Ethereum has reached a critical milestone in August 2025, surging to an all-time high of $4,797.42. This price movement is not just another speculative rally but is underpinned by a robust inflow of institutional capital and the historic approval of spot Ethereum ETFs in the United States. The latest net inflows have topped $516 million, signaling a profound shift in how both retail and institutional investors perceive Ethereum as an asset class.

Ethereum Hits $4,797.42: The Role of ETF Inflows

The approval and subsequent launch of spot Ethereum ETFs have fundamentally altered the landscape for crypto buyers. These ETFs, including BlackRock’s ETHA and Fidelity’s FETH, have attracted billions in net inflows. According to recent data, iShares Ethereum Trust (NASDAQ: ETHA) alone has amassed over $1 billion from investors since its debut (source). This influx has provided consistent buying pressure on ETH markets, propelling prices higher.

But why do ETF inflows matter so much? Unlike futures-based products, spot ETFs require actual purchases of ETH to back shares issued to investors. As a result, every dollar invested translates to direct demand on the underlying asset. When you see net inflows like $516 million over a short period, it reflects real capital entering the ecosystem, not just speculative bets.

Peter Thiel’s Bet: Institutional Confidence at New Highs

The entry of high-profile investors like Peter Thiel is further validating Ethereum’s status as an institutional-grade asset. Thiel’s Founders Fund now holds significant stakes in both ETH itself and related companies such as BitMine Immersion Technologies, recently reported to be building one of the largest corporate ETH treasuries globally. These moves are not isolated; they are part of a broader trend where venture funds and major asset managers are allocating larger portions of their portfolios to Ethereum.

This wave of institutional adoption is creating a feedback loop: large inflows drive up prices, which attracts more attention from sophisticated investors seeking exposure through regulated vehicles like ETFs. As noted by analysts, continued capital rotation into Ether could push prices as high as $8,000 by year-end if current momentum persists.

Ethereum Net Inflows Analysis: What It Means for Crypto Buyers in 2025

The record-breaking $516 million net inflow into Ethereum spot products this quarter isn’t just headline fodder, it has direct implications for anyone considering how to buy Ethereum securely or diversify their crypto holdings. For one thing, these flows underscore growing confidence in regulatory clarity around digital assets. The SEC’s greenlight for spot ETFs provides both retail and institutional buyers with safer, more transparent access points compared to unregulated exchanges.

Ethereum (ETH) Price Prediction 2026-2031

Professional outlook based on 2025’s bullish momentum, ETF inflows, and institutional adoption

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $5,200 | $6,000 | $7,200 | +25% (avg) | Sustained ETF inflows and institutional adoption drive new highs; regulatory clarity supports growth |

| 2027 | $4,800 | $6,700 | $8,500 | +12% (avg) | Potential mid-cycle correction, but ecosystem upgrades (e.g., L2 scaling) and staking demand fuel recovery |

| 2028 | $5,400 | $7,800 | $10,200 | +16% (avg) | Bullish cycle resumes as adoption of Ethereum-based applications accelerates; DeFi and Web3 expansion |

| 2029 | $6,000 | $9,100 | $12,000 | +17% (avg) | Mainstream integration (CBDCs, tokenization) and improved scalability attract traditional finance |

| 2030 | $6,800 | $10,500 | $14,000 | +15% (avg) | Global regulation matures; Ethereum cements position as leading smart contract platform |

| 2031 | $7,200 | $11,200 | $15,500 | +7% (avg) | Market matures; growth steady but slower, driven by enterprise use and global utility |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 remains bullish, underpinned by strong institutional interest, ETF inflows, and expanding use cases. While market cycles and corrections are expected, the long-term trajectory points to higher valuations with average prices potentially surpassing $11,000 by 2031. Bullish scenarios see ETH reaching up to $15,500, while bearish cases reflect possible corrections but maintain a positive long-term trend.

Key Factors Affecting Ethereum Price

- Sustained inflows into spot Ethereum ETFs and institutional adoption

- Regulatory clarity in the U.S. and globally

- Technological upgrades (scalability, Layer 2 solutions, Ethereum roadmap)

- Expansion of DeFi, NFTs, and enterprise blockchain use cases

- Competition from alternative smart contract platforms (e.g., Solana, Avalanche)

- Macro-economic factors and global risk appetite

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Moreover, this environment rewards disciplined strategies over speculation. As more institutions allocate capital using sophisticated risk management frameworks, volatility may decrease relative to previous cycles, but sharp corrections can still occur on macro news or regulatory shifts. For new buyers entering at these levels, understanding market structure and liquidity dynamics is essential.

