In a move shaking up both traditional equity markets and the crypto sector, Nasdaq has unveiled new rules that directly impact how public companies can buy and hold cryptocurrency. For investors seeking crypto exposure via public companies, these changes are more than regulatory fine print, they reshape the risk and opportunity landscape for crypto treasury strategies.

Nasdaq’s New Crypto Rules: Raising the Bar for Public Companies

As of September 2025, Nasdaq now requires shareholder approval before listed companies can issue new shares to fund cryptocurrency purchases. This rule is not a blanket ban on crypto treasuries, but it does mean that any significant pivot toward holding digital assets must be put to a shareholder vote. The intention? To enhance transparency and ensure investors are not blindsided by major shifts in corporate strategy.

This move follows a surge in interest among public firms, over 180 companies have announced plans to raise more than $132 billion for digital asset treasuries. Nasdaq’s intervention effectively puts this rush on hold, forcing boards to make their case directly to shareholders before deploying capital into assets like Bitcoin or Ethereum.

Immediate Market Impact: Crypto Treasury Stocks Take a Hit

The market’s reaction was swift and unforgiving. Shares of prominent crypto treasury names plunged after the announcement, reflecting investor uncertainty around future growth prospects and deal delays. Notably:

- Iris Energy stock fell by 7.39%

- Cipher Mining dropped 7.46%

This volatility underscores just how intertwined regulatory shifts are with the fortunes of companies pursuing aggressive crypto treasury strategies. Even Bitcoin itself was not immune, after an initial dip of roughly 2%, it stabilized at its current level of $110,786.00.

Why Is Nasdaq Tightening Oversight Now?

The timing is no accident. The past year saw an explosion in demand for indirect crypto exposure through equities, especially as Bitcoin surged past $100,000 and reached its current price of $110,786.00. Many investors view buying shares in public miners or firms with large token reserves as a secure cryptocurrency investing alternative to holding coins directly.

However, this trend also attracted shell companies and speculative financing schemes that raised concerns about market integrity and investor protection. By requiring shareholder votes for substantial crypto deals, Nasdaq aims to:

