Japan is officially pulling crypto payments out of the margins and dropping them right on Main Street. With the October 2025 launch of the Nudge Card, Japan will become the first major economy to offer a fully regulated stablecoin credit card, accepted at over 150 million VISA merchants worldwide. This isn’t just another fintech gimmick – it’s a calculated leap toward mainstream adoption, signaling a global shift in how we buy, spend, and interact with digital assets.

Japan’s Stablecoin Credit Card: The Details That Matter

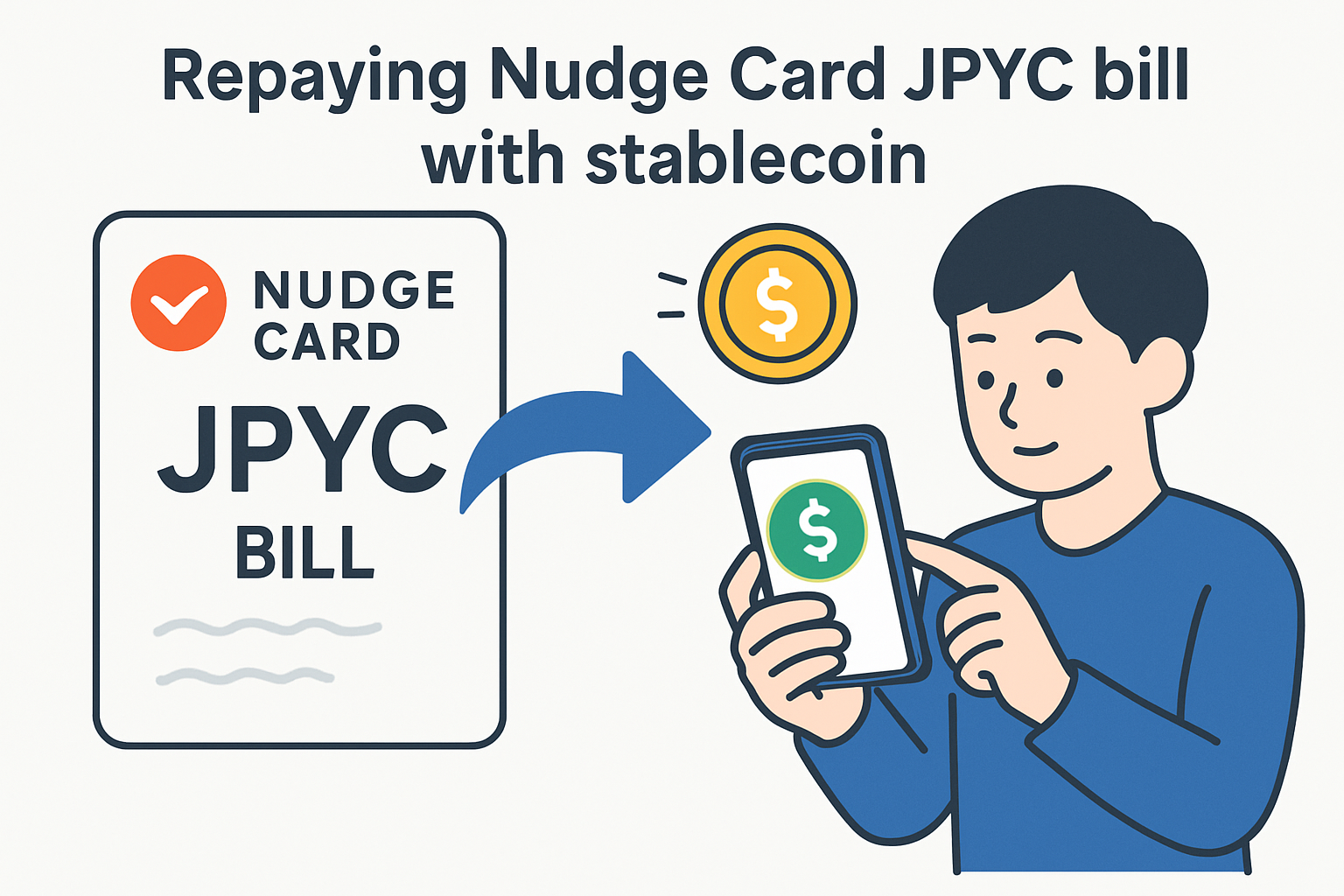

The Nudge Card will let users repay their credit card bills with JPYC, a yen-pegged stablecoin issued by JPYC Corporation. Transactions are settled on the Polygon blockchain, but the end-user experience is frictionless – you swipe your card at any VISA terminal and settle later in digital yen. This isn’t some limited pilot; it’s a full-scale rollout backed by regulatory approval and robust infrastructure.

This move comes on the heels of Circle’s USDC being greenlit for use in Japan as of March 2025, and JPYC receiving its license to issue yen-backed stablecoins (Reuters). The regulatory clarity is what sets Japan apart: there’s no guesswork about compliance or settlement risk. For anyone looking to buy cryptocurrency securely or use it in real-world payments, this environment is as close to plug-and-play as crypto gets.

Why This Is Bigger Than Just Japan

Japan’s move isn’t happening in isolation. In Latin America, Visa has already partnered with Bridge to launch stablecoin-linked cards (Reuters). But Japan’s approach is unique because it leverages both domestic innovation (JPYC) and international standards (VISA acceptance), all under tight regulatory supervision. The message is clear: stablecoins are moving from speculative assets to everyday financial tools.

Top Advantages of Stablecoin Credit Cards

-

Global Acceptance via VISA Network: The Nudge Card, launching in Japan, will be accepted at over 150 million VISA merchants worldwide, enabling seamless stablecoin payments across borders.

