Solana’s rise from an experimental blockchain to a leading smart contract platform has been nothing short of remarkable. Now, with the SEC’s newly streamlined ETF approval process, the market is on the verge of a watershed moment: a Solana ETF could be approved as early as July 2025. This would mark a turning point for both institutional and retail investors seeking secure and easy exposure to digital assets, without the technical hurdles of managing private keys or navigating unregulated exchanges.

Solana ETF Approval: Why 2025 Is Different

The landscape for crypto ETFs has shifted dramatically. In September 2025, the SEC adopted new rules that allow major U. S. exchanges like NYSE and Nasdaq to list spot cryptocurrency ETFs through generic listing standards, slashing approval times from eight months to just 75 days (source). Bloomberg Intelligence now pegs the odds of Solana ETF approval at 90% this year (source). The SEC’s request for updated S-1 filings from fund issuers signals that regulatory hurdles are being cleared faster than ever.

This regulatory clarity is critical for mainstream adoption. ETFs are familiar vehicles for investors who want regulated, liquid access to markets, think gold or S and P 500 funds. A Solana ETF would offer these same benefits, allowing investors to buy SOL exposure through traditional brokerage accounts, IRAs, or even retirement plans.

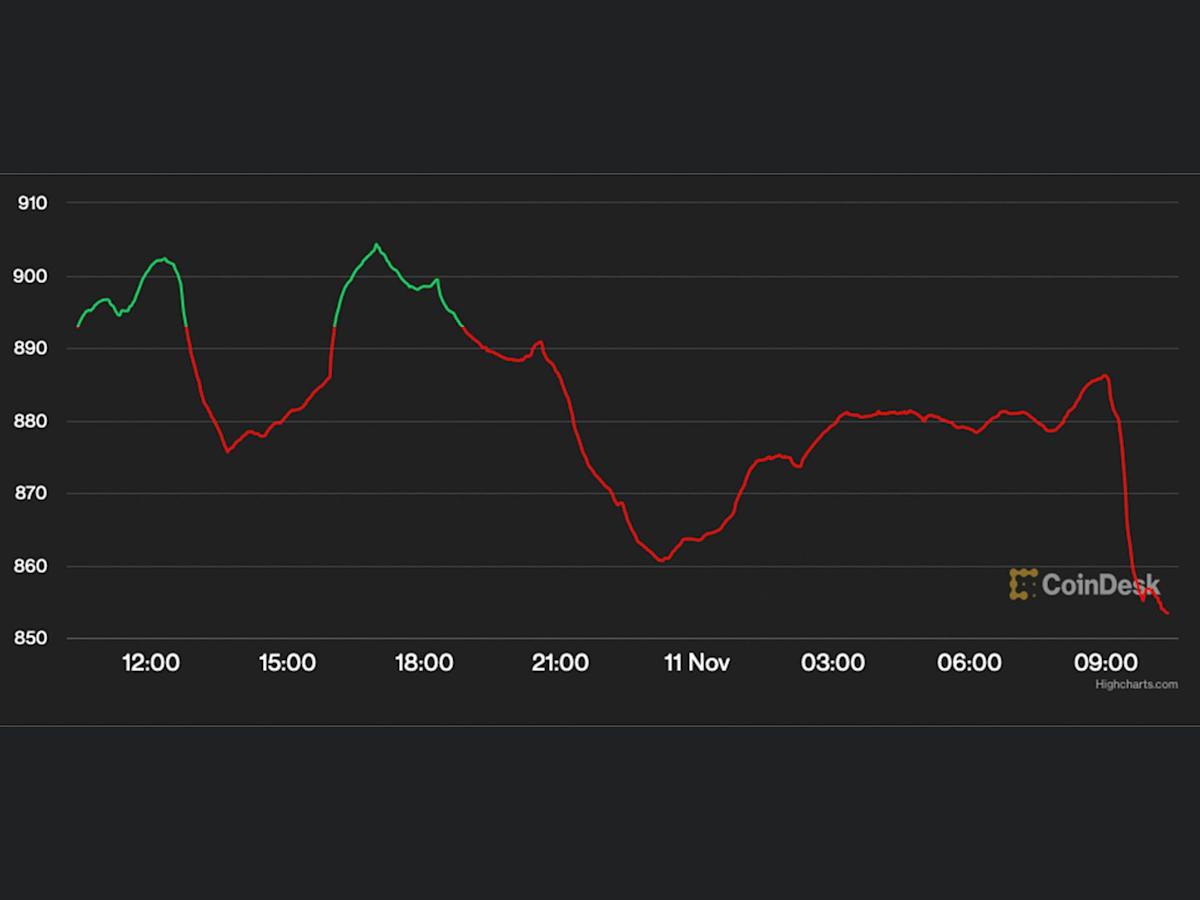

Current Market Data: SOL Price Climbs as Anticipation Builds

As of October 1,2025, Binance-Peg SOL (SOL) trades at $218.31, up $12.12 ( and 0.0588%) over the past 24 hours, with intraday highs reaching $218.98 and lows at $204.47. This price action reflects not only the broader crypto rally but also specific anticipation around ETF approval and strong institutional inflows, over $291 million in recent weeks according to Brave New Coin.

The prospect of a U. S. -listed Solana spot ETF is already attracting sophisticated capital and retail traders alike. If approved, analysts expect surging demand for SOL shares due to easier access via regulated platforms, a shift that could further boost liquidity and price stability.

Solana (SOL) Price Prediction 2026-2031 Post-ETF Approval

