Ethereum is in the spotlight again, and this time the catalyst is clear: institutional buying and ETF inflows are rewriting the rules for crypto investors. As of August 12,2025, Ethereum (ETH) is trading at $4,260.15, a level that reflects not just retail enthusiasm but a tidal wave of professional capital pouring into the ecosystem.

Institutional Money Moves the Needle: Why ETH Is Outperforming

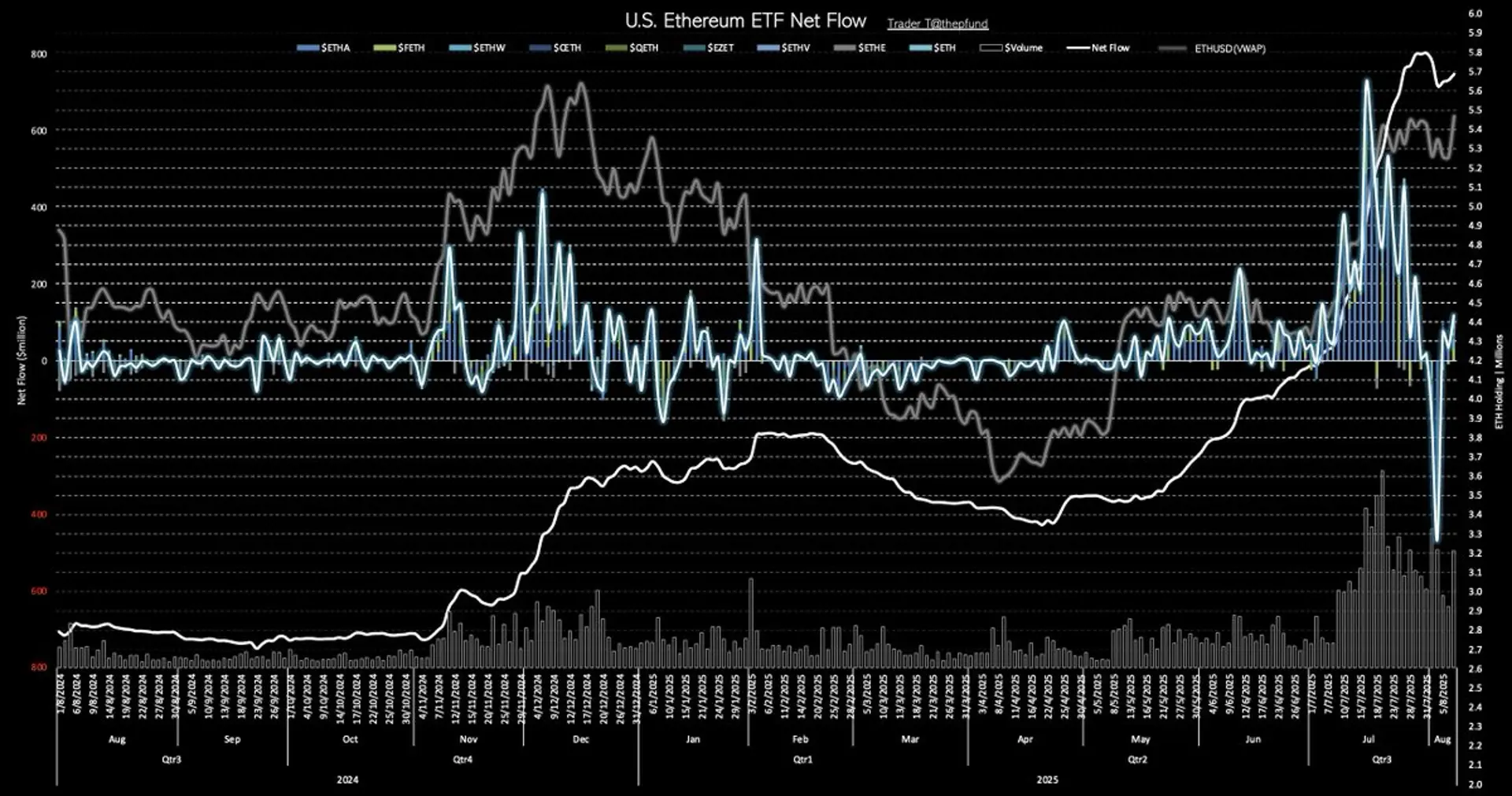

The game changed when financial giants like BlackRock and Fidelity threw their weight behind Ethereum. BlackRock’s iShares Ethereum Trust (ETHA) has already crossed $10 billion in assets under management, making it one of the fastest-growing ETFs in history. In July 2025 alone, Ethereum-focused ETFs attracted more than $5.37 billion in inflows, posting an unbroken streak of 19 days with positive net flows (source).

