Ethereum has taken center stage in 2025’s crypto investment narrative, with U. S. spot Ethereum ETFs smashing through a record $1.02 billion in net inflows on August 11 alone. This surge, led by BlackRock’s iShares Ethereum Trust ETF (ETHA) and Fidelity’s Ethereum Fund (FETH), signals a seismic shift in how both institutional and retail investors view the world’s second-largest blockchain. ETH currently trades at $4,776.95, its highest level in over two years, propelled by this institutional buying spree and a growing appetite for secure crypto exposure.

Ethereum ETF Inflows Reach Historic Highs in August 2025

The magnitude of recent Ethereum ETF inflows is difficult to overstate. With $2.3 billion pouring into these funds over just six days in August, ETH ETFs have not only overtaken Bitcoin ETFs for the month but have also absorbed as much ETH as the network has issued since the post-merge era began (KuCoin News). BlackRock’s ETHA alone attracted approximately $640 million on August 11, while Fidelity’s FETH captured an additional $277 million.

This momentum is not isolated; it builds on a year of accelerating inflows, with total spot Ethereum ETF capital now exceeding $10.8 billion according to Brave New Coin. The influx reflects not just speculative interest but a structural shift toward regulated, institution-friendly vehicles for crypto investment.

Institutional Adoption and Regulatory Clarity Fuel Secure Crypto Buying

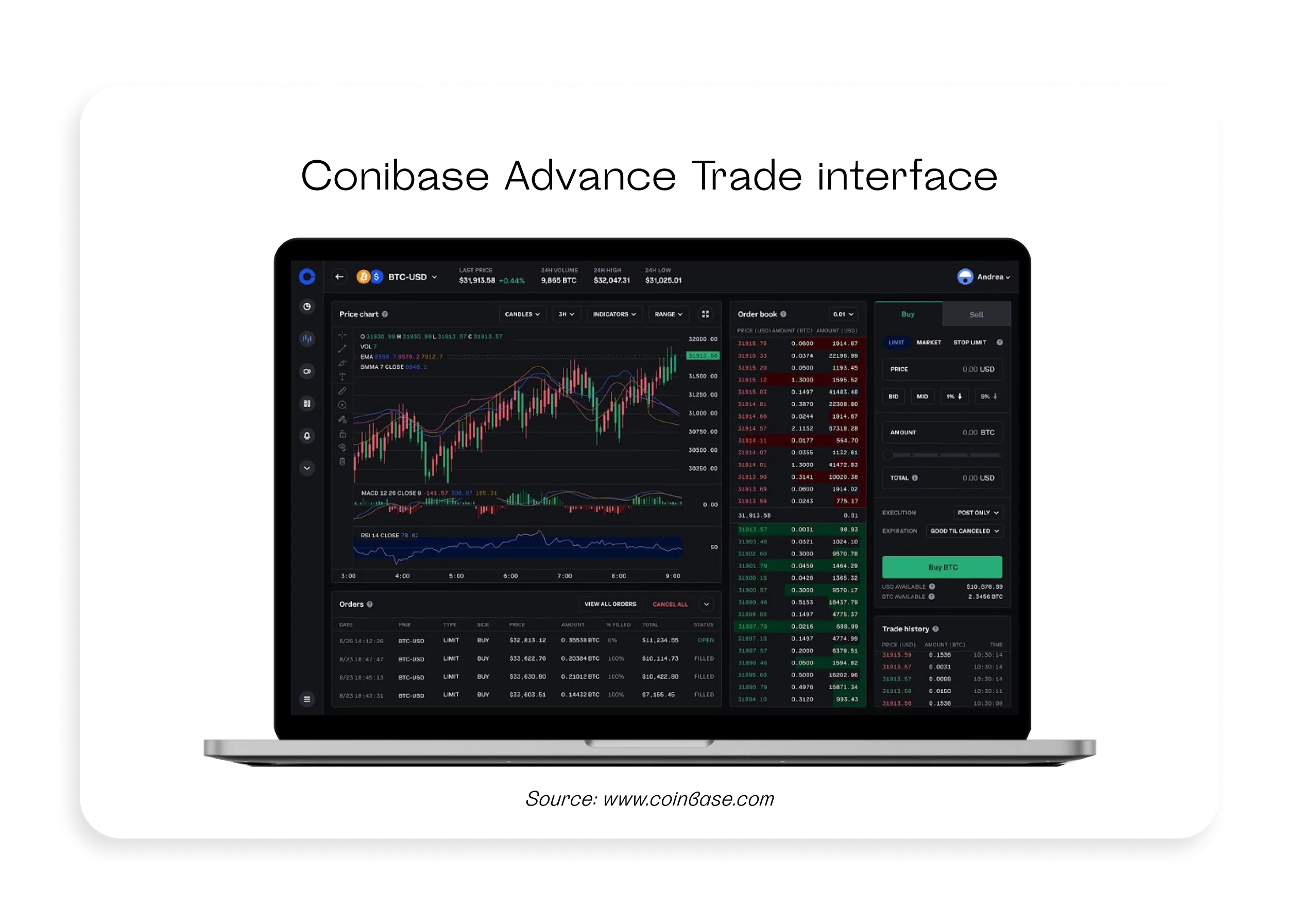

Why are these inflows so significant for those looking to buy Ethereum securely? The answer lies in the intersection of regulatory clarity and institutional trust. Major financial institutions such as PNC Bank and JPMorgan are now actively partnering with leading crypto platforms like Coinbase to offer digital asset trading services (Reuters: PNC taps Coinbase). This mainstream acceptance is reinforced by favorable U. S. policy moves that have brought new transparency to the sector.

For investors wary of hacks or unregulated exchanges, ETFs provide a compliant, transparent route into ETH exposure without having to self-custody assets or navigate complex wallets. The spike in ETF demand suggests that more capital is flowing through secure channels than ever before, a trend likely to persist as regulatory guardrails strengthen further.

“Institutional money isn’t just chasing returns, it’s demanding robust security frameworks and regulatory oversight, “ says blockchain analyst Helen Zhao.

Ethereum Price Surge: What Does $4,776.95 Mean for Buyers?

The current ETH price of $4,776.95 represents more than just a milestone; it signals renewed confidence in Ethereum as the backbone of decentralized finance (DeFi) and Web3 infrastructure (Cointelegraph: Ether ETFs Hit Record Inflow). Exchange balances have dropped to their lowest levels since 2016, indicating reduced selling pressure and long-term conviction among holders (KuCoin News).

