Vanguard’s monumental policy shift has just unlocked the simplest, most secure gateway for millions of investors to buy Bitcoin. As of December 2,2025, the world’s second-largest asset manager, overseeing $11 trillion, now permits its 50 million clients to trade spot Bitcoin ETFs directly on its platform. With Bitcoin trading at $93,942.00, this change arrives amid surging demand and a maturing market, making vanguard bitcoin etf buy 2025 a reality without the hassles of exchanges or wallets.

This reversal ends years of Vanguard’s staunch resistance to crypto, driven by concerns over volatility. New CEO Salim Ramji, poached from BlackRock where he spearheaded the blockbuster iShares Bitcoin Trust (now at $70 billion), has steered the firm toward client-led innovation. Vanguard won’t launch its own crypto products or allow leveraged plays, but spot ETFs for Bitcoin, Ethereum, XRP, and Solana are now fair game. For risk-averse investors, this means secure BTC purchase Vanguard style: regulated, low-cost, and integrated into familiar brokerage accounts.

Vanguard’s Calculated Pivot Reshapes Crypto Access

Picture this: a firm synonymous with index funds and buy-and-hold discipline suddenly embraces digital assets. Vanguard’s move reflects Bitcoin’s evolution from fringe speculation to portfolio staple, especially as it holds steady above $93,000. Clients can now tap high-volume ETFs like BlackRock’s IBIT or Fidelity’s FBTC without leaving the platform, sidestepping the cybersecurity risks of direct custody. Trading volume in these ETFs has exploded, underscoring their liquidity and appeal for easy crypto etf investment.

Vanguard’s decision aligns with client demand, but maintains our focus on long-term value over hype.

Strategically, this positions Vanguard competitively against rivals like BlackRock and Fidelity, who dominate ETF inflows. Yet, Ramji’s team draws a firm line: no futures-based or inverse products, preserving the firm’s low-risk ethos. For portfolio managers like myself, this opens doors to tactical allocations without compromising due diligence.

Bank of America’s Synergistic Green Light Amplifies Momentum

Parallel to Vanguard, Bank of America is directing its wealth advisors to consider bank of america bitcoin allocation of 1% to 4% starting January 5,2026. Covering top ETFs like Bitwise BITB, Fidelity FBTC, and Grayscale BTC, BofA signals institutional conviction in Bitcoin as a ‘gold rival. ‘ With over 15,000 advisors now empowered, this funnels regulated capital into crypto, boosting bitcoin etf trading volume and price stability.

From a pragmatic lens, these shifts aren’t impulsive. Bitcoin’s 24-hour range of $91,857 to $94,013 at $93,942.00 demonstrates resilience amid macro uncertainties. BofA’s research coverage validates ETFs as the bridge for traditional portfolios, much like Vanguard’s platform integration. Together, they democratize access, reducing barriers for conservative investors wary of unregulated exchanges.

Strategic Advantages of Buying BTC via Vanguard ETFs

Why prioritize Vanguard for your Bitcoin entry? First, security: ETFs hold actual BTC in cold storage via custodians like Coinbase, eliminating private key risks. Second, ease: trade like any stock during market hours, with Vanguard’s rock-bottom fees. Third, diversification: pair with your existing holdings for balanced exposure. At current levels around $93,942.00, a modest 2% allocation could hedge inflation without overexposure.