This surge in institutional ETH buying is not just a headline – it’s creating a real supply crunch. With over 27 million ETH staked and annual issuance rates slashed post-Merge, there’s simply less Ethereum available for buyers. The result? Every fresh wave of ETF inflows ratchets up upward price pressure. As Cointific reports, more ETH is being locked away than mined or sold on exchanges.

Retail vs Institutional: The Growing Divide in Crypto Investing

This new landscape isn’t just about big numbers – it’s about a fundamental shift in who controls the market narrative. Data from Bitget and AInvest show that institutions are aggressively accumulating ETH while many retail traders remain on the sidelines or trade short-term volatility spikes. The gap between these groups has never been wider.

For everyday investors, this means two things:

- Validation: Major institutions backing Ethereum boosts its credibility as an asset class.

- Volatility: Large ETF flows can amplify both upswings and corrections, making price action sharper and potentially more unpredictable.

The net effect? Retail investors must adapt their strategies to thrive alongside deep-pocketed players with longer time horizons and more sophisticated risk management tools.

Ethereum (ETH) Price Prediction 2026-2031

Forecasts reflecting institutional accumulation, ETF inflows, and evolving market dynamics

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,600 | $4,800 | $6,500 | +12.7% | ETF inflows stabilize, institutional accumulation drives steady growth |

| 2027 | $4,200 | $5,600 | $7,800 | +16.7% | Broader ETF adoption, Layer 2 scaling boosts DeFi/utility |

| 2028 | $4,900 | $6,500 | $9,000 | +16.1% | Mainstream DeFi adoption, regulatory clarity improves sentiment |

| 2029 | $5,400 | $7,400 | $10,500 | +13.8% | ETH as digital asset for institutions, increased staking reduces liquid supply |

| 2030 | $6,000 | $8,200 | $12,000 | +10.8% | Global capital markets integrate ETH, tech upgrades enhance scalability |

| 2031 | $6,600 | $9,000 | $14,000 | +9.8% | Widespread ETH ETF retail adoption, ETH 3.0/AI integrations |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 remains broadly bullish, underpinned by sustained institutional ETF inflows, ongoing supply constraints due to staking, and expanding adoption across both retail and institutional investors. While periods of volatility and regulatory uncertainty may trigger pullbacks, the long-term trajectory is upward, especially as Ethereum cements its role as a foundational layer for decentralized finance and tokenized assets. The average price is projected to grow at a healthy double-digit rate year-over-year, with maximum prices reflecting bullish scenarios tied to accelerated adoption and favorable macro conditions.

Key Factors Affecting Ethereum Price

- Sustained institutional demand and ETF inflows creating a supply crunch

- Ethereum’s technological advancements (e.g., scaling solutions, upgrades)

- Regulatory clarity and global acceptance of crypto ETFs

- Competition from other smart contract platforms (Solana, Avalanche, etc.)

- Macro-economic cycles and investor risk appetite

- Retail adoption via ETF products and mainstream financial integration

- Staking and reduced ETH issuance lowering liquid supply

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ethereum Investment Strategies for 2025: Navigating the New Normal

The influx of institutional capital isn’t just driving prices – it’s changing how individuals can get exposure to Ethereum entirely. Spot ETFs make it possible for anyone to buy into ETH through traditional brokerage accounts without managing wallets or worrying about private keys. But with opportunity comes complexity: fees vary widely between funds, tracking errors can occur during volatile periods, and sudden outflows (like August’s record $465 million single-day exit) can trigger rapid price swings.

If you’re looking to capitalize on this environment, here are actionable steps:

- Diversify your entry points: Consider blending direct ETH purchases with ETF exposure for flexibility.

