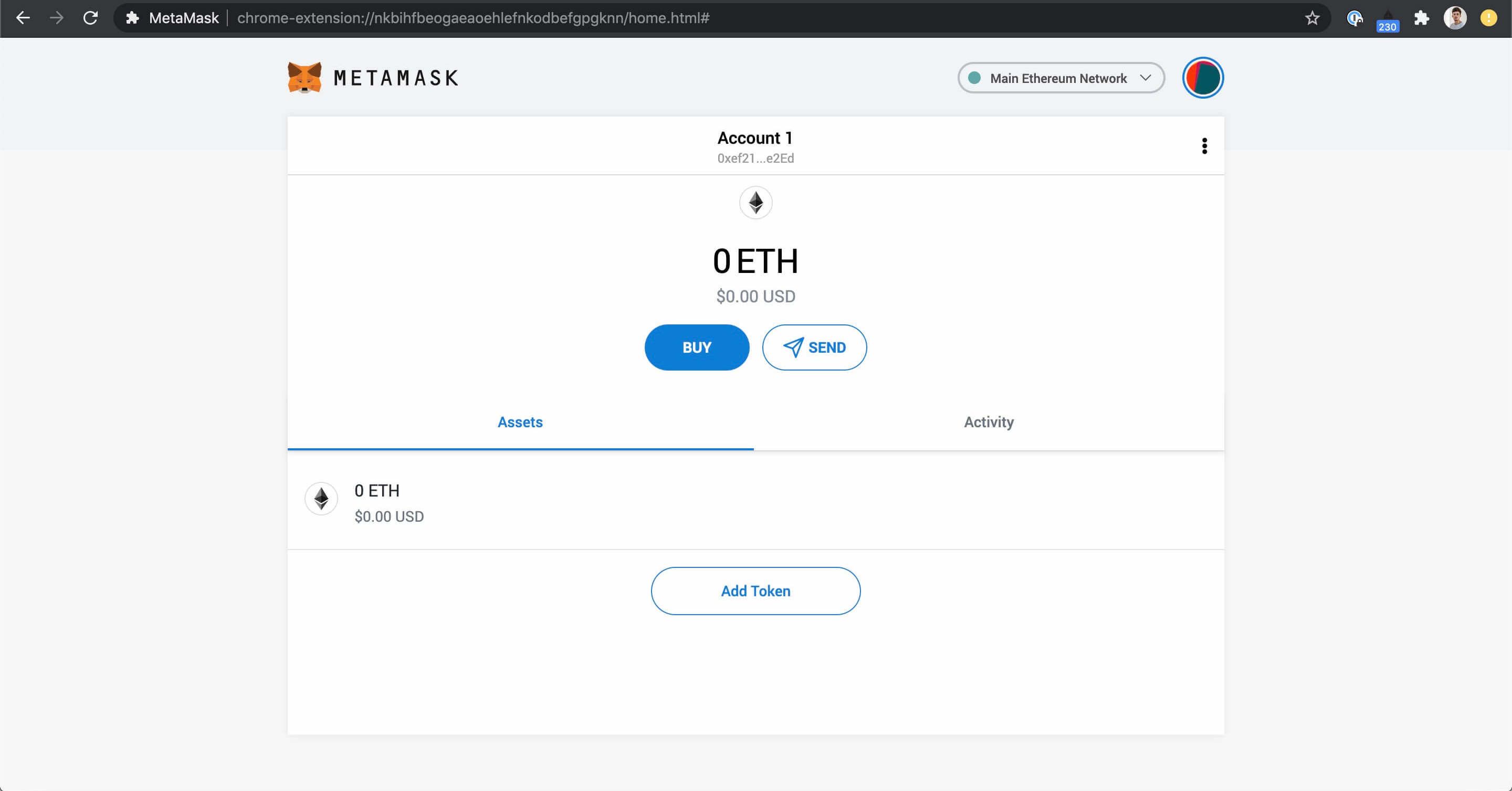

Transfer Assets to a Compatible Wallet: Move your purchased crypto to a secure, non-custodial wallet compatible with liquid staking protocols. Popular options include MetaMask, Ledger, or Trust Wallet.

