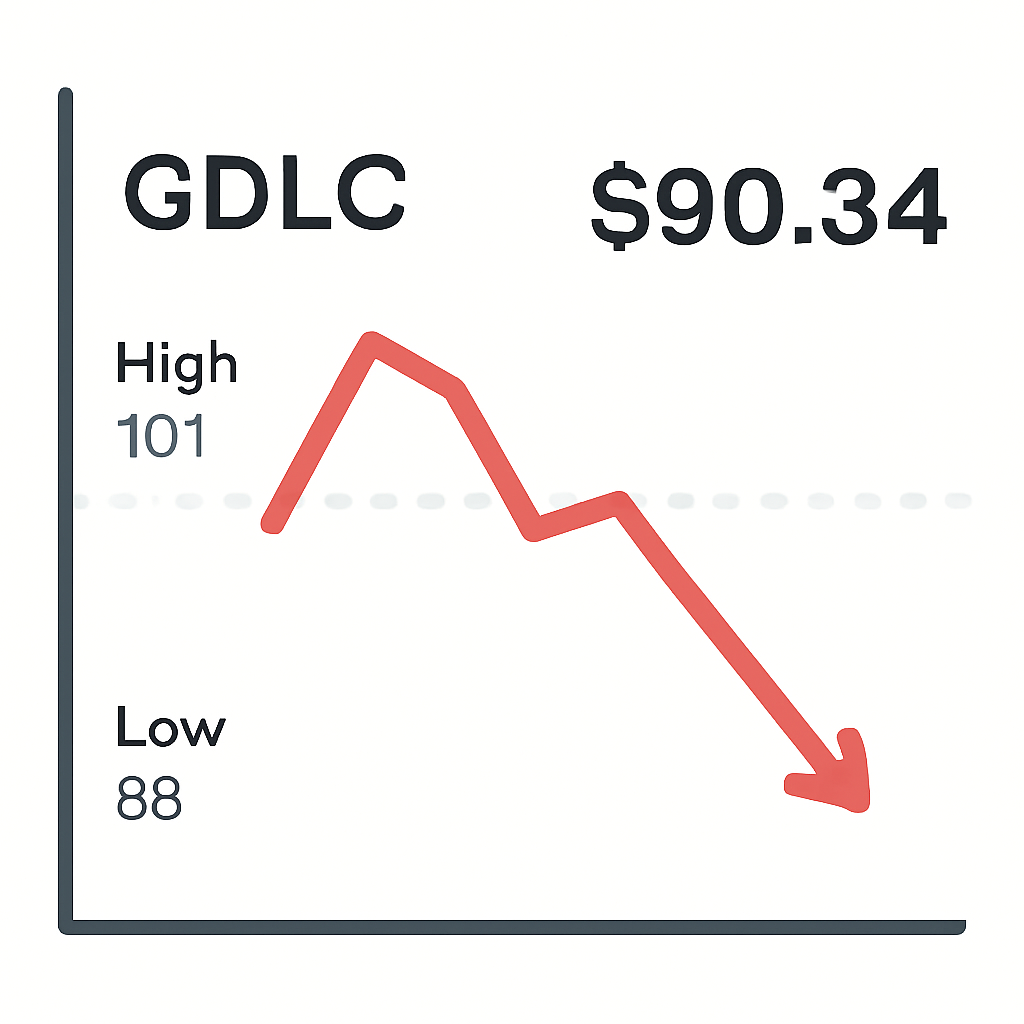

The landscape of crypto investing in the United States has shifted dramatically with the launch of the Grayscale CoinDesk Crypto 5 ETF (GDLC). For years, American investors seeking diversified and secure crypto exposure faced significant barriers: complex custody requirements, fragmented access, and regulatory uncertainty. Now, GDLC, trading on NYSE Arca at a current price of $90.34: offers a streamlined solution that bundles five of the most established digital assets into one regulated investment vehicle.