- Increase disclosure around digital asset purchases

- Deter opportunistic stock sales purely for token hoarding

- Empower shareholders to weigh in on high-risk treasury moves

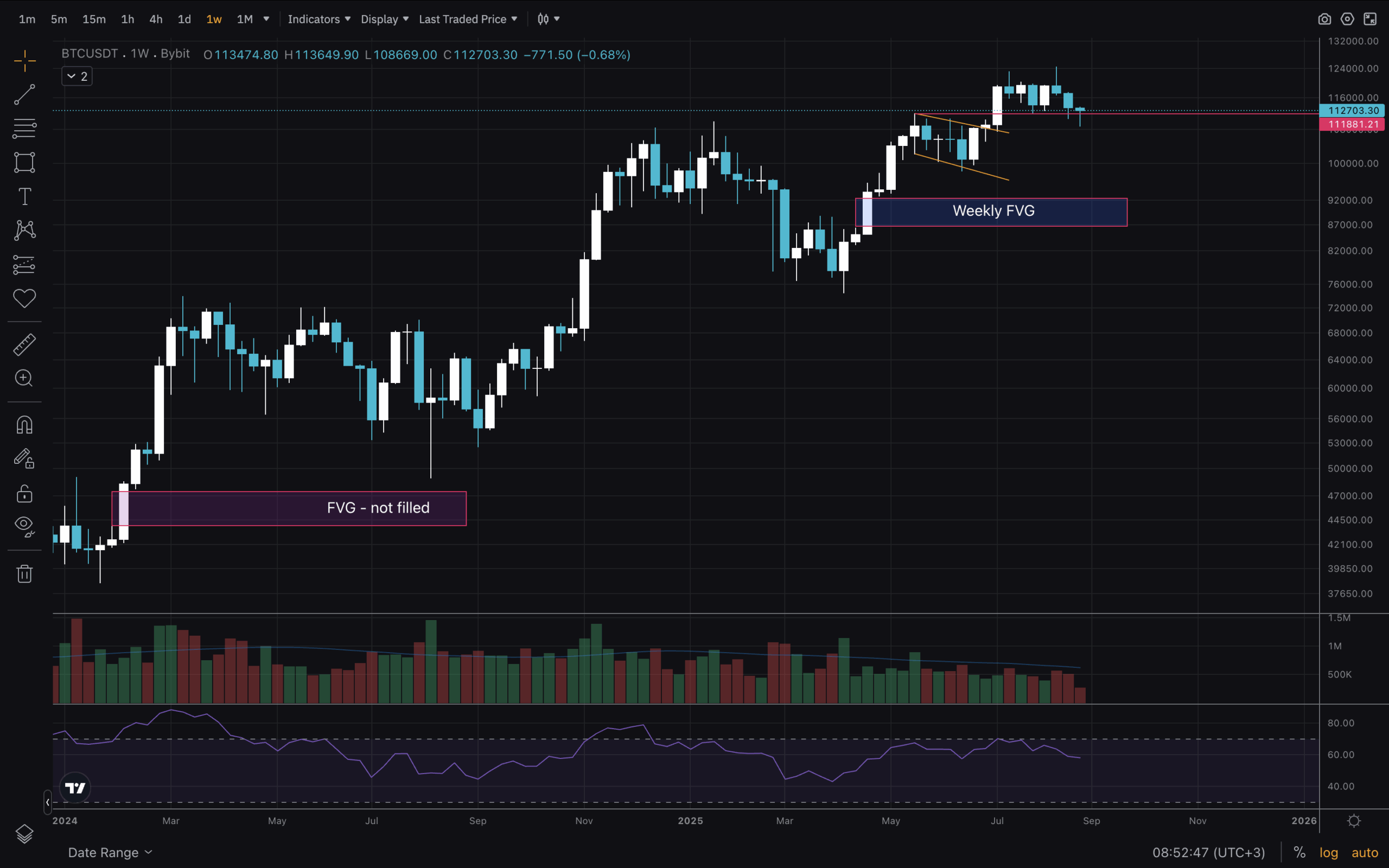

Bitcoin (BTC) Price Prediction Table: 2026–2031

Forecast based on $110,786.00 BTC price (September 2025), considering new Nasdaq regulations and evolving global crypto landscape.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $85,000 | $115,000 | $140,000 | +3.8% | Potential regulatory headwinds and post-halving consolidation; volatility remains high due to institutional uncertainty. |

| 2027 | $90,000 | $125,000 | $160,000 | +8.7% | Gradual recovery as institutions adapt to regulations; increased adoption offsets stricter capital flows. |

| 2028 | $100,000 | $145,000 | $190,000 | +16.0% | Possible new bull cycle driven by global adoption, ETF expansion, and improved regulatory clarity. |

| 2029 | $120,000 | $175,000 | $235,000 | +20.7% | Network upgrades and macroeconomic shifts drive demand; Bitcoin seen as digital gold amid inflation concerns. |

| 2030 | $140,000 | $205,000 | $280,000 | +17.1% | Wider mainstream integration and maturing DeFi ecosystem; robust competition from tokenized assets. |

| 2031 | $160,000 | $230,000 | $320,000 | +12.2% | Bitcoin cements role as a reserve asset; global regulatory harmonization and increased capital inflows. |

Price Prediction Summary

Bitcoin is expected to experience moderate short-term volatility in response to new Nasdaq regulations impacting crypto treasury strategies, but the long-term trend remains upward. After a potential period of consolidation and adaptation in 2026, renewed institutional participation, technological advancements, and broader adoption could fuel significant price appreciation through 2031. Minimum and maximum price ranges reflect both bearish (regulatory clampdowns, macro shocks) and bullish (global adoption, favorable policy, technological leaps) scenarios.

Key Factors Affecting Bitcoin Price

- Nasdaq and broader regulatory changes affecting corporate crypto treasury strategies and capital inflows.

- Global regulatory harmonization or fragmentation impacting institutional adoption.

- Bitcoin halving cycles and supply dynamics.

- Development and adoption of Bitcoin Layer 2 solutions and integration with DeFi.

- Macroeconomic trends, including inflation, currency devaluation, and demand for digital assets as a hedge.

- Competition from other digital assets and tokenized real-world assets.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating the New Landscape: What Investors Need to Monitor

If you’re considering buying crypto through stocks or using public company shares as your gateway into digital assets, understanding these regulatory headwinds is critical:

Key Factors to Watch After Nasdaq’s Crypto Rule Changes

-

Shareholder Approval Requirements: Nasdaq now mandates that companies obtain shareholder approval before issuing new shares to purchase cryptocurrency. This increases transparency and gives investors a direct say in major treasury decisions.

-

Impact on Crypto Treasury Companies: Firms like Iris Energy and Cipher Mining saw their stock prices drop by 7.39% and 7.46%, respectively, following the rule change. Investors should monitor the performance of such companies as market sentiment may remain volatile.