- Monitor ETF flows closely: Persistent inflows often precede rallies; sharp outflows can signal reversals (see recent data).

- Stay nimble: Use stop losses or trailing stops if trading short-term moves; don’t underestimate volatility spikes triggered by institutional shifts.

Ethereum Price Prediction 2026-2031

Professional Forecasts Based on Institutional Buying, ETF Inflows, Market Cycles, and Adoption Trends (Baseline: $4,260.15 as of August 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,600 | $4,800 | $6,200 | +13% | ETF-driven demand remains robust, but volatility persists; possible regulatory headwinds. |

| 2027 | $4,100 | $5,600 | $7,800 | +16% | Retail adoption accelerates, ETH 2.0 scalability upgrades boost DeFi/NFT use cases. |

| 2028 | $4,900 | $6,700 | $9,200 | +20% | Mainstream integration and EVM adoption expand, but competition from L2s and alt-L1s intensifies. |

| 2029 | $5,200 | $7,900 | $11,000 | +18% | Macro environment favors risk assets; institutional allocations increase, but cycles create sharp corrections. |

| 2030 | $5,800 | $9,200 | $13,500 | +16% | Major enterprises leverage Ethereum for tokenization and settlement; regulatory clarity improves. |

| 2031 | $6,400 | $10,800 | $16,000 | +17% | ETH matures as a yield-bearing institutional asset; global adoption and network upgrades sustain growth. |

Price Prediction Summary

Ethereum is poised for continued growth through 2031, driven by persistent institutional inflows, ETF demand, and advances in blockchain technology. While significant price appreciation is expected, periods of heightened volatility and corrections are likely due to changing macro conditions and evolving regulatory frameworks. Average prices are projected to rise steadily, with bullish scenarios fueled by widespread adoption and technology upgrades, and bearish scenarios reflecting potential regulatory or competitive challenges.

Key Factors Affecting Ethereum Price

- Sustained institutional accumulation and ETF inflows driving demand

- Ethereum supply crunch due to staking and ETF holdings

- Major network upgrades (e.g., scalability, sharding, EIP improvements)

- Expansion of DeFi, NFTs, and real-world asset tokenization on Ethereum

- Regulatory developments in the US, EU, and Asia affecting ETF and crypto markets

- Competition from layer-2 solutions and alternative smart contract platforms

- Macro-economic factors impacting investor risk appetite

- Retail adoption trends and global financial integration

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As Ethereum’s price holds above $4,260.15, the landscape for both new and seasoned investors is evolving fast. The days of retail-driven rallies are giving way to a market increasingly shaped by institutional flows and ETF mechanics. This shift demands a new playbook, one that blends traditional financial acumen with crypto-native flexibility.

Key Risks and Rewards: What Everyday Investors Should Watch

With institutions setting the pace, everyday investors face a double-edged sword. On one hand, higher liquidity and validation from Wall Street can support further upside. On the other, institutional dominance can lead to sudden, outsized moves, both up and down, as large players rebalance or rotate positions.

- Liquidity surges: ETF-driven demand can create fast price ramps but also sharp reversals if inflows slow or reverse.

- Transparency: ETF holdings and flows are public, savvy investors can track these metrics for early signals of trend shifts.

- Regulatory overhang: While ETFs add legitimacy, regulatory changes or tax shifts could impact product structure or investor returns.

The August 2025 record single-day outflow of $465 million from Ethereum ETFs was a wakeup call: even in a bullish cycle, profit-taking or macro shocks can trigger rapid drawdowns. If you’re trading short-term swings, keep one eye on ETF flow data and another on global risk sentiment.

Top Ethereum Investment Strategies for 2025

-

1. Leverage Spot Ethereum ETFs (e.g., BlackRock ETHA, Fidelity Ethereum Fund): Gain exposure to Ethereum’s price movements without direct crypto custody. ETFs like BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund offer regulated, accessible investment vehicles—ideal for those seeking institutional-grade security and liquidity.

