For years, institutional players eyed Bitcoin with caution, wary of regulatory uncertainty and security risks. But the landscape shifted dramatically in early 2024 when the U. S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs. This move didn’t just open the door for Wall Street – it fundamentally changed how everyday investors access and perceive cryptocurrency.

Bitcoin ETFs: Opening the Gates for All Investors

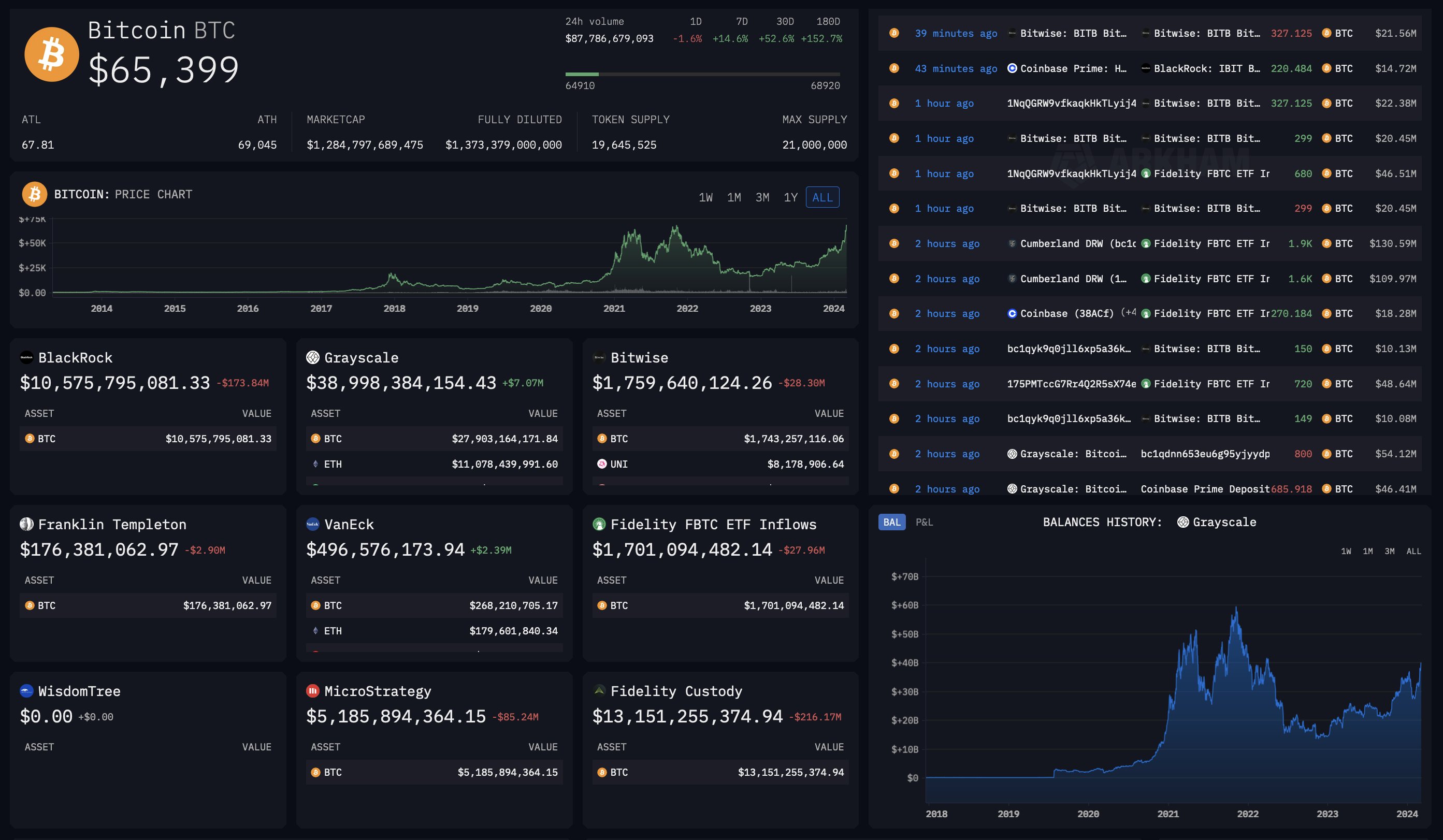

Historically, buying Bitcoin meant navigating exchanges, wallets, and private keys. Now, with spot Bitcoin ETFs available through mainstream brokers, investing in crypto is as familiar as purchasing a stock or index fund. This simplicity has proven magnetic: retail investors have flocked to these products in record numbers, with nearly 80% of total assets under management in spot Bitcoin ETFs coming from non-institutional buyers as of October 2024 (source).

