Japan is making headlines in the crypto world with its decisive move to ban insider trading in digital assets, a development that could have profound consequences for global buyers. As the Financial Services Agency (FSA) prepares to enforce a sweeping set of amendments to the Financial Instruments and Exchange Act (FIEA) by 2026, cryptocurrencies will soon be classified as financial products, placing them under the same stringent insider trading rules that govern traditional securities. This regulatory shift is not just a local affair; it’s a bellwether for how major economies might approach crypto oversight in the coming years.

Japan’s Regulatory Overhaul: What’s Changing?

At the heart of these reforms is a clear message: crypto markets are maturing, and with maturity comes accountability. The FSA’s amendments will empower the Securities and Exchange Surveillance Commission (SESC) to investigate suspicious crypto trades, impose fines directly proportional to illicit gains, and refer egregious cases for criminal prosecution. For the first time, trading cryptocurrencies based on undisclosed information will be explicitly prohibited under Japanese law, closing a loophole that has long been exploited in decentralized asset markets.

This aligns Japan’s approach with established financial centers and addresses a critical gap in global crypto compliance. As AInvest notes, these measures are designed to enhance market integrity and foster institutional confidence, both of which are essential for the next phase of digital asset adoption.

Impact on Global Crypto Buyers and Market Integrity

For international investors and everyday buyers, Japan’s crackdown signals a shift toward greater transparency and security in crypto trading. By treating cryptocurrencies like other financial products, Japan is setting a precedent that could inspire similar moves by other G20 nations. The immediate effect is a likely increase in investor trust, particularly among institutions that have hesitated to enter markets perceived as unregulated or prone to manipulation.

However, the implications run deeper. Enhanced oversight may attract more liquidity and stability to exchanges operating within Japan’s jurisdiction, which could ripple out to global trading volumes. Yet, challenges remain in defining who qualifies as an “insider” within decentralized networks, and enforcing these rules across borders may prove complex, especially as digital assets flow freely between exchanges worldwide.

Current Market Snapshot: Bitcoin Holds Above $100,000

These regulatory developments come at a pivotal moment for crypto markets. Bitcoin (BTC) is currently trading at $104,624.00, reflecting a 24-hour drop of 5.95% but still maintaining its position well above the symbolic $100,000 threshold. The recent volatility underscores why robust regulation is top of mind for policymakers and investors alike. In environments where price swings are pronounced, the risk of market manipulation through insider information becomes even more acute.

Bitcoin Price Prediction 2026-2031: Impact of Japan’s Regulatory Crackdown

Forecasts based on Japan’s 2025–2026 regulatory overhaul, global adoption trends, and evolving market conditions

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $93,000 | $116,000 | $146,000 | +11% | Regulatory clarity attracts new institutional capital, but global volatility persists |

| 2027 | $110,000 | $138,000 | $172,000 | +19% | Mainstream adoption accelerates; stricter global regulation tempers extreme rallies |

| 2028 | $124,000 | $158,000 | $205,000 | +14% | Technical upgrades and ETF expansion drive higher average prices |

| 2029 | $140,000 | $181,000 | $242,000 | +15% | Increased integration with traditional finance; periodic corrections |

| 2030 | $158,000 | $210,000 | $282,000 | +16% | Mature global regulatory frameworks and broader institutional participation |

| 2031 | $178,000 | $243,000 | $330,000 | +16% | Bitcoin seen as a strategic asset class; macro cycles and competition shape volatility |

Price Prediction Summary

Bitcoin’s price outlook from 2026 through 2031 is broadly positive, with Japan’s regulatory reforms enhancing global trust, reducing market manipulation, and paving the way for greater institutional involvement. While short-term volatility remains due to ongoing regulatory adjustments and macroeconomic factors, the long-term trajectory is upward, supported by broader adoption and clearer legal frameworks. Both bullish and bearish scenarios are reflected in the min/max price ranges, accounting for global economic cycles and potential market disruptions.

Key Factors Affecting Bitcoin Price

- Japan’s regulatory crackdown enhances global market integrity and investor confidence.

- Broader institutional adoption as crypto markets align with traditional financial regulations.

- Potential for further regulatory harmonization in other major economies.

- Ongoing technical upgrades to Bitcoin’s network improve scalability and security.

