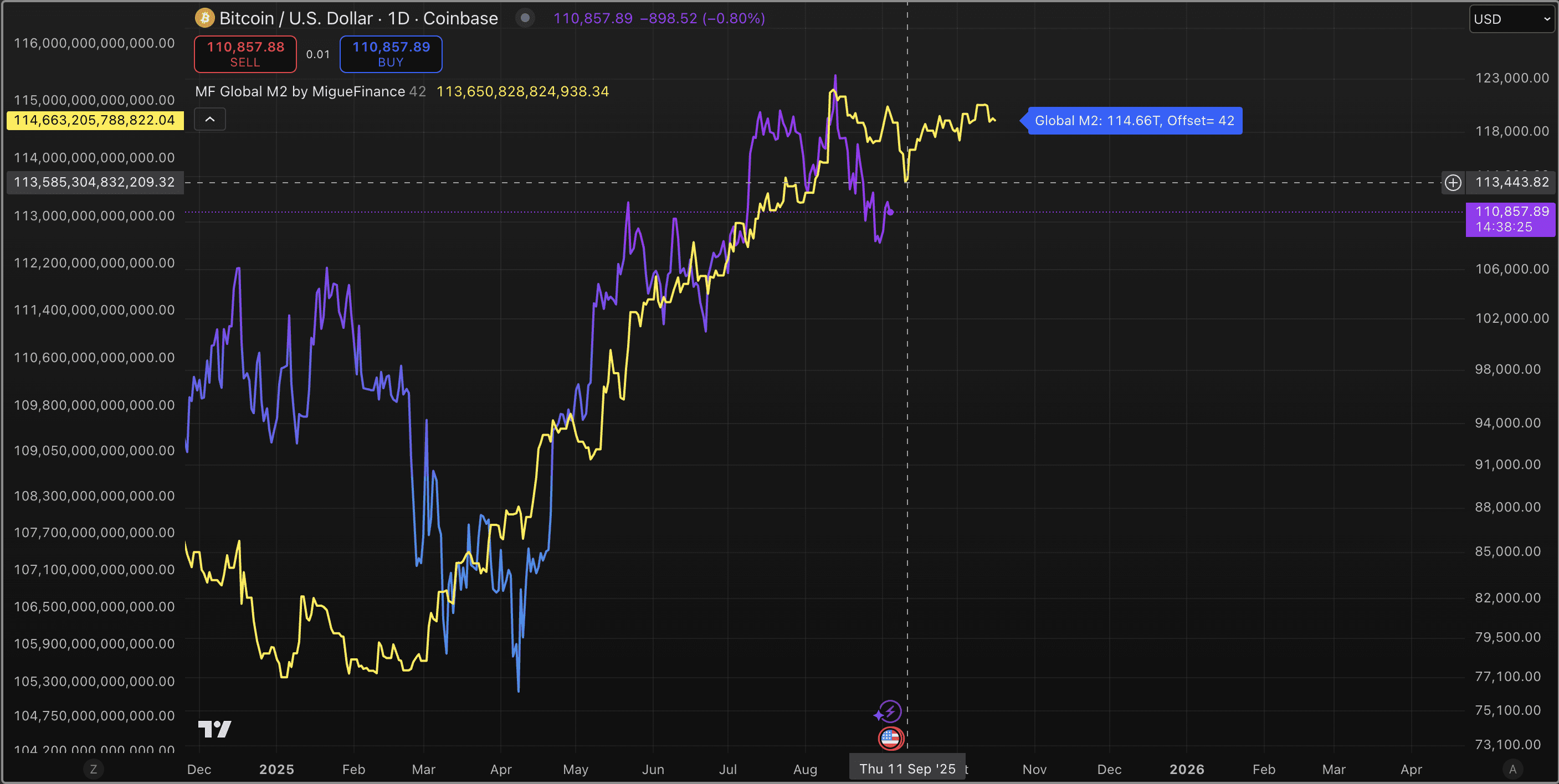

September 2025 has proven once again that crypto markets can turn on a dime. Bitcoin’s price tumbled below $110,000 before rebounding to $112,916.00 as of this writing, rattling both new and seasoned investors. Such volatility is nothing new for digital assets, but the speed and intensity of the recent rout have reignited concerns about how to buy cryptocurrency safely during market crashes.

