Bitcoin is holding its ground in dramatic fashion. After a wild October flush that wiped out over $19 billion in leveraged positions, the world’s largest cryptocurrency has stabilized around $108,043.00. For first-time crypto buyers eyeing 2025 as their entry point, this is the kind of reset that can set the stage for smarter, safer investment decisions.

Bitcoin Maintains Position Above $100,000 After Leverage Flush

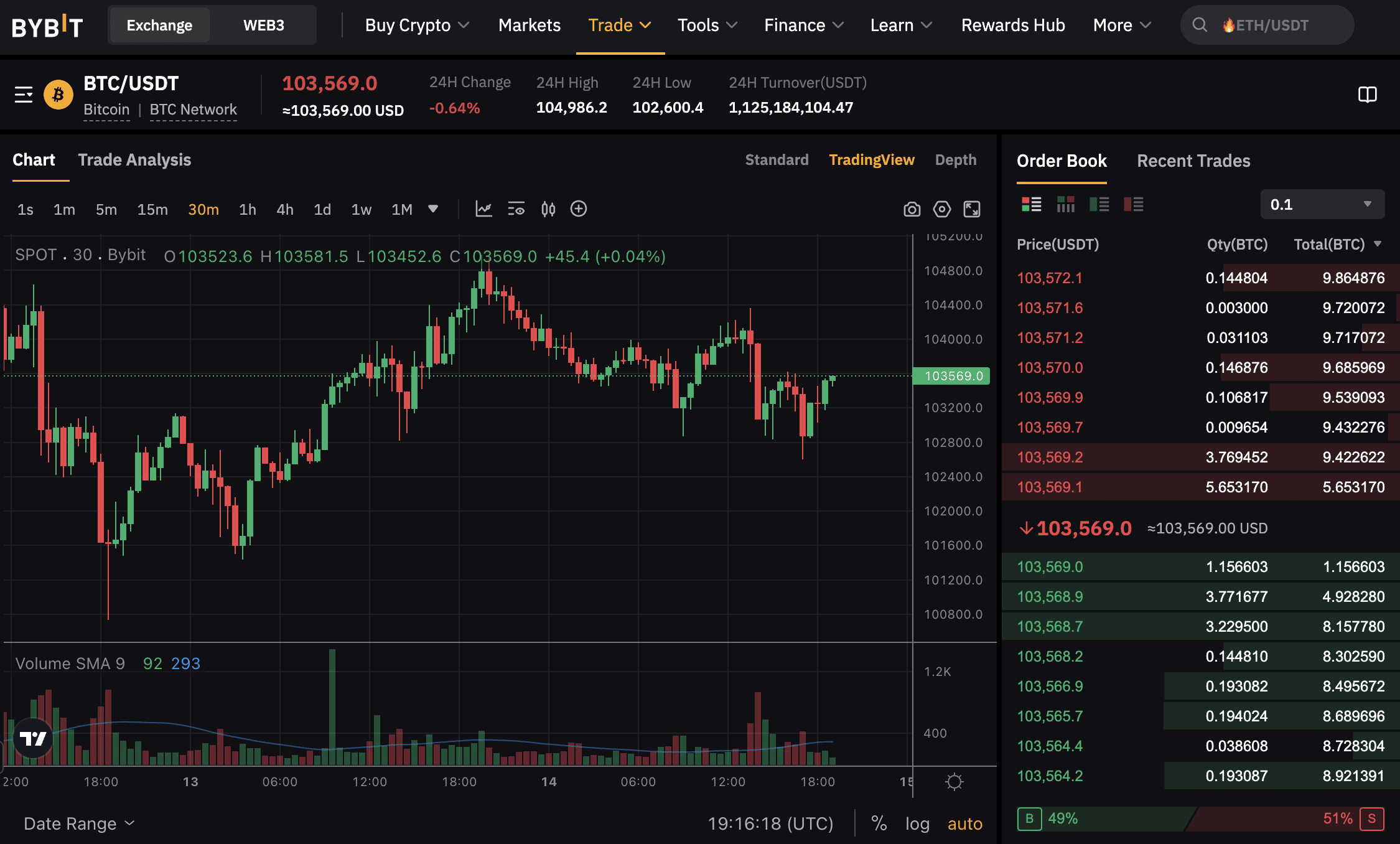

Let’s talk facts: Just weeks ago, Bitcoin tumbled from above $122,000 to a low near $104,783 after President Donald Trump’s 100% tariff announcement on Chinese imports sent shockwaves through global markets. The result? A massive bitcoin leverage flush that forced over-leveraged traders out and triggered a market-wide reset. Now, with Bitcoin bouncing back and trading steadily at $108,043.00, the landscape feels less like a minefield and more like fertile ground for new investors.

This isn’t just about surviving volatility – it’s about understanding what comes next. The flush was painful for those caught on the wrong side of leverage, but it’s also cleared out much of the speculative froth. Analysts are buzzing about how this sets up a healthier market structure and reduces the risk of cascading liquidations moving forward.

Why This Market Reset Matters for First-Time Buyers

If you’re new to crypto, here’s why you should care: The recent leverage shakeout means Bitcoin’s current price isn’t being propped up by reckless bets. Instead, we’re seeing a more organic level of support as institutional investors continue to accumulate and retail buyers regain confidence.

For beginners, this is prime time to learn how to buy bitcoin safely in 2025. The market reset has made it easier to spot real value versus hype-driven price spikes. Plus, with institutional crypto accumulation on the rise, you’re not alone – big money is betting on crypto’s long-term future right alongside you.