- Global macroeconomic trends, such as inflation and monetary policy, affecting risk appetite.

- Competition from other cryptocurrencies and tokenized assets.

- Challenges in cross-border enforcement and defining insider trading in decentralized networks.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Japan’s reforms could serve as a stabilizing force, particularly if they encourage more institutional participation and improve market surveillance. For those looking to buy cryptocurrency securely, understanding these evolving regulations is now as important as tracking price trends or technical signals.

What to Watch: Enforcement and Global Ripple Effects

While Japan’s new rules are expected to be fully implemented by 2026, the global crypto community is already watching closely. Will other major markets follow suit? How will exchanges adapt their compliance protocols? And perhaps most importantly, what does this mean for buyers seeking a transparent and fair marketplace?

As these questions unfold, one thing is clear: the era of regulatory ambiguity in crypto is coming to an end, and Japan is leading the charge toward a new standard of market integrity.

For global buyers, the landscape is changing rapidly. As Japan’s Financial Services Agency (FSA) tightens its grip on insider trading, international exchanges and wallet providers are likely to feel the pressure to upgrade their compliance measures. This could mean more rigorous Know Your Customer (KYC) processes, enhanced transaction monitoring, and stricter disclosure requirements for project teams and insiders. While some may see this as a hurdle, many seasoned investors recognize it as a step toward long-term market legitimacy.

Yet, the challenges of enforcing insider trading rules in decentralized environments cannot be understated. Unlike traditional equities, crypto assets often operate on permissionless networks, where information asymmetry and pseudonymity are the norm. Regulators must grapple with defining who counts as an “insider” in DAOs, DeFi protocols, or token projects with global teams. The cross-border nature of crypto trading further complicates matters, as enforcement relies on international cooperation and information sharing.

How Buyers Can Protect Themselves: A Practical Guide

Whether you’re a retail investor or managing an institutional portfolio, adapting to Japan’s new rules, and the global trend they represent, requires a proactive approach. Here are actionable steps to navigate this evolving environment:

Practical Tips for Secure Crypto Buying in Japan

-

Monitor Official Announcements: Stay informed by following updates from the Financial Services Agency (FSA) and Securities and Exchange Surveillance Commission (SESC). These agencies regularly publish news about regulatory changes and enforcement actions.