-

Reduced Currency Volatility: By using yen-pegged stablecoins like JPYC, cardholders avoid the price swings of typical cryptocurrencies, ensuring predictable spending and repayments.

-

Streamlined Crypto-to-Fiat Payments: The Nudge Card allows users to repay credit card bills directly with JPYC, eliminating the need for complex conversions between crypto and traditional money.

-

Regulatory Compliance and Security: Japan’s stablecoin credit cards are fully compliant with local crypto and payment regulations, offering users enhanced protection and peace of mind.

-

Faster and Cheaper Cross-Border Transactions: Stablecoin-backed cards like the Nudge Card facilitate quick, low-fee international payments compared to traditional banking systems.

For global crypto watchers and swing traders alike, this marks a fundamental shift in market structure. Instead of waiting for mass adoption through slow-moving banks or clunky exchange integrations, we now see direct bridges between digital assets and legacy payment rails.

The Regulatory Green Light: A Blueprint for Crypto Payment Growth

Regulatory clarity has been the missing link for years. Japan’s Financial Services Agency paved the way by approving Circle’s USDC for use in March 2025 (Circle), then fast-tracked licensing for JPYC as the country’s first yen-pegged stablecoin. Now with Slash Vision Labs collaborating on a new cryptocurrency-backed credit card (according to Cointelegraph), there are multiple points of entry into regulated digital payments.

This ecosystem approach – combining local fintechs, global payment networks, and government oversight – makes Japan a case study for other markets considering similar moves. It also gives users confidence that they can buy cryptocurrency securely, knowing their transactions are protected by both blockchain transparency and traditional consumer protections.

The Ripple Effect: What Comes Next?

The launch of the Nudge Card will set off competitive pressure globally. Expect other regions with strong fintech sectors (think Singapore or Switzerland) to push their own versions soon. For now though, all eyes are on Tokyo as crypto adoption trends move from theory into daily practice.

With Japan’s regulatory wall finally breached, stablecoin credit cards are positioned to become a catalyst for mainstream crypto payments. The Nudge Card is more than a local experiment, it’s a proof of concept that digital assets can coexist with legacy financial infrastructure without compromising on speed, security, or consumer familiarity.

For traders, investors, and everyday users, the implications are huge. Stablecoin credit cards like Nudge reduce volatility risk by settling in fiat-pegged tokens. They also eliminate the need for constant on-ramps and off-ramps between crypto exchanges and traditional banks. This is a frictionless bridge right into the heart of global commerce, 150 million VISA merchants is not a testbed; it’s the world stage.

How This Changes Your Crypto Playbook

If you’re still treating crypto as an isolated investment silo, it’s time to rethink your approach. The ability to buy cryptocurrency securely and spend it directly at point-of-sale locations will force both consumers and businesses to adjust their strategies. Merchants gain access to new customer segments who want transparency and instant settlement. Users get more control over how their digital assets are deployed, whether for daily expenses or cross-border transactions.

Real-Life Uses for Stablecoin Credit Cards Like Nudge Card JPYC

-

Shop at Over 150 Million VISA Merchants Worldwide — Use your Nudge Card JPYC at any store, restaurant, or online shop that accepts VISA, enabling seamless payments with yen-backed stablecoins.

-

Repay Credit Card Bills Using JPYC Stablecoin — Settle your monthly credit card balance directly with JPYC, simplifying payments and eliminating the need to convert to fiat yen.

-

Make Cross-Border Purchases Without Currency Exchange Fees — Use your stablecoin credit card to pay for goods and services abroad, avoiding traditional foreign exchange markups.

-

Access Digital Services and Subscriptions — Pay for streaming, cloud storage, and other digital subscriptions using your Nudge Card JPYC wherever VISA is accepted.

-

Streamline Expense Management for Businesses — Companies can issue Nudge Card JPYC to employees, track spending, and settle expenses in stablecoins for faster, transparent accounting.

This isn’t just about convenience; it’s about unlocking liquidity trapped in digital wallets and putting it to work in the real economy. The days of waiting for ACH transfers or worrying about wire cut-off times are numbered. With every swipe of a stablecoin-backed card, another wall between legacy finance and Web3 comes down.

Risks, Roadblocks, and What To Watch

Of course, there are caveats. While Japan’s regulatory clarity is impressive, other jurisdictions may not move as quickly, or as cohesively. There are still questions around cross-border compliance, tax treatment of crypto payments, and how global regulators will respond when stablecoins start eating into traditional payment rails’ market share.

Security remains paramount. Even with robust oversight from agencies like Japan’s FSA, users should maintain best practices: strong passwords, hardware wallets for large holdings, and vigilance against phishing attempts remain non-negotiable.

Will you use a stablecoin credit card for everyday purchases in 2025?

Japan is launching its first stablecoin credit card, the Nudge Card, in October 2025, allowing users to make purchases using yen-backed stablecoins like JPYC at over 150 million VISA merchants. As stablecoin cards gain traction globally, we’re curious about your plans.

The bottom line? Crypto payment revolution isn’t a distant future scenario, it’s happening now in Tokyo convenience stores and soon at checkout counters worldwide. The smart money is watching how these first-mover experiments play out before making big bets elsewhere.

Get Ready For The Next Phase Of Crypto Payments

The launch of the Nudge Card marks an inflection point not just for Japan but for anyone tracking crypto adoption trends. It sets clear standards around compliance while proving that digital currencies can be woven into everyday commerce without sacrificing user experience or regulatory safeguards.

If you’re serious about staying ahead, whether as an investor or someone looking to actually use your coins, now is the time to watch these developments closely. As more markets follow Japan’s lead, expect rapid innovation in both product offerings and user expectations around how we buy, sell, and pay with crypto.