Crypto wallet security is under the microscope in 2025, and for good reason. With XRP trading at $2.48 and institutional interest at an all-time high, the stakes have never been higher. The recent $3.05 million XRP heist via an Ellipal hardware wallet hack is a brutal reminder: even so-called “cold” wallets aren’t bulletproof if you neglect the fundamentals. In this market, complacency is your enemy. Here’s how to protect your digital assets from both sophisticated cybercriminals and real-world threats, using hard-won lessons from the latest breaches.

XRP at $2.48: Why Security Matters More Than Ever

With Evernorth’s $1 billion public listing and XRP cementing its place as the fifth-largest cryptocurrency, attackers are actively targeting anyone holding significant amounts of crypto. The rise of “wrench attacks” – physical coercion for seed phrases – and digital exploits means you must lock down both your devices and your personal security habits. The Ellipal hack was a wake-up call: a single point of failure can drain a wallet in minutes.

The Top 5 Crypto Wallet Security Practices for 2025

Top 5 Crypto Wallet Security Practices for 2025

-

Store the majority of your crypto in hardware (cold) wallets, not on exchanges or hot wallets. Hardware wallets like Ledger and Trezor keep your private keys offline, making them much less vulnerable to hacks and phishing attacks that target online platforms. This lesson was underscored by the $3 million XRP hack, which exploited weaknesses in hot wallet storage.

-

Enable multi-factor authentication (MFA) on all wallet and exchange accounts, preferably using authenticator apps rather than SMS. MFA adds a critical layer of defense. Use trusted apps like Authy or Google Authenticator instead of SMS, which can be intercepted by SIM-swapping attacks.

-

Regularly update wallet firmware, operating systems, and all related apps to patch known vulnerabilities. Hackers often exploit outdated software. Make sure your hardware wallet (e.g., Ledger, Trezor), mobile wallet, and device OS are always running the latest versions to stay protected.

