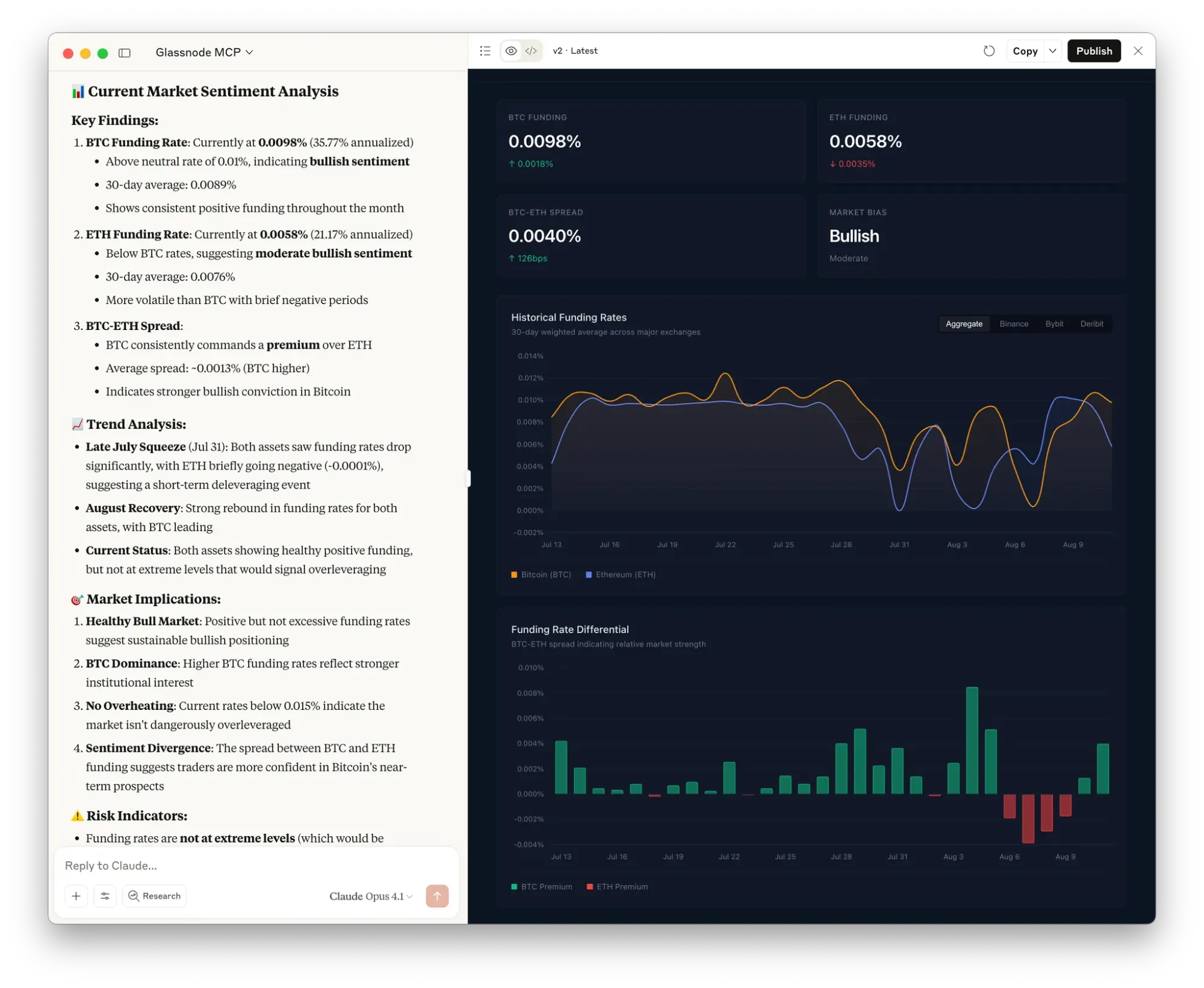

The cryptocurrency landscape in 2025 is being shaped by a convergence of volatile price action and evolving institutional strategies. In August, Bitcoin’s price tumbled below $111,000 after a massive whale offloaded 24,000 BTC (roughly $2.7 billion), triggering a sharp flash crash and over $550 million in liquidations. This event not only rattled leveraged traders but also underscored the persistent risks that come with high-stakes crypto investing, especially as market structure shifts toward more institutional participation.

Bitcoin Holds Above $111,000: Navigating Flash Crash Fallout

At the time of writing, Bitcoin is trading at $111,530.00, having clawed back from a recent low of $108,951.00. While this recovery offers some relief to battered bulls, the flash crash has left scars across the market psyche. Analysts are warning that Bitcoin remains vulnerable as it hangs by a thread above key support levels (source). The magnitude of this drop was amplified by highly leveraged positions and cascading liquidations, a scenario that has become all too familiar for seasoned crypto investors.

“The recent flash crash is a stark reminder that even as institutions enter the space, crypto remains fundamentally unpredictable. Robust risk controls are non-negotiable. ”

Institutional ETF Moves: Outflows Signal Strategic Rebalancing

This year’s volatility isn’t just about retail panic or whale activity, it’s increasingly influenced by institutional flows into and out of regulated investment vehicles. In August alone, spot Bitcoin ETFs saw six consecutive days of outflows totaling $1.19 billion, according to Farside data (source). These ETF trends are pivotal: while some view them as signals of waning confidence, others see strategic rebalancing at work.