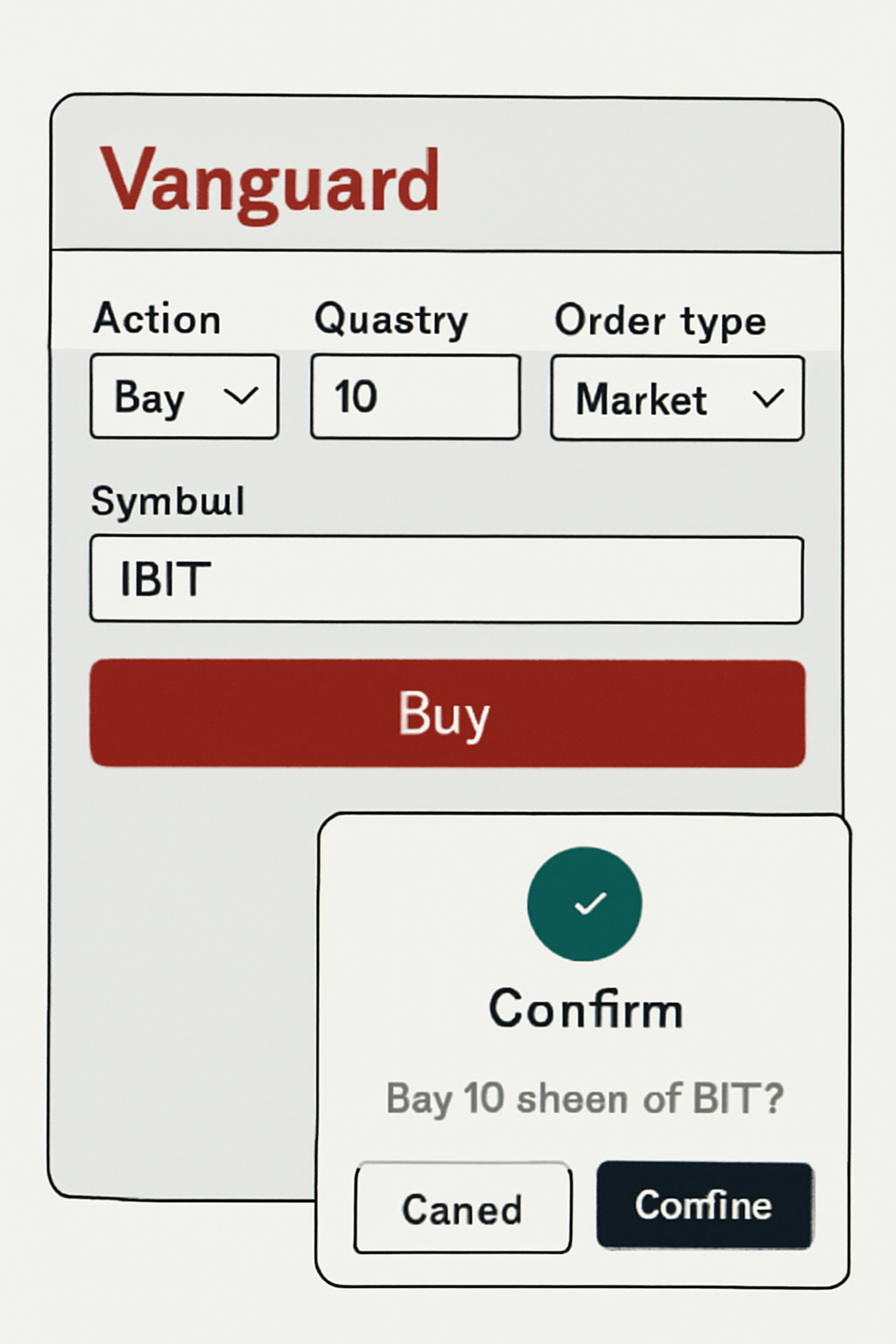

Consider the mechanics. Log into your Vanguard account, search for tickers like IBIT or FBTC, and execute. No KYC hurdles beyond your brokerage setup, no tax headaches from direct crypto sales. This setup excels for secure btc purchase vanguard, blending institutional-grade safety with retail simplicity. As Bitcoin ETF assets surpass hundreds of billions, liquidity ensures tight spreads even in volatility spikes.

