Wall Street is making its boldest crypto move yet. Morgan Stanley’s E*Trade crypto trading integration isn’t just another headline – it’s a seismic shift for anyone serious about secure ways to buy Bitcoin. With Bitcoin sitting strong at $113,669.00, this move throws open the doors of regulated crypto brokerage to millions of mainstream investors, and the implications are huge.

Morgan Stanley E*Trade Crypto Trading: A Wall Street Power Play

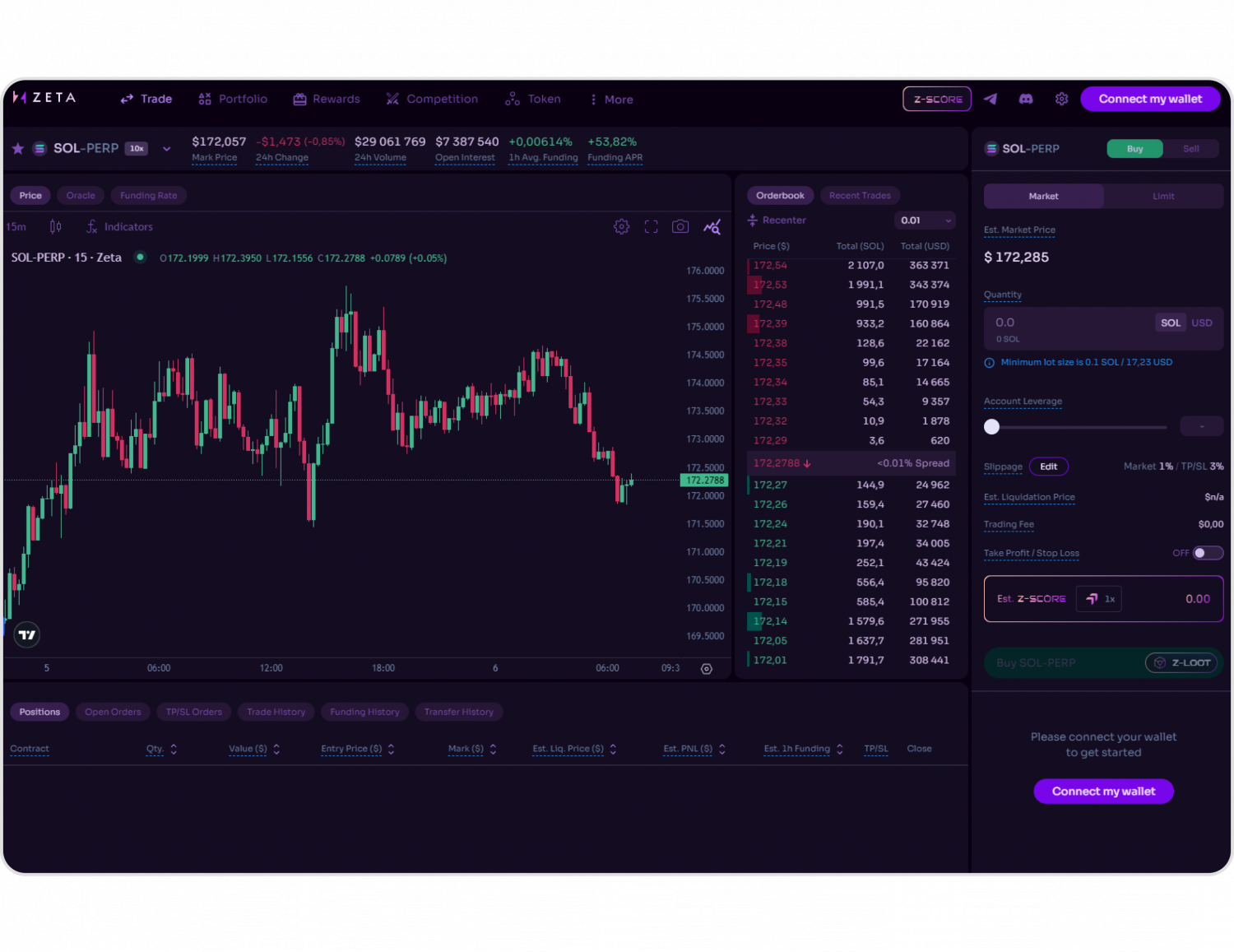

Let’s cut to the chase: Morgan Stanley is bringing Bitcoin, Ethereum, and Solana trading directly to E*Trade accounts in early 2026, thanks to a partnership with digital asset infrastructure leader Zerohash. This isn’t just about adding new coins – it’s about fusing traditional finance with digital assets under one powerhouse roof. For years, crypto traders have juggled risky offshore exchanges and regulatory gray areas. Now, you’ll be able to buy, sell, and hold major coins on a platform trusted by millions of stock and ETF investors.

This move comes as the global crypto market caps out around $3.9 trillion, with Bitcoin alone commanding $2.25 trillion of that firepower (source). The timing? Perfect. Regulatory clarity is surging under the Trump administration’s supportive stance on digital assets (source), and Wall Street is racing to catch up with retail demand.

Why the Zerohash Partnership Changes Everything for Secure Bitcoin Buying

The secret sauce behind this launch is Morgan Stanley’s alliance with Zerohash, a rising unicorn in crypto infrastructure. Zerohash just raised $104 million in a funding round backed by heavyweights like Morgan Stanley and SoFi (source). This isn’t just PR hype – it means your trades will clear through a system designed for institutional-grade security and compliance.

No more worrying about shady platforms or disappearing funds. When you buy Bitcoin at $113,669.00 through E*Trade, you’re doing so in an environment that meets Wall Street standards for custody and transparency. That’s a game-changer for anyone who values safety as much as opportunity.

Bitcoin at $113,669: Secure Access Goes Mainstream

