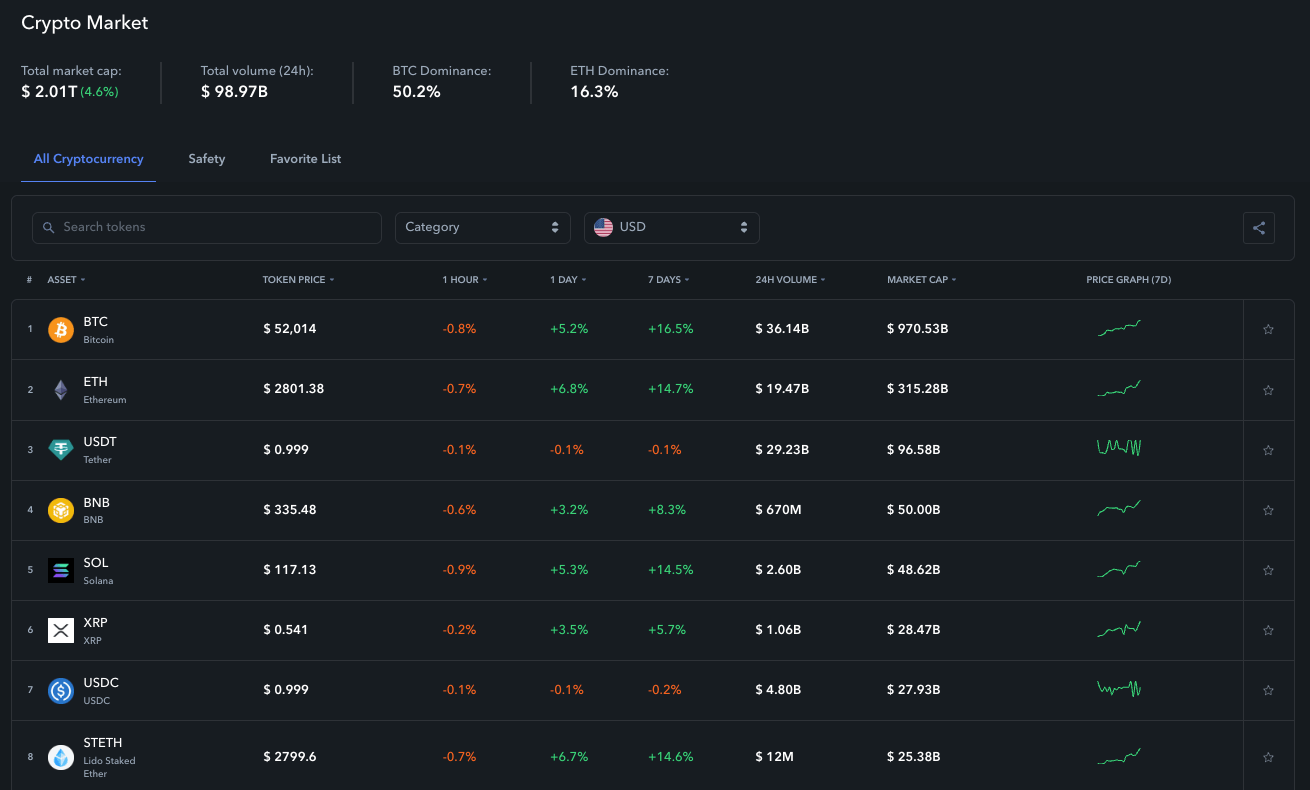

On October 10,2025, the global crypto landscape shifted dramatically. President Donald Trump’s announcement of a 100% tariff on all Chinese imports, effective November 1, sent shockwaves through financial markets. The immediate aftermath was historic: over $19 billion in crypto positions were liquidated within 24 hours, marking the largest single-day wipeout in digital asset history. Bitcoin (BTC) plunged to $104,782 before partially recovering to $115,185 as of October 12. Ethereum (ETH) mirrored this volatility, dropping to $3,637 before rebounding to $4,146.24.