Bitcoin (BTC) Price Prediction 2026-2031: Post-Vanguard ETF Listing and Institutional Adoption

Forecasts incorporating ETF inflows from Vanguard ($11T AUM), Bank of America allocations, 2028 halving, and macro trends; baseline 2025 avg: $120K

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $110,000 | $160,000 | $220,000 | +33% |

| 2027 | $150,000 | $230,000 | $320,000 | +44% |

| 2028 | $220,000 | $350,000 | $500,000 | +52% |

| 2029 | $280,000 | $450,000 | $650,000 | +29% |

| 2030 | $350,000 | $580,000 | $850,000 | +29% |

| 2031 | $450,000 | $750,000 | $1,100,000 | +29% |

Price Prediction Summary

Bitcoin is set for substantial appreciation amid Vanguard’s reversal to allow crypto ETFs for 50M clients, BofA’s 1-4% allocation recommendation, and ongoing institutional inflows. Projections show average prices climbing from $160K in 2026 to $750K by 2031, with bull scenarios exceeding $1M driven by adoption and halvings, while bears account for potential macro downturns.

Key Factors Affecting Bitcoin Price

- Vanguard’s policy shift enabling BTC/ETH/XRP/SOL ETFs for $11T AUM clients

- Bank of America opening BTC ETFs to wealth management with 1-4% portfolio recommendations

- 2028 Bitcoin halving reducing supply issuance

- Surging institutional inflows and mainstream adoption

- Favorable regulatory environment and macro trends supporting risk assets

- Technological advancements and growing BTC use cases like store-of-value

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These predictions hinge on sustained ETF inflows, post-halving supply dynamics, and favorable macro tailwinds, but they underscore Bitcoin’s potential from its current $93,942.00 perch. For strategic investors, timing entries via Vanguard ETFs minimizes downside while capturing upside.

Navigating Risks in the Vanguard Bitcoin ETF Era

Bitcoin’s allure at $93,942.00 doesn’t erase volatility; 24-hour swings from $91,857 to $94,013 remind us of that. Vanguard’s guardrails, no leveraged products, help, but prudent sizing matters. Limit exposure to 1-2% initially, scaling based on conviction. Pair with stabilizers like bonds or gold ETFs for ballast. This approach tempers easy crypto etf investment enthusiasm with discipline, avoiding the pitfalls that ensnared early adopters.

Regulatory clarity bolsters confidence, yet watch for policy reversals or custody issues. Vanguard’s selection of spot ETFs ensures direct BTC backing, but premium/discount tracking warrants monitoring. From my hybrid analysis, technicals show support at $90,000, with RSI neutral, primed for measured gains if volume holds.

Institutions like Bank of America reinforce this maturity. Their 1-4% bank of america bitcoin allocation guidance sets a template: treat BTC as 21st-century gold, not a lottery ticket. Vanguard clients gain similar firepower without advisory fees, amplifying retail edge.

Top 5 BTC ETFs on Vanguard

-

1. IBIT (BlackRock iShares Bitcoin Trust)AUM: $70 billionExpense Ratio: 0.25%24h Volume: $3.2 billionTop performer with massive inflows.

-

2. FBTC (Fidelity Wise Origin Bitcoin Fund)AUM: $25 billionExpense Ratio: 0.25%24h Volume: $1.5 billionStrong liquidity from Fidelity’s platform.

-

3. GBTC (Grayscale Bitcoin Trust)AUM: $18 billionExpense Ratio: 1.50%24h Volume: $600 millionEstablished pioneer, higher fee.