This surge in accessibility is more than a convenience upgrade. It’s a seismic shift in market participation. Retail investors who once hesitated due to technical barriers or security fears can now gain exposure to Bitcoin within their existing brokerage accounts, benefitting from regulatory oversight and protections that traditional crypto exchanges often lack.

Institutional Buying: Stability Meets Legitimacy

The arrival of institutional money has been equally transformative. Large asset managers and financial advisors now hold 22.9% of all U. S. -listed Bitcoin ETF assets, according to CoinShares’ Q1 2025 13F filings (source). Even as some hedge funds recently pulled back, advisors and pension funds are stepping up their allocations.

This influx isn’t just about deep pockets – it brings new legitimacy to the asset class itself. SEC approval signals regulatory acceptance, while the involvement of household names like Goldman Sachs in offering Bitcoin ETF products further reassures skeptical investors. The result? Crypto is no longer an outsider’s game; it’s a core portfolio consideration for both retail and institutional players.

The Ripple Effect on Bitcoin Price and Market Dynamics

With Bitcoin trading at $116,521 as of August 19,2025 (down just 0.66% on the day), ETF flows have become a major force shaping price action and volatility patterns across crypto markets. Increased liquidity from institutional buyers tends to dampen wild swings – making the market more attractive for risk-averse retail participants seeking stable exposure.

Interestingly, while on-chain data shows fewer direct wallet purchases by retail users, analysts note that many have simply shifted their buying activity into regulated ETFs (source). This migration reflects a maturing investor base prioritizing security and convenience over self-custody.

Bitcoin Price Prediction 2026-2031: The ETF Era and Market Evolution

Forecasts reflect the impact of institutional ETF adoption, regulatory trends, and maturing market dynamics.

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $90,000 | $125,000 | $160,000 | +7% | Potential regulatory tightening in US/EU; ETF flows stabilize, mild correction possible |

| 2027 | $105,000 | $143,000 | $190,000 | +14% | Renewed institutional interest; global ETF expansion; increased sovereign adoption |

| 2028 | $118,000 | $163,000 | $220,000 | +14% | Next Bitcoin halving boosts scarcity narrative; tech upgrades (e.g., scaling) attract more institutional inflows |

| 2029 | $130,000 | $182,000 | $250,000 | +12% | Maturing ETF markets, wider retail adoption; regulatory clarity in major economies |

| 2030 | $145,000 | $205,000 | $280,000 | +13% | Bitcoin seen as digital gold; integration with traditional finance deepens |

| 2031 | $160,000 | $230,000 | $320,000 | +12% | Mainstream adoption, cross-border use cases expand; competition from CBDCs and altcoins tempers upside |

Price Prediction Summary

Bitcoin’s price outlook for 2026-2031 is bullish but tempered by periodic corrections and evolving regulatory and competitive landscapes. After the ETF-driven surge, a phase of consolidation and steady growth is expected, with average annual gains in the 12-14% range. Institutional and retail flows via ETFs, next halving impacts, and broader adoption as a store of value are primary drivers, though downside risks remain from potential regulatory crackdowns or macro shocks.

Key Factors Affecting Bitcoin Price

- Institutional and retail ETF flows: Continued demand, especially during bull cycles, will drive liquidity and price discovery.

- Regulatory environment: Favorable regulation can unlock new capital; restrictive regimes may trigger corrections.

- Bitcoin halving cycles: The 2028 halving is likely to provide a supply shock, historically associated with bullish trends.

- Technological improvements: Network upgrades (e.g., scaling, security) will boost investor confidence and utility.

- Macro environment: Inflation, monetary policy, and geopolitical events may increase Bitcoin’s appeal as a non-correlated asset.

- Competition: Growth of CBDCs and alternative blockchains could cap upside if they capture market share or regulatory favor.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Retail Strategies Evolve Amid Institutional Influence

The democratization of access hasn’t erased competition between big players and individuals. In fact, it’s inspired new approaches among retail investors seeking alpha in an increasingly sophisticated environment:

- Diversification: Many now blend spot ETF holdings with direct crypto purchases or altcoins to balance risk.

