July 2025 marked a pivotal moment for stablecoins: centralized exchanges recorded a staggering $5.7 billion net outflow of stablecoins, the highest since May 2021. On-chain data shows a clear shift as users pull assets from exchanges, but not from the crypto ecosystem itself. The total stablecoin supply has actually surpassed $300 billion by October 2025, underscoring that capital is rotating, not fleeing. This dynamic, often described as the “stablecoin exodus 2025,” signals new priorities in how investors approach secure cryptocurrency buying and custody during periods of volatility.

What’s Driving the Stablecoin Exodus?

The sharp uptick in crypto exchange outflows is not a simple vote of no confidence in digital assets. Instead, it reflects a more nuanced evolution in user behavior and risk management. Several factors are at play:

Key Drivers of Record Stablecoin Outflows in 2025

-

Shift Toward Self-Custody and DeFi Platforms: Investors are increasingly withdrawing stablecoins from centralized exchanges to manage assets in self-custody wallets or participate in decentralized finance (DeFi) protocols, seeking greater control and privacy.

-

Regulatory Uncertainty and New Caps: The Bank of England and other regulators have announced or implemented caps on stablecoin holdings (e.g., £10,000–£20,000 per individual), prompting users to move funds off exchanges to avoid potential restrictions.

-

Institutional Adoption and New Stablecoin Issuance: Major banks are exploring and launching stablecoins pegged to G7 currencies, driving users to transfer assets to new platforms or products for better yields and institutional-grade security.

-

Security and Compliance Concerns: Heightened awareness of technical, economic, and regulatory risks—including compliance requirements and exchange vulnerabilities—has led to precautionary withdrawals by both retail and institutional participants.

-

Growth in Cross-Border Payments and On-Chain Utility: The expanding use of stablecoins for cross-border payments and on-chain transactions is encouraging users to hold assets in wallets rather than on exchanges, leveraging faster and cheaper transfers.

For many, the move is about greater control. As regulatory scrutiny intensifies and centralized exchange hacks remain a persistent threat, self-custody and decentralized finance (DeFi) platforms offer perceived safety and flexibility. The Bank of England’s (BoE) announcement to implement stablecoin holding caps, ranging from £10,000 to £20,000 per individual, further highlights the growing regulatory response to these flows. (Reuters)

Stablecoin Withdrawal Trends: Implications for Secure Crypto Buying

For investors looking to buy crypto securely in 2025, these withdrawal trends present both opportunities and challenges. On one hand, the robust growth in stablecoin supply, now over $300 billion, demonstrates strong demand for digital dollars and euros as on-ramps to other assets. On the other, exchange outflows can signal tightening liquidity and higher volatility on centralized platforms. This means that buyers may need to adapt their strategies, especially when moving large sums or seeking to minimize slippage and fees.

Institutional Moves and Regulatory Shifts

Major global banks are now exploring the issuance of stablecoins pegged to G7 currencies, a development that could reshape the landscape for both retail and institutional participants. (Reuters) At the same time, the BoE and other regulators are tightening oversight to prevent risks to the traditional financial system. The Treasury Department has warned of potential deposit outflows up to $6.6 trillion if stablecoins become mainstream, raising systemic risk concerns for banks and policymakers alike.

How Are Stablecoins Reshaping Crypto Security?

With more users opting for self-custody and DeFi, technical and operational security become paramount. Investors must weigh the benefits of holding stablecoins off-exchange against new risks, such as smart contract vulnerabilities and personal key management failures. As stablecoins move into mainstream finance and cross-border payments, their role as a gateway for secure cryptocurrency buying is only set to grow.

To navigate this evolving landscape, buyers need to be more discerning about where and how they store digital assets. The record-breaking $5.7 billion net outflow from exchanges in July 2025 is a clear indicator that even sophisticated market participants are prioritizing control over convenience. In the current climate, understanding the nuances of stablecoin withdrawal trends is essential for anyone seeking to buy crypto securely during periods of market stress or regulatory flux.

Regulatory interventions, like the BoE’s holding caps, are designed to mitigate systemic risks but can also create friction for high-volume or institutional buyers. For example, if you are planning to accumulate stablecoins for a major purchase or to move into another asset, these limits may affect transaction timing and strategy. Meanwhile, the proliferation of G7-pegged stablecoins by major banks suggests that the future of secure crypto buying will be increasingly intertwined with traditional financial infrastructure.