Drawing on lessons from the latest downturn, this guide explores four actionable strategies that can help you navigate turbulent times: prioritizing secure wallet storage, implementing dollar-cost averaging (DCA), verifying exchange security and liquidity, and double-checking transaction fees and network congestion. Each strategy is crucial for minimizing risk while taking advantage of potential buying opportunities during sharp declines.

Bitcoin Holds Above $110,000: What the September 2025 Rout Teaches Us

The recent crash was triggered by a combination of high leverage, thin liquidity, and macroeconomic headwinds like rising Treasury yields and recession fears. Historical data shows September is often a weak month for Bitcoin, with average returns slipping to −3.80% since 2013 (source). Yet every major correction brings fresh opportunities, if you know how to protect your capital while buying in.

1. Prioritize Secure Wallet Storage

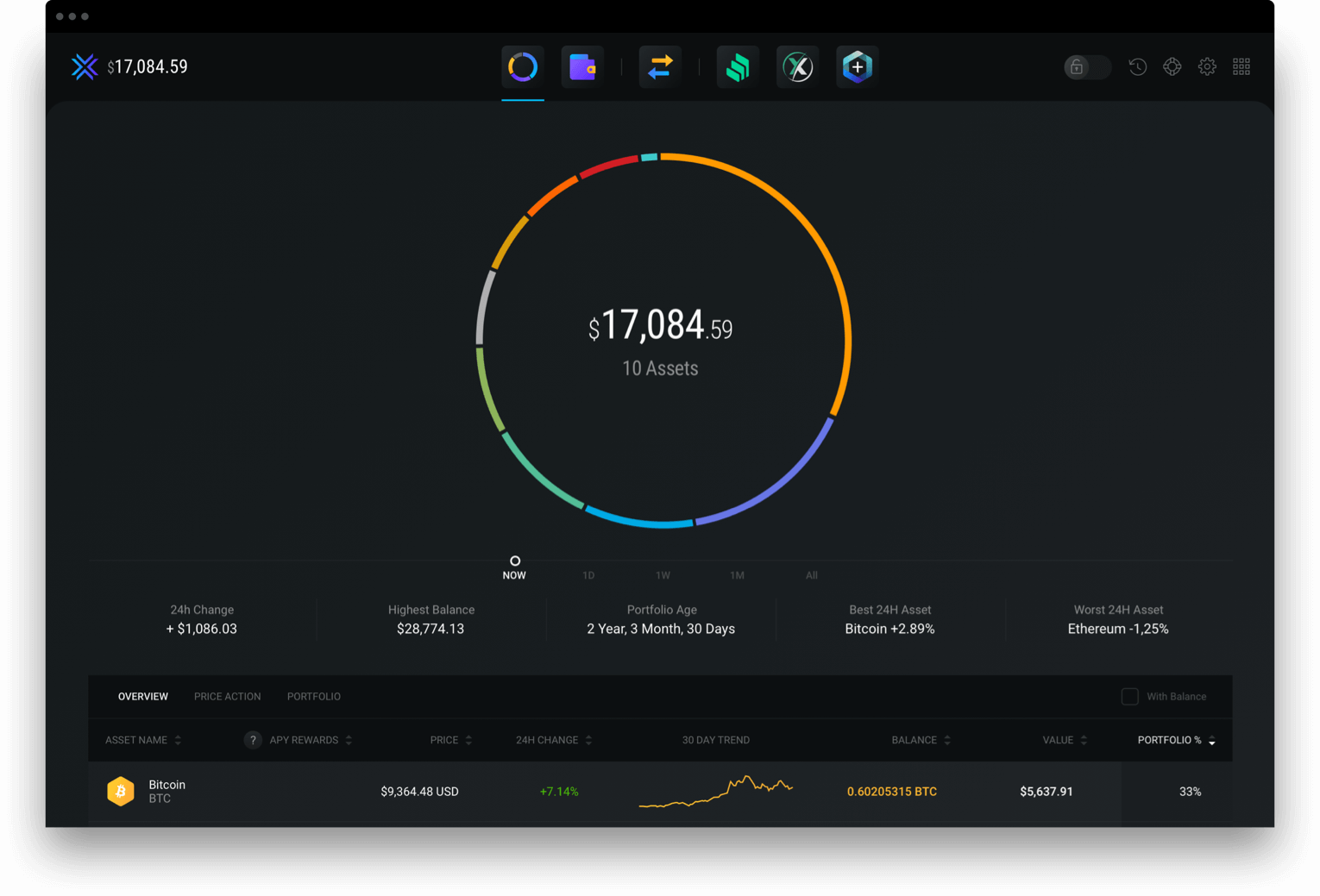

When market panic sets in, exchanges become prime targets for hackers and withdrawal freezes are not uncommon. The first lesson: get your coins off exchanges as soon as you buy. Use reputable non-custodial wallets like Exodus, which is rated best overall in September 2025 (source), or Zengo, ideal for beginners due to its intuitive interface and robust security features.

By storing your assets in a wallet where you control the private keys, you minimize exposure to third-party risks that escalate during periods of volatility. Cold wallets such as Tangem are also recommended for longer-term holdings or larger sums (source).

Top Strategies for Safe Crypto Buying in September 2025

-

Prioritize Secure Wallet Storage: Use reputable, non-custodial wallets like Exodus or Zengo to store your Bitcoin and other cryptocurrencies. This ensures you control your private keys and reduces exposure to exchange hacks during volatile periods. Both Exodus and Zengo are top-rated for security and user experience in 2025.