This price appreciation is also supported by whale activity, large investors have reportedly acquired over $1.3 billion worth of ETH during the latest rally (Coinspeaker). Analysts are already predicting further upside potential if institutional flows remain strong and staking continues to lock up supply.

Ethereum (ETH) Price Prediction Table: 2026–2031

Analyst forecasts based on ETF momentum, institutional adoption, and evolving regulatory landscape (2025 baseline: $4,776.95)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $4,200 | $5,350 | $7,100 | +12% | Post-ETF consolidation; continued institutional inflows, but potential for correction after rapid 2025 gains |

| 2027 | $4,750 | $6,400 | $8,800 | +20% | Ethereum ecosystem expands into real-world asset tokenization; regulatory clarity improves, boosting adoption |

| 2028 | $5,200 | $7,850 | $11,000 | +23% | DeFi and Web3 growth accelerate; Layer-2 scaling and upgrades drive utility; volatility persists |

| 2029 | $6,000 | $9,300 | $13,800 | +19% | Mainstream financial integration; increased competition from new smart contract platforms, but ETH remains dominant |

| 2030 | $7,000 | $11,250 | $17,000 | +21% | Potential new all-time high; mass adoption of on-chain finance, global regulatory harmonization |

| 2031 | $6,800 | $13,400 | $21,000 | +19% | Matured crypto market; ETH as a global settlement layer, but macro risks and disruptive tech remain |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is broadly bullish, underpinned by record ETF inflows, institutional adoption, and technological advancements. While short-term corrections are possible after the 2025 surge, long-term trends favor steady growth, with average prices projected to nearly triple by 2031. Bullish scenarios could see ETH reaching $21,000 if adoption and innovation continue at pace, while bearish cases reflect macroeconomic or regulatory setbacks.

Key Factors Affecting Ethereum Price

- Sustained institutional investment through ETFs and treasury buying

- Evolving global regulatory clarity and increased security for investors

- Ethereum network upgrades (scalability, Layer-2 adoption, energy efficiency)

- Expansion of DeFi, tokenized real-world assets, and Web3 applications

- Competition from emerging smart contract platforms (e.g., Solana, Avalanche)

- Macro environment: interest rates, global economic cycles, and risk appetite

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Secure Crypto Purchases Amid Record Inflows

If you’re considering how to buy Ethereum securely during this unprecedented market phase, understanding these dynamics is crucial:

Top Tips for Secure Crypto Buying in 2025

-

Choose Regulated Platforms: Use established exchanges like Coinbase, Kraken, or Binance US that comply with U.S. regulations. These platforms offer robust security measures and insurance against certain losses.