-

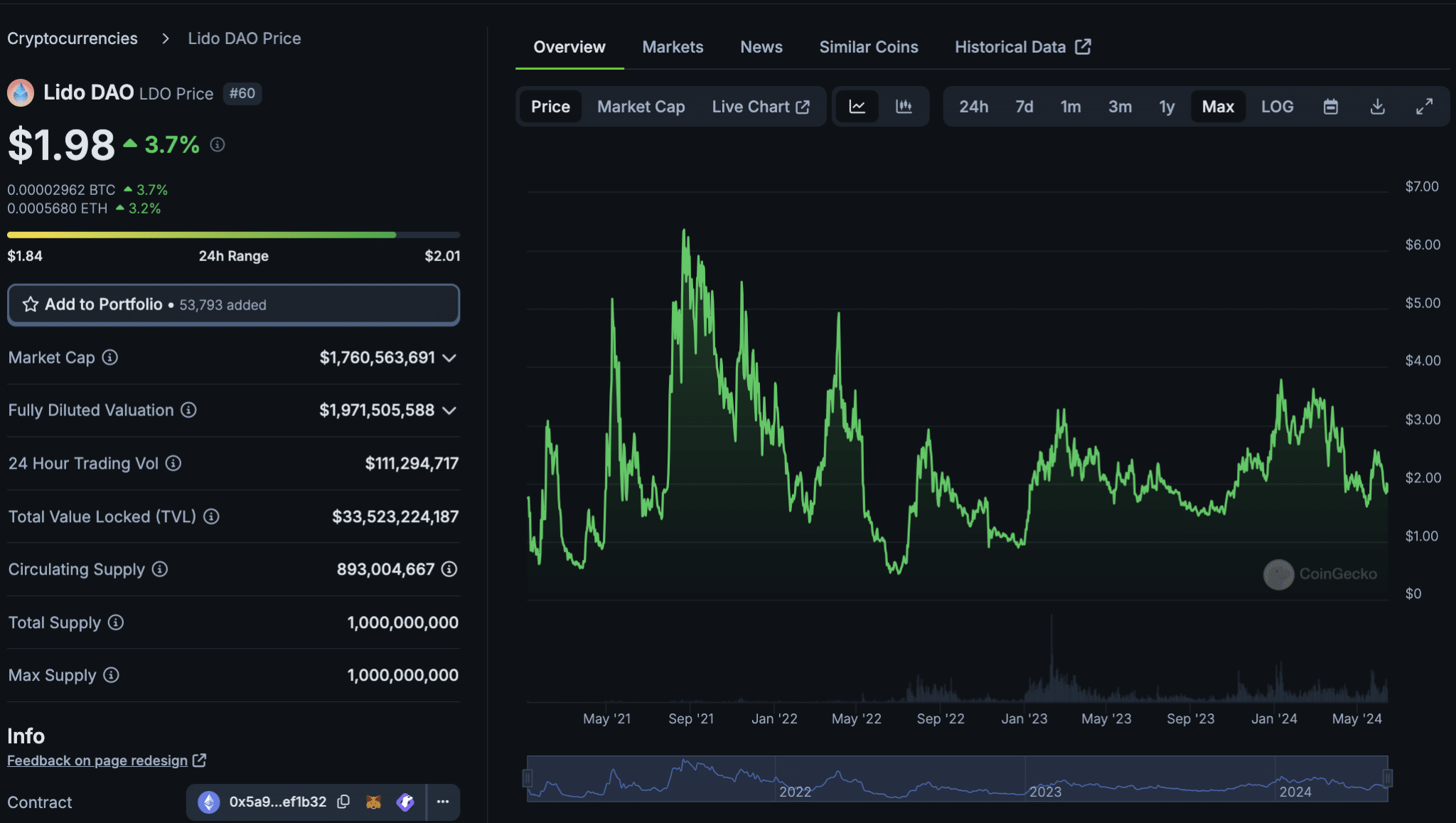

2. Stake ETH for Passive Income: With over 27 million ETH staked and Ethereum’s annual issuance rate reduced post-Merge, staking through platforms like Lido Finance, Coinbase, or Kraken allows investors to earn rewards while supporting network security.