The numbers tell the story: By Q2 2025, institutional ownership of Bitcoin ETFs reached nearly 25% of total assets under management (source). Notably, Harvard Endowment invested $116 million in the iShares Bitcoin Trust, a sign that blue-chip institutions are treating crypto as both an inflation hedge and a portfolio diversifier amid macroeconomic uncertainty.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Based on 2025 ETF Flows, Institutional Moves, and Recent Flash Crash Events

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $75,000 | $118,000 | $170,000 | +6% | Bearish scenario: Regulatory clampdowns or further ETF outflows could push BTC as low as $75,000. Recovery likely if ETF inflows resume and macro environment stabilizes. |

| 2027 | $82,000 | $130,000 | $195,000 | +10% | Institutional accumulation and improved ETF sentiment could drive higher averages, but volatility remains due to potential government sales or regulatory shocks. |

| 2028 | $90,000 | $145,000 | $230,000 | +12% | Halving cycle effects bolster bullish sentiment; potential for new all-time highs if adoption in payments and reserves accelerates. |

| 2029 | $100,000 | $165,000 | $270,000 | +14% | Growing use as a store of value and further ETF market penetration. Min price reflects risk of tech failures or global economic contraction. |

| 2030 | $115,000 | $185,000 | $320,000 | +12% | Mainstream adoption and increased strategic reserves push BTC higher. Bearish scenario could play out if major security or network issues arise. |

| 2031 | $130,000 | $210,000 | $370,000 | +13% | Potential for significant upside as digital asset infrastructure matures. Downside risk from global policy shifts or disruptive financial innovations. |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 reflects a maturing asset class influenced by institutional adoption, ETF flows, and macroeconomic trends. While volatility and downside risks remain—especially in the wake of flash crashes and regulatory uncertainty—strong institutional interest and new use cases provide a foundation for progressive growth. The average price is expected to rise steadily, with significant upside potential in bullish scenarios, but investors should be prepared for persistent risks and sharp corrections.

Key Factors Affecting Bitcoin Price

- ETF inflows/outflows and institutional allocation trends

- Regulatory developments and potential government interventions

- Macroeconomic factors such as inflation, interest rates, and global liquidity

- Technological upgrades to Bitcoin’s protocol and broader crypto infrastructure

- Market sentiment and the impact of major liquidations/whale movements

- Emergence of new competitors and alternative digital assets

- Geopolitical events influencing global reserve strategies

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategic Shifts in Crypto Buying: Caution Meets Opportunity

The aftermath of the flash crash has catalyzed a more nuanced approach to buying cryptocurrency securely in 2025. Institutional allocators are favoring regulated products like ETFs for both transparency and risk management, while retail investors increasingly seek guidance on navigating volatility without overexposing themselves to leverage-driven wipeouts.

One major development shaping these strategies is the U. S. government’s creation of a Strategic Bitcoin Reserve in March 2025, capitalized with forfeited holdings, which has added an additional layer of legitimacy to digital assets (source). This move has encouraged more structured allocation models among asset managers who previously sat on the sidelines due to regulatory ambiguity or counterparty risk concerns.

Meanwhile, the rise of Ethereum to new records amid Bitcoin’s turbulence has further diversified institutional attention. With Ethereum ETF inflows projected to reach $10.8 billion by Q2 2025 and stablecoins now making up over half of the $138 billion market, asset allocators are no longer viewing crypto through a Bitcoin-only lens. Ether’s emerging premium reflects its growing role in decentralized finance and enterprise applications, offering a counterbalance to Bitcoin’s store-of-value narrative.

For individual investors, the lesson from this year’s volatility is clear: secure crypto buying now demands more than just picking coins or timing the market. It requires robust custody solutions, diversification across regulated products, and a willingness to adapt as institutional flows reshape liquidity and price discovery. As Harvard Endowment’s move shows, even sophisticated players are layering their exposure through ETFs and direct holdings, often rebalancing in response to both macro shifts and sudden market events.

Managing Risk: Practical Steps for 2025 Crypto Buyers

If you’re looking to buy cryptocurrency securely in this environment, consider these pragmatic strategies:

Practical Risk Management Steps for Secure Crypto Buying in 2025

-

Consider Spot Bitcoin and Ethereum ETFs: Reduce direct custody risks by investing through regulated ETFs such as iShares Bitcoin Trust (IBIT) or Grayscale Ethereum Trust (ETHE), which are favored by institutional investors for their oversight and transparency.

-

Enable Two-Factor Authentication (2FA): Protect your exchange and wallet accounts by activating 2FA with apps like Authy or Google Authenticator to add an extra layer of security.

-

Diversify Across Multiple Assets: Avoid overexposure to a single cryptocurrency by allocating funds among established coins such as Bitcoin (BTC), Ethereum (ETH), and select stablecoins like USDC or USDT.

-

Stay Informed on Regulatory and Institutional Developments: Follow updates on major moves such as the U.S. Strategic Bitcoin Reserve and institutional ETF allocations through trusted sources like Investor’s Business Daily and CoinDesk.

Market observers should also keep an eye on upcoming regulatory decisions, such as the October ruling on new Bitcoin and Ethereum ETFs, which could further influence both sentiment and inflows across digital assets.

“We’re seeing a maturing market where institutional rebalancing can trigger short-term pain but lay the groundwork for more sustainable long-term growth. The winners will be those who blend discipline with adaptability. ”

Volatility Isn’t Going Anywhere: Why Strategic Patience Matters

The Bitcoin flash crash of August 2025 was not an outlier but a symptom of deeper structural changes, where whales, leveraged traders, and institutions all play pivotal roles. While some analysts warn that Bitcoin could revisit $75,000 if outflows accelerate (source), others remain bullish on eventual recovery toward $200,000 if ETF inflows regain momentum.

This tug-of-war makes it essential for both retail and professional investors to avoid knee-jerk reactions. Instead, use volatility as an opportunity for disciplined accumulation or strategic rebalancing, always anchored by clear risk parameters.