The U. S. crypto landscape just got a seismic shake-up, and if you’re an American looking to buy cryptocurrency in 2025, you’ll want to pay close attention. The Commodity Futures Trading Commission (CFTC) has issued a new advisory that’s turning heads across the industry. For years, regulatory uncertainty kept U. S. traders fenced off from the world’s most liquid digital asset markets, forcing many to settle for limited choices or riskier workarounds. But as of August 2025, that wall is coming down.

CFTC Crypto Advisory: What Changed for U. S. Buyers?

The CFTC’s latest move clarifies how foreign crypto firms can register as Foreign Boards of Trade (FBOTs), legally opening their doors to American customers. This is more than bureaucratic fine print, it’s a game-changer for anyone searching for secure crypto exchanges for Americans or wanting to buy cryptocurrency in the US in 2025 with confidence.

Under this advisory, major offshore platforms like Binance and OKX now have a clear regulatory path to offer their services directly to Americans, provided they play by the CFTC’s rules. The result? U. S. buyers get access to deeper liquidity pools, more trading pairs, and innovative products that were previously out of reach.

Let’s talk numbers: at the time of writing, Bitcoin (BTC) is trading at $108,512, reflecting a 1.33% dip over the last 24 hours with an intraday high of $111,106 and a low of $107,492. Ethereum (ETH) sits at $4,400.93, up 0.56% on the day (source). These prices underscore just how much is at stake, the global market is moving fast, and American buyers now have a front-row seat.

Why This Matters: Secure and Easy Crypto Access in 2025

This isn’t just about convenience, it’s about security and transparency. Previously, U. S. -based traders faced tough choices: stick with limited domestic offerings or take their chances offshore without regulatory protection. Now, thanks to the CFTC crypto advisory, registered FBOTs must channel U. S. customers through regulated intermediaries like futures commission merchants or introducing brokers (details here). That means more oversight and stronger consumer safeguards, exactly what savvy investors crave.

Acting CFTC Chair Caroline Pham summed it up: “American companies that were forced to set up shop in foreign jurisdictions to facilitate crypto asset trading now have a path back to U. S. markets. ” (crypto.news)

Offshore Crypto Trading Regulations Get an Upgrade

The new framework signals a shift away from ad hoc enforcement toward clear rules-based access, a breath of fresh air after years of regulatory whiplash (see more here). This clarity is already luring big names back; exchanges that once exited the U. S. market are preparing reentry strategies under these updated guidelines.

If you’ve been waiting for an easier way to buy crypto securely in the US, or if you’re itching for international-grade leverage, this advisory may be your ticket.

Bitcoin (BTC) Price Prediction 2026-2031 After CFTC Advisory

Forecast incorporates regulatory clarity from the 2025 CFTC advisory, global exchange access, and evolving U.S. crypto adoption.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $95,000 | $120,000 | $145,000 | +10.6% | Regulatory boost, but post-advisory volatility |

| 2027 | $110,000 | $137,000 | $170,000 | +14.2% | Increased U.S. participation, bullish sentiment |

| 2028 | $125,000 | $155,000 | $195,000 | +13.1% | Mainstream adoption, ETF expansion |

| 2029 | $140,000 | $173,000 | $225,000 | +11.6% | Halving cycle momentum, institutional inflows |

| 2030 | $160,000 | $195,000 | $260,000 | +12.7% | Global macro tailwinds, digital gold narrative |

| 2031 | $185,000 | $220,000 | $300,000 | +12.8% | Peak adoption, potential for new ATH |

Price Prediction Summary

Bitcoin is expected to benefit from the CFTC’s 2025 regulatory clarity, driving increased U.S. market participation, liquidity, and institutional inflows. Volatility will remain, with price projections showing a steady upward trajectory as adoption accelerates and regulatory risks subside. The minimum and maximum predictions reflect both bullish and bearish scenarios, accounting for global macro factors and crypto-specific risks.

Key Factors Affecting Bitcoin Price

- CFTC regulatory clarity enabling direct U.S. access to global exchanges

- Increased institutional adoption and ETF expansion post-2025

- Upcoming Bitcoin halving cycles (2028, 2032) impacting supply dynamics

- Potential for U.S. and global economic shifts (e.g., inflation, monetary policy)

- Technological upgrades (e.g., Layer 2, scaling solutions) enhancing utility

- Competition from other digital assets and evolving investor preferences

- Global regulatory harmonization and mainstream financial integration

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

But before you jump in, let’s break down what this means for your everyday crypto journey, and how you can ride this new wave without getting swept out to sea. The CFTC’s move doesn’t just open the floodgates for international exchanges; it also raises the bar for security, compliance, and consumer protection. That’s a win-win for American traders who’ve long felt boxed in by restrictive platforms or forced to navigate regulatory gray zones.