Let’s put this in perspective: Bitcoin holding above $113,000 isn’t just a price milestone – it signals institutional confidence and massive retail interest converging at once. With E*Trade clients soon able to deploy their dry powder (over $1.3 trillion!) into BTC, ETH, or SOL order flow (source), we’re looking at an era where secure cryptocurrency investing isn’t niche – it’s mainstream finance.

Bitcoin (BTC) Price Prediction Table: 2026–2031

Professional outlook following Morgan Stanley’s E*Trade crypto integration and evolving institutional adoption trends. Prices reflect projected market cycles, adoption, and regulatory scenarios.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $89,500 | $122,000 | $159,000 | +7.3% | Initial E*Trade adoption; possible short-term volatility as retail inflows surge and profit-taking occurs. |

| 2027 | $104,000 | $138,000 | $185,000 | +13.1% | Post-halving effect and broader Wall Street participation fuel bullish sentiment. Regulatory clarity continues to improve. |

| 2028 | $120,000 | $155,000 | $210,000 | +12.3% | Growing integration in traditional finance, increasing ETF flows, and wider retail/institutional use cases drive demand. |

| 2029 | $135,000 | $172,000 | $240,000 | +11.0% | Potential onset of a new market cycle top. Technology upgrades (e.g., scaling, privacy) and macroeconomic factors influence price. |

| 2030 | $122,000 | $158,000 | $220,000 | -8.1% | Possible market correction as cycle matures; increased competition from altcoins and changing macro conditions. |

| 2031 | $135,000 | $170,000 | $245,000 | +7.6% | Renewed institutional adoption, further regulatory acceptance, and technological advancements set stage for next bull phase. |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is broadly bullish, reflecting continued institutional adoption, particularly following Morgan Stanley’s E*Trade integration. While significant volatility and market corrections remain likely due to cyclical factors, the overall trajectory points to higher average prices as crypto becomes further entrenched in global finance. Conservative minimums account for regulatory setbacks or macroeconomic headwinds, while bullish maximums reflect periods of strong inflows and innovation.