How the Trade War Escalation Sparked a Crypto Crash

This wasn’t just another headline-driven dip. The scale and speed of the sell-off caught even seasoned investors off guard. The trigger: Trump’s aggressive tariff response to China’s rare earth export restrictions, a move that reignited full-scale trade war fears and rattled risk assets worldwide. As traditional markets tumbled, crypto – often considered both a hedge and a high-beta risk asset – became ground zero for panic-driven liquidations.

Within hours of the tariff announcement, major exchanges saw cascading forced sales as leveraged traders were caught offside. Over 1.66 million traders were liquidated, according to Yahoo Finance, with long positions bearing the brunt of the pain. Bitcoin’s swift fall below $120,000 was a psychological blow that accelerated automated selling across exchanges and DeFi protocols alike.

Bitcoin Holds Above $115,000 After Massive Liquidations

The dust has only begun to settle. As of October 12, Bitcoin trades at $115,185, while Ethereum sits at $4,146.24. These numbers matter – they reflect not just a recovery from panic lows but also ongoing uncertainty as investors digest macroeconomic risks.

The sheer magnitude of liquidations suggests that leverage had reached unsustainable levels heading into this event. According to Business Today, this was an unprecedented flush-out for both retail speculators and institutional whales. Yet some see opportunity amid chaos: as one analyst told Times of India, sharp corrections can “reset” markets for more sustainable growth over time.

DeFi Platforms Prove Resilient Amid Exchange Outages

While centralized exchanges buckled under trading volumes and outages during peak volatility, decentralized finance (DeFi) platforms largely remained operational and stable (CoinCentral). This resilience is now fueling debate over whether self-custody and DeFi protocols offer safer harbors during systemic shocks.