-

Market Reaction and Bitcoin Price Movements: The new regulations led to a 2% intraday drop in Bitcoin before stabilizing at $110,786.00. Watch for further crypto price swings as regulatory scrutiny increases.

-

Increased Regulatory Scrutiny: Nasdaq’s move reflects a broader trend of heightened oversight in the crypto sector. Investors should stay informed about evolving regulations that could impact both public companies and digital asset markets.

-

Potential Delisting or Suspension Risks: Companies that fail to comply with the new rules may face suspension or delisting from Nasdaq. It’s important to review the compliance status of any crypto-related public company in your portfolio.

The landscape is shifting quickly, and strategic investors will need to adapt their approach as the implications of these rule changes continue to unfold.

One of the most immediate consequences of Nasdaq’s rules is that companies can no longer quietly amass large crypto positions without direct shareholder involvement. This increased scrutiny fundamentally changes the calculus for both corporate boards and retail investors. For boards, it means more rigorous justification for any proposed crypto allocation; for investors, it offers a layer of protection but also introduces new hurdles to rapid treasury growth.

Strategic Implications: Balancing Opportunity and Oversight

While some may see these new Nasdaq crypto rules as stifling innovation, others recognize that transparency and governance are essential for sustainable market development. Shareholder votes don’t just slow down decision-making, they provide a forum for debate about risk tolerance, diversification, and long-term value creation.

For investors seeking secure cryptocurrency investing via public companies, this is a double-edged sword. On one hand, oversight reduces the risk of reckless treasury moves or speculative bubbles driven by opaque management decisions. On the other, it could limit upside potential if shareholder skepticism stalls otherwise lucrative crypto initiatives.

The cost of compliance will likely rise as well. Shell companies, previously popular vehicles for quick crypto treasury pivots, now face higher barriers to entry under Nasdaq’s listing overhaul (source). This could reduce speculative activity but also make it harder for nimble startups to participate meaningfully in the digital asset space.

Investor Playbook: Adapting Crypto Exposure Strategies

How should you respond as an investor? The key is to remain agile and informed:

Key Steps for Investors Adapting to Nasdaq’s Crypto Rule Changes

-

Review Your Exposure to Crypto Treasury Stocks. With Nasdaq’s new rules impacting companies like Iris Energy and Cipher Mining (which saw stock declines of 7.39% and 7.46%, respectively), assess your holdings in public firms that buy and hold crypto as part of their treasury strategy.

-

Monitor Shareholder Vote Announcements. Nasdaq now requires shareholder approval before companies can issue new shares to fund crypto purchases. Stay alert for proxy statements and voting schedules from companies such as MicroStrategy and Marathon Digital Holdings to understand upcoming changes.

-

Evaluate Direct Crypto Investment Alternatives. To avoid regulatory uncertainty, consider gaining exposure through direct crypto purchases on regulated platforms like Coinbase or Gemini, where Bitcoin is currently priced at $110,786.00.

-

Track Regulatory Updates and Company Disclosures. Increased scrutiny means more frequent disclosures from public companies. Use resources like SEC EDGAR to access official filings and stay informed about how Nasdaq-listed firms are adapting.

-

Diversify Across Crypto Investment Vehicles. Explore regulated options such as the Grayscale Bitcoin Trust (GBTC) or ProShares Bitcoin Strategy ETF (BITO) to spread risk and maintain exposure to crypto markets without relying solely on corporate treasuries.

Pay close attention to proxy statements and annual reports from companies with stated or potential interests in digital assets. The new rules mean that any significant shift into crypto will be telegraphed through shareholder communications, giving you time to assess risks before they materialize on the balance sheet.

If your goal is diversified crypto exposure via public companies, consider spreading your investments across firms with different approaches to digital assets, miners, payment processors, and blockchain infrastructure providers all face unique regulatory pressures under the new regime.

Looking Ahead: Market Integrity vs. Innovation

The broader trend is unmistakable: regulators are intent on bringing greater discipline to how listed firms interact with volatile assets like Bitcoin (currently at $110,786.00). While this may temper short-term enthusiasm for aggressive treasury strategies, it could also foster more robust, and ultimately more valuable, crypto equity markets over time.

Keen observers will note that regulatory clarity often precedes institutional adoption. If Nasdaq’s approach proves effective at balancing innovation with investor safeguards, we could see renewed confidence among both retail and professional market participants.

The bottom line? As always in markets, especially those as dynamic as crypto, information edge and strategic flexibility remain your greatest allies. Stay attuned to regulatory updates, scrutinize company disclosures carefully, and remember: options are opportunities, manage them wisely.