Crypto traders, brace yourselves! The crypto market crash of 2025 has shaken the industry to its core, wiping out a staggering $300 billion in value in a matter of days. With Bitcoin (BTC) currently trading at $111,680, Ethereum at $4,099.75, and BNB at $1,009.78, volatility is the new normal. But if you play your cards right, this chaos can be your opportunity.

The past few weeks have been a masterclass in market panic: exchange hacks, hedge fund liquidations, and regulatory curveballs have tested even the most seasoned investors. Yet the smart money isn’t running scared – it’s adapting with ironclad risk management strategies designed for this exact moment.

Why Secure Crypto Buying Matters More Than Ever

The 2025 crash has proven that how you buy crypto is as important as what you buy. With leveraged bets unraveling and digital-asset treasuries slashing their Bitcoin purchases (from 64,000 BTC in July to just 12,600 BTC in August), survival depends on discipline and security-first tactics. If you’re looking for actionable ways to buy crypto safely during this storm, these five strategies are non-negotiable.

5 Secure Crypto Buying Strategies for the 2025 Crash

-

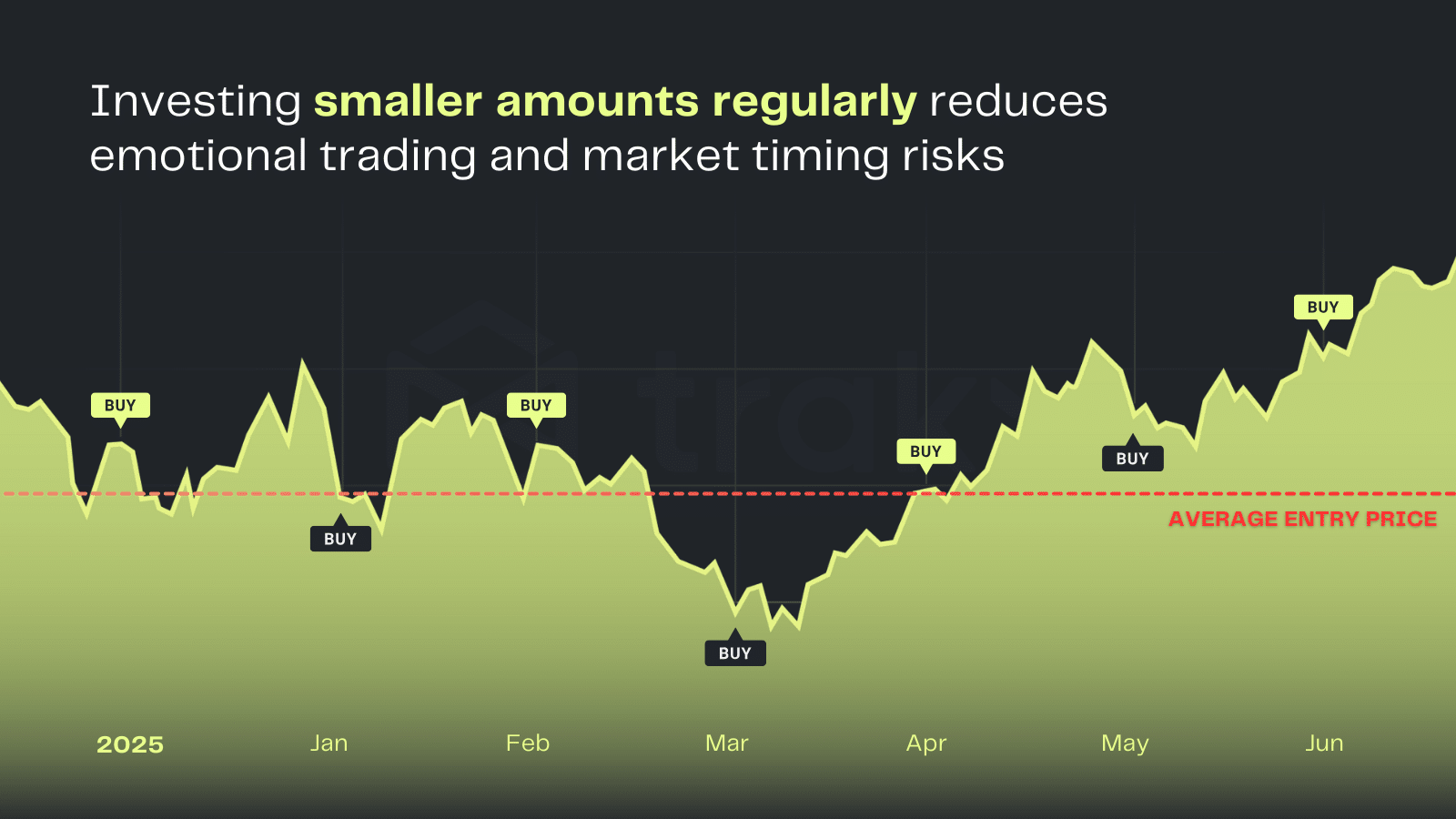

Prioritize Dollar-Cost Averaging (DCA) Over Lump-Sum Buys During Volatility: Instead of investing all at once, spread your purchases by buying fixed amounts of crypto at regular intervals. This helps smooth out price fluctuations—especially crucial with Bitcoin trading at $111,680 and Ethereum at $4,099.75—and reduces the risk of buying at market peaks.

-

Use Reputable, Regulated Exchanges with Proof-of-Reserves and Enhanced Security: Choose established platforms like Coinbase, Kraken, or Binance that offer proof-of-reserves, two-factor authentication, and robust regulatory compliance. This minimizes risks from hacks or insolvency, which have contributed to recent market turmoil.

-

Set Strict Stop-Loss and Take-Profit Orders to Manage Downside Risk: Protect your investments by using stop-loss and take-profit features on exchanges. These automated orders help limit losses and lock in gains during volatile swings, like those recently seen in Bitcoin and Cardano ($0.795777).