GDLC’s Structure: A New Standard for Secure Crypto Investing

The GDLC ETF is designed to track the performance of a basket comprising Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). These assets collectively account for over 90% of the digital asset market’s capitalization. The fund’s current composition is approximately 72% Bitcoin, 17% Ethereum, with the remaining 11% split among XRP, Solana, and Cardano. This allocation strategy ensures broad exposure while maintaining a focus on liquidity and market leadership.

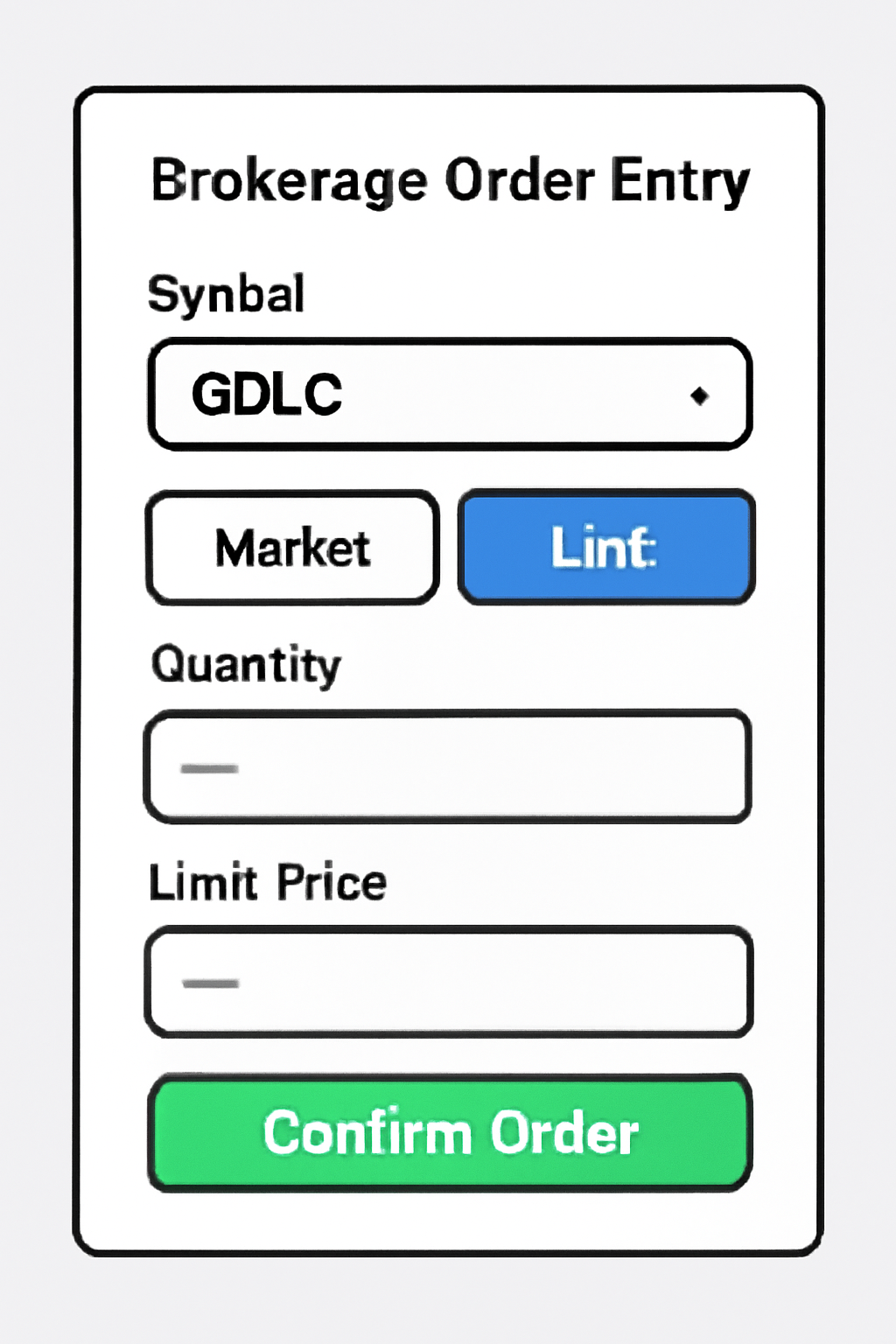

For investors who have been hesitant to navigate multiple wallets or exchanges, or who worry about custody risks, GDLC delivers a familiar brokerage-accessible format. It’s now possible to buy shares in a multi-token crypto ETF as easily as purchasing any traditional stock or ETF.

