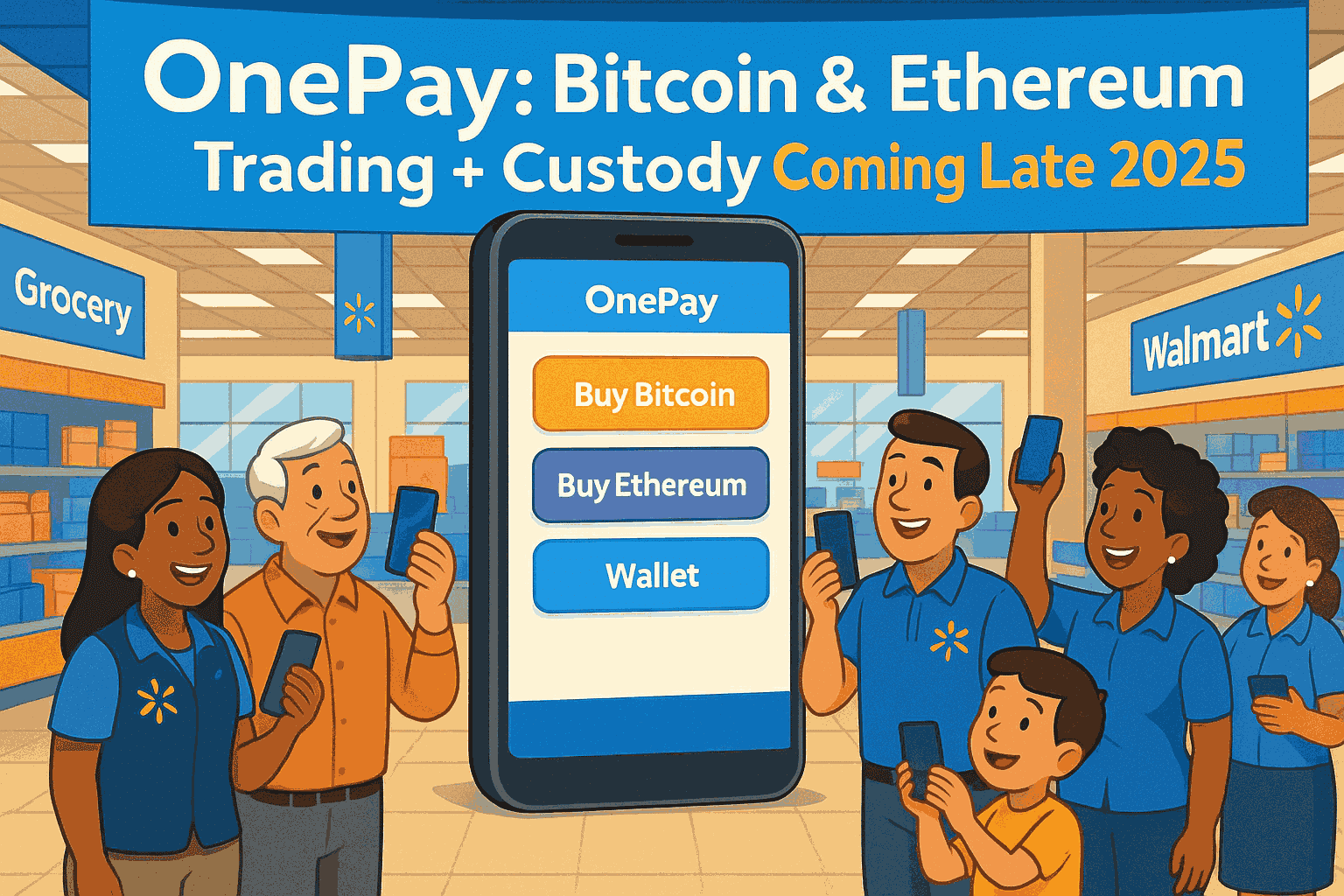

Walmart is making a bold move into digital finance: its fintech arm, OnePay, is set to roll out Bitcoin and Ethereum trading and custody services to millions of U. S. users by the end of 2025. This announcement comes as Bitcoin holds steady at $123,303.00, up nearly 0.90% in the past 24 hours, while Ethereum trades at $4,495.39. The integration signals a significant shift in how everyday Americans can access and use crypto.

Walmart’s Entry: Why This Matters for Mainstream Crypto Adoption

For years, buying crypto was an exercise in navigating unfamiliar exchanges and complicated wallets. Now, with OnePay’s upcoming launch of direct Bitcoin and Ethereum trading, users will be able to buy, sell, and hold these assets right inside their mobile banking app. This isn’t just about convenience – it’s about trust and reach. Walmart touches nearly every American household; its entry into crypto could be the catalyst that pushes digital assets even further into the mainstream.

OnePay isn’t just another fintech startup. Backed by Walmart’s vast customer base and retail network, it aims to offer a seamless bridge between traditional banking features (like high-yield savings accounts or credit cards) and new digital asset services. According to Brave New Coin, users will also have the ability to convert their crypto holdings into cash balances for purchases at Walmart stores or to pay off credit card balances – a practical use case that most current crypto apps don’t yet offer.