For those assessing whether to enter the market after Ethereum’s historic surge, it’s crucial to evaluate both the opportunities and inherent risks. The influx of institutional capital, as seen with Peter Thiel’s Founders Fund and major ETF providers, signals a maturation of the Ethereum ecosystem. Yet, as with any asset nearing all-time highs, prudent risk management should guide every decision.

How to Buy Ethereum Securely in 2025

Thanks to regulatory clarity and new financial products, buying Ethereum securely is more accessible than ever. Spot ETFs now offer a regulated alternative for those wary of self-custody risks or exchange hacks, a persistent concern in previous cycles. For hands-on buyers, leading exchanges with robust security practices remain viable; always prioritize platforms with strong insurance coverage and transparent operational histories.

Top Secure Ways to Buy Ethereum in 2025

-

1. U.S. Spot Ethereum ETFs (e.g., BlackRock ETHA, Fidelity FETH)Gain regulated exposure to Ethereum through spot ETFs like BlackRock’s ETHA and Fidelity’s FETH. These funds, now available on major U.S. exchanges, offer institutional-grade security and compliance, making them a popular choice for both retail and professional investors in 2025.

-

2. CoinbaseAs the largest U.S.-regulated crypto exchange, Coinbase offers robust security features, insurance coverage, and an intuitive interface for buying Ethereum at the current price of $4,797.42. It supports advanced authentication and cold storage for user assets.