Professional forecasts based on ETF approval, institutional inflows, and evolving market dynamics (2025 baseline: $218.31/SOL)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg vs. Prior Year) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $185.00 | $265.00 | $380.00 | +21.4% | Post-ETF inflows stabilize SOL price; potential retrace after initial hype, but strong institutional support maintains upward trend. |

| 2027 | $235.00 | $320.00 | $460.00 | +20.8% | ETF-driven adoption grows, more staking and DeFi use cases expand demand; regulatory clarity boosts investor confidence. |

| 2028 | $280.00 | $375.00 | $540.00 | +17.2% | Mainstream adoption accelerates, new scaling upgrades released; competition from other L1s tempers max upside. |

| 2029 | $315.00 | $420.00 | $650.00 | +12.0% | Sustained institutional presence, possible new ETF products (leveraged/inverse); macro cycles could lead to volatility. |

| 2030 | $350.00 | $470.00 | $780.00 | +11.9% | Global crypto adoption rises, Solana ecosystem matures, but regulatory headwinds or tech risks may cap upside. |

| 2031 | $390.00 | $510.00 | $890.00 | +8.5% | SOL seen as a major institutional asset; market matures, growth rates moderate, but long-term value remains strong. |

Price Prediction Summary

Solana’s price outlook post-ETF approval is strongly bullish, with significant institutional inflows expected to drive higher valuations. While initial volatility may occur as the market digests ETF launches, overall adoption and usage are projected to rise steadily. By 2031, SOL could reach an average price of $510, with potential peaks approaching $900 in bullish scenarios. However, the market will remain subject to broader crypto cycles, competition, and evolving regulations.

Key Factors Affecting Solana Price

- ETF approval and timing, driving institutional and retail inflows

- Regulatory clarity and ongoing SEC stance on crypto ETFs

- Solana network upgrades, scalability, and ecosystem growth

- Competition from Ethereum, emerging L1s, and new technologies

- Macroeconomic conditions and global crypto adoption rates

- Potential for new ETF variants (e.g., staking, leveraged)