-

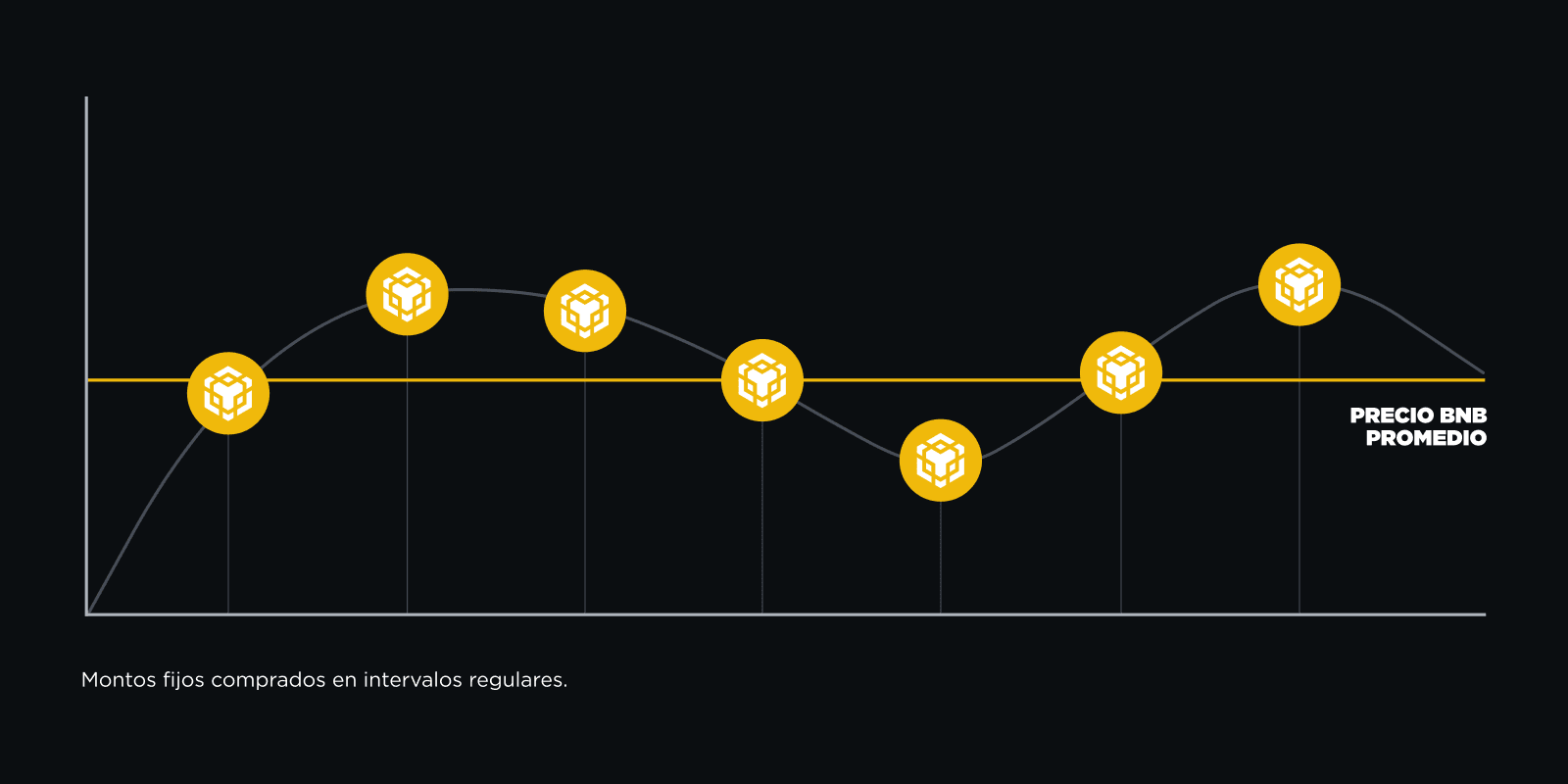

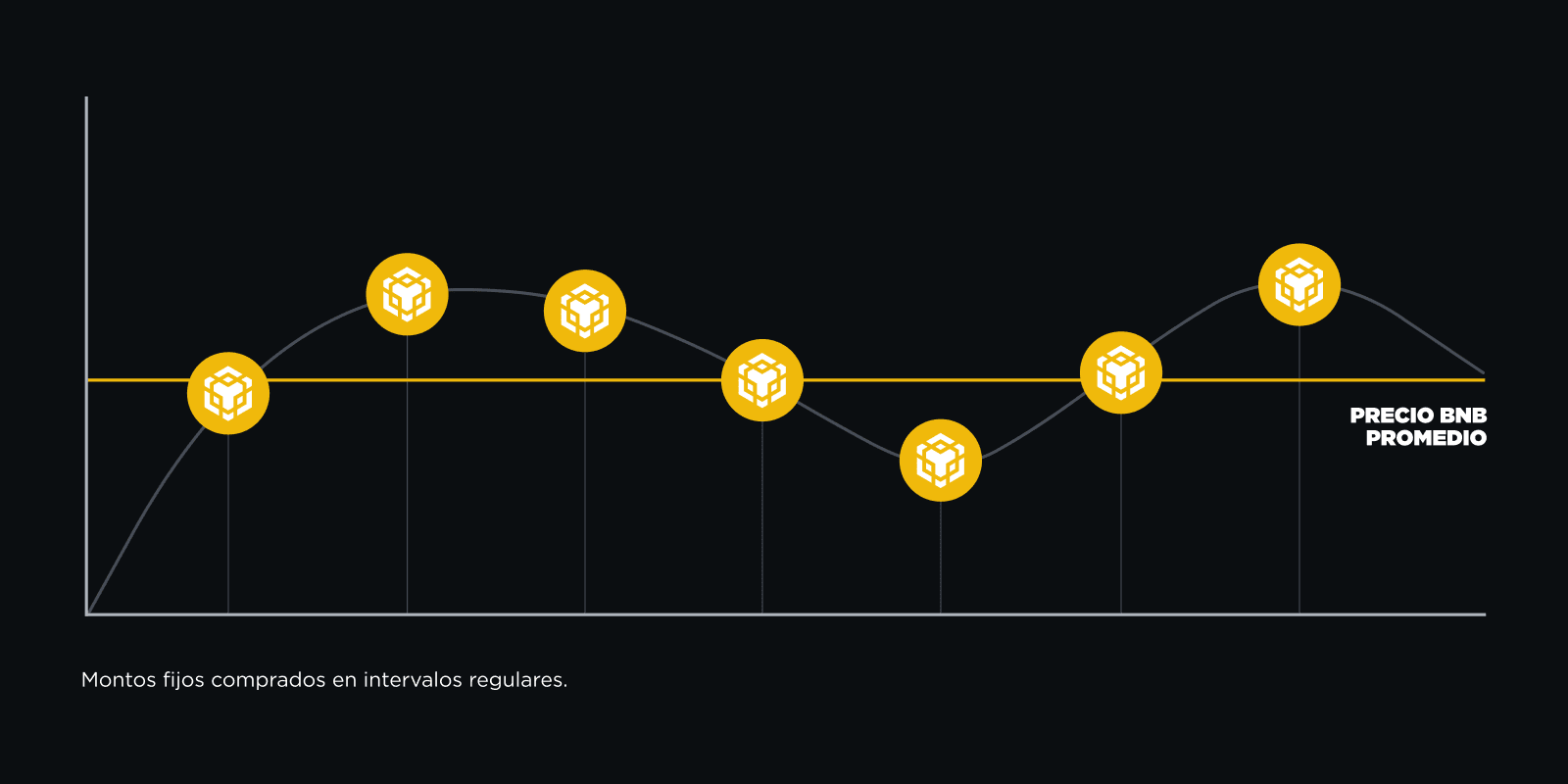

Implement Dollar-Cost Averaging (DCA): Rather than making large, lump-sum purchases during a crash, spread out your buys over days or weeks. This minimizes the risk of catching further price drops and helps you average out your entry price, reducing emotional decision-making during high volatility.

-

Verify Exchange Security and Liquidity: Choose exchanges with robust security protocols such as two-factor authentication and cold storage, high liquidity, and transparent proof-of-reserves. This helps you avoid withdrawal freezes or insolvency risks, which are heightened during market stress events. Established platforms like Coinbase and Kraken are known for these features.

-

Double-Check Transaction Fees and Network Congestion: Monitor real-time transaction fees and blockchain congestion—especially for Bitcoin, where fees can spike above $20 during crashes. This vigilance helps you avoid overpaying or having transactions delayed, which is crucial when prices are moving rapidly.

2. Implement Dollar-Cost Averaging (DCA)

Catching a falling knife rarely ends well, even for professionals. Instead of making a large purchase all at once during a crash, spread your buys over days or weeks using DCA. This disciplined approach reduces the risk of entering at a local high if prices drop further after your initial buy.

