Yunfeng Financial Group, the Hong Kong-listed powerhouse co-founded by Alibaba’s Jack Ma, has just made headlines with a strategic purchase of 10,000 Ethereum (ETH), valued at exactly $44 million. This isn’t just another headline-grabbing move for the crypto news cycle. For everyday crypto buyers, Yunfeng’s bold bet on Ethereum marks a pivotal moment in the evolution of digital assets as institutional players increasingly treat ETH as a core reserve for future innovation.

Why Yunfeng’s $44M Ethereum Purchase Signals a New Era

Let’s be clear: this isn’t speculative trading. Yunfeng is positioning Ethereum as a foundational asset to power its ambitions in Web3, real-world asset (RWA) tokenization, and artificial intelligence. According to CryptoSlate, this acquisition is part of a broader treasury transformation, one that aligns with global trends where corporate ETH holdings have surged by an astonishing 384% since June 2025, now totaling over 4.4 million ETH across institutions.

For context, Ethereum is currently trading at $4,467.56, with a 24-hour high of $4,487.28 and low of $4,264.33. Yunfeng’s timing demonstrates both confidence in ETH’s resilience and its expanding utility beyond speculation, especially for decentralized finance and smart contract applications.

Institutional Adoption: What It Means for Retail Crypto Buyers

When major players like Yunfeng Financial make sizable moves into Ethereum, it sends powerful signals to the market:

- Validation: Institutional adoption reinforces the legitimacy of Ethereum as more than just a speculative asset.

- Liquidity and Stability: Large corporate holdings can enhance market depth and reduce volatility over time.

- Long-Term Confidence: Strategic treasury allocations indicate belief in ETH’s future role powering Web3 infrastructure and RWA tokenization.

This institutional momentum often precedes increased retail participation and can drive more robust price performance, though it also brings higher scrutiny from regulators and competitors alike.

Ethereum Price Outlook: September 2025 and Beyond

The influx of institutional capital into ETH has coincided with surging staking activity. According to recent data from CoinCentral, the ETH staking queue has reached its highest level in two years, a direct reflection of increased confidence in Ethereum’s long-term prospects. As more companies treat ETH as a strategic reserve asset, retail buyers should pay close attention to these macro shifts rather than short-term price swings.

Ethereum (ETH) Price Prediction 2026-2031

Professional Analyst Forecasts Incorporating Jack Ma-Linked Yunfeng’s $44M ETH Acquisition and Rising Institutional Adoption

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Potential % Change (from 2025 Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,200 | $6,350 | +16% to +42% | Continued institutional adoption, ETH as a corporate reserve asset, moderate global economic growth |

| 2027 | $4,250 | $5,850 | $7,800 | +31% to +74% | Web3, RWA tokenization and DeFi growth accelerate, regulatory clarity improves |

| 2028 | $4,000 | $6,500 | $9,200 | +45% to +106% | ETH 2.0 scalability upgrades, AI/blockchain integration, increased competition from alt-L1s |

| 2029 | $4,300 | $7,200 | $10,600 | +61% to +137% | Mainstream enterprise adoption, new DeFi/RWA financial products, possible regulatory headwinds |

| 2030 | $4,800 | $8,100 | $12,000 | +81% to +169% | Ethereum secures role as global settlement layer, mass institutional allocation, potential ETF approvals |

| 2031 | $5,100 | $9,250 | $14,000 | +107% to +213% | Widespread tokenization of real-world assets, strong Web3/AI ecosystem, ETH as a strategic reserve asset globally |

Price Prediction Summary

Ethereum’s long-term outlook remains robust, with Yunfeng’s $44M purchase exemplifying a broader institutional trend. ETH is increasingly seen not only as a speculative asset but as a strategic reserve and technological backbone for Web3, DeFi, RWA, and AI innovation. While volatility persists, ongoing adoption, technological upgrades, and regulatory progress are likely to support a progressive price increase through 2031. Bullish scenarios could see ETH surpassing $14,000, while bearish macro or regulatory shocks may limit growth, but ETH is expected to retain a multi-thousand dollar floor.

