In 2025, the world of bitcoin cloud mining has become nearly unrecognizable compared to just a few years ago. With Bitcoin now trading at $114,525.00, and the global cloud mining market soaring to $12 billion in Q1 alone, the barriers to crypto ownership are falling fast. For new investors and crypto-curious savers, cloud mining platforms offer a path to participate in Bitcoin’s upside without the technical headaches or upfront costs of hardware ownership. Let’s explore how this boom is reshaping access and why the top ten platforms of 2025 are making it easier than ever to buy and earn Bitcoin securely.

Cloud Mining’s Breakout Year: Why 2025 Changed Everything

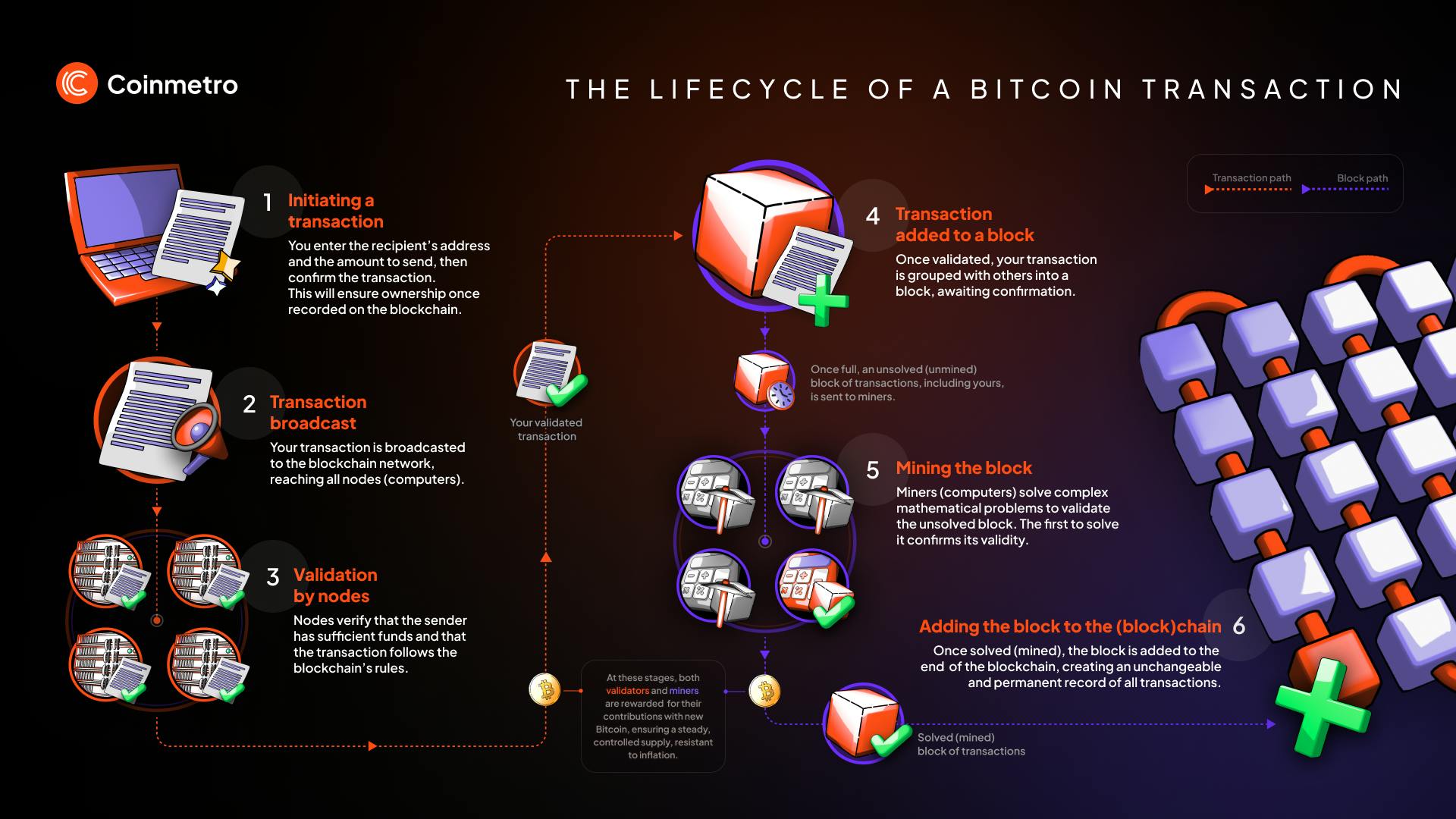

The 2025 Bitcoin halving event, which reduced block rewards from 6.25 BTC to 3.125 BTC, was a seismic shift for miners and investors alike. This change extended return-on-investment periods by as much as 60% for some contracts, forcing consolidation among industry players and driving a wave of innovation focused on efficiency and transparency. The result? A new generation of cloud mining sites that prioritize security, legal compliance, and user-friendly experiences.

