The arrival of the first U. S. XRP ETF marks a pivotal moment for mainstream crypto investing. With the U. S. Securities and Exchange Commission’s (SEC) recent rule changes, spot cryptocurrency ETFs like the XRP ETF are now on a faster track to market. As of September 20,2025, XRP trades at $3.00, and several major asset managers, including Franklin Templeton, Bitwise, and 21Shares, are vying for SEC approval to launch their own XRP ETFs. While these products are not yet available for trading, understanding how to buy the first U. S. XRP ETF will give you a head start when they hit the market.

Why Is an XRP ETF So Significant for Investors?

Unlike buying XRP directly on a crypto exchange, an ETF allows investors to gain exposure to the price movements of XRP through familiar brokerage accounts, no digital wallets or private keys required. This lowers barriers for traditional investors and enables seamless portfolio integration alongside stocks and bonds. It also comes at a time when regulatory clarity is improving; recent SEC rule changes now allow exchanges like NYSE and Nasdaq to list spot crypto ETFs in as little as 75 days (source).

“Options are opportunities, manage them wisely. “: Sophie Mercer

Step-by-Step Guide: How to Buy America’s First Spot XRP ETF

When the first U. S. -listed spot XRP ETF launches (look for tickers like XRPR), here’s exactly how you can get started using a mainstream U. S. brokerage platform:

- Open an account with a U. S. brokerage or investing app that offers the XRPR ticker. Top choices include Fidelity, Charles Schwab, or Robinhood.

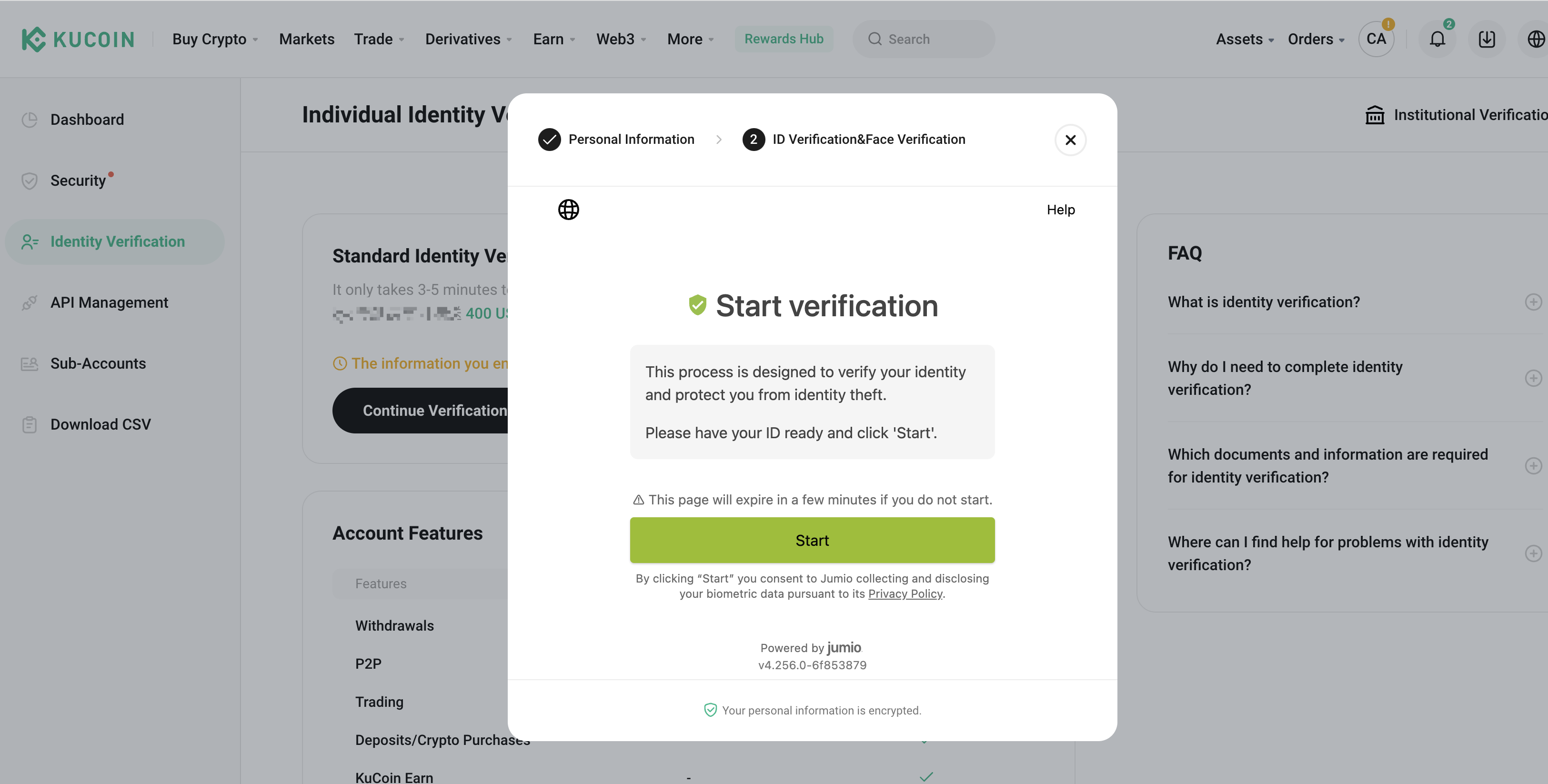

- Complete identity verification and fund your account. Link your bank account or use wire transfer to deposit funds securely.