How Regulatory Shifts Have Enabled Multi-Token ETFs

The debut of GDLC follows pivotal changes at the U. S. Securities and Exchange Commission (SEC). The SEC recently approved new listing standards that allow exchanges such as NYSE, Nasdaq, and Cboe Global Markets to list spot digital asset-backed funds using generic criteria. This reform slashes approval timelines from up to 240 days to as little as 75 days, a move that signals growing regulatory maturity around crypto products.

This regulatory clarity has not only paved the way for Grayscale’s innovation but has also set a precedent for future multi-token ETFs. By lowering procedural friction and enhancing transparency, these changes are attracting both institutional allocators and retail investors eager for diversified crypto exposure without operational headaches.

Why GDLC Changes the Game for Secure Crypto Investing

The significance of Grayscale’s move cannot be overstated. The ability to access multiple top-tier cryptocurrencies through one ticker provides as detailed by CNBC: addresses long-standing pain points in buying cryptocurrency securely:

- Simplified Access: Investors can purchase shares via standard brokerage accounts without learning new platforms or managing private keys.

- Diversification: Exposure to five leading coins reduces idiosyncratic risk compared to buying single tokens outright.

- Regulated Structure: As an SEC-approved product trading on NYSE Arca, GDLC offers robust investor protections absent from many offshore exchanges.

This approach is particularly attractive for those who want diversified exposure but are wary of exchange hacks or self-custody mishaps, a recurring theme in crypto headlines over recent years.

Grayscale CoinDesk Crypto 5 ETF (GDLC) Price Prediction 2026-2031

Professional outlook based on current market trends, regulatory shifts, and underlying crypto asset performance

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $76.00 | $92.00 | $120.00 | +2.0% | Initial volatility post-launch; regulatory clarity supports moderate growth. Min reflects possible crypto market correction. |

| 2027 | $85.00 | $104.00 | $138.00 | +13.0% | Broader institutional adoption and ETF inflows drive higher averages; high reflects a strong bull market in crypto. |

| 2028 | $92.00 | $116.00 | $154.00 | +11.5% | Continued crypto acceptance, new product launches, and expansion into retirement accounts fuel growth. |

| 2029 | $101.00 | $129.00 | $175.00 | +11.2% | Mainstream portfolio integration and steady BTC/ETH growth; max scenario assumes another major crypto bull cycle. |

| 2030 | $109.00 | $142.00 | $195.00 | +10.1% | Crypto market matures, volatility decreases; regulatory environment remains favorable and drives ETF demand. |

| 2031 | $118.00 | $156.00 | $215.00 | +9.9% | Wider adoption in asset allocation models, significant global crypto integration; max reflects strong economic tailwinds. |

Price Prediction Summary

GDLC is poised for steady growth over the next six years, supported by its diversified crypto exposure, favorable regulatory developments, and increasing institutional participation. While the ETF will experience volatility in line with the broader crypto market, the trend is upward, with average annual gains projected between 10-13%. Minimum price scenarios reflect possible crypto downturns or regulatory headwinds, while maximum scenarios capture potential bull markets and technological adoption surges.

Key Factors Affecting Grayscale Digital Large Cap Fund Stock Price

- Performance of underlying cryptocurrencies (especially BTC and ETH, which comprise ~89% of holdings)

- Regulatory clarity and further SEC approvals for digital asset ETFs

- Macroeconomic cycles impacting risk appetite for crypto assets

- Institutional and retail adoption of crypto ETFs in portfolios

- Technological developments and network upgrades in major cryptocurrencies

- Potential for increased competition from other crypto ETFs or investment products

- Global economic environment and U.S. monetary policy changes impacting capital flows

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

The Market Impact: Accessibility Meets Liquidity

The introduction of GDLC comes at a time when demand for secure crypto investing is soaring among U. S. investors. With its current price at $90.34, GDLC provides an entry point that reflects live market conditions while offering instant diversification across five major coins.