- Security, network reliability, and developer activity on Solana

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

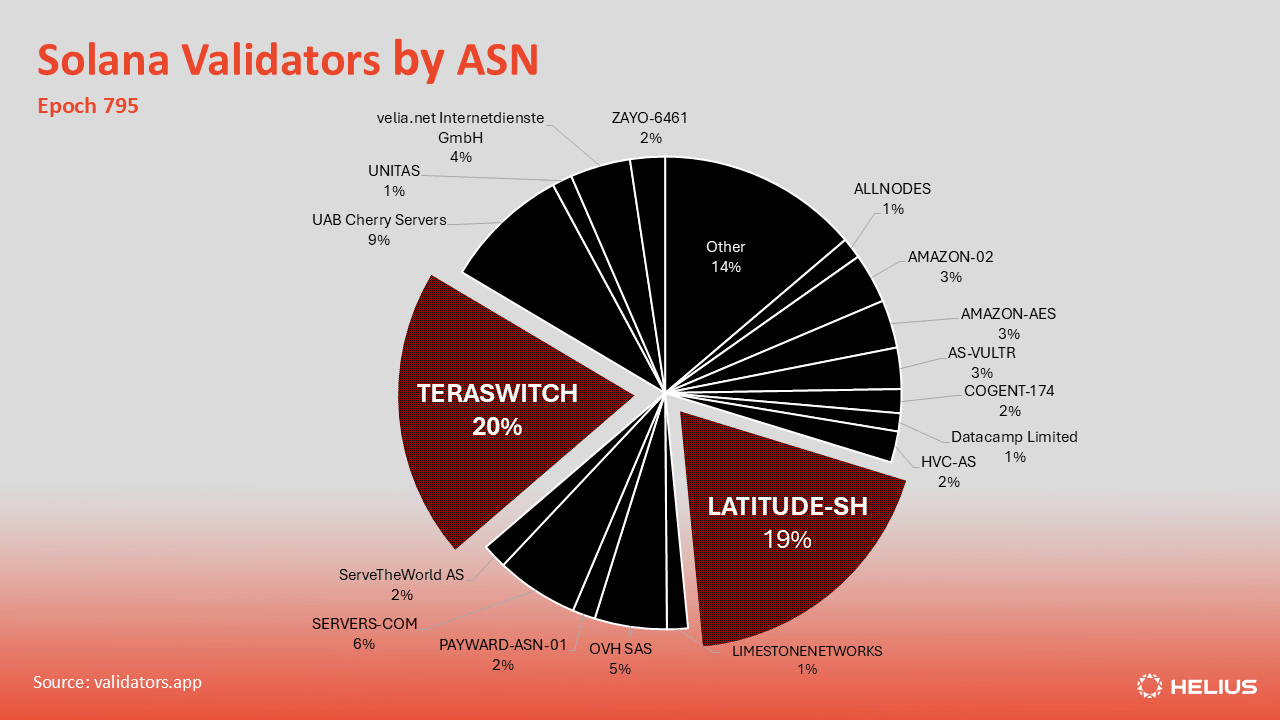

The Macro Case: Why Solana Stands Out Among Crypto ETFs

The pending Solana ETPs are not just about convenience, they signal a broader shift in how digital assets are integrated into diversified portfolios. Compared with legacy players like Bitcoin or Ethereum, Solana offers unique value propositions: ultra-fast transaction speeds, low fees, and an ecosystem that’s rapidly expanding into DeFi, NFTs, and Web3 infrastructure.

For investors weighing Solana vs Ethereum, the coming months will be instructive. While Ethereum remains dominant in total value locked (TVL) and developer activity, Solana’s technical upgrades and robust institutional flows position it as a credible alternative, especially if its ETF receives regulatory blessing ahead of other altcoins.

Why Investors Are Excited for Solana ETFs in 2025

-

Regulated and Secure Exposure: Solana ETFs will be listed on major U.S. exchanges like the NYSE and Nasdaq, offering investors a secure, regulated way to gain exposure to Solana without managing private keys or wallets.

-

Simplified Buying Process: Investors can purchase Solana ETFs through established brokerage platforms such as Charles Schwab, Fidelity, and Robinhood, making crypto investing as easy as buying traditional stocks.

-

Enhanced Market Integrity: SEC approval and oversight increase investor confidence, as ETFs must meet strict compliance and reporting standards, reducing risks associated with unregulated crypto exchanges.

-

Institutional Adoption and Liquidity: With $291 million in recent institutional inflows, Solana is attracting significant attention from major funds like Grayscale and VanEck, which can boost liquidity and price stability.

-

Potential for Staking Rewards: Some proposed Solana ETFs are exploring integrated staking mechanisms, allowing investors to potentially earn passive income through regulated fund structures.

-

Transparent Pricing and Performance: Solana ETFs will track the spot price of SOL—currently $218.31—providing clear, real-time valuation and performance data via trusted financial platforms like Bloomberg and Yahoo Finance.