DeFi Stability vs. Exchange Outages During Crypto Crashes

-

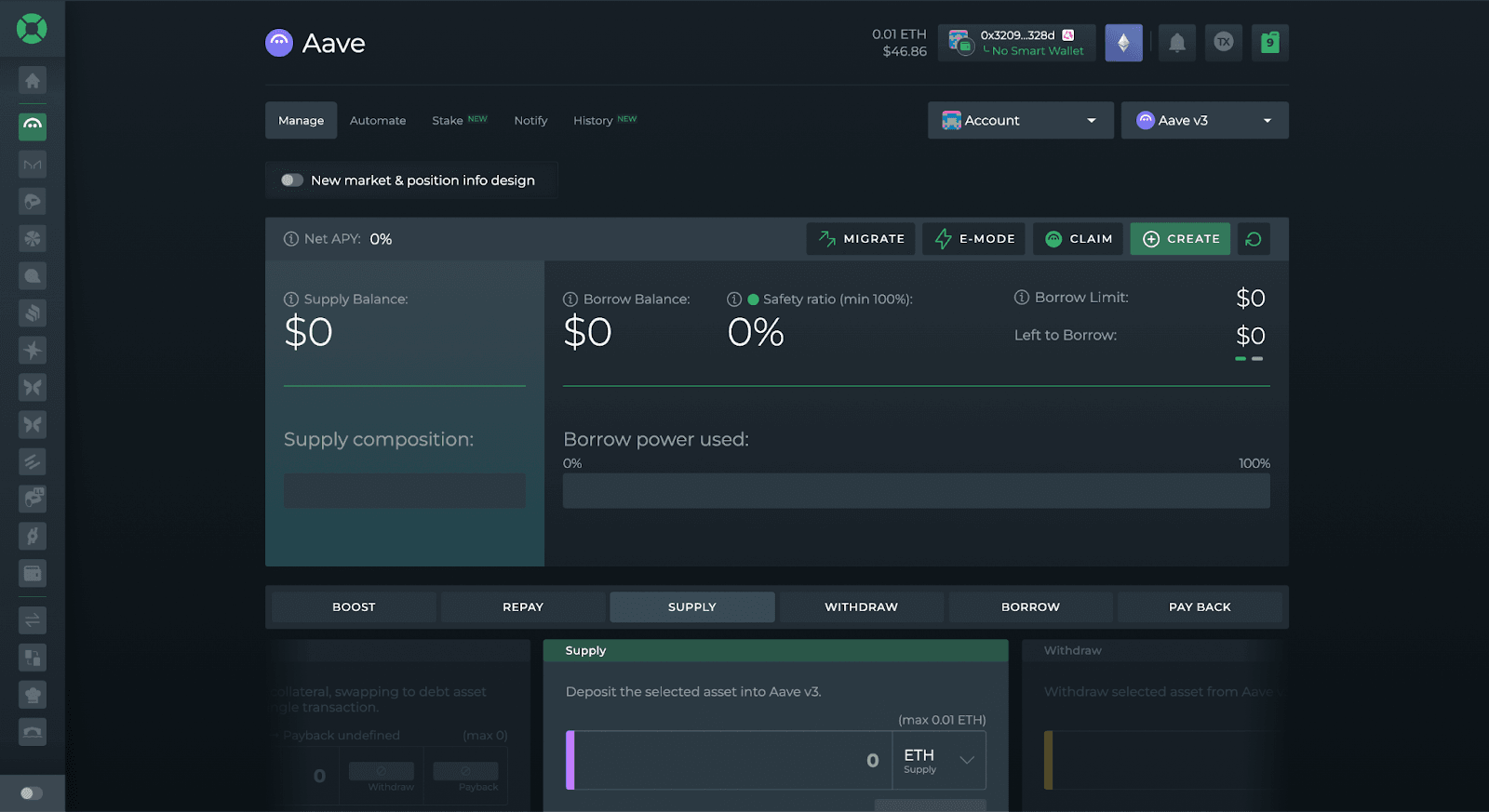

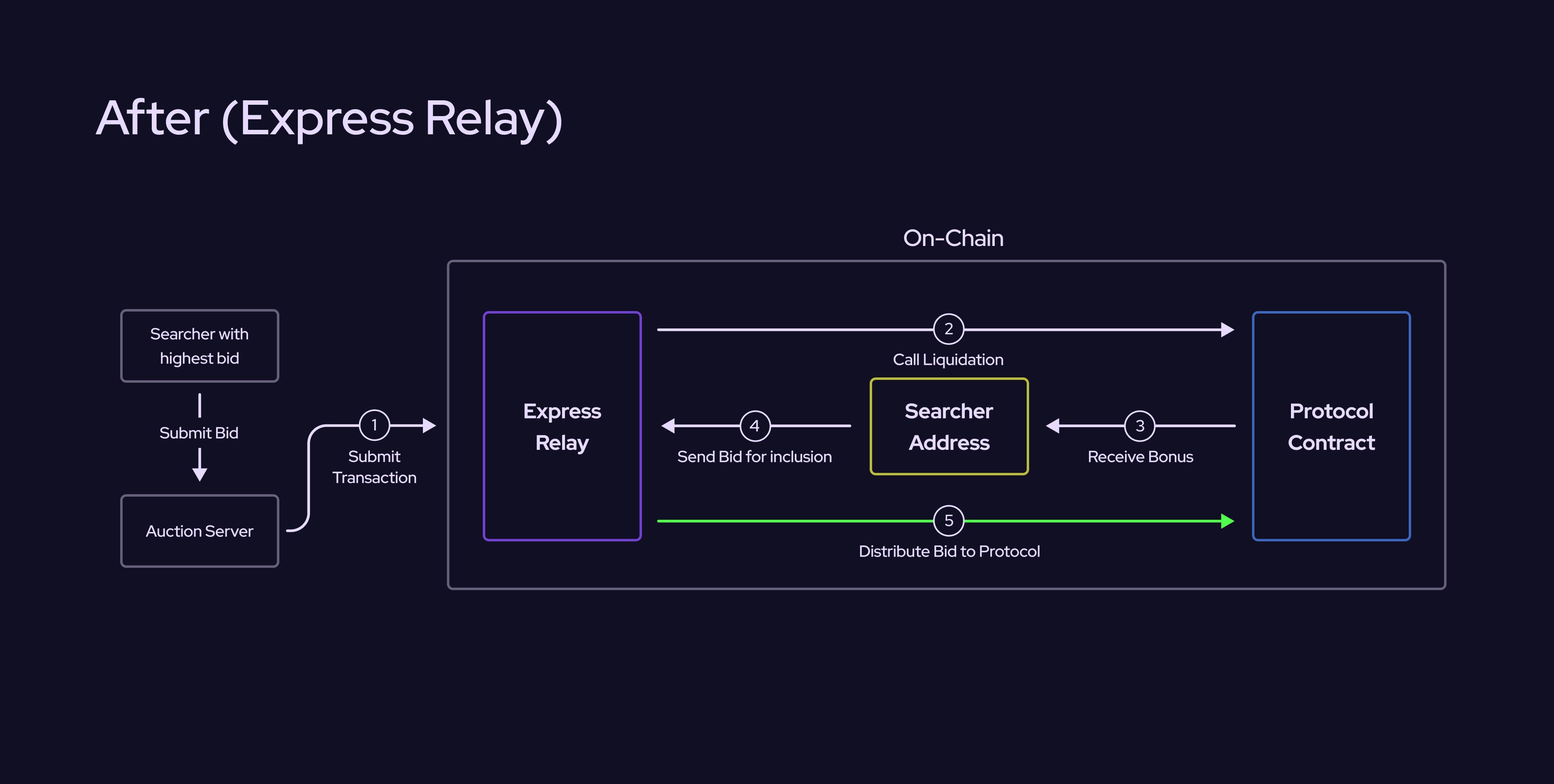

DeFi Platforms Remain Operational: Leading DeFi protocols like Aave and Compound continued to process transactions and liquidations automatically, even as Bitcoin fell to $104,782 and $19 billion was wiped out. Their decentralized, on-chain architecture prevented downtime and allowed users to access funds throughout the crash.