-

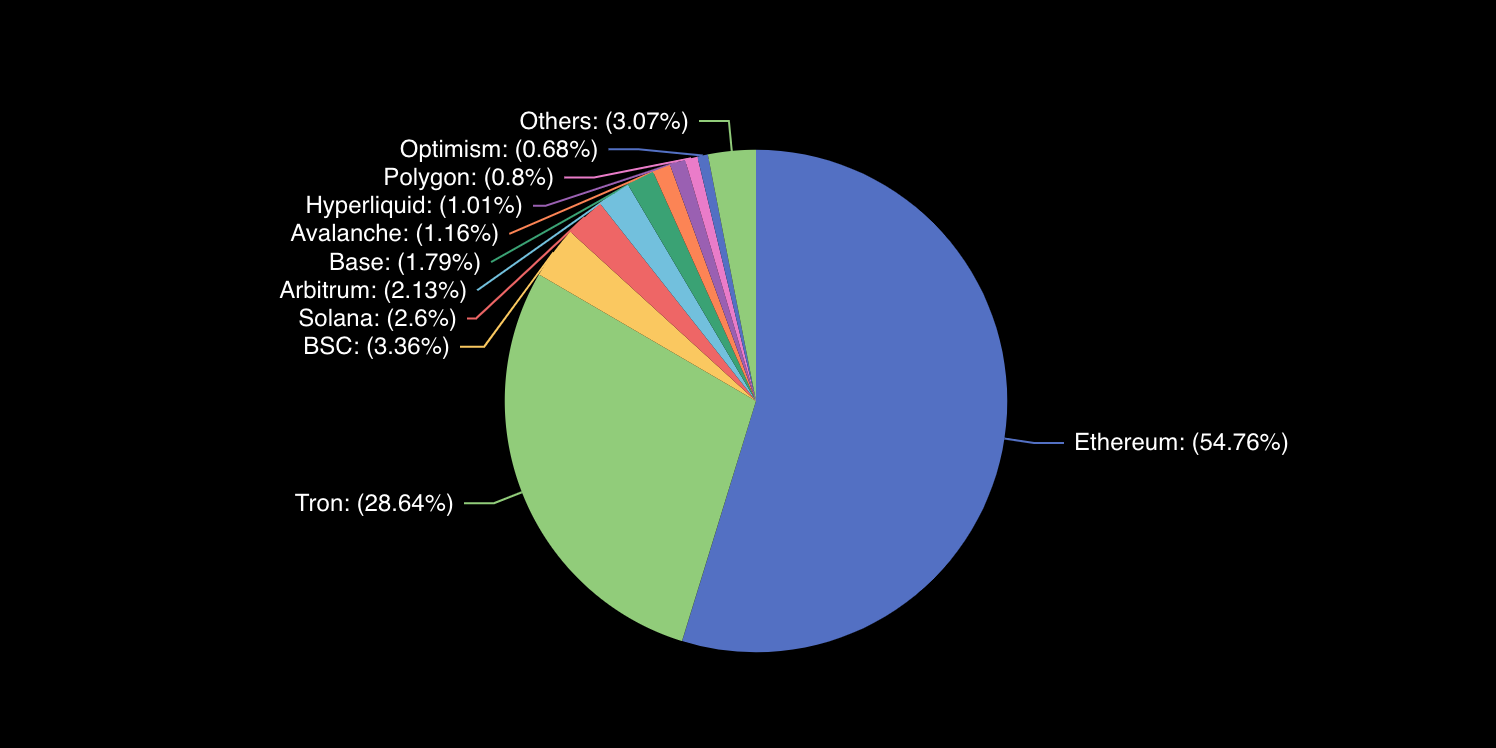

Diversify Holdings Across Multiple Coins and Stablecoins to Mitigate Single-Asset Exposure: Spread your investments among major cryptocurrencies—such as BTC, ETH, BNB, XRP, ADA—and reputable stablecoins like USDT or USDC. Diversification helps cushion your portfolio against sharp drops in any single asset.

-

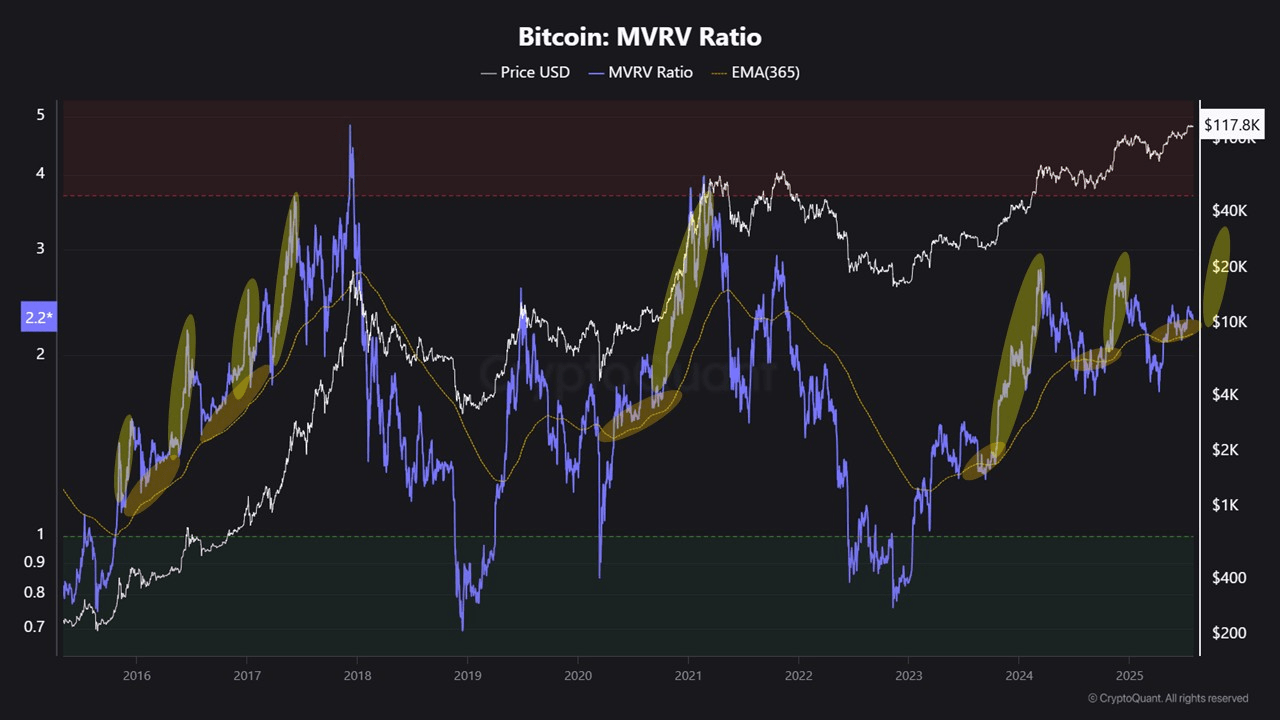

Monitor On-Chain Metrics and Treasury Movements for Early Warning Signs: Use tools like CryptoQuant or Glassnode to track large transfers, exchange inflows, and treasury activity. Sudden drops in Bitcoin treasury buying—like the decrease from 64,000 BTC to 12,600 BTC in August 2025—can signal increased market risk.

#1: Prioritize Dollar-Cost Averaging (DCA) Over Lump-Sum Buys During Volatility

Lump-sum buys might feel tempting when prices nosedive – but history shows that trying to “catch the bottom” is a losing game for most traders. Instead, embrace Dollar-Cost Averaging (DCA): invest a fixed amount at regular intervals regardless of price swings. This approach smooths out volatility and reduces emotional decision-making – exactly what you need when markets are swinging wildly between highs like $112,340 and lows like $109,256 in a single day.