How to Buy Crypto Securely in the US: What Changes Now?

With leading platforms like Binance and OKX preparing to serve Americans again, you’ll notice some immediate perks: deeper liquidity, tighter spreads, and access to advanced derivatives products that were previously off-limits. But perhaps most importantly, these exchanges must now meet robust CFTC standards, think KYC (know your customer) checks, transparent reporting, and mandatory segregation of client funds. This is a huge leap forward from the wild-west days of offshore trading.

Top 5 Tips for Secure US Crypto Buying After CFTC Advisory

-

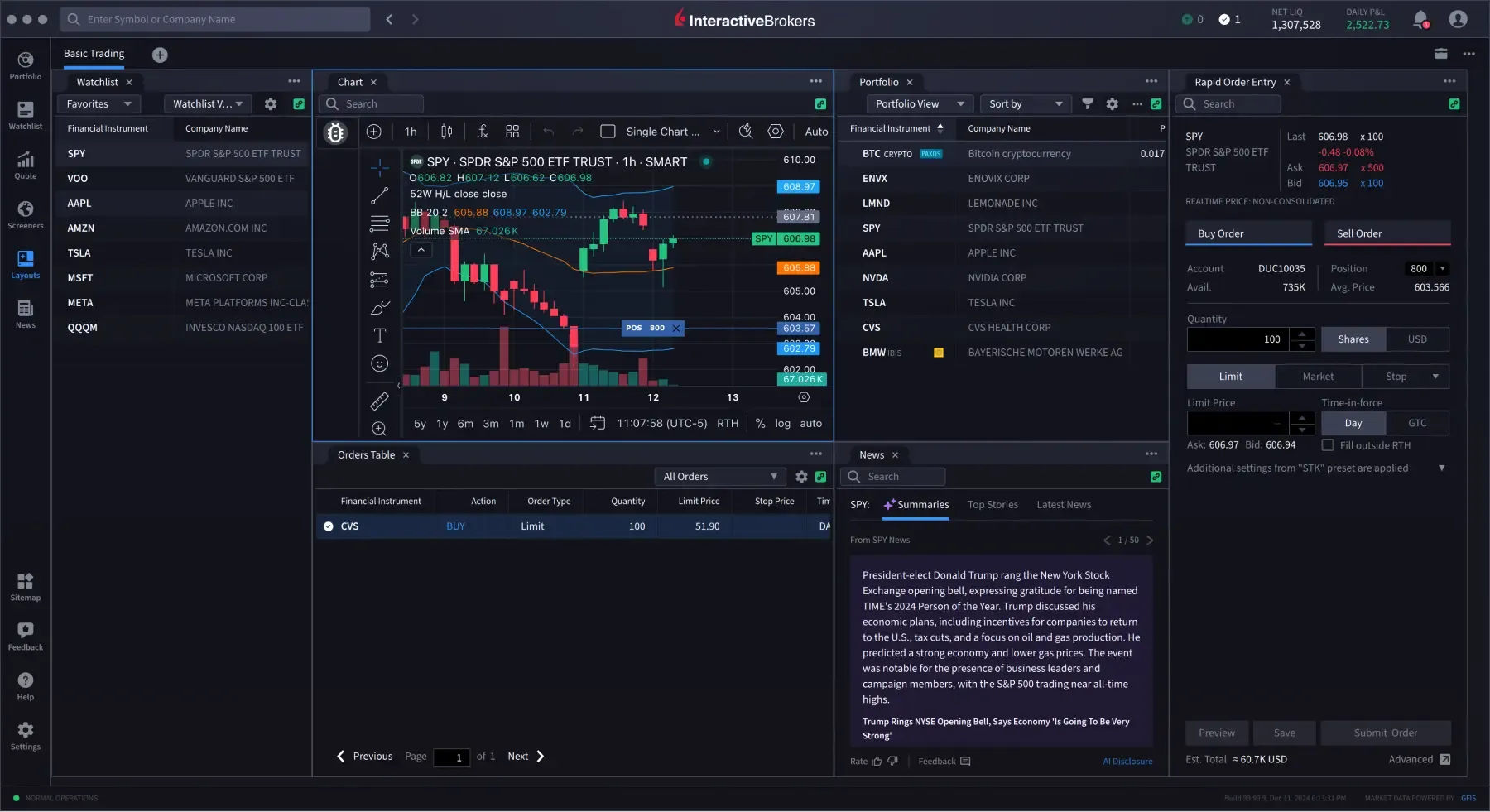

Verify Intermediary Registration: Use CFTC-regulated intermediaries such as Interactive Brokers or other registered futures commission merchants for added protection and streamlined access to global liquidity.