-

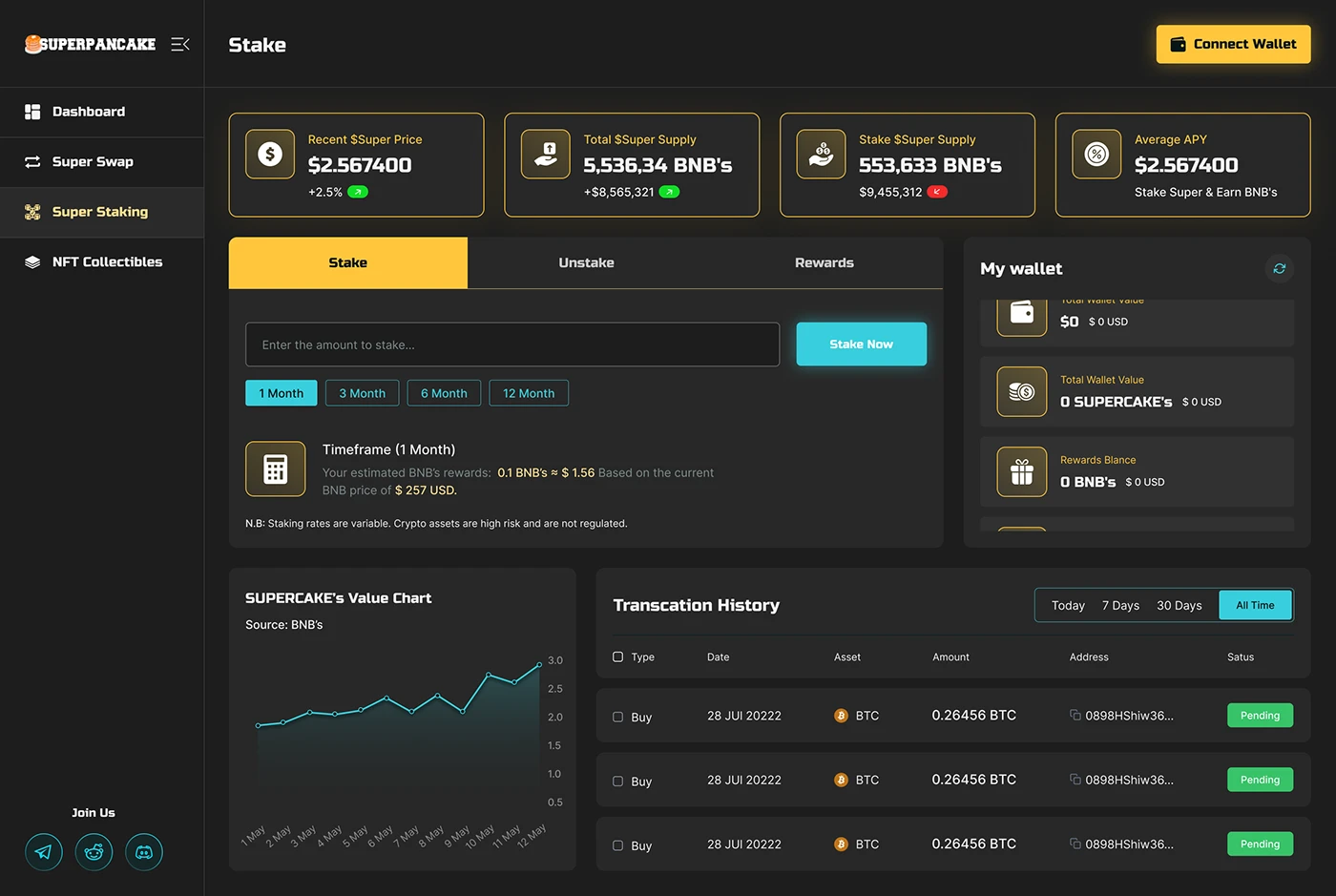

Select a Compliant Liquid Staking Protocol: Choose a well-known, SEC-compliant liquid staking platform such as Lido, Rocket Pool, or StakeWise. Ensure the protocol issues staking receipt tokens (SRTs) on a one-to-one basis with your deposit, as clarified by the SEC.

-

Review Protocol Terms and SEC Guidance: Before staking, carefully read the protocol’s documentation and the latest SEC guidance to ensure the service meets all regulatory requirements and that your SRTs are not considered securities.

-

Stake Your Assets and Receive SRTs: Deposit your crypto into the liquid staking protocol. You will receive staking receipt tokens (SRTs) representing your staked assets and accrued rewards, allowing you to maintain liquidity without unstaking.

-

Monitor Your Holdings and Rewards: Use your wallet or dashboard tools provided by the staking protocol to track your SRTs, rewards, and overall portfolio performance. Stay informed about any protocol updates or regulatory changes.

-

Stay Vigilant Against Risks: Remain aware of potential risks such as smart contract vulnerabilities, protocol changes, or evolving SEC interpretations. Regularly review official sources and community updates to protect your investments.

Transparency is key. Reputable providers will publish their protocols, audits, and compliance statements. Look for clear documentation about how SRTs are issued and redeemed. If there’s any ambiguity or marketing hype about “extra” rewards that aren’t linked directly to protocol-level staking, proceed with caution.

Security remains paramount, choose platforms with robust custody solutions and a track record of safeguarding user assets. Even with regulatory clarity, technical risks such as smart contract bugs or validator slashing still exist.

What This Means for the Broader Crypto Market

The SEC’s stance could be a tipping point for mainstream adoption of DeFi products. We’re likely to see:

- Growth in institutional participation, as banks and asset managers seek compliant yield strategies.

- Acceleration of product innovation, with new ETFs or mutual funds referencing liquid staking tokens.

- Greater international harmonization, as other jurisdictions look to the U. S. framework when updating their own crypto regulations.

This evolution won’t be without challenges. As always in crypto markets, volatility can return quickly, and regulatory interpretations may shift with new leadership or emerging risks.

If you’re considering entering liquid staking now that the regulatory fog has lifted, keep your focus on fundamentals: transparency, security, and compliance first, yield second.