Top Beginner Crypto Buying Tips for 2025

-

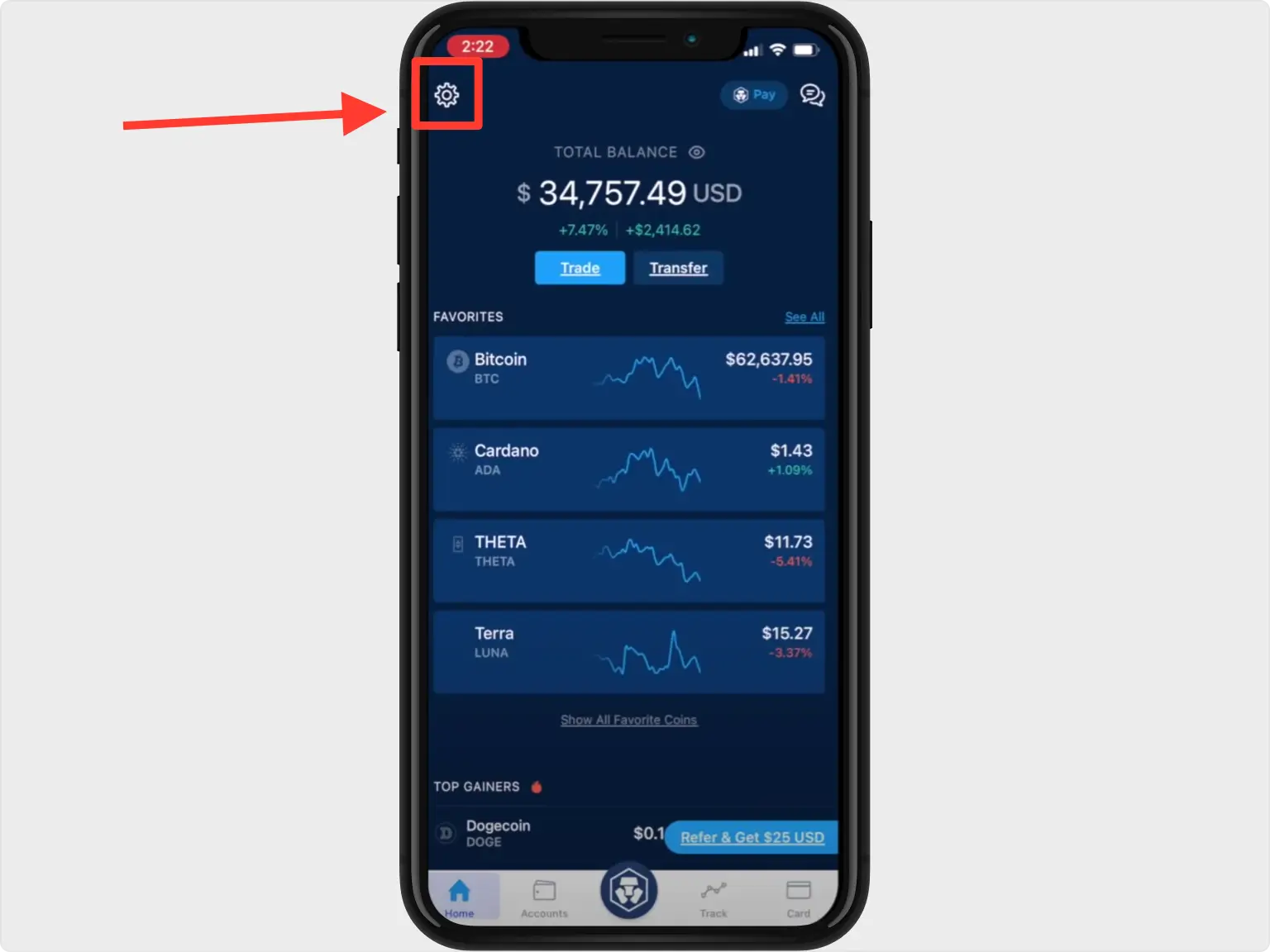

Verify Your Identity (KYC): Complete the Know Your Customer (KYC) process. This step is required on regulated exchanges and helps protect your account and funds.

-

Start Small & Use Dollar-Cost Averaging (DCA): Don’t try to time the market. Invest small amounts regularly—especially after recent volatility, with Bitcoin currently at $108,043.00—to reduce risk and build your position over time.

-

Understand Leverage—Use It Sparingly: If you try leverage, stick to low levels (2x–5x) and only on established platforms like Binance Futures or Kraken Futures. High leverage can lead to rapid losses, as seen in the recent $19 billion liquidation event.

-

Diversify Your Portfolio: Don’t put all your funds into one coin. Consider a mix of assets like Bitcoin (BTC), Ethereum (ETH), and select large-cap altcoins to spread risk.