Key Factors Affecting Ethereum Price

- Surging institutional adoption—especially as a treasury reserve asset (e.g., Yunfeng, other corporates)

- Growth of Web3, DeFi, and real-world asset (RWA) tokenization on Ethereum

- Ongoing technical upgrades (scalability, ETH 2.0, L2 expansion)

- Broader regulatory clarity and global crypto policy evolution

- Competitive pressure from alt-L1s and new blockchain innovations

- Global macroeconomic environment and risk appetite

- Potential for ETH ETFs and mainstream financial products

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re considering your own entry point or evaluating how to buy Ethereum securely in 2025, it’s worth noting that institutional buys like Yunfeng’s can spark both opportunity and volatility. Always assess your risk tolerance before following big money moves, and remember that while institutions may lead trends, disciplined money management remains key for individual investors.

Yunfeng’s Ethereum purchase is also a signal that the line between traditional finance and crypto is rapidly blurring. When a major Hong Kong-listed conglomerate, closely associated with Jack Ma, allocates $44 million in internal cash reserves to ETH, it marks a departure from the old paradigm of corporate treasuries limited to fiat and equities. This move is not isolated; it fits into a larger pattern of Asian financial giants embracing blockchain-based assets for their balance sheets, as seen in the recent $70 million Ethereum bond issued in Hong Kong.

For everyday investors, Yunfeng’s action provides both inspiration and a cautionary tale. On one hand, institutional adoption can bolster price floors and drive mainstream acceptance. On the other, it can introduce new risks, such as regulatory changes or shifts in global liquidity, that disproportionately impact retail participants who lack the resources of large firms.

The Practical Takeaway: How to Buy Ethereum Securely in 2025

If you’re looking to follow institutional footsteps and add ETH to your portfolio, security should be your top priority. Here are some best practices for buying Ethereum securely in 2025:

Secure Steps for Buying & Storing Ethereum in 2025

-

Verify Current Ethereum Price: Before purchasing, check the latest Ethereum price. As of September 3, 2025, ETH is trading at $4,467.56, with a 24-hour high of $4,487.28 and a low of $4,264.33. Always confirm real-time prices on trusted sources like CoinGecko or CoinMarketCap.