-

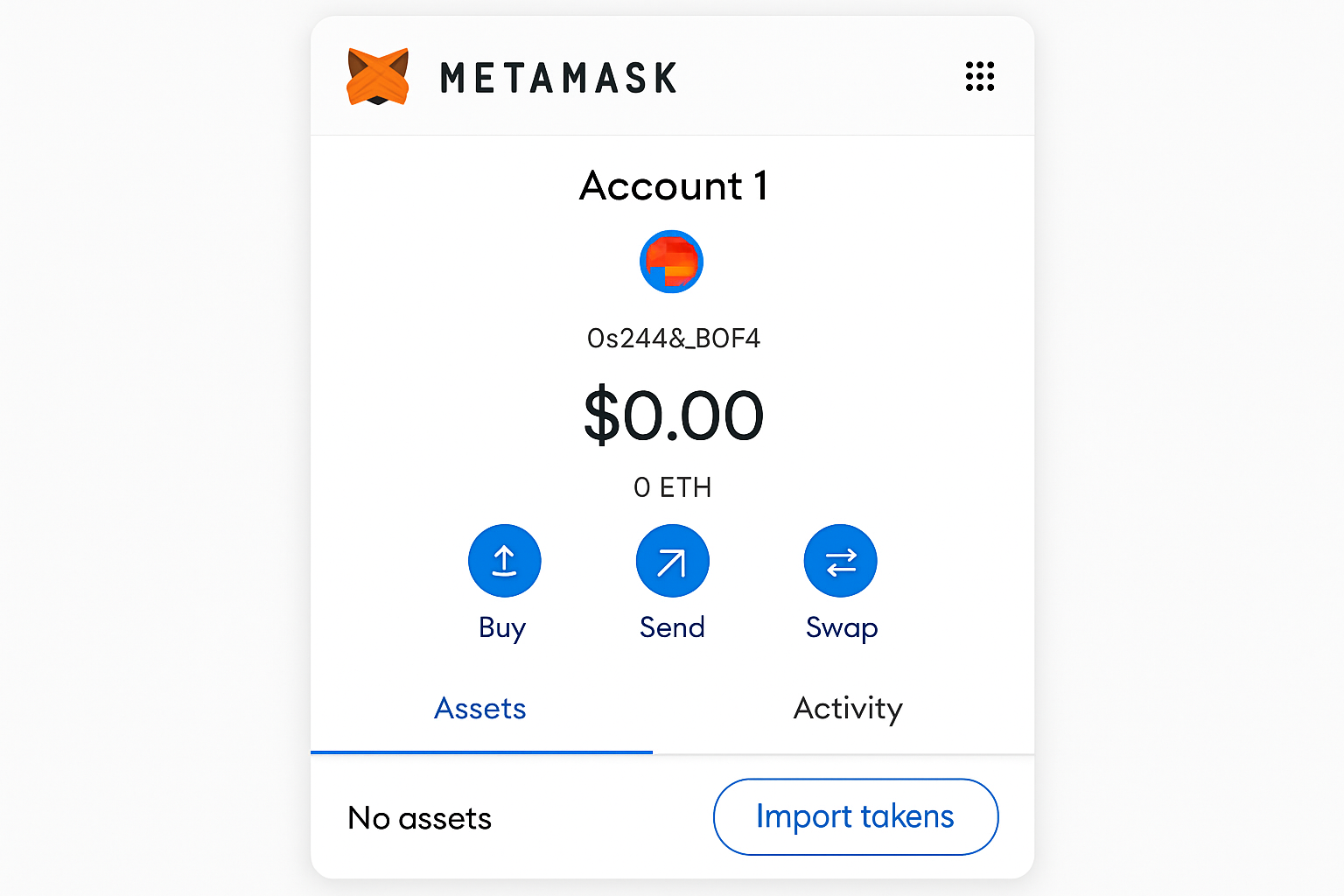

Self-Custody vs. Custodial Risks: DeFi users retained direct control over their assets via self-custody wallets like MetaMask, while centralized exchange customers faced withdrawal delays and potential losses if platforms froze accounts.

-

Transparency and Real-Time Data: DeFi protocols offer full transparency—anyone can monitor liquidations, collateral ratios, and protocol health on-chain. In contrast, exchanges often provide limited or delayed information during outages, increasing uncertainty for users.

-

Automated Liquidations vs. Manual Intervention: DeFi platforms rely on smart contracts to execute liquidations based on preset rules, ensuring orderly processing even in extreme volatility. Centralized exchanges sometimes intervene manually, which can lead to inconsistent outcomes and user frustration during market crashes.

What’s Next? Macro Risks and Buying Opportunities

The macro backdrop remains volatile as US-China relations enter uncharted territory. Will further tariffs or retaliatory measures spark new waves of selling? Or has the worst already passed for digital assets? For those with a long-term view and strong risk management discipline, such market dislocations can present rare buying opportunities – but only if approached thoughtfully.

Bitcoin (BTC) Price Prediction Table (2026–2031) Post-Tariff Crash

Professional BTC price outlook following the 2025 Trump 100% China tariff shock, with min/avg/max ranges reflecting market volatility, recovery potential, and macroeconomic risks.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $95,000 | $125,000 | $155,000 | +8.6% | High volatility persists as market digests trade war impact; potential for further dips if tariffs escalate, but strong recovery if global tensions ease. |

| 2027 | $110,000 | $142,000 | $180,000 | +13.6% | Partial stabilization; institutional adoption and halving anticipation drive a recovery trend. Volatility remains elevated due to global macro uncertainties. |

| 2028 | $125,000 | $167,000 | $215,000 | +17.6% | Bullish momentum builds post-halving; increasing adoption and clearer regulation support higher prices, but external shocks remain a risk. |

| 2029 | $145,000 | $192,000 | $240,000 | +15.0% | Continued growth as crypto integrates deeper into global finance. Regulatory clarity and technological upgrades drive confidence. |

| 2030 | $170,000 | $218,000 | $270,000 | +13.5% | Market matures, volatility decreases. BTC seen as key digital asset; macroeconomic cycles still influence price swings. |

| 2031 | $190,000 | $242,000 | $295,000 | +11.0% | Steady growth with mainstream adoption; potential for new highs if global economic environment stabilizes and crypto regulation is favorable. |

Price Prediction Summary

Following the historic crash triggered by the 2025 China tariff announcement, Bitcoin is expected to undergo a period of heightened volatility and gradual recovery. The medium-term outlook is constructive, with institutional interest, post-halving dynamics, and technological improvements providing upside potential. However, ongoing macroeconomic and regulatory risks will keep price ranges wide, with 2031 average prices potentially more than doubling from post-crash 2025 levels in a favorable scenario.