#2: Use Reputable, Regulated Exchanges with Proof-of-Reserves and Enhanced Security

The recent exchange hack that fueled the latest sell-off was a brutal reminder: not all platforms are created equal. Stick with exchanges that are fully regulated in your jurisdiction and provide transparent proof-of-reserves audits. Enhanced security features such as multi-factor authentication and withdrawal whitelists are now table stakes for anyone serious about protecting their assets from both hackers and insolvency scares.

#3: Set Strict Stop-Loss and Take-Profit Orders to Manage Downside Risk

If you’re not using stop-losses or take-profit orders in this environment, you’re flying blind! Automated exit points help you lock in gains or limit losses without having to monitor prices every second – crucial when Bitcoin can swing by thousands within hours. Setting these orders based on your personal risk tolerance can mean the difference between surviving a flash crash or getting wiped out alongside overleveraged traders.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook post-2025 crypto crash, factoring in market volatility, adoption, and regulatory shifts.

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $80,000 | $115,000 | $140,000 | +3% | Continued volatility post-2025 crash; regulatory uncertainty persists but institutional interest stabilizes prices. |

| 2027 | $90,000 | $128,000 | $170,000 | +11% | Improved regulatory clarity and gradual macro recovery; Bitcoin adoption increases, but market remains cautious. |

| 2028 | $100,000 | $145,000 | $200,000 | +13% | New cycle begins with halving effects, increased adoption in emerging markets, and growing use cases. |

| 2029 | $120,000 | $167,000 | $245,000 | +15% | Bullish sentiment driven by global inflation hedging and increased integration into financial systems. |

| 2030 | $140,000 | $192,000 | $295,000 | +15% | Mainstream acceptance accelerates, ETFs and institutional products expand, but tech/regulatory risks linger. |

| 2031 | $160,000 | $215,000 | $340,000 | +12% | Matured market, high competition from altcoins, but Bitcoin retains store-of-value status; volatility moderates. |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is cautiously optimistic, reflecting recovery and growth after the 2025 crash. While short-term volatility and regulatory risks remain, long-term prospects are supported by adoption, technological development, and increasing institutional participation. The minimum and maximum price ranges account for both bearish and bullish scenarios, with average prices showing steady progression.

Key Factors Affecting Bitcoin Price

- Global macroeconomic conditions and monetary policy

- Regulatory developments in major economies (U.S., EU, Asia)

- Institutional adoption and capital flows

- Network security and scalability improvements

- Emergence of competing digital assets and technologies

- Market sentiment and investor risk appetite

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ready to level up your crypto buying game? The next two strategies will make sure you’re not just surviving but thriving no matter how wild the market gets. . .

#4: Diversify Holdings Across Multiple Coins and Stablecoins to Mitigate Single-Asset Exposure

Concentration is a killer in this market. The $300 billion wipeout didn’t just hit Bitcoin or Ethereum, it dragged down the entire crypto landscape. That’s why smart buyers are spreading risk across multiple assets, including top coins like BTC, ETH, BNB, XRP, and ADA. Don’t sleep on stablecoins either; they offer a safe harbor during extreme volatility and can be quickly deployed when new opportunities arise. By diversifying, you shield yourself from catastrophic losses if one asset tanks unexpectedly.

#5: Monitor On-Chain Metrics and Treasury Movements for Early Warning Signs

Want to get ahead of the next big move? Start tracking on-chain data and major treasury activities. In 2025, one of the earliest red flags was the sudden plunge in Bitcoin treasury buying, from 64,000 BTC in July to just 12,600 BTC in August (source). Watching wallet flows, exchange reserves, or whale activity can give you a crucial edge, letting you spot panic selling or accumulation before headlines hit. Combine these insights with your technical analysis for a powerful one-two punch against market chaos.

Turning Chaos Into Opportunity: Secure Buying Mindset for 2025

The big lesson from this year’s crash? Speed alone isn’t enough, discipline and adaptability separate winners from losers. If you want to buy crypto securely during periods like this:

- Stick to your DCA plan, no matter how wild the headlines get.

- Avoid shady exchanges – proof-of-reserves is now non-negotiable.

- Automate your exits with stop-losses and take-profits so emotion never dictates your moves.

- Diversify relentlessly, even when tempted by outsized gains in one coin.

- Stay data-driven: let on-chain metrics inform your decisions instead of FOMO or fear.

This isn’t just about surviving the crypto market crash 2025. It’s about building habits that will keep your capital safe through every future shakeout. If you play it smart today, using proven risk management strategies, you’ll be ready to seize tomorrow’s opportunities while others are still licking their wounds.