The Competitive Landscape: OnePay vs PayPal, Venmo and Cash App

This move places OnePay squarely in competition with established fintech giants like PayPal, Venmo, and Cash App – all of which already offer some form of cryptocurrency trading. But OnePay brings two unique advantages: direct retail utility at Walmart stores and integration with a wider suite of personal finance tools within one app.

The technical infrastructure behind these features is powered by Zerohash, a Chicago-based crypto infrastructure provider recently backed by Morgan Stanley and Interactive Brokers after raising $104 million in funding. While this partnership ensures robust back-end support for secure cryptocurrency buying and custody, users should note that Zerohash’s services do not carry FDIC or SIPC insurance protection. In other words: while you’ll enjoy easy access to digital assets through OnePay, your holdings won’t be insured against loss if something goes wrong.

What Everyday Crypto Buyers Need to Know Right Now

If you’re new to retail crypto investing or looking for more accessible ways to diversify your portfolio, Walmart’s move is worth paying attention to. Here are some key takeaways:

Key Benefits of Using Walmart’s OnePay for Crypto Beginners

-

Seamless Integration with Everyday Banking: OnePay allows users to buy, sell, and hold Bitcoin and Ethereum directly within the same app used for checking, savings, and payments—no need for separate crypto exchanges or wallets.

-

Direct Spending at Walmart Stores: Users can convert Bitcoin and Ethereum holdings into cash balances to make purchases at Walmart locations or pay off Walmart credit card balances, bridging digital assets with real-world spending.

-

User-Friendly Experience for Beginners: OnePay is designed for mainstream users, offering simple onboarding and intuitive navigation compared to traditional crypto exchanges, making it easier for first-time buyers to get started.

-

Trusted Infrastructure and Security: Crypto trading and custody are powered by Zerohash, a regulated and established crypto infrastructure provider recently backed by Morgan Stanley and Interactive Brokers, adding credibility and security for new users.

-

Competitive with Leading Fintech Platforms: OnePay’s crypto features rival those of PayPal, Venmo, and Cash App, giving users access to the same modern financial tools within a single, Walmart-backed app.

-

Real-Time Market Access: As of October 6, 2025, Bitcoin is priced at $123,303 and Ethereum at $4,495.39, allowing users to track and trade these assets with up-to-date pricing directly in the app.

- Simplicity: Buy Bitcoin or Ethereum as easily as topping up your debit card balance.

- Practicality: Instantly convert crypto into spendable cash at checkout or pay off your credit card within the same app.

- Mainstream confidence: Leverage Walmart’s reputation for security and reliability when entering the world of digital assets.