Key Factors Affecting Bitcoin Price

- US-China geopolitical tensions and global macroeconomic conditions

- Institutional adoption and Bitcoin halving cycles

- Regulatory developments in major economies (US, EU, China)

- Advancements in Bitcoin technology and scaling solutions

- Competition from other digital assets and blockchain platforms

- Market sentiment and liquidity, especially after large liquidation events

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For investors considering entry or rebalancing, timing and security are paramount. Volatility at this scale can create both steep discounts and elevated risks, especially with liquidity still thin and sentiment fragile. The recent crash underscores the importance of using limit orders, avoiding excessive leverage, and maintaining a diversified portfolio that isn’t overexposed to a single catalyst.

Those who weathered the storm often did so by prioritizing secure custody solutions and maintaining access to DeFi protocols, which remained functional while several major exchanges experienced outages. The ability to transact, swap, or provide liquidity on decentralized platforms proved invaluable as centralized venues struggled under the weight of panicked selling and surging withdrawals. The contrast between these systems is now front-and-center for anyone seeking resilience in their crypto strategy.

Strategies for Buying Crypto During Volatility

Buying crypto in the aftermath of a crash requires a measured approach. Here are a few strategies to consider in this environment:

1. Assess your risk tolerance: Volatility can persist for weeks or months after a major macro shock. Only allocate capital you can afford to lock up for the long term.

2. Use secure wallets: With centralized exchanges still recovering from outages, prioritize hardware or reputable software wallets for any new purchases.

3. Monitor macro headlines: Policy shifts, new tariffs, or diplomatic escalations can trigger further price swings. Stay informed and be ready to adjust your strategy.

Crypto “whales” and institutional players are already taking advantage of the dislocation, quietly accumulating Bitcoin and Ethereum at what they view as attractive entry points. According to Mitrade, these large players often buy into fear, betting on the asset class’s long-term adoption and resilience.

Lessons for the Next Market Shock

While no one can predict the next catalyst, the October 2025 crash highlights a few enduring lessons for digital asset investors:

Key Lessons from the Trump China Tariff Crypto Crash

-

Geopolitical Events Can Trigger Rapid Market Volatility. The 100% China tariff announcement on October 10, 2025, led to an immediate and historic $19 billion crypto liquidation, proving that macroeconomic and political shocks can cause sudden, severe price swings in digital assets.

-

Risk Management Is Essential for Crypto Investors. Over 1.66 million traders were liquidated in 24 hours during the crash, highlighting the importance of setting stop-losses, using appropriate leverage, and regularly reassessing risk exposure in volatile markets.

-

Market Recovery Can Be Swift But Unpredictable. After plunging 8.4% to $104,782, Bitcoin rebounded to $115,185 within two days, demonstrating both the resilience and unpredictability of crypto markets following major shocks.

-

Long-Term Investors May Find Opportunity Amid Panic. Despite the historic sell-off, some market participants viewed the dip as a buying opportunity for assets like Bitcoin and Ethereum, emphasizing the value of a long-term perspective and disciplined investment strategy.

• Leverage cuts both ways: High leverage can amplify gains, but it also accelerates losses and forced liquidations.

• Self-custody matters: Outages and withdrawal delays on exchanges can lock up funds at the worst possible time.

• DeFi can offer resilience: Decentralized platforms have proven robust even as centralized venues falter.

• Macro events drive crypto cycles: Geopolitical risks and policy shocks can move crypto markets as much as native industry news.

As Bitcoin holds above $115,185 and Ethereum stabilizes at $4,146.24, the dust is far from settled. The coming weeks will test whether digital assets can reclaim their narrative as both a hedge and a growth vehicle in a world defined by uncertainty. For now, prudent risk management, secure custody, and a clear-eyed view of macro forces remain the best tools for navigating what comes next.