- Tactical allocation: Retail buyers are watching ETF inflows/outflows closely as real-time sentiment signals.

- Securitized savings: Some use crypto ETFs within retirement accounts for tax efficiency – something previously out of reach.

This strategic shift is visible in the growing sophistication of retail crypto investing strategies. With tools and data once reserved for hedge funds now widely available, retail investors are leveraging ETF flows, technical analysis, and macro trends to inform their decisions. The days of blind speculation are giving way to more nuanced, risk-managed approaches that mirror traditional finance.

Top Retail Crypto Investing Strategies in the Bitcoin ETF Era

-

Utilize Spot Bitcoin ETFs for Regulated ExposureSpot Bitcoin ETFs like the iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) allow retail investors to gain direct Bitcoin price exposure through traditional brokerage accounts, eliminating the need to manage private keys or use crypto exchanges. These ETFs are regulated and offer added security, making them a preferred entry point for many retail investors.

-

Dollar-Cost Averaging (DCA) Into Bitcoin ETFsMany retail investors are adopting a DCA approach by making regular, fixed-amount purchases of Bitcoin ETFs regardless of price fluctuations. This strategy helps mitigate the impact of volatility and reduces the risk of making poorly timed lump-sum investments, especially with Bitcoin trading at $116,521 as of August 19, 2025.

-

Diversify With Crypto-Related Stocks and Thematic ETFsRetail investors are broadening their portfolios by including crypto-adjacent stocks such as Coinbase (COIN) and thematic ETFs like the Amplify Transformational Data Sharing ETF (BLOK), which invests in companies benefiting from blockchain adoption. This approach offers indirect crypto exposure and can help manage risk.

-

Monitor ETF Holdings and Institutional FlowsStaying informed about institutional activity—such as shifts in 13F filings and changes in ETF holdings—can help retail investors gauge market sentiment and adjust their strategies accordingly. Platforms like ETF.com and CoinShares provide valuable insights on ETF flows and institutional participation.

-

Leverage Tax-Advantaged Accounts for Bitcoin ETF InvestmentsRetail investors are increasingly purchasing Bitcoin ETFs through IRAs and 401(k)s on platforms like Fidelity and Charles Schwab. This strategy can defer or reduce taxes on crypto gains, making long-term holding more attractive in a regulated environment.

Yet, the institutional presence is not without its complexities. According to recent 13F filings, while some hedge funds have trimmed their Bitcoin ETF positions in Q1 2025, financial advisors and pension funds have stepped up as key buyers (source). This rotation underscores a broader acceptance of Bitcoin as a long-term store of value, no longer just a speculative asset but a legitimate portfolio diversifier.

Navigating Volatility: What $116,521 Bitcoin Means for Investors

As Bitcoin holds steady above $116,521, market participants are recalibrating expectations. The influx of institutional capital has contributed to deeper liquidity pools and narrower bid-ask spreads, a boon for anyone seeking efficient trade execution or large-scale exposure. At the same time, the sheer scale of ETF inflows can amplify price moves during periods of heightened demand or panic selling.

For everyday investors, this means opportunity, and responsibility. While ETFs reduce some technical hurdles and provide regulatory safeguards, they don’t eliminate price risk or market cycles. Understanding how institutional flows impact volatility and sentiment is now essential for anyone allocating capital to crypto through traditional brokerage channels.

The interplay between retail enthusiasm and institutional discipline continues to shape the landscape. On-chain research suggests that while direct wallet accumulation by individuals has slowed, overall participation remains robust thanks to these new vehicles (source). The result? A more resilient market structure, one that can absorb shocks and recover faster from bouts of volatility.

What’s Next: Innovation and Global Implications

Looking ahead, the rise of spot Bitcoin ETFs may only be the beginning. Asset managers are already exploring products tied to yield strategies or multi-asset crypto baskets. Meanwhile, international adoption is accelerating as regulators in Europe and Asia move toward similar frameworks, potentially unlocking trillions in global capital.

The transformation isn’t just about price action or portfolio construction; it’s about trust. With over $130 billion in assets under management globally by mid-2025 (source), Bitcoin ETFs have redefined what secure cryptocurrency purchases look like for millions worldwide.

Whether you’re a seasoned trader or just starting out, understanding these evolving dynamics is critical. As institutions continue shaping the narrative, and as innovation unlocks new forms of access, the game for everyday crypto investors will keep changing. Staying informed will be your best edge in this rapidly maturing market.