This multi-token ETF structure also enhances overall market liquidity by aggregating demand into a single product rather than dispersing it across fragmented spot markets or less-regulated exchanges. As more investors seek regulated vehicles for buying cryptocurrency securely, products like GDLC are likely to become foundational pillars in both retail and institutional portfolios.

For investors weighing the merits of a Grayscale Crypto ETF versus buying individual coins on an exchange, the calculus is shifting. GDLC’s structure delivers not just convenience, but also a strategic risk-mitigation layer that’s hard to replicate through DIY crypto investing. With the ETF’s transparent composition, currently 72% Bitcoin, 17% Ethereum, and 11% split among XRP, Solana, and Cardano, holders can benefit from the price action of multiple leaders while sidestepping the operational risks of managing several wallets or exchanges.

Top Advantages of Holding GDLC vs. Direct Crypto Ownership

-

Broad Diversification in a Single Investment: GDLC provides exposure to five leading cryptocurrencies—Bitcoin, Ethereum, XRP, Solana, and Cardano—through one ETF, reducing the need to manage multiple wallets or exchanges.

-

Regulated and Secure Structure: As a publicly traded ETF on NYSE Arca, GDLC operates under SEC oversight, offering investors a higher degree of regulatory protection and transparency compared to unregulated crypto exchanges.

-

Streamlined Tax Reporting: GDLC simplifies tax documentation by providing standardized 1099 forms, whereas direct crypto ownership often requires complex record-keeping for each transaction.

-

No Private Key or Wallet Management: Investors in GDLC avoid the risks of self-custody, such as lost keys or hacks, since all assets are held securely by institutional custodians.

-

Easy Access via Brokerage Accounts: GDLC can be bought and sold like any stock through traditional brokerage platforms, eliminating the need for specialized crypto accounts or onboarding processes.

-

Enhanced Liquidity and Price Transparency: Trading on NYSE Arca ensures real-time pricing and high liquidity, unlike some crypto exchanges that may experience slippage or limited order books.

-

Automatic Portfolio Rebalancing: GDLC periodically adjusts its holdings to reflect the market capitalization of its underlying assets, saving investors the effort and transaction costs of manual rebalancing.

Liquidity is another critical advantage. Because GDLC trades on NYSE Arca with a current price of $90.34, investors can enter or exit positions during standard market hours with the same ease as any stock or traditional ETF. This stands in stark contrast to many spot crypto exchanges, which often face withdrawal delays or liquidity crunches during periods of volatility.

What This Means for U. S. Crypto Adoption

The launch of GDLC is more than a product milestone, it’s a signal that U. S. financial infrastructure is finally adapting to meet modern investor demand for secure crypto investing. By offering regulated access to a diversified basket of digital assets, Grayscale is helping to bridge the gap between traditional finance and decentralized technologies.

This evolution brings several downstream effects:

- Lower Barriers for Institutions: Pension funds and asset managers can now allocate to crypto via familiar vehicles without bespoke custody arrangements.

- Increased Transparency: Investors have clear visibility into holdings and pricing, audited within a regulated framework.

- Potential for Broader Product Innovation: As regulatory standards solidify, expect more multi-token ETFs and thematic crypto funds tailored to different risk profiles.

How to Buy GDLC: Steps for Secure Exposure

If you’re ready to add diversified crypto exposure through your brokerage account, purchasing GDLC is straightforward. Here’s a quick guide:

This simplicity marks a dramatic departure from the days when secure crypto investing meant navigating arcane wallet setups or worrying about exchange solvency. Now you can participate in digital asset growth with institutional-grade safeguards, all while maintaining flexibility and liquidity at every step.

Options are opportunities, manage them wisely.