-

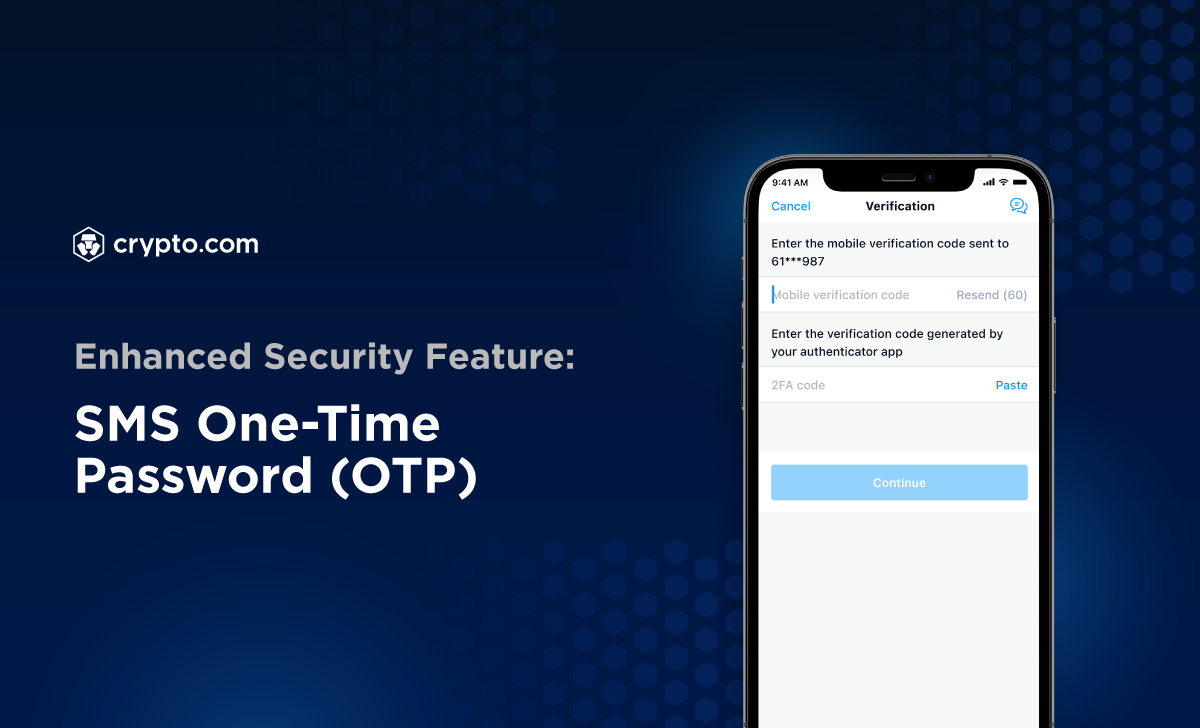

Enable Two-Factor Authentication (2FA): Always activate 2FA on your exchange accounts for enhanced security. Use trusted apps like Authy or Google Authenticator to protect your funds from unauthorized access.

-

Monitor Real-Time Market Data: Stay updated on current prices—Bitcoin (BTC) is $108,512 and Ethereum (ETH) is $4,400.93 as of August 2025. Rely on reputable sources like CoinDesk and CoinMarketCap for accurate information.

For those wondering about how to buy crypto securely in the US, it’s all about choosing CFTC-registered FBOTs and using regulated intermediaries. This approach brings peace of mind, and makes it much harder for bad actors to operate in the shadows. You can finally access global markets without sacrificing safety or compliance.