-

Utilize Spot ETFs for Simplicity and Security: Consider investing in spot Ethereum ETFs such as BlackRock’s ETHA or Fidelity’s FETH. ETFs provide regulated exposure to ETH without needing to manage private keys.

-

Enable Two-Factor Authentication (2FA): Always activate 2FA on your exchange and wallet accounts. Apps like Google Authenticator and Authy add an extra layer of protection against unauthorized access.

-

Stay Informed on Regulatory Changes: Follow updates from the U.S. Securities and Exchange Commission (SEC) and major news outlets to understand evolving crypto regulations and ensure compliance when buying.

-

Verify Official Sources Before Transactions: Double-check URLs and official app downloads to avoid phishing scams. Use trusted sources like CoinGecko or CoinMarketCap to confirm token contract addresses.

-

Monitor Market Trends and On-Chain Data: Use analytics platforms such as Glassnode or Dune Analytics to track ETF inflows, exchange balances, and price movements. For example, Ethereum is currently trading at $4,776.95, reflecting strong institutional demand.

The combination of regulated ETF products, major bank partnerships with trusted exchanges, and robust on-chain security protocols makes this one of the most secure environments yet for new entrants into crypto markets.

While the headlines focus on record-breaking numbers, the practical implications for everyday investors are equally profound. The surge in Ethereum ETF inflows is not only a barometer of institutional confidence but also a catalyst for improved investor protections and transparent pricing. With ETH trading at $4,776.95, buyers now have more tools than ever to participate safely and efficiently in the market.

One of the most significant shifts is the mainstream integration of crypto into traditional finance. As major banks like JPMorgan and PNC Bank forge partnerships with platforms such as Coinbase, retail investors gain access to vetted trading environments and custodial solutions once reserved for elite clients. This convergence has dramatically reduced barriers to entry while raising industry standards for compliance and security.

How Institutional Investment Shapes Retail Crypto Buying

Institutional adoption doesn’t just bring capital; it brings accountability. ETFs are subject to rigorous oversight, audited reserves, and transparent reporting, features that help demystify crypto for newcomers and veterans alike. The influx of regulated capital into Ethereum has also prompted exchanges to enhance their own security protocols, from multi-signature wallets to real-time transaction monitoring.

This institutional momentum is echoed by on-chain data: exchange balances are at a nine-year low, suggesting that investors are holding ETH longer or staking it to earn yield rather than flipping it for short-term gains (KuCoin News). For those looking to buy Ethereum securely, this trend adds another layer of confidence, reduced selling pressure often signals market health and long-term value creation.

Practical Steps: Secure Crypto Buying in 2025

To capitalize on this environment, consider these research-driven strategies:

Top Strategies for Secure Ethereum Purchases in 2025

-

Utilize Regulated Ethereum ETFs like BlackRock’s iShares Ethereum Trust ETF (ETHA) and Fidelity’s Ethereum Fund (FETH) for exposure to ETH without directly handling crypto wallets. These ETFs saw record inflows—ETHA alone attracted $640 million in a single day—reflecting strong institutional confidence and robust regulatory oversight.

-

Leverage Institutional Crypto Services provided by major banks like PNC Bank and JPMorgan in partnership with Coinbase Institutional. These services offer secure custody, compliance, and direct access to ETH, reflecting the growing integration of crypto in traditional finance.

-

Enable Multi-Factor Authentication (MFA) and use strong, unique passwords on all crypto accounts and wallets. Platforms like Coinbase and Kraken support advanced MFA options, significantly reducing the risk of unauthorized access to your Ethereum holdings.

First, leverage regulated ETF products if you prefer hands-off exposure with built-in compliance and insurance protections. Second, when buying ETH directly through exchanges, choose platforms partnered with reputable banks or those with robust track records in security audits and regulatory compliance.

Third, explore staking options if you plan to hold long-term; not only does this support network security but it can also provide additional yield, an increasingly popular strategy among both institutions and individual investors as staking locks up over $150 billion worth of ETH across platforms (AInvest).

Looking Ahead: What Could Disrupt This Momentum?

The outlook remains bullish as long as regulatory clarity persists and institutional flows continue. However, potential disruptors include unexpected regulatory reversals or critical exploits in DeFi protocols that could undermine trust. Keeping an eye on policy developments, and using secure purchase methods, will be essential for anyone navigating the evolving landscape.

Ultimately, the convergence of record Ethereum ETF inflows, robust price action at $4,776.95, and maturing regulatory frameworks has set a new standard for secure crypto buying in 2025. Whether you’re new to digital assets or a seasoned participant seeking sustainable growth opportunities, these trends offer a blueprint for participating confidently in one of finance’s most dynamic markets.