As Bitcoin hovers at $89,144 amid a post-peak correction from its October all-time high above $125,000, Wall Street’s sharpest minds see more than volatility, they see validation. Bernstein analysts, led by Gautam Chhugani, have stuck to their $510 price target for Coinbase Global (COIN), now trading at $269.73. That implies nearly 90% upside, even as the stock sheds gains from its July peak near $444. In a market flushed with forced sellers and macroeconomic jitters from the Federal Reserve’s cautious pivot, this forecast isn’t hype, it’s a research-backed bet on Coinbase’s transformation into a diversified crypto universal bank.

Coinbase’s resilience shines through its latest guidance: subscription and services revenue projected at $665-745 million for Q3 2025 alone. This isn’t just trading fees; it’s stablecoin yields, institutional custody, and staking rewards building a moat around the platform. Bernstein raised the target from $310 in June, forecasting $14.1 billion in total revenue by 2027 with earnings per share hitting $20.38. For investors eyeing coinbase stock forecast 510 2025, this underscores a pivot from pure exchange to ecosystem powerhouse, less tethered to Bitcoin’s swings.

Bernstein’s Deep Dive: Coinbase Beyond the Trading Desk

Chhugani’s team doesn’t mince words, calling Coinbase the most misunderstood business in crypto. Trading volumes may ebb with Bitcoin’s 24-hour dip of $447 to $89,144, but non-trading revenue now dominates. Stablecoin interest alone could rival spot trading profits, while custody services lure institutions wary of self-hosted risks. Staking, too, positions Coinbase as Ethereum’s gatekeeper, capturing fees from a network whose utility grows despite market noise.

Zoom out, and the math stacks up. At current levels, COIN’s forward multiples compress, trading at a discount to its growth trajectory. Bernstein’s models factor in product expansions like Base layer-2 scaling and international pushes, areas where competitors lag. This isn’t blind optimism; it’s extrapolated from Q2 earnings beats and a balance sheet fortified against downturns. For those researching bernstein coinbase prediction, the firm’s track record on crypto infrastructure speaks volumes, having nailed prior cycles.

Bitcoin’s 2025 Pullback: Opportunity Knocking for Secure Accumulation

Bitcoin’s slide from $125,000 and to $89,144 mirrors broader equity wobbles and Fed hawkishness, yet on-chain metrics scream oversold. Exchange reserves dwindle, long-term holders accumulate, and ETF inflows persist despite the noise. Reuters notes bearish year-end odds below $90,000, but history favors dips as entry points, clearing weak hands for the next leg up. At this juncture, tying into bernstein coinbase prediction, Coinbase offers the ideal on-ramp, blending accessibility with institutional-grade security.

Coinbase’s Fortress: Diversified Revenue in a Volatile Crypto Landscape

Bernstein highlights how Coinbase decouples from pure BTC exposure. Custody now serves heavyweights like BlackRock’s ETFs, generating steady fees irrespective of price action. Stablecoins like USDC, co-issued with Circle, yield interest on billions in circulation, a cash cow scaling with adoption. Staking services, live for ETH and beyond, tap proof-of-stake economics projected to eclipse proof-of-work energy debates.

In Q3 guidance, these streams signal durability, even as spot trading softens with Bitcoin at $89,144. Compare to peers hemorrhaging in bear phases; Coinbase’s 90% upside to $510 rests on this blend, per coinbase stock forecast 510 2025 models. Investors should note the stock’s beta to BTC has moderated, rewarding holders through cycles. As volatility shakes out, platforms like Coinbase emerge stronger, primed for regulatory tailwinds under clearer U. S. frameworks.

This maturation positions Coinbase not just as a trading venue, but as the safest crypto exchange 2025 contender for retail and institutional alike. With Bitcoin dipping to $89,144, the platform’s tools enable precise accumulation without the pitfalls of decentralized pitfalls or offshore risks.