- Search for the XRP ETF by entering its ticker symbol (e. g. , XRPR) in your broker’s trading platform.

- Place a buy order for your desired number of shares. Review all order details before confirming your purchase.

This streamlined process mirrors traditional stock purchases but gives you direct exposure to one of crypto’s most established assets, all from within your existing brokerage dashboard.

XRP Price Update: Holding Steady at $3.00

XRP is currently priced at $3.00, reflecting both increasing institutional interest and optimism about pending ETF approvals. The price has traded between $2.98 and $3.05 in the past 24 hours, a tight range that signals consolidation ahead of major news catalysts.

XRP Price Prediction (ETF Impact): 2026-2031

Analyst Forecasts for Post-ETF Launch Performance vs Direct XRP Holdings

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg vs. Current) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $2.40 | $3.50 | $5.10 | +17% | ETF launches, moderate adoption, market volatility |

| 2027 | $2.70 | $4.20 | $6.50 | +40% | Broader ETF acceptance, rising institutional inflows |

| 2028 | $2.90 | $5.10 | $8.20 | +70% | Mainstream ETF adoption, network upgrades |

| 2029 | $3.20 | $5.90 | $10.00 | +97% | Crypto bull cycle, increased regulatory clarity |

| 2030 | $3.50 | $6.80 | $12.50 | +127% | Peak adoption, cross-border payments expansion |

| 2031 | $3.80 | $7.50 | $15.00 | +150% | Global institutional integration, high competition |

Price Prediction Summary

XRP is poised for gradual growth following the anticipated launch of U.S. spot XRP ETFs, with major upside potential if ETF products drive substantial institutional adoption. Average price projections suggest a 17% to 150% increase from current levels by 2031, with bullish scenarios hinging on strong ETF inflows and broader crypto market cycles. Bearish scenarios reflect risks from regulatory setbacks or limited adoption.

Key Factors Affecting XRP Price

- SEC approval and timing of U.S. spot XRP ETFs

- Institutional inflows enabled by ETF accessibility

- Global regulatory trends and legal clarity for XRP

- Technological advancements in the XRP Ledger and payment use cases

- Macro crypto market cycles and Bitcoin/Ethereum performance

- Competition from other payment-focused blockchains

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Mainstream Crypto Investing: What Sets ETFs Apart?

The upcoming launch of spot cryptocurrency ETFs like XRPR is poised to transform how retail investors approach digital assets. Instead of managing wallets or navigating complex exchanges, you’ll be able to buy or sell shares just as you would any stock or index fund, making crypto exposure more accessible than ever before.

For many, the appeal of an XRP ETF is not just about convenience. ETFs offer built-in regulatory oversight, daily liquidity, and institutional-grade custody solutions, features that help mitigate some of the risks associated with holding crypto directly. This can be especially attractive for investors who want to diversify their portfolios without the operational headaches of self-custody or navigating multiple crypto exchanges.

It’s also important to consider the tax implications. With an ETF, capital gains are typically reported in a familiar format on your annual brokerage statements, making it easier to track and report to the IRS compared to frequent trading on crypto exchanges. Plus, if you’re already using a platform like Fidelity or Charles Schwab for your retirement accounts, integrating XRPR into your IRA or 401(k) could be as simple as a few clicks, pending plan eligibility.

Alternatives While You Wait: Direct XRP Purchase

Since America’s first spot XRP ETF is still awaiting final SEC approval as of September 20,2025, some investors may not want to wait. If you’re eager for XRP exposure today, consider purchasing XRP directly from trusted exchanges such as Kraken or Coinbase. The process involves:

How to Buy XRP Directly on a Major U.S. Exchange

-

Open an account with a U.S. brokerage or investing app that offers the XRP ETF (such as those listing the XRPR ticker, e.g., Fidelity, Charles Schwab, or Robinhood).

-

Complete the necessary identity verification and fund your brokerage account using a linked bank account or wire transfer. This ensures your account is ready to trade.

-

Search for the XRP ETF by entering its ticker symbol (e.g., XRPR) in your broker’s trading platform. This will display the ETF’s current market data and trading options.

-

Place a buy order for the desired number of XRP ETF shares, review your order details, and confirm the purchase. Monitor your portfolio for updates.

While this approach requires managing your own digital wallet and understanding private key security, it provides immediate exposure to XRP’s price movements at $3.00. For those comfortable with direct crypto management, this remains a viable interim strategy until ETFs become available.

Strategic Considerations: ETF vs Direct Purchase

Choosing between an ETF and direct purchase comes down to your risk tolerance and investing style:

- Simplicity and Security: ETFs reduce operational complexity and offer institutional-grade protection.

- Direct Ownership: Buying actual XRP allows participation in on-chain activities like staking (if supported) but comes with added responsibility.

- Tax Reporting: ETFs streamline tax documentation; direct holdings may require more detailed record-keeping.

No matter which route you choose, staying informed about regulatory changes is critical. The SEC’s accelerated approval process means new opportunities can emerge quickly, having your brokerage account set up now ensures you won’t miss out when XRPR goes live.

What Happens Next?

The race is on among asset managers like Franklin Templeton and Bitwise to bring the first spot XRP ETF (XRPR) to U. S. markets. With current prices consolidating around $3.00, investor anticipation is building ahead of final SEC decisions (source). Once approved, following the four-step process outlined above will let you participate in this milestone moment for mainstream crypto investing.

If you’re serious about adding digital assets to your portfolio but want institutional safeguards and easy access, keep a close eye on XRPR’s launch timeline.

Sophie Mercer or Buyingcryptotoday