Platforms like ZA Miner, Binance Cloud Mining, and NiceHash have surged in popularity by offering turnkey solutions: users can buy into mining contracts with just a few clicks, track earnings in real time, and enjoy robust customer support – all without ever handling a piece of hardware.

The Top 10 Cloud Mining Platforms Making Crypto Accessible

The competition among providers is fierce, but several names stand out for their commitment to safety, transparency, and ease-of-use:

Top 10 Bitcoin Cloud Mining Platforms of 2025

-

ZA Miner: The new benchmark for cloud mining in 2025, ZA Miner stands out for its transparent contracts, rapid payouts, and innovative AI-driven efficiency. Its LTC Smart Newbie Plan and BTC Smart Miner options are popular with new users seeking a secure entry point.

-

Binance Cloud Mining: As part of the world’s largest crypto exchange, Binance Cloud Mining offers users seamless integration with trading, robust security, and competitive mining contract rates, making it ideal for both beginners and institutional investors.

-

NiceHash: Known for its flexible marketplace, NiceHash allows users to buy and sell hashpower with ease. Its user-friendly platform and transparent pricing have made it a go-to choice for those seeking customizable mining solutions in 2025.

-

ECOS: ECOS is renowned for its regulatory compliance, clear contract terms, and integrated crypto wallet. Its AI-powered mining optimization delivers stable returns, appealing to users seeking reliability and transparency.

-

Hashing24: With a long-standing reputation, Hashing24 provides access to real mining hardware in secure data centers. Its simple interface and fixed-term contracts offer predictable returns for new and experienced miners alike.

-

Bitdeer: Bitdeer partners with leading mining farms worldwide, offering diverse contract options and real-time performance tracking. Its focus on green energy and institutional-grade security attracts eco-conscious investors.

-

Mining Rig Rentals: This platform enables users to rent mining rigs directly from owners, providing flexibility and control over mining strategies. Its transparent rating system helps users choose reliable rigs and maximize profits.

-

Genesis Mining: One of the oldest and most trusted names in cloud mining, Genesis Mining offers a variety of contract lengths and cryptocurrencies. Its robust security and global infrastructure make it a top choice in 2025.

-

MultiMiner: MultiMiner stands out for its cross-platform compatibility and intuitive design. It supports multiple coins and provides detailed analytics, making it suitable for users wanting to diversify their mining portfolios.

-

StormGain: Combining cloud mining with a crypto trading platform, StormGain allows users to mine Bitcoin without hardware and instantly trade or withdraw earnings. Its mobile-first approach appeals to on-the-go investors.

- ZA Miner: Widely regarded as the new benchmark for user-friendly cloud mining in 2025. ZA Miner offers transparent pricing plans like the LTC Smart Newbie Plan ($200 for two days) and BTC Classic Miner ($400 for six days), making it easy for beginners to start small.

- Binance Cloud Mining: Backed by one of crypto’s most trusted brands. Binance integrates seamlessly with its exchange ecosystem so users can mine Bitcoin directly within their accounts – no wallet transfers or technical setup required.

- NiceHash: Known for its marketplace model where users can rent hash power or sell their own. NiceHash’s reputation for reliability continues into 2025 with improved AI-driven allocation that maximizes returns while minimizing downtime.

- ECOS: A favorite among eco-conscious investors due to its green-energy focus and AI-powered contract optimization.

- Hashing24: One of the longest-standing names in cloud mining; it remains popular thanks to simple contracts and consistent payouts.

- Bitdeer: Distinguished by its flexible contract lengths and support for multiple cryptocurrencies beyond Bitcoin.

- Mining Rig Rentals: Offers granular control over rental terms – ideal for advanced users seeking custom strategies without owning physical rigs.

- Genesis Mining: Renowned for transparency reports on energy use and real-time performance dashboards.

- MultiMiner: Praised for its intuitive interface that caters especially well to first-time miners entering the space in 2025.

- StormGain: Unique in blending trading tools with cloud mining services so users can switch between earning modes easily.

The rise of institutional investment has also bolstered trust across these platforms: BlackRock’s entry into green-energy operations sent ripples through the sector while Google’s AI Hashrate Balancer slashed energy waste by nearly a third at major providers (hashbeat.com). This influx of capital means better infrastructure – and more stable returns – for retail participants too.

No Hardware? No Problem: How Cloud Mining Enables Easy Crypto Buying

If you’ve wondered how to buy bitcoin without hardware, you’re not alone. In fact, one reason behind this year’s surge in market capitalization is that modern platforms have eliminated most technical hurdles. Onboarding is now as simple as signing up online – often with KYC-compliant procedures – then selecting your preferred contract size or duration based on your risk profile.

Many providers (notably ECOS and MultiMiner) now offer free trial contracts or demo balances so you can test drive earnings before committing real funds.