Practical Tips for Secure Cryptocurrency Buying During Volatility

Practical Steps for Secure Crypto Buying in 2025

-

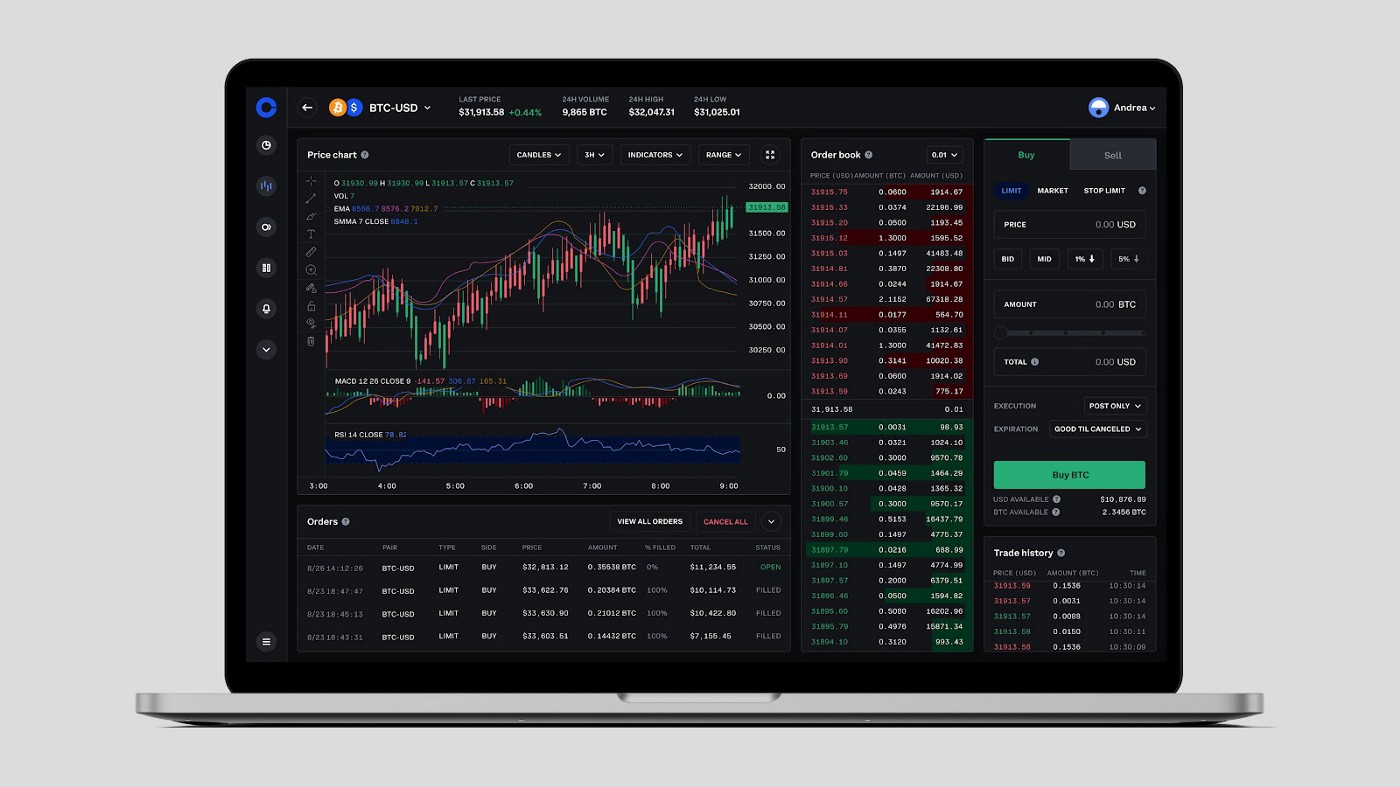

Use Regulated Centralized Exchanges for Fiat On-RampsPlatforms like Coinbase, Kraken, and Bitstamp remain among the most compliant and transparent for buying crypto with fiat. Always verify their latest regulatory status and ensure they support your desired stablecoin, especially as exchange outflows and new caps (such as the Bank of England’s £10,000–£20,000 stablecoin limits) may affect available options.

-

Transfer Assets to Self-Custody Wallets After PurchaseGiven the record $5.7 billion stablecoin outflows from exchanges in July 2025, consider moving your crypto to reputable self-custody wallets like Ledger (hardware) or MetaMask (software). This reduces exposure to potential exchange insolvency or withdrawal freezes.

-

Verify Stablecoin Backing and TransparencyChoose stablecoins with clear, audited reserves. USDC (by Circle) and USDT (by Tether) regularly publish attestations, while new G7-pegged stablecoins from major banks are emerging. Review audit reports and regulatory disclosures before using any stablecoin for purchases.

-

Consider Decentralized Exchanges (DEXs) for Non-Custodial TradingPlatforms like Uniswap and 1inch allow you to trade directly from your wallet, bypassing centralized custodians. Ensure you understand smart contract risks and use only well-audited, established DEXs.

-

Stay Informed on Regulatory Changes and Stablecoin CapsMonitor updates from regulators such as the Bank of England and US Treasury, as new rules (like the UK’s stablecoin holding limits) may impact your ability to buy, hold, or transfer stablecoins on certain platforms.

Given this backdrop, risk management is more important than ever. Here are some actionable strategies for secure cryptocurrency buying in 2025:

- Leverage reputable self-custody solutions: Hardware wallets and multisig setups can reduce exposure to exchange failures.

- Monitor exchange liquidity: Large outflows may lead to thinner order books and higher slippage; plan trades accordingly.

- Stay updated on regulatory changes: New caps or compliance rules can impact your ability to move funds freely.

- Diversify stablecoin holdings: Consider using multiple issuers or chains to mitigate issuer-specific risks.

As the stablecoin landscape matures, buyers who adapt to these new realities, incorporating both technical and regulatory safeguards, will be best positioned to navigate volatility and protect their capital.

What Comes Next for Stablecoin Users?

With the total stablecoin supply now exceeding $300 billion, the exodus from exchanges is less about exit and more about evolution. Investors are demanding more autonomy, better security, and greater transparency, pushing the industry toward innovative custody models and compliance frameworks. As banks enter the stablecoin space and regulators continue to adapt, the coming year will likely see even more sophisticated tools for secure cryptocurrency buying.

Ultimately, the record stablecoin outflows of 2025 are not a sign of retreat but a signal of growing sophistication among crypto users. Those who understand the implications, and who proactively manage both technical and regulatory risks, will have the edge in this new era of digital finance.