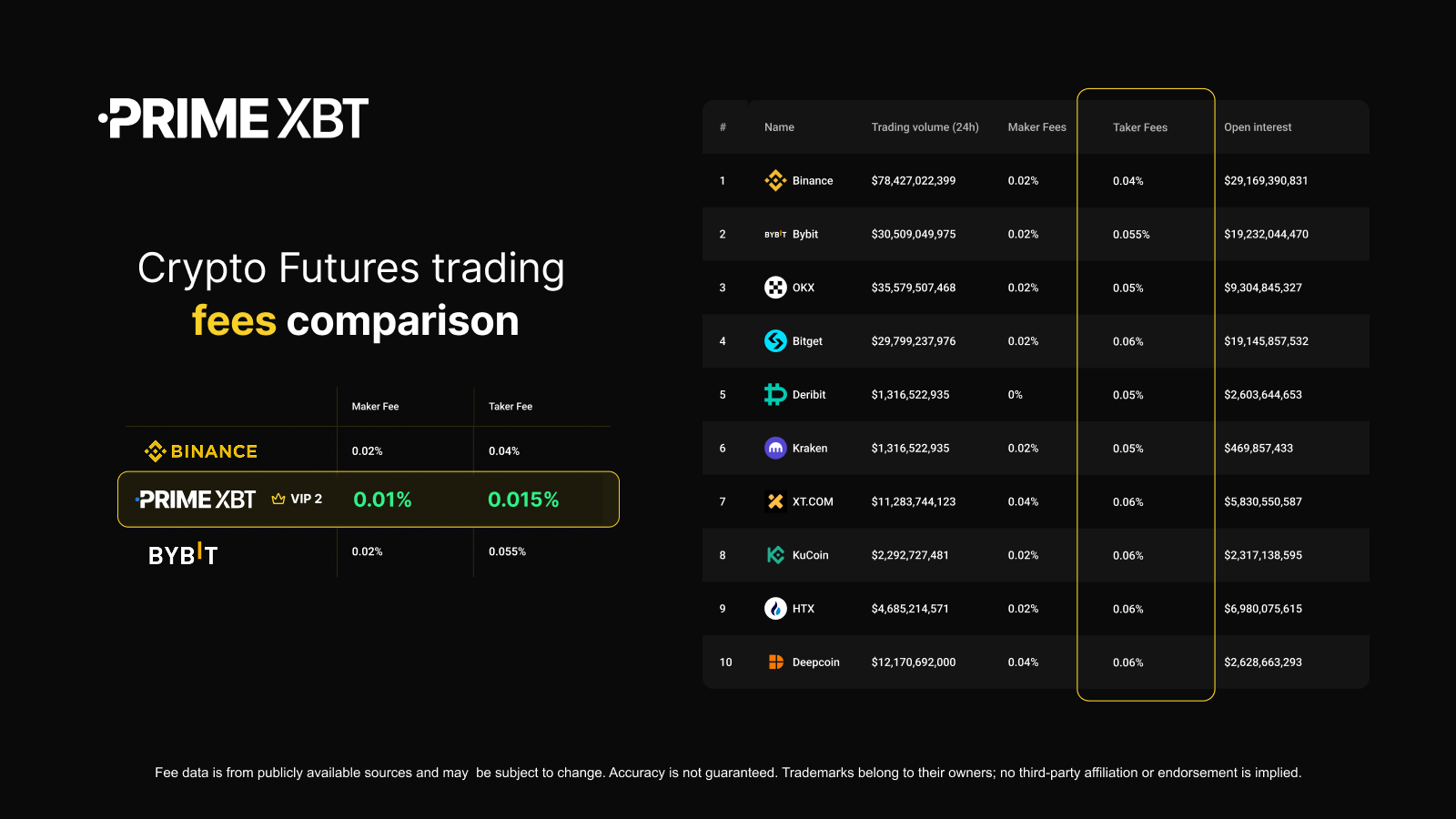

What About Fees and Product Selection?

Expect more competition among exchanges as they vie for American customers. That means better fee structures, more innovative products (think perpetual swaps and options), and a broader selection of coins, all under one regulatory roof. The days of being stuck with limited pairs or high withdrawal fees on domestic-only platforms could soon be history.

This also levels the playing field for American institutions looking to enter or expand their digital asset strategies. With Bitcoin holding steady at $108,512 and Ethereum at $4,400.93, institutional liquidity is flowing back into markets that once seemed out of reach (source). If you’re an individual trader or represent a fund, this is your chance to tap into deeper order books, without crossing legal lines.

What Should US Crypto Buyers Watch For Next?

The CFTC’s advisory is only one step in an evolving landscape. As more foreign exchanges complete registration as FBOTs, expect further updates on eligible assets, margin requirements, and reporting standards. Stay alert for announcements from your preferred trading platforms, especially those with new US offerings on deck.

If you’re ready to take advantage of these changes:

Bottom line: The regulatory fog is finally lifting for Americans eager to buy cryptocurrency securely in 2025. With clear rules now guiding offshore access, and Bitcoin still commanding attention above $100K, the future looks bright (and a lot less complicated) for US buyers seeking both opportunity and protection.