-

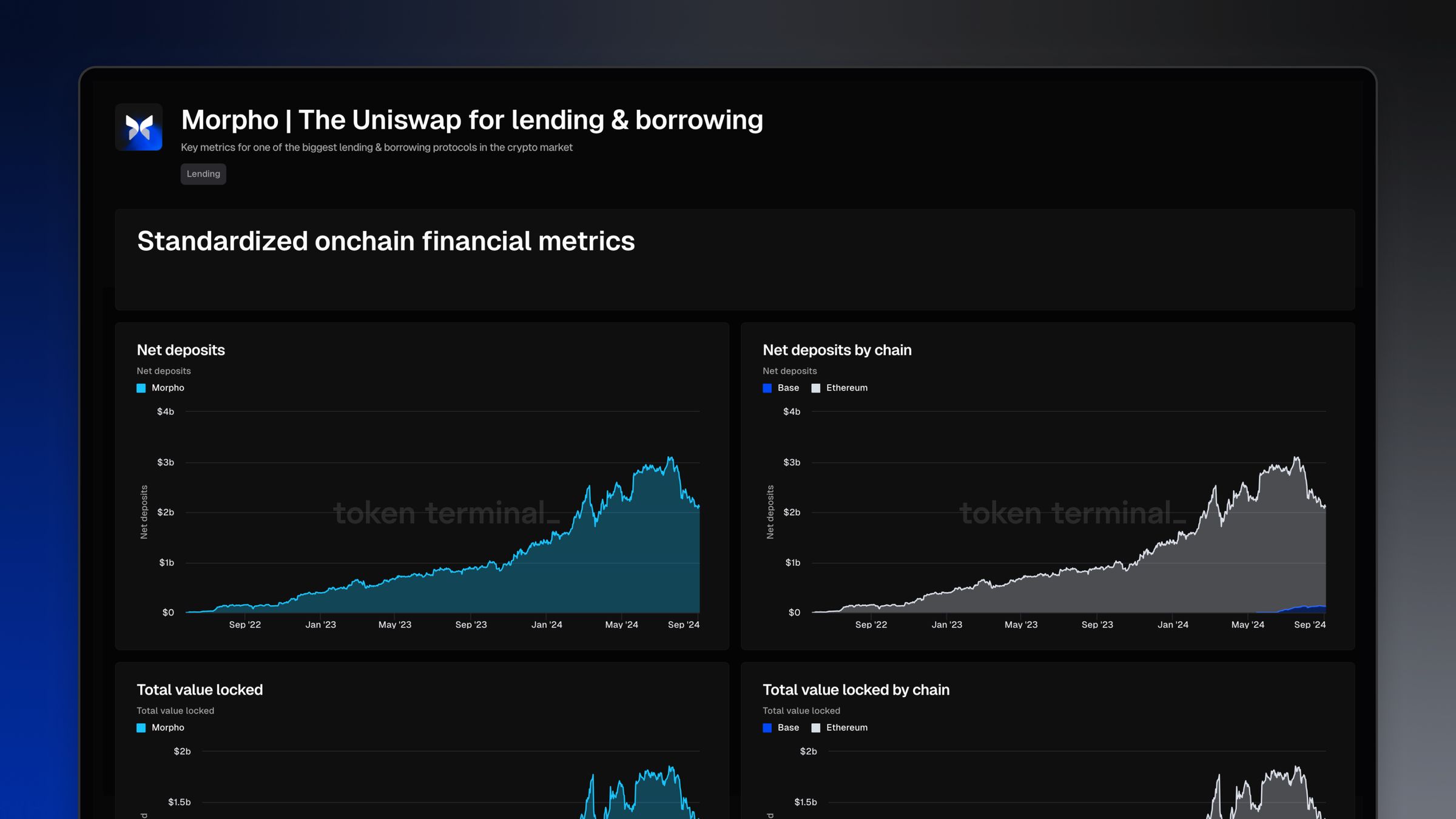

Stay Informed & Use Reliable Tools: Follow reputable sources like CoinDesk and explore AI-powered platforms such as Token Metrics for research and market insights.

-

Enable Two-Factor Authentication (2FA): Protect your accounts with 2FA using apps like Google Authenticator or Authy for an extra layer of security.

The key takeaway? Don’t let recent volatility scare you off. Instead, see it as your chance to enter at a more stable price point – and with less risk of sudden liquidation events shaking up your portfolio. If you want to dive deeper into how past surges impacted first-time buyers and strategies for entering the market now, check out this detailed guide.

The Smart Way to Approach Bitcoin in 2025: Safety First

Ready to buy your first bitcoin? Start by focusing on safety and discipline. Choose regulated exchanges with robust security features and always enable two-factor authentication. Verify your identity (KYC), use secure wallets for storage, and never invest more than you can afford to lose.

Leverage sounds exciting but can be a double-edged sword for beginners. Experts recommend starting with zero or very low leverage – think 2x to 5x max – until you’re comfortable with market swings and risk management tools. Remember: Slow and steady wins the race when you’re building your crypto foundation.