-

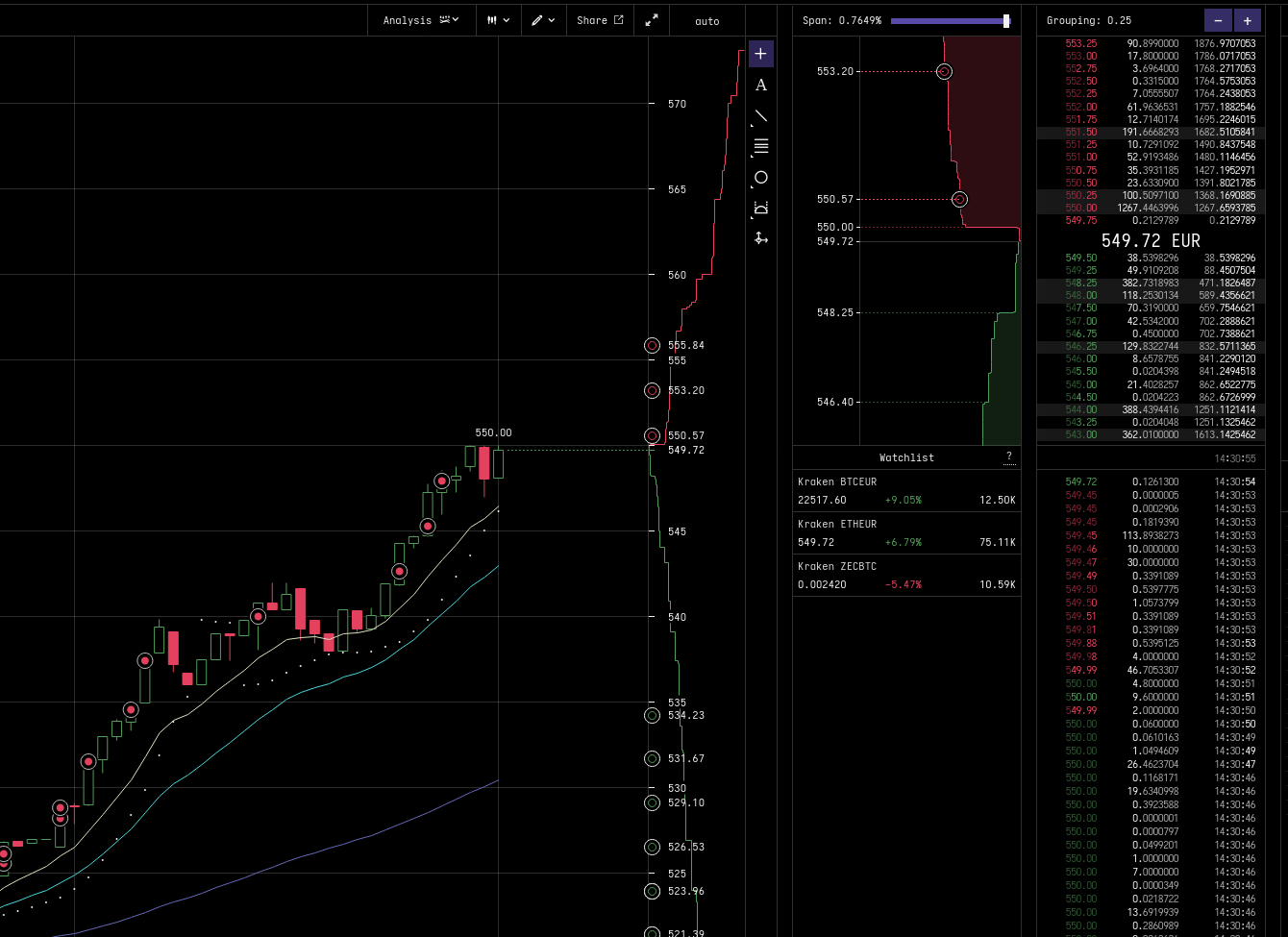

3. KrakenKraken is renowned for its strong security track record and transparent operations. The exchange provides multiple fiat onramps, 2FA, and proof-of-reserves audits, making it a trusted platform for purchasing Ethereum securely.

-

4. GeminiFounded by the Winklevoss twins, Gemini is a New York trust company emphasizing regulatory compliance and user protection. It offers insured hot wallets and a secure environment for buying and storing Ethereum.