-

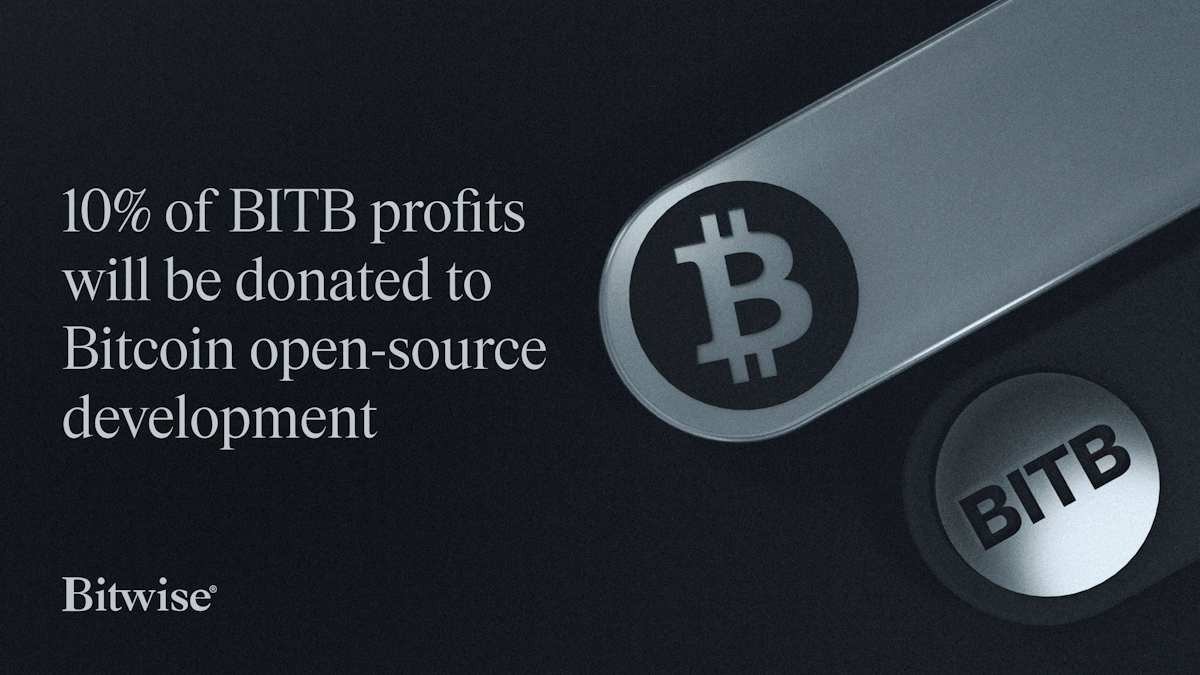

4. BITB (Bitwise Bitcoin ETF)AUM: $4.4 billionExpense Ratio: 0.20%24h Volume: $300 millionCompetitive low-cost option.

-

5. ARKB (ARKB 21Shares Bitcoin ETF)AUM: $3.9 billionExpense Ratio: 0.21%24h Volume: $200 millionBacked by ARK innovation focus.

Portfolio Integration Tactics for 2025

Integrating Bitcoin via Vanguard demands strategy over impulse. Start with correlation analysis: BTC’s low ties to equities (around 0.4) offer true diversification. Rebalance quarterly, selling highs to fund dips. At $93,942.00, dollar-cost averaging through ETFs smooths entry, leveraging Vanguard’s commission-free trades.

For tax efficiency, hold long-term; ETFs mirror stock treatment, simplifying 1099s. Amid rising bitcoin etf trading volume, execution quality shines, no slippage like decentralized exchanges. This setup suits my CFA-informed playbook: fundamentals first (network growth, adoption metrics), charts second (breakouts above $95,000 signal strength).

Client demand drove Vanguard’s U-turn, per Ramji, but execution separates winners. Avoid FOMO; model scenarios. A 2% slice at current prices could yield 30-50% portfolio lift in bull cases, per historical analogs, yet demands patience.

Big banks’ convergence validates Bitcoin’s staying power. Vanguard’s platform, now crypto-enabled, streamlines secure BTC purchase Vanguard for the masses. As assets under management swell, expect tighter bid-ask spreads and deeper liquidity. Position accordingly: measured, informed, resilient. Bitcoin at $93,942.00 isn’t a peak; it’s a platform for strategic growth in portfolios built to last.