-

3. Utilize Dollar-Cost Averaging (DCA) via Major Exchanges: Mitigate volatility by setting up recurring ETH purchases on trusted platforms such as Coinbase, Binance, or Kraken. DCA helps smooth out entry points, especially during periods of high price swings like those seen in 2025.

-

4. Monitor Institutional and ETF Inflows for Trend Signals: Track real-time ETF inflows using resources like Farside Investors or Bloomberg Terminal. Surges in weekly inflows—such as the recent $327 million—often precede major price movements, offering actionable insights for retail investors.

-

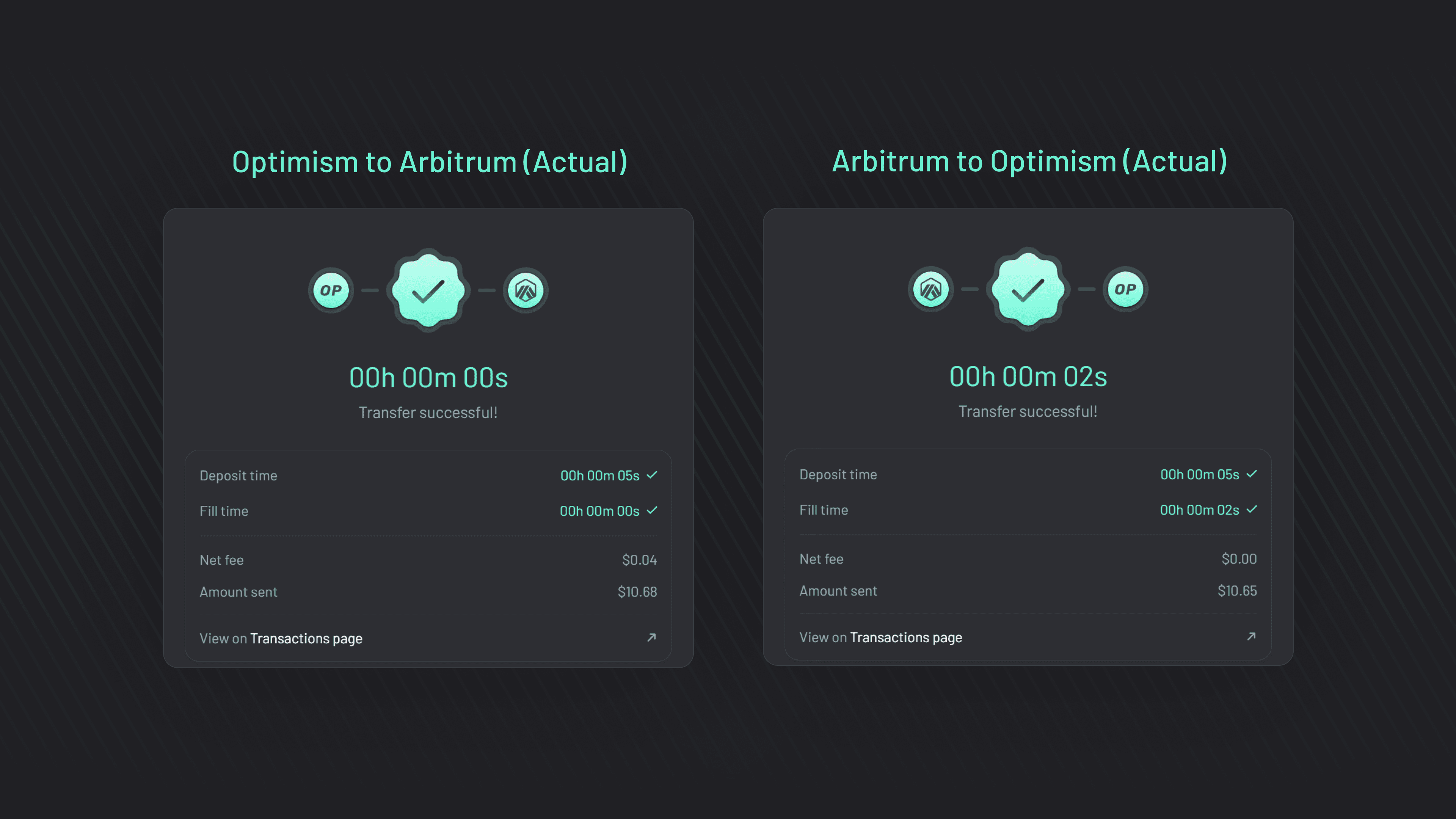

5. Diversify with Layer 2 Solutions and DeFi Protocols: Explore Ethereum Layer 2 networks (e.g., Arbitrum, Optimism) and leading DeFi platforms like Aave or Uniswap to access additional yield opportunities and lower transaction fees, broadening your ETH investment exposure.