Key Factors Affecting Bitcoin Price

- Institutional adoption via platforms like E*Trade and growing ETF markets.

- Regulatory developments in the US and globally; continued government support or intervention.

- Market cycles, including Bitcoin halving events and speculative bubbles/corrections.

- Technological advancements in Bitcoin (scalability, privacy, security).

- Macro environment: inflation, fiat currency devaluation, and global economic trends.

- Competition from Ethereum, Solana, and emerging altcoins.

- Retail adoption trends and the integration of crypto into traditional finance platforms.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

And there’s more coming down the pipe: Morgan Stanley plans to roll out a unified wallet solution so clients can manage both stocks and digital assets seamlessly within one dashboard (source). Imagine checking your S and P 500 holdings right next to your BTC stack, all under the same login.

This is the kind of integration traders have demanded for years. No more jumping through hoops with unregulated offshore exchanges or sweating over withdrawal delays. Morgan Stanley E*Trade crypto trading brings the speed, reliability, and compliance of a top-tier brokerage to your Bitcoin, Ethereum, and Solana trades. The Zerohash partnership ensures institutional security at every step, think robust custody, real-time compliance checks, and seamless fiat-to-crypto conversion.

How Does This Turbocharge Safe Cryptocurrency Investing?

The days of “wild west” crypto are numbered. With regulated giants like Morgan Stanley entering the arena, expect tighter spreads, deeper liquidity, and instant order execution, all under strict compliance protocols. This isn’t just about making it easier to buy Bitcoin at $113,669.00; it’s about setting a new gold standard for secure ways to buy Bitcoin in the US.

Top Benefits of Trading Crypto with Morgan Stanley E*Trade

-

Institutional-Grade Security: E*Trade leverages Morgan Stanley’s robust security protocols and Zerohash’s digital asset infrastructure, providing a trusted, regulated environment for buying and holding cryptocurrencies like Bitcoin, Ethereum, and Solana.

-

Direct Access to Leading Cryptocurrencies: At launch, clients can trade Bitcoin (BTC) (currently $113,669), Ethereum (ETH), and Solana (SOL)—all within the familiar E*Trade platform.

-

Unified Investment Ecosystem: Seamlessly manage both traditional and digital assets in one place, thanks to E*Trade’s upcoming comprehensive wallet solution for crypto and stocks.

-

Trusted Partnership with Zerohash: The collaboration with Zerohash—a leading crypto infrastructure provider recently valued at over $1 billion—ensures reliable trade execution and custody.

-

Regulatory Confidence: Benefit from Morgan Stanley’s compliance expertise and the evolving, supportive regulatory landscape, giving peace of mind to both new and experienced crypto investors.

For traders who live by speed and discipline, this is a dream scenario. You get direct access to major coins without leaving your trusted brokerage ecosystem, and you never have to compromise on security or regulatory clarity. That’s a massive win whether you’re dollar-cost averaging into BTC or scalping ETH on momentum moves.

What Sets This Apart from Robinhood and Schwab?

While Robinhood and Schwab have made their own crypto plays, Morgan Stanley’s approach is all about depth and integration. The planned wallet solution goes beyond simple buy-and-sell functionality, it aims for a unified experience where digital assets sit alongside traditional holdings. That means seamless portfolio management and faster pivots between asset classes as market conditions evolve.

Plus, with Zerohash’s institutional infrastructure handling the backend, you’re not just getting retail-level access, you’re stepping into a system built for professional-grade reliability.

The Bottom Line: Adapt or Get Left Behind

If you’ve been waiting for a sign that regulated crypto brokerage is here to stay, this is it. With Bitcoin at $113,669.00 and Wall Street all-in on digital assets, mainstream adoption is set to accelerate fast. Whether you’re an active trader or a long-term investor looking for safe cryptocurrency investing options, Morgan Stanley’s E*Trade integration is your green light.

The future belongs to those who move quickly and adapt boldly. Secure your edge now, because when traditional finance meets blockchain innovation at this scale, opportunities won’t wait around.