-

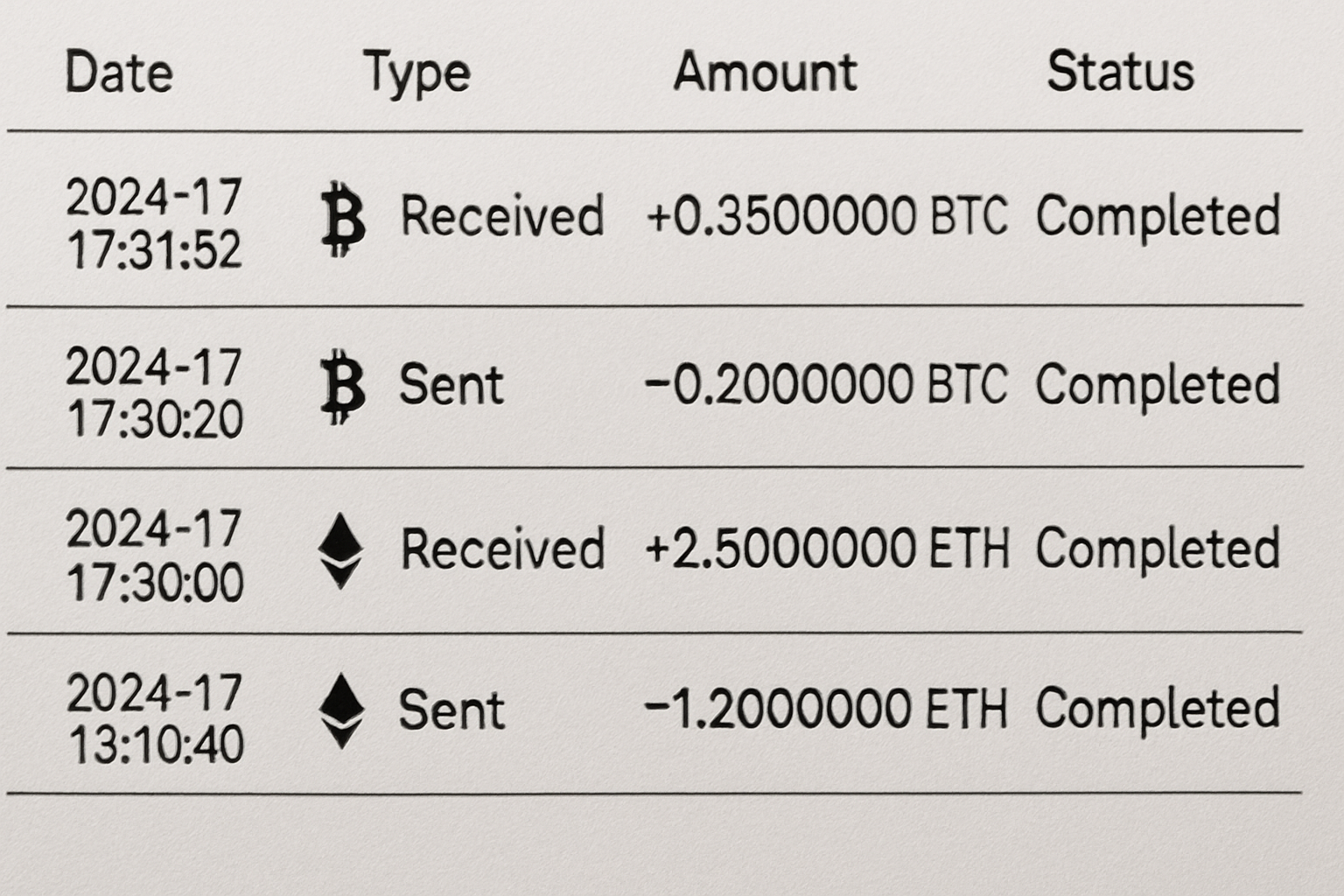

Keep Detailed Transaction Records: Maintain comprehensive records of all crypto purchases, sales, and transfers. This documentation can help demonstrate compliance if questioned by regulators and is essential for accurate tax reporting under Japanese law.

-

Be Cautious with Non-Registered Platforms: Avoid using overseas or unregistered exchanges that do not comply with Japanese regulations. These platforms may not provide adequate investor protection and could expose you to legal risks under the new insider trading rules.

-

Understand Market Volatility: With Bitcoin currently priced at $104,624.00 (down 5.95% in 24h), be aware that regulatory changes can impact prices and liquidity. Use tools like CoinDesk or CoinMarketCap to monitor real-time market data.

-

Consult Licensed Professionals: For large or complex transactions, seek advice from a licensed Japanese legal or financial advisor familiar with the new crypto regulations. This can help you avoid inadvertent violations and optimize your investment strategy.

As regulatory frameworks mature, buyers should prioritize platforms that are transparent about their compliance standards. Look for exchanges registered with recognized authorities and avoid platforms with opaque ownership or dubious practices. Staying informed on local and global regulatory updates is now as crucial as tracking price action or technical analysis.

Potential Upsides: More Stability, More Opportunity?

Japan’s crackdown may ultimately serve as a catalyst for broader adoption and innovation. By clarifying legal boundaries and imposing real consequences for misconduct, the reforms are likely to weed out bad actors and reduce the risk of sudden market shocks caused by insider manipulation. This could make crypto a more attractive asset class for conservative investors who have thus far remained on the sidelines.

Furthermore, as more countries align their crypto regulations with established financial norms, we could see a convergence of global standards, making cross-border trading safer and more predictable. This is particularly relevant as Bitcoin maintains a price of $104,624.00, a level that continues to draw attention from both retail and institutional players looking for secure entry points.

Key Takeaways for 2025,2026: Adapting to the New Normal

Buyers should expect a period of adjustment as exchanges, wallets, and token projects update their compliance playbooks. Those who adapt quickly, by embracing transparency and robust risk management, will be best positioned to thrive. Watching how Japan’s SESC enforces these new rules will offer valuable insights for anyone navigating the next phase of crypto’s evolution.

Ultimately, Japan’s bold stance is about more than just policing bad behavior. It’s about building a foundation for sustainable growth in the digital asset economy. For global buyers, this means a future where securely buying cryptocurrency is not only possible, but standard practice.