Bitcoin Price Prediction 2026-2031

Comprehensive BTC Price Outlook Post-Leverage Flush and Market Stabilization (Baseline: $108,043 as of Oct 2025)

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $89,000 | $121,000 | $155,000 | +12% | Potential for high volatility as macroeconomic tensions ease; institutional accumulation continues; possible regulatory headwinds |

| 2027 | $98,000 | $139,000 | $185,000 | +15% | Increased mainstream adoption, improved regulatory clarity, and possible next halving cycle anticipation |

| 2028 | $110,000 | $162,000 | $215,000 | +17% | Halving event expected; supply reduction may drive price up; expanding DeFi and ETF products |

| 2029 | $130,000 | $182,000 | $245,000 | +12% | Greater institutional participation; global economic shifts; competition from CBDCs and altcoins |

| 2030 | $145,000 | $206,000 | $285,000 | +13% | Wider integration in payment systems; technological improvements (e.g., Lightning Network); possible ETF expansion |

| 2031 | $165,000 | $228,000 | $325,000 | +11% | Maturing market, global acceptance, but more moderate growth; regulatory equilibrium and increased security |

Price Prediction Summary

Following the 2025 leverage flush and market stabilization, Bitcoin is positioned for renewed growth, albeit with notable volatility. The average price is projected to rise steadily year-over-year, driven by cyclical market factors, institutional adoption, and technological advancements. While the minimum price scenario reflects potential bearish macro events or regulatory shocks, maximum projections account for bullish institutional flows and global adoption. Investors should expect both opportunities and risks as Bitcoin matures toward 2031.

Key Factors Affecting Bitcoin Price

- Macroeconomic events and global monetary policy (e.g., tariffs, inflation)

- Regulatory developments in major economies (US, EU, China)

- Institutional adoption and ETF inflows

- Bitcoin halving cycles and supply dynamics

- Technological improvements (e.g., scalability, security)

- Competition from altcoins and central bank digital currencies (CBDCs)

- Market sentiment and retail investor participation

- Potential black swan events or systemic shocks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Stay tuned for more actionable strategies and step-by-step guides to help you navigate your first bitcoin purchase confidently in this new era of crypto stability!

It’s easy to get swept up in the hype, but smart crypto investing in 2025 is all about strategy and self-protection. With Bitcoin at $108,043.00 and market volatility cooling off post-leverage flush, you have a real shot at building wealth without reckless risk.

Let’s break down the essentials for first-time buyers:

- Pick a regulated exchange: This is your safety net. Top-tier platforms require identity verification (KYC) and offer insurance on digital assets.

- Secure your holdings: Move your Bitcoin off exchanges into a private wallet if you’re not actively trading. Hardware wallets are the gold standard for long-term security.

- Diversify: Don’t put all your funds into one asset. Explore other major coins or stablecoins to spread out risk.

The recent crypto market reset has also made it clear: leverage is not a shortcut to riches, especially for new investors. The October flush was a harsh lesson for many who overextended themselves. If you’re tempted by leverage, start small, 2x or 3x at most, and always use stop-loss orders. Protect your capital like a pro!

What Institutional Accumulation Means For You

The big players aren’t sitting on the sidelines. Institutional crypto accumulation is picking up steam, signaling that confidence in Bitcoin’s long-term trajectory is strong, even after wild swings. This isn’t just good news for Wall Street; it provides stability and liquidity that benefit everyone, including retail newcomers.

If you’re wondering when to make your move, consider this: periods of consolidation after major corrections often lead to more sustainable growth phases. Instead of chasing parabolic moves, look for steady accumulation zones where volatility is lower and fundamentals are stronger.

Your Next Steps: Actionable Tips For New Crypto Investors

Top Beginner Crypto Buying Tips for 2025

-

Choose a Regulated Crypto Exchange: Start your journey on established, regulated platforms like Coinbase, Kraken, or Binance. These exchanges offer robust security, transparent fees, and comply with KYC/AML regulations, making them ideal for first-time buyers.

-

Use Secure Wallets for Storage: Protect your assets by transferring your crypto to secure wallets such as Ledger Nano X or Trezor Model T. Hardware wallets keep your private keys offline, reducing the risk of hacks.