Simplifying Secure Cryptocurrency Purchases

A core appeal of ETFs is security, no need for self-custody or worrying about exchange hacks. With a regulated Solana ETF on platforms like NYSE or Nasdaq, buying SOL becomes as straightforward as purchasing Apple stock or an S and P index fund. This evolution could bring millions of new participants into crypto markets who were previously deterred by complexity or perceived risk.

Looking ahead, the ETF structure also introduces robust safeguards for investors. Fund assets are held with qualified custodians, and regulatory oversight ensures transparency in pricing, reporting, and operations. For those who have hesitated to buy Solana securely due to concerns about wallet management or exchange solvency, these protections are game-changing.

Crucially, the SEC’s emphasis on clear procedures for in-kind redemptions and staking mechanisms in S-1 filings could set Solana ETFs apart from earlier crypto ETPs. If staking rewards are passed through to ETF holders, this would further align the product with Solana’s native yield-generating features, potentially making it more attractive than spot funds for Bitcoin or Ethereum.

How to Buy Solana: What Changes with an ETF?

For most investors, the arrival of a Solana ETF in 2025 will mark a fundamental shift in how they access digital assets. Instead of navigating crypto exchanges or worrying about private keys, you’ll be able to purchase shares via your existing brokerage account, whether you’re using Fidelity, Charles Schwab, or a mobile-first app. This simplicity radically lowers the barrier to entry for individuals and institutions alike.

Key Steps to Buy Solana Securely via an ETF in 2025

-

Research Approved Solana ETFs: Begin by identifying SEC-approved Solana ETFs listed on major U.S. exchanges such as NYSE, Nasdaq, or Cboe Global Markets. Check official ETF provider websites (e.g., VanEck, BlackRock) and the SEC’s EDGAR database for the latest filings and approval status.

-

Open an Account with a Regulated Broker: Choose a reputable, FINRA-registered brokerage like Charles Schwab, Fidelity, Robinhood, or TD Ameritrade that offers access to U.S.-listed ETFs. Complete all KYC (Know Your Customer) and security verification steps for account protection.

-

Fund Your Brokerage Account Securely: Deposit funds using secure methods such as wire transfer, ACH, or bank transfer. Use strong passwords and enable two-factor authentication to safeguard your account.

-

Place an Order for the Solana ETF: Search for the official ticker symbol of the approved Solana ETF (e.g., VanEck Solana Trust or BlackRock Solana ETF) on your broker’s platform. Decide between market or limit orders based on your investment strategy and execute the purchase.

-

Monitor Performance and Stay Informed: Track your Solana ETF’s performance using tools on your broker’s dashboard or financial platforms like Bloomberg and Morningstar. Stay updated on Solana’s price (currently $218.31 as of October 1, 2025) and ETF news for ongoing security and market developments.

As ETFs become available on mainstream platforms, expect liquidity and trading volumes to increase further. This should help dampen volatility and improve price discovery, two persistent challenges in crypto markets. For those seeking exposure as part of a diversified portfolio or retirement plan, this is a significant leap forward.

Macro perspective: The expedited approval process for crypto ETFs is not just about faster access, it signals that digital assets are being woven into the fabric of traditional finance. As regulatory hurdles fall away and products like Solana ETPs proliferate, we’re likely witnessing the early stages of mass adoption.

Risks and Considerations: What Investors Should Watch

No investment is without risk, even as Solana regulation matures. While an ETF structure brings greater oversight and security, it does not eliminate market volatility or technology risks inherent to blockchain networks. Investors should remain mindful of potential smart contract bugs, network outages (which have impacted Solana before), or broader macroeconomic headwinds affecting digital assets globally.

Regulatory clarity can also evolve quickly; what seems certain today may change if policymakers revisit crypto taxation or securities laws. Diversification remains essential, no single asset should dominate your portfolio, even with new secure cryptocurrency purchase options on offer.

Final Thoughts: A New Era for Crypto Investing

The imminent approval of a U. S. -listed Solana ETF at current prices around $218.31 stands as both a milestone for digital asset integration and a bellwether for future innovation in financial markets. If you’ve been waiting for an easy and secure way to gain exposure to blockchain growth stories beyond Bitcoin and Ethereum, 2025 is poised to deliver that opportunity, with regulatory guardrails firmly in place.