DCA can be automated on many exchanges or done manually by setting reminders to purchase at regular intervals. Not only does this smooth out your entry price over time but it also helps take emotion out of volatile markets, a key advantage when fear dominates headlines.

3. Verify Exchange Security and Liquidity Before Buying

The chaos of September’s rout exposed weaknesses in several trading platforms, some faced withdrawal delays while others struggled with liquidity crunches as trading volumes spiked. Before executing any trade:

- Choose exchanges with strong security protocols, such as two-factor authentication (2FA) and cold storage for client funds.

- Check proof-of-reserves statements, which demonstrate an exchange’s solvency in real time.

- Select platforms with deep liquidity pools, reducing slippage even during high volatility periods.

This diligence can help you avoid becoming collateral damage if an exchange faces insolvency or technical issues when you need access most (source). Reliable options include Coinbase, Kraken, and Binance, all of which have established track records through previous market shocks (source).

Bitcoin Price Prediction Table: 2026-2031 (Post-September 2025 Crash)

Forecasts based on current market volatility, historical cycles, and evolving crypto fundamentals

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $90,000 | $120,000 | $155,000 | +6.3% | Continued volatility post-crash; possible regulatory tightening; accumulation phase |

| 2027 | $102,000 | $138,000 | $182,000 | +15.0% | Recovery as macroeconomic outlook improves; institutional interest grows |

| 2028 | $118,000 | $158,000 | $210,000 | +14.5% | Potential for new all-time highs if adoption accelerates; possible halving effect |

| 2029 | $132,000 | $172,000 | $235,000 | +8.9% | Market consolidation; increased competition from altcoins; regulatory clarity |

| 2030 | $150,000 | $192,000 | $265,000 | +11.6% | Wider mainstream adoption; new use cases (e.g., global payments, store of value) |

| 2031 | $170,000 | $215,000 | $300,000 | +12.0% | Matured market, high institutional presence, possible integration with CBDCs |

Price Prediction Summary

Bitcoin is projected to recover from the September 2025 crash, with gradual growth fueled by adoption and maturing market conditions. While volatility and macroeconomic factors will continue to drive sharp price swings, the long-term outlook remains positive, with new highs possible toward 2030-2031. Investors should plan for both bullish and bearish scenarios, as regulatory and technological developments could have outsized impacts.