-

Start Small and Dollar-Cost Average (DCA): Minimize risk by investing small amounts regularly instead of making large, one-time purchases. Platforms like Gemini and Coinbase offer automated DCA features to help you build your portfolio steadily.

-

Research and Diversify: Don’t put all your funds into a single asset. Explore top cryptocurrencies like Bitcoin (BTC)—currently priced at $108,043.00—and Ethereum (ETH) to spread risk and capture more opportunities.

-

Leverage Responsibly—If at All: Beginners should avoid or strictly limit leverage. If you must use leverage, stick to low levels (2x–5x) on reputable platforms like Kraken or Binance and understand the risks of liquidation, especially after recent market events.

-

Enable Two-Factor Authentication (2FA): Secure your accounts with 2FA using apps like Google Authenticator or Authy. This extra layer of protection helps prevent unauthorized access to your crypto holdings.

-

Stay Informed With Reliable Tools: Use trusted resources like Token Metrics and CoinGecko for market analysis, news, and real-time price tracking. Staying updated helps you make smarter decisions in a fast-moving market.

You don’t need to be an expert day one, but you do need discipline and curiosity. Here’s how to stay ahead:

- Keep learning: Follow reputable news sources and educational content tailored for beginners.

- Avoid FOMO: Don’t chase pumps or panic during dips; stick with your plan.

- Embrace dollar-cost averaging: Regular, small purchases can smooth out volatility and reduce stress.

- Use AI tools wisely: Platforms like Token Metrics can help analyze trends but never replace critical thinking.

If you want more depth on how past surges shaped today’s strategies, and what first-time buyers should know right now, take a look at this in-depth analysis.

Bitcoin (BTC) Price Prediction Table: 2026-2031

Professional outlook based on post-leverage flush market reset, institutional trends, and evolving regulatory and macroeconomic factors.

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg Price YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $123,000 | $154,000 | +13.9% | Steady recovery as leverage resets; institutional accumulation grows; potential volatility if new regulations emerge |

| 2027 | $109,000 | $136,000 | $174,000 | +10.6% | Mainstream adoption accelerates; ETFs and regulated products expand; halving effects fade |

| 2028 | $120,000 | $151,000 | $200,000 | +11.0% | New bull cycle possible; tech upgrades (Layer 2, privacy) gain traction; global macro factors supportive |

| 2029 | $134,000 | $170,000 | $230,000 | +12.6% | Increasing competition from altcoins; continued institutional entry; possible regulatory headwinds |

| 2030 | $148,000 | $192,000 | $265,000 | +12.9% | Wider acceptance as digital gold; integration into global finance; volatility remains but less extreme |

| 2031 | $164,000 | $218,000 | $310,000 | +13.5% | Potential for new ATHs; widespread adoption by sovereigns and corporations; cyclical corrections likely |

Price Prediction Summary

Bitcoin is expected to maintain a steady upward trajectory from 2026 to 2031, following the 2025 leverage flush and subsequent market stabilization. Institutional adoption and expanding use cases will likely support higher average prices, though periodic corrections and regulatory uncertainties may cause volatility. The minimum and maximum price ranges reflect both conservative and bullish scenarios, offering a comprehensive view for investors.

Key Factors Affecting Bitcoin Price

- Institutional adoption and capital inflows

- Global macroeconomic events (e.g., tariffs, inflation)

- Regulatory developments (KYC, taxation, ETF approvals)

- Technological improvements (scalability, privacy, Layer 2 solutions)

- Market cycles (halvings, bull/bear phases)

- Competition from altcoins and tokenized assets

- Geopolitical events impacting risk appetite

- Investor education and mainstream accessibility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The bottom line? The leverage flush may have rattled nerves, but it also cleared the decks for smarter investing. With Bitcoin stabilized above $100,000 and institutional support growing, this could be an ideal window to take your first confident step into crypto, just remember to stay sharp and secure every move!