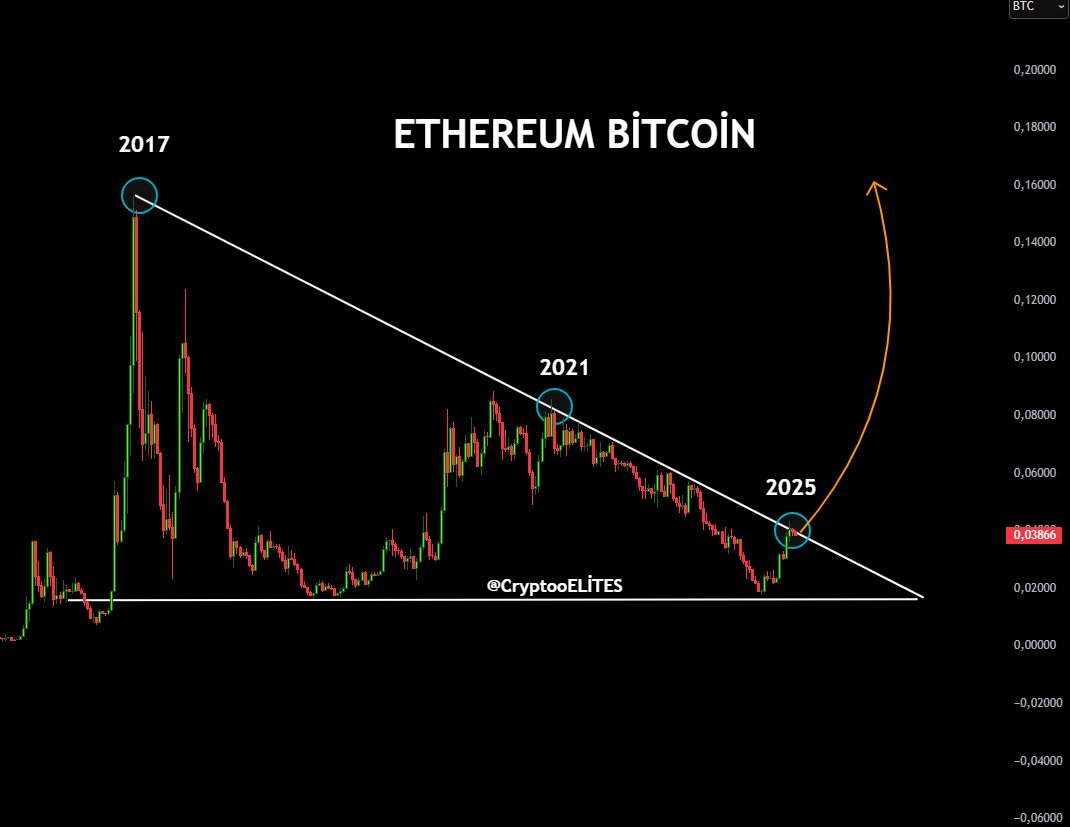

This democratization of access is especially important as more Americans look for alternative investment options outside traditional stocks or bonds. With Bitcoin currently priced at $123,303.00 (up 0.90% today) and Ethereum at $4,495.39, mainstream platforms like OnePay could make it easier than ever for everyday buyers to participate in these markets without steep learning curves or specialized accounts.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook based on current market trends, adoption, and integration of crypto trading in mainstream fintech apps like Walmart’s OnePay (as of October 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-Over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $132,000 | $165,000 | +7% | Continued institutional adoption and mainstream fintech integration, but possible regulatory headwinds and post-halving consolidation. |

| 2027 | $110,000 | $144,000 | $180,000 | +9% | Increased retail access via apps like OnePay, but potential for higher volatility with macroeconomic uncertainties. |

| 2028 | $125,000 | $162,000 | $210,000 | +12.5% | Bullish cycle likely as next Bitcoin halving approaches; improved infrastructure and ETF expansion drive demand. |

| 2029 | $140,000 | $182,000 | $240,000 | +12% | Mainstream payment integration and global adoption, but possible profit-taking and market corrections. |

| 2030 | $155,000 | $205,000 | $275,000 | +12.6% | Broad institutional acceptance, regulatory clarity, and possible banking partnerships accelerate price appreciation. |

| 2031 | $175,000 | $230,000 | $310,000 | +12.2% | Bitcoin matures as a global asset, but cycle volatility persists. Potential for both new all-time highs and sharp corrections. |

Price Prediction Summary

Bitcoin is poised for steady growth through 2031, driven by mainstream adoption (such as Walmart’s OnePay integration), increasing institutional participation, and growing use as a store of value. However, the market will likely experience significant volatility, with periods of consolidation and sharp corrections alongside bullish cycles. Regulatory clarity, technological advancements, and broader financial integration will be key in shaping BTC’s price trajectory.

Key Factors Affecting Bitcoin Price

- Walmart’s OnePay and similar fintech app integrations expanding retail access and utility for Bitcoin.

- Continued institutional and corporate adoption, including ETFs and treasury allocations.

- Potential for increased regulatory scrutiny in the U.S. and globally, which could introduce volatility.

- Upcoming Bitcoin halvings, which historically drive supply shocks and bullish cycles.

- Competition from alternative cryptocurrencies and new financial technologies.

- Macro-economic factors such as inflation, interest rates, and global economic stability.

- Advancements in Bitcoin scaling solutions and interoperability with traditional finance.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Still, it’s crucial for new users to understand the unique risks and limitations of crypto investing within fintech apps. Unlike traditional bank deposits, digital assets held via OnePay’s partner Zerohash are not insured by FDIC or SIPC. This means that if Zerohash were to experience a technical failure or security breach, your entire crypto balance could be at risk. For those prioritizing safety, it’s wise to keep only as much in-app as you’re comfortable potentially losing.

Navigating Security and Regulatory Considerations

With regulatory scrutiny on fintechs intensifying, OnePay’s move into crypto trading raises important questions about compliance and consumer protection. Not all states will have access to these features at launch due to varied local regulations. Users should carefully review their state’s eligibility and stay updated on policy changes that may affect their ability to buy or sell Bitcoin and Ethereum through the app.

![]()

On the technical side, Zerohash’s institutional backing from firms like Morgan Stanley adds credibility, but also highlights the growing intersection between Wall Street and Main Street finance. This partnership could set a precedent for other major retailers contemplating similar integrations in the coming years.

How Will This Shape Retail Crypto Investing?

The broader impact of Walmart’s entry into crypto may be felt in increased competition among fintechs to lower fees, improve user experience, and expand educational resources for retail investors. With over 90% of Americans living within 10 miles of a Walmart store, OnePay has the potential to introduce digital assets to demographics previously underserved by existing platforms.

It’s also a pivotal moment for mainstream crypto adoption. As more household brands offer secure cryptocurrency buying options directly integrated with daily spending tools, digital assets will move further away from being niche investments toward becoming part of everyday financial life.

Tips for Getting Started with Crypto on OnePay

For anyone considering their first purchase:

- Start small – Test out buying a small amount of Bitcoin or Ethereum before making larger investments.

- Double-check fees – Compare transaction costs with other platforms like PayPal or Cash App.

- Enable two-factor authentication – Secure your account with extra verification steps.

- Stay informed – Follow updates from both Walmart and regulators regarding new features or changes in service availability.

The bottom line: Whether you’re drawn by simplicity, retail utility, or an interest in diversifying your portfolio beyond stocks and bonds, Walmart’s OnePay crypto integration is likely to reshape how Americans approach digital assets. As always, invest thoughtfully, consider both opportunity and risk as you explore this new frontier in finance.