How to Buy Ethereum Securely Amid Institutional FOMO

The easiest way to get exposure remains direct purchase via reputable exchanges, but now, ETFs offer an alternative for those wary of self-custody risks. Whichever route you choose:

- Verify platform security: Stick to regulated venues with robust custody solutions.

- Avoid leverage traps: Institutional volatility spikes can liquidate overleveraged retail positions in minutes.

- Diversify timing: Use dollar-cost averaging to smooth entry points during price surges like we’re seeing at $4,260.15.

If you want deeper context on how institutional inflows are squeezing supply and fueling this rally, check out the analysis at Cointific.

The Road Ahead: Will ETH Sustain Above $4,260?

The question now is not just whether Ethereum can hold above $4,260.15, it’s whether this level becomes a new floor or another fleeting milestone. With net inflows continuing across major ETFs and over 27 million ETH locked in staking contracts, the supply/demand imbalance remains unresolved. However, as we saw with August’s volatility spike and outflows, nothing moves in a straight line, even in an institutional era.

If retail participation accelerates alongside institutions (as some analysts predict), we could see another leg up toward ambitious targets discussed in recent forecasts.

Ethereum (ETH) Price Prediction Table: 2026–2031

Forecasts based on current market trends, institutional inflows, ETF dynamics, and macroeconomic scenarios. All prices are in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,700 | $4,850 | $6,200 | +13.8% | ETF inflows remain robust; some regulatory uncertainty persists; volatility elevated |

| 2027 | $4,250 | $5,600 | $7,800 | +15.5% | Broader retail adoption via ETFs; Layer-2 scaling and DeFi growth; potential for first ETH ETF in Asia |

| 2028 | $4,900 | $6,500 | $9,200 | +16.1% | Global regulatory clarity improves; ETH becomes key institutional asset; staking exceeds 35M ETH |

| 2029 | $5,700 | $7,400 | $11,000 | +13.8% | Major upgrades (e.g., Danksharding); ETH used as settlement layer for tokenized RWAs; competition from Solana/Cardano |

| 2030 | $6,200 | $8,600 | $13,500 | +16.2% | NFT resurgence and Web3 adoption; ETH ETFs in major markets; macro bull cycle |

| 2031 | $5,800 | $9,200 | $15,000 | +7.0% | Market matures; regulatory headwinds in some regions; ETH faces scaling and sustainability challenges |

Price Prediction Summary

Ethereum is poised for continued long-term growth, driven by institutional demand, ETF inflows, and expanding real-world use cases. After the recent surge above $4,000 in 2025, the market is expected to remain volatile but generally bullish. By 2031, ETH could reach an average price of $9,200, with bullish scenarios targeting up to $15,000, depending on regulatory clarity, technology upgrades, and macroeconomic conditions.

Key Factors Affecting Ethereum Price

- Institutional adoption and ETF inflows creating persistent demand and supply crunch.

- Regulatory clarity in the US, EU, and Asia will be crucial for sustained inflows and market confidence.

- Technological upgrades (e.g., Layer-2 scaling, Danksharding) enhancing scalability and utility.

- Rising competition from other smart contract platforms (Solana, Cardano, Avalanche).

- Macro market cycles, including global liquidity and risk appetite.

- Retail adoption trends, especially via ETF channels and staking.

- Potential black swan events or regulatory shocks impacting sentiment and flows.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The bottom line? Ethereum’s surge past $4,260.15 is not just a number, it’s proof that crypto markets are maturing fast under the influence of institutional capital and new investment vehicles. For everyday investors willing to adapt their approach and stay informed about ETF dynamics, there are asymmetric opportunities ahead, but only if you respect the risks as much as the rewards.