For those wary about security or legal standing: leading services like Binance Cloud Mining and Genesis Mining publish regular third-party audits ensuring compliance with local regulations across Europe, Asia-Pacific, and North America. This transparency sets them apart from legacy players that once operated in regulatory gray zones.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Post-$114,525 Milestone Outlook Amid Cloud Mining Boom and Institutional Adoption

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-on-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $89,000 | $125,000 | $158,000 | +9.2% | Potential correction as post-halving mining ROI plateaus; global adoption continues |

| 2027 | $98,000 | $139,000 | $180,000 | +11.2% | Renewed institutional inflows; regulatory clarity in US/EU spurs confidence |

| 2028 | $120,000 | $158,000 | $210,000 | +13.7% | Next wave of cloud mining innovation, AI-driven efficiency gains |

| 2029 | $135,000 | $174,000 | $245,000 | +10.1% | Increased competition from altcoins; possible pre-halving anticipation rally |

| 2030 | $150,000 | $190,000 | $275,000 | +9.2% | Mainstream financial integration; Bitcoin ETF and sovereign adoption expand |

| 2031 | $165,000 | $208,000 | $310,000 | +9.5% | Wider DeFi and tokenization use cases; global regulatory harmonization |

Price Prediction Summary

Bitcoin is expected to maintain a strong growth trajectory through 2031, leveraging the accessibility provided by the cloud mining boom, institutional participation, and continued technological innovation. While some volatility and corrections are anticipated, the overall outlook remains bullish, with average prices potentially rising to $208,000 by 2031. Maximum price scenarios reflect the potential for speculative rallies and accelerated adoption, while minimums account for regulatory or macroeconomic setbacks.

Key Factors Affecting Bitcoin Price

- Institutional adoption of cloud mining contracts and direct BTC holdings

- AI-driven mining efficiency and green energy initiatives

- Regulatory developments in major economies (US, EU, Asia)

- Impact of future Bitcoin halvings and supply constraints

- Competition from altcoins and evolving blockchain technologies

- Macroeconomic environment and global risk appetite

- Integration with mainstream finance (ETFs, banks, sovereign funds)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Another major shift in 2025 is the growing focus on contract flexibility and user empowerment. Platforms like Mining Rig Rentals let users fine-tune every aspect of their cloud mining experience, from hash rate selection to contract duration. This granular control appeals to both hobbyists and sophisticated investors seeking to balance risk and reward without physical ownership headaches.

Meanwhile, legacy giants such as Genesis Mining and Hashing24 have doubled down on transparency. Genesis Mining’s real-time performance dashboards are now industry standard, allowing participants to monitor every watt consumed and satoshi earned. Hashing24’s consistent payouts remain a magnet for those who value predictability in an otherwise volatile asset class.

Security, Regulation and amp; Peace of Mind

The regulatory landscape has matured dramatically. In 2025, global standards require cloud mining sites to pass regular audits and maintain robust anti-fraud protocols. Binance Cloud Mining, for example, leverages its exchange-grade security stack for mining accounts, while StormGain offers two-factor authentication and cold storage options for mined Bitcoin. The result: retail investors can participate with confidence that their capital is protected by best-in-class safeguards.

This increased oversight has also led to more stable returns. AI-powered optimization, like Google’s Hashrate Balancer, has become standard across top providers, reducing inefficiencies and helping platforms deliver on their advertised yields (hashbeat.com). As a result, new entrants like ZA Miner, with its transparent pricing models and rapid onboarding process, have quickly gained market share among first-time buyers.

Comparing the Top Platforms: What Sets Each Apart?

The diversity among the top ten platforms means there’s a solution for every kind of participant:

- ZA Miner: Best for absolute beginners seeking clarity in pricing and contract terms.

- Binance Cloud Mining: Ideal for those who want seamless integration with an existing crypto portfolio.

- NiceHash: Suits users looking to rent or sell hash power dynamically.

- ECOS: Appeals to eco-conscious miners with green energy commitments.

- Hashing24: Trusted by those who value stability over flashiness.

- Bitdeer: Offers flexibility across multiple coins beyond Bitcoin.

- Mining Rig Rentals: Empowers advanced users with custom strategies.

- Genesis Mining: Leader in transparency reporting and operational excellence.

- MultiMiner: Perfect for novices thanks to its intuitive dashboard design.

- StormGain: Unique hybrid platform blending mining with trading tools in one app.

This range of offerings allows both seasoned investors and crypto newcomers to find the right balance between simplicity, control, cost-efficiency, and regulatory assurance. The days of wild-west uncertainty are fading fast as these platforms set new industry norms around user protection and operational clarity.

Looking Ahead: The Future of Cloud Mining and Crypto Buying Accessibility

The macro trend is clear: as Bitcoin holds firm above $114,000, and cloud mining revenue hits unprecedented highs, the infrastructure supporting easy crypto entry keeps improving. With institutional capital fueling innovation, AI driving efficiency gains, and strict regulation underpinning trust, 2025 marks a turning point where anyone can participate in the upside of digital assets without technical barriers or hardware risk.

For investors focused on sustainability or passive income streams, platforms like ECOS and Bitdeer lead the way; for active traders or tinkerers, NiceHash or Mining Rig Rentals offer unmatched flexibility.

Ultimately, this year’s boom isn’t just about higher prices, it’s about democratizing access so that more people can invest for tomorrow while acting with purpose today.