Key Factors Affecting Bitcoin Price

- Market cycles (post-halving effects, historical seasonality)

- Global macroeconomic conditions (inflation, recession, interest rates)

- Regulatory actions and clarity (especially in major economies)

- Institutional adoption and capital inflows

- Technological advancements (scalability, security, new use cases)

- Competition from altcoins and other digital assets

- Sentiment and behavioral trends among retail investors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Even with careful exchange selection, it’s essential to remain vigilant. Keep withdrawal limits in mind and test small transfers before moving larger sums. This simple step can save you from headaches if an exchange suddenly enacts tighter controls or experiences technical outages during turbulent markets.

4. Double-Check Transaction Fees and Network Congestion

During periods of heightened volatility like September 2025, the Bitcoin network can become congested, driving transaction fees sharply higher. At the peak of the rout, median fees soared above $20 per transaction, a significant cost if you’re making multiple buys or transferring funds between wallets (source). Before confirming any purchase or transfer, always verify current fee levels using real-time blockchain explorers or your exchange’s fee estimator.

If possible, time your transactions for off-peak hours when network demand is lower. Alternatively, consider using wallets that allow you to customize transaction fees based on urgency. For those investing in altcoins, be aware that congestion on the Ethereum or other networks can also spike fees unexpectedly.

Bringing It All Together: Safe Crypto Buying in Uncertain Times

Buying cryptocurrency during a crash is not for the faint of heart, but it also presents unique opportunities for disciplined investors willing to act prudently. By prioritizing secure wallet storage with trusted options like Exodus or Zengo, implementing dollar-cost averaging to mitigate entry risk, verifying exchange security and liquidity rigorously, and double-checking transaction fees before every move, you put yourself in a position to capitalize on market dislocations without taking unnecessary risks.

4 Safe Crypto Buying Strategies for the 2025 Crash

-

Implement Dollar-Cost Averaging (DCA): Rather than making large, lump-sum purchases during a crash, spread out your buys over days or weeks. This approach minimizes the risk of catching further price drops and helps you average out your entry price for Bitcoin, which recently traded around $112,916.

-

Verify Exchange Security and Liquidity: Choose exchanges with robust security protocols—such as two-factor authentication and cold storage—and high liquidity. Platforms like Coinbase, Kraken, and Binance offer transparent proof-of-reserves, helping you avoid withdrawal freezes or insolvency risks during market stress events.

-

Double-Check Transaction Fees and Network Congestion: Monitor real-time transaction fees and blockchain congestion—especially for Bitcoin, where median fees have recently spiked above $20 during crashes. This vigilance helps you avoid overpaying or having transactions delayed when network activity surges.

Remember that no strategy eliminates risk entirely, especially in a market as dynamic as crypto. However, these four steps offer a robust framework for navigating volatility with confidence and clarity.

Staying Ahead: Monitoring Market Sentiment and Adapting Quickly

The September 2025 rout has shown that even at $112,916.00, well above earlier cycle highs, Bitcoin remains susceptible to swift corrections fueled by macroeconomic shocks and internal leverage unwinds. Staying informed through reputable sources and regularly reviewing your security practices will help you adapt as conditions evolve.

Which crypto safety strategy do you consider most important during market crashes?

Market volatility like the September 2025 Bitcoin rout (BTC price: $112,916.00) highlights the need for smart safety strategies. Which approach do you prioritize when buying or holding crypto during turbulent times?

For further guidance on choosing top-rated wallets or understanding how best to buy Bitcoin safely in 2025, consult detailed guides from sources like Money.com and 99Bitcoins. As always, prioritize your own due diligence over hype, and remember that patience and preparation are your best allies when markets get rough.