-

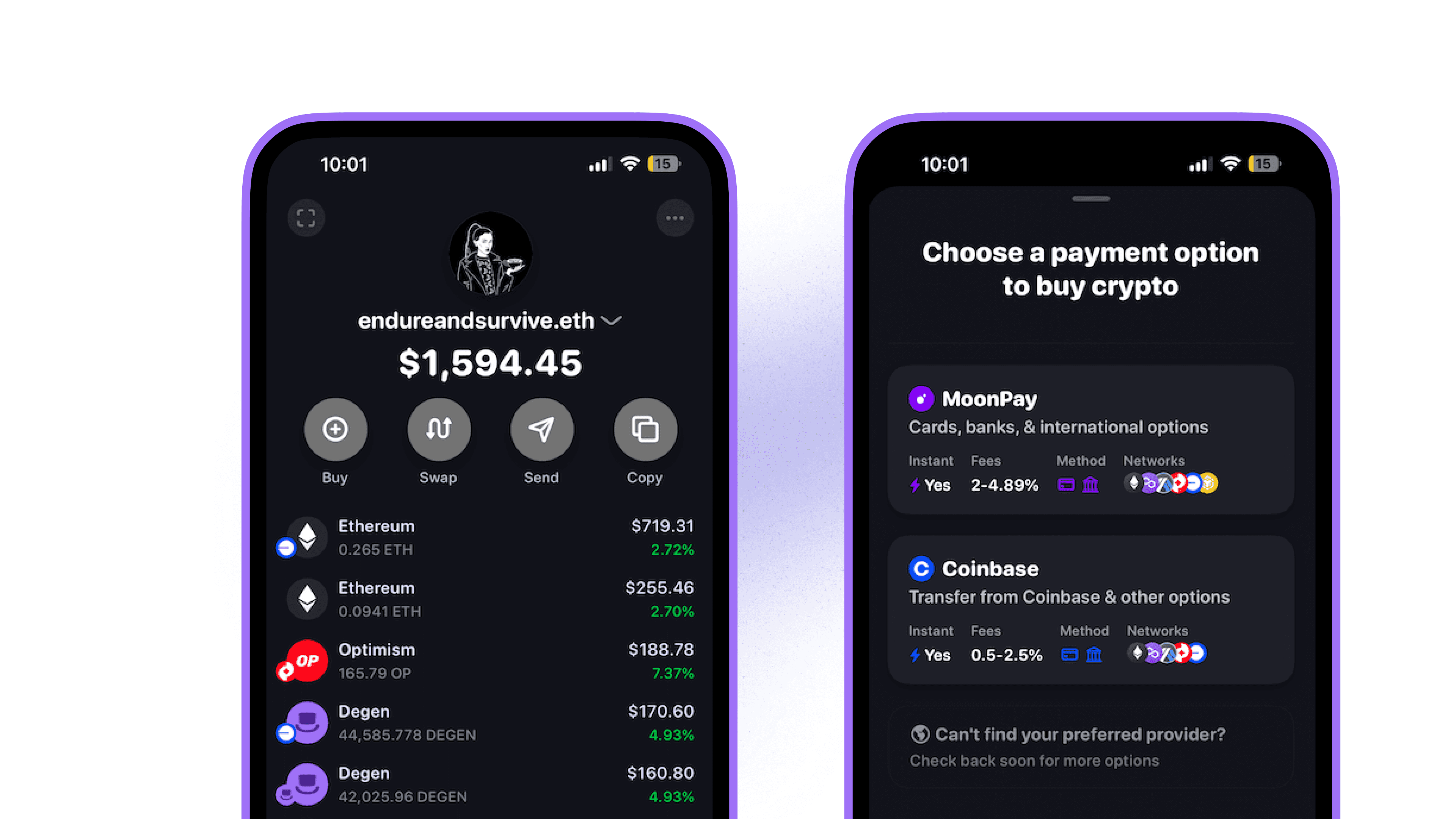

5. Ledger Hardware Wallet (Buy via Ledger Live)For maximum self-custody, Ledger hardware wallets allow users to purchase Ethereum directly through the Ledger Live app, integrating with trusted onramps like MoonPay and Wyre. This ensures private key control and offline asset protection.

For investors seeking direct exposure while minimizing custody risks, hardware wallets and multi-signature solutions provide enhanced protection against unauthorized access. Staking options through trusted platforms also allow ETH holders to earn yield while supporting network security, an increasingly popular strategy among institutions as well.

Ethereum Price Prediction 2025: What’s Next After $4,797.42?

With Ethereum trading at $4,797.42, the debate intensifies over its next major milestone. Bullish forecasts cite continued ETF inflows and expanding real-world use cases, such as decentralized finance (DeFi), tokenization of assets, and enterprise adoption, as catalysts for further appreciation. However, seasoned traders know that parabolic moves often invite volatility.

Market participants should monitor key metrics: net inflows into ETFs, on-chain activity (such as active addresses and staking rates), and macroeconomic factors like interest rates or regulatory developments in major jurisdictions. These indicators will shape price action in the coming quarters.

Ethereum (ETH) Price Prediction 2026-2031

Professional forecasts based on ETF inflows, institutional adoption, and evolving market conditions post-2025 all-time high.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $4,200 | $6,000 | $8,500 | +25% | Continued ETF inflows, moderate bull market, ETH 2.0 upgrades drive momentum |

| 2027 | $4,000 | $6,800 | $10,200 | +13% | Market volatility, potential regulatory tightening, but staking and DeFi growth support price |

| 2028 | $4,300 | $7,700 | $12,000 | +13% | Mainstream adoption accelerates, Layer 2 scaling matures, ETH sees increased institutional allocation |

| 2029 | $5,000 | $8,900 | $14,500 | +16% | Major enterprises deploy on Ethereum, global ETF markets expand, competition from other L1s rises |

| 2030 | $5,600 | $10,400 | $17,000 | +17% | Widespread DeFi and NFT integration, ETH becomes a staple institutional asset, macroeconomic headwinds possible |

| 2031 | $6,200 | $12,200 | $20,000 | +17% | Ethereum solidifies as leading smart contract platform, potential regulatory harmonization globally |

Price Prediction Summary

Ethereum is poised for significant long-term growth following its 2025 all-time high, primarily fueled by strong ETF inflows, institutional adoption, and ongoing technological upgrades. While price appreciation is expected to be robust, year-over-year gains may moderate as the market matures. Minimum price predictions reflect potential bear market or regulatory setbacks, while maximum scenarios account for aggressive institutional and retail adoption. Overall, ETH remains a leading candidate for continued outperformance among crypto assets.

Key Factors Affecting Ethereum Price

- Sustained spot ETF inflows and institutional demand

- Ethereum’s transition to full Proof-of-Stake and scaling solutions (Layer 2)

- Regulatory clarity in major markets (US, EU, Asia)

- Competition from alternative smart contract platforms (e.g., Solana, Avalanche)

- Growth in DeFi, NFTs, and real-world asset tokenization on Ethereum

- Macroeconomic cycles and global risk appetite

- Potential technological breakthroughs or security incidents

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If institutional demand remains strong and no adverse regulatory surprises emerge, targets near $8,000 are plausible according to several professional forecasts (source). Still, sharp corrections are possible if sentiment shifts or if ETF inflows slow abruptly.

Key Takeaways for Crypto Buyers

- Ethereum’s all-time high at $4,797.42 is underpinned by record institutional flows, not just retail speculation.

- Spot ETFs have transformed access for both retail and institutional investors by providing regulated exposure to ETH.

- Major players like Peter Thiel signal rising confidence in Ethereum’s long-term trajectory but also raise the stakes for disciplined investing.

- Security remains paramount, choose regulated products or secure custody solutions when buying ETH in 2025.

The landscape for digital assets is evolving rapidly. With net inflows setting new records and high-profile endorsements fueling momentum, Ethereum is firmly on the radar of global capital allocators. As always, aligning investment decisions with sound research, and an unwavering focus on capital preservation, will separate winners from those caught off guard by market reversals.