-

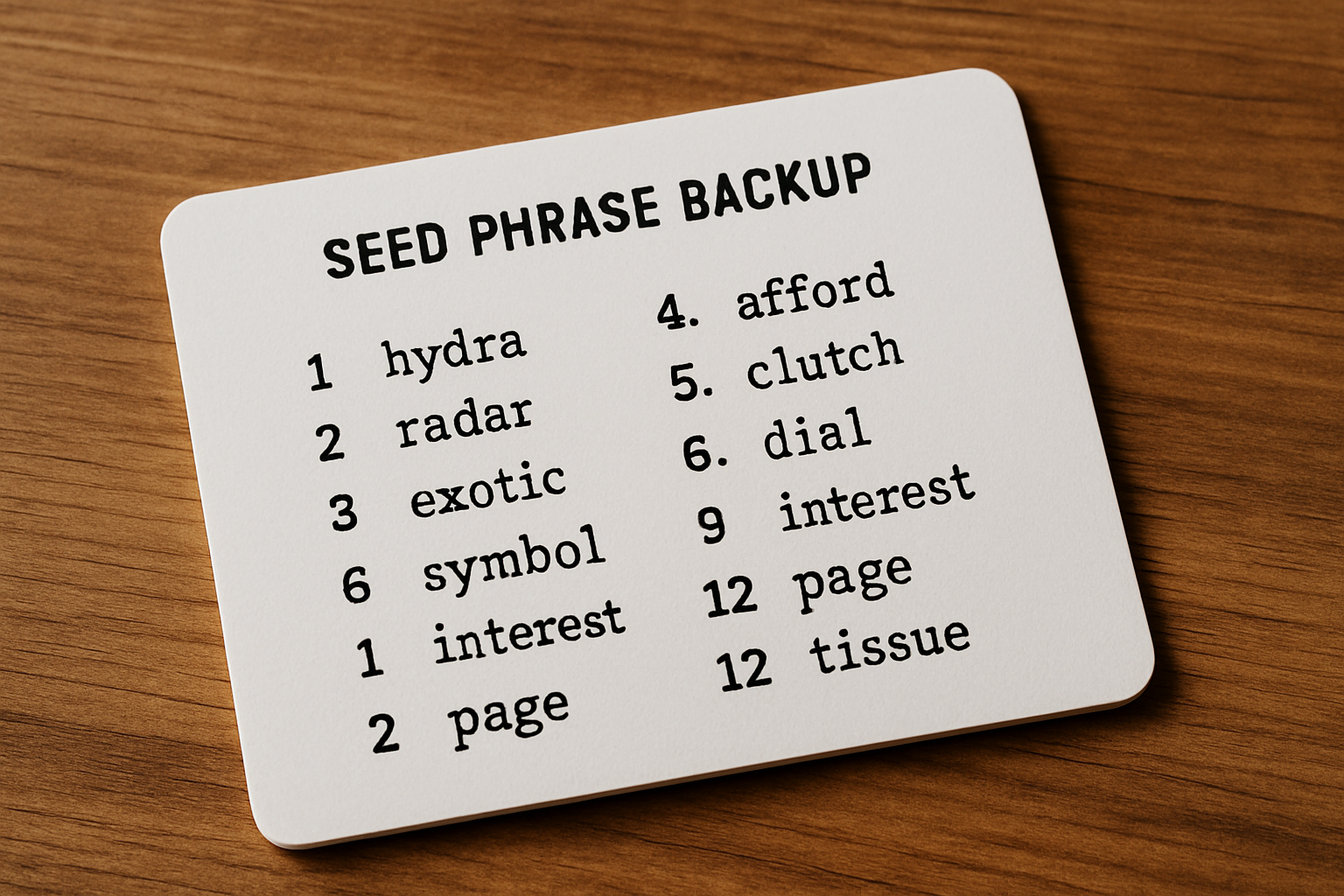

Back up your wallet seed phrase securely offline and never share it or enter it on suspicious sites or apps. Write your seed phrase on paper or use a metal backup like Cryptosteel. Store it in a safe, offline location—never in cloud storage or digital notes. This protects you from both online theft and physical disasters.

Let’s break down each essential practice and why it matters right now.

1. Store the Majority of Your Crypto in Hardware (Cold) Wallets

If you’re still keeping large balances on exchanges or in hot wallets, you’re playing with fire. Exchanges are prime targets for hackers, and hot wallets are only as secure as your device. Cold wallets – like Ledger, Trezor, or Ellipal – keep your keys offline. But as the Ellipal breach proved, no hardware wallet is invincible if you ignore updates or mishandle your seed phrase. Treat your cold wallet as a vault, not a daily spending account.

2. Enable Multi-Factor Authentication (MFA) Everywhere

Every exchange and wallet you use should have MFA enabled. But not all MFA is equal. Authenticator apps (like Google Authenticator or Authy) are vastly more secure than SMS-based codes, which can be intercepted by SIM-swapping attacks. Make MFA mandatory for logins, withdrawals, and even API access. If your platform doesn’t support app-based MFA in 2025, it’s time to find a new one.

3. Use Unique, Complex Passwords for Every Account

It’s 2025. If you’re still recycling passwords or using anything remotely guessable, you’re a sitting duck. Every crypto-related account needs a strong, unique password – ideally generated by a password manager. Change passwords regularly and never share them. The Ellipal hack investigation revealed that attackers often exploit reused or weak credentials to escalate access. Don’t give them an inch.

Stay Ahead: Updates, Backups, and Physical Security

Software vulnerabilities are discovered every week. If you’re not updating your wallet firmware, operating system, and related apps as soon as patches drop, you’re leaving the door open. The Ellipal exploit was partly due to outdated firmware. Back up your seed phrase offline – never digitally – and never enter it on suspicious sites or apps. Remember: if someone gets your seed phrase, they own your funds. Full stop.

Backing up your seed phrase isn’t just a checklist item, it’s your last line of defense. Store it physically, in a safe location, ideally split between two secure places. Never type it into your phone, cloud storage, or any device connected to the internet. Phishing sites and malware are designed to trick you into giving up this master key. If you ever need to recover your wallet, only use official hardware or trusted, air-gapped devices. Once compromised, funds are gone forever, there’s no undo button in crypto.

4. Regularly Update Wallet Firmware, OS, and Apps

Staying current with updates isn’t optional. The $3.05 million XRP hack happened because the victim’s wallet firmware was outdated, leaving a known vulnerability open for exploitation. Set reminders to check for updates monthly, both for your hardware wallet and the device it connects to. Don’t ignore update prompts or delay security patches; attackers move fast when new exploits are published. If your wallet manufacturer stops providing updates, migrate your funds to a supported device immediately.

5. Back Up Your Wallet Seed Phrase Securely Offline

Every seasoned trader knows: your seed phrase is the single point of failure most often overlooked. Write it down by hand, don’t take photos or store it in cloud drives. Consider using fireproof safes or specialized metal backup tools to protect against physical damage. Never trust anyone asking for your seed phrase, regardless of how convincing their story is. Social engineering attacks are getting more sophisticated every year.

Physical Security: The New Frontier in 2025

With the rise in wrench attacks and targeted kidnappings for crypto, digital hygiene isn’t enough. Never brag about your holdings online or in person; anonymity is your friend. Use PO boxes for deliveries related to crypto hardware wallets and keep your home security up to date. Consider multi-signature wallets for large holdings, so even if you’re physically coerced, a single key won’t unlock the vault.

The market is evolving fast: XRP’s current price of $2.48 makes it an attractive target for both cybercriminals and real-world thieves alike. As institutional adoption accelerates and the stakes grow higher, so does the sophistication of attacks. Tools like NordVPN’s new address checker can help spot scam addresses before you send funds (details here), but ultimately, security starts with you.

Bottom line: Every layer of protection matters, hardware wallets, MFA, strong passwords, timely updates, and offline backups all work together to keep your assets safe in 2025’s high-stakes environment.