-

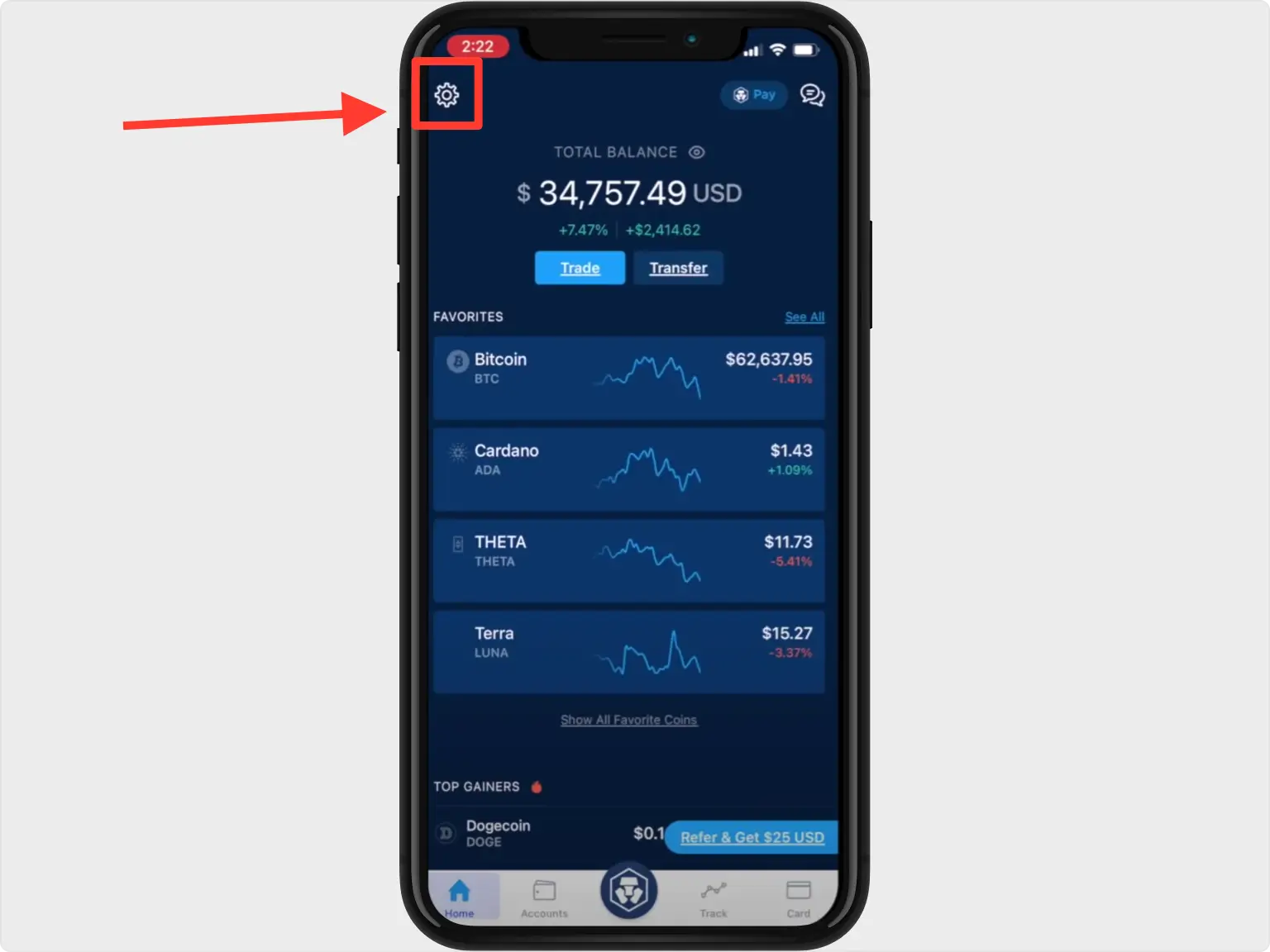

Enable Two-Factor Authentication (2FA): Secure your exchange account with 2FA using apps like Authy or Google Authenticator to add an extra layer of protection against unauthorized access.

-

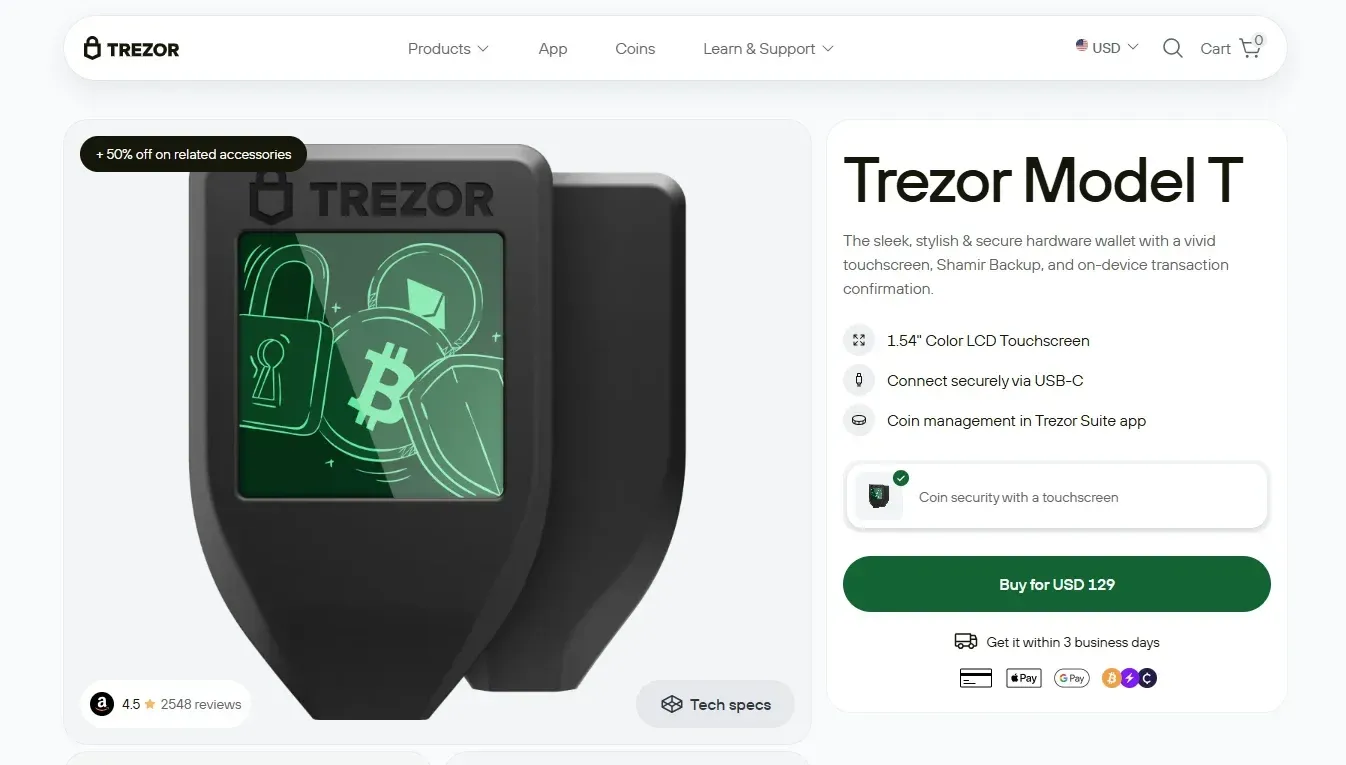

Transfer ETH to a Secure Wallet: Move your Ethereum from the exchange to a personal wallet. Hardware wallets like Ledger and Trezor offer offline storage, minimizing hacking risks. For software options, consider MetaMask or Trust Wallet.

-

Backup Your Wallet and Private Keys: Safely store your wallet’s recovery phrase and private keys in multiple secure locations. Avoid digital copies—use physical backups like paper or metal seed phrase storage devices such as Cryptosteel.

-

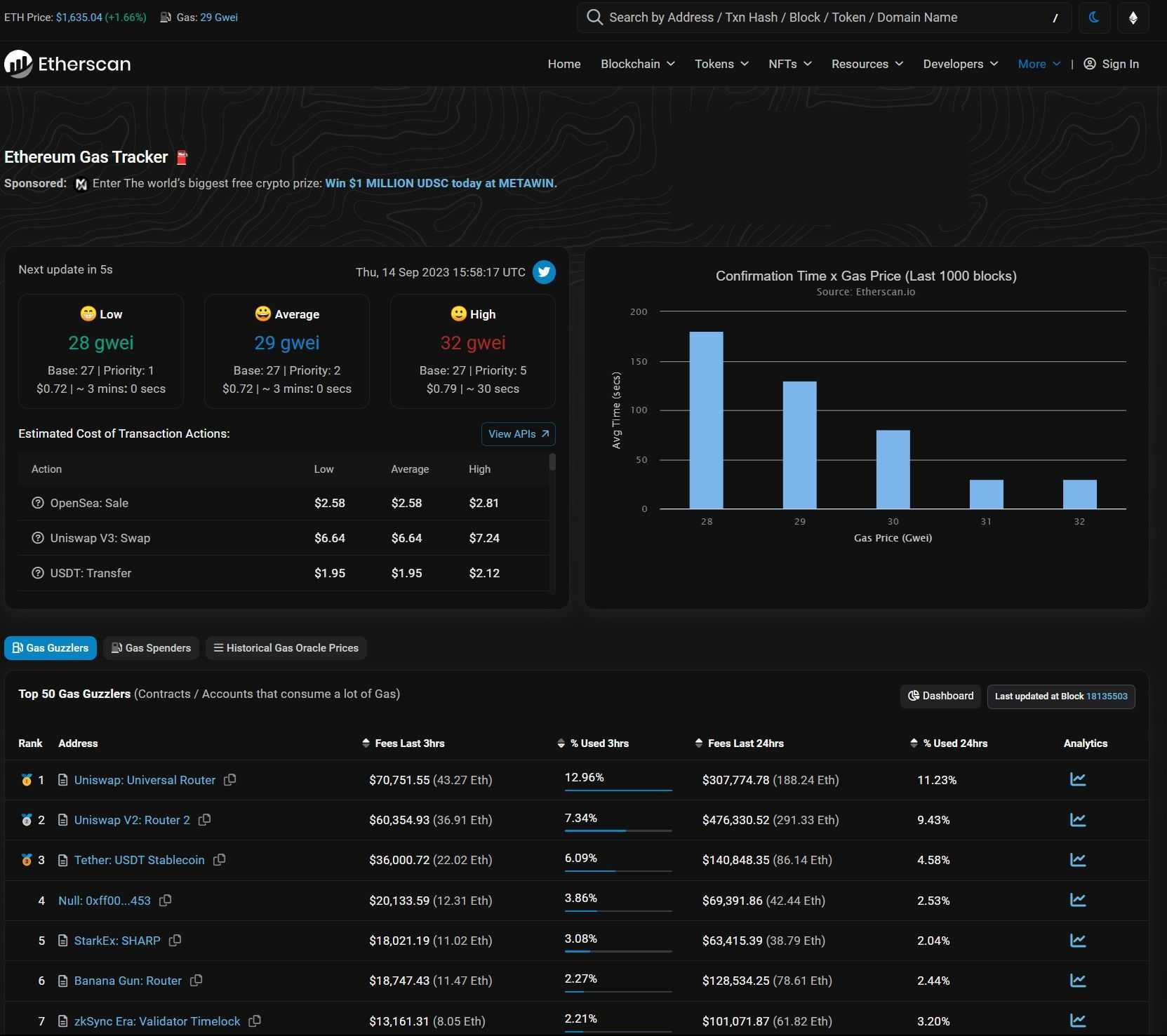

Monitor Transaction Confirmations: After transferring ETH, verify the transaction on Etherscan to ensure it is confirmed and completed. This step helps prevent loss due to incorrect addresses or network congestion.

-

Stay Informed About Security Threats: Regularly follow updates from trusted sources like Chainalysis, CoinDesk, and official wallet blogs to stay aware of new scams, phishing attempts, and best practices for securing your holdings.

Given the current price of $4,467.56, buyers should use reputable exchanges with robust compliance standards. Always enable two-factor authentication and consider self-custody solutions like hardware wallets for long-term storage.

Will Institutional Crypto Investments Change Market Dynamics?

The answer is already unfolding. As more listed companies treat ETH as a strategic reserve asset, we’re witnessing increased transparency in on-chain transactions and more sophisticated risk management tools entering the space. This could mean greater price stability over time, though sharp corrections remain possible during periods of macro uncertainty.

“Jack Ma’s Yunfeng isn’t just buying ETH, they’re betting on an entire ecosystem shift toward decentralized finance and tokenized real-world assets. “

If you want to track these trends yourself, keep an eye on:

- 24-hour trading volumes: Look for sustained volume above $10 billion alongside price moves above key thresholds like $4,600.

- Staking activity: High staking queues signal long-term confidence from both institutions and retail holders.

- Treasury disclosures: Watch for more public companies announcing crypto allocations, it’s often a leading indicator for sector momentum.

The Bottom Line: What Everyday Buyers Should Do Now

Don’t chase headlines blindly. Instead, use institutional moves like Yunfeng’s as data points when forming your own thesis about crypto’s future role in global finance. Assess whether your investment horizon matches the long-term vision these companies are betting on, and always protect your capital first.

If you’re ready to take action or simply want to monitor market momentum, tools like real-time price widgets and professional prediction tables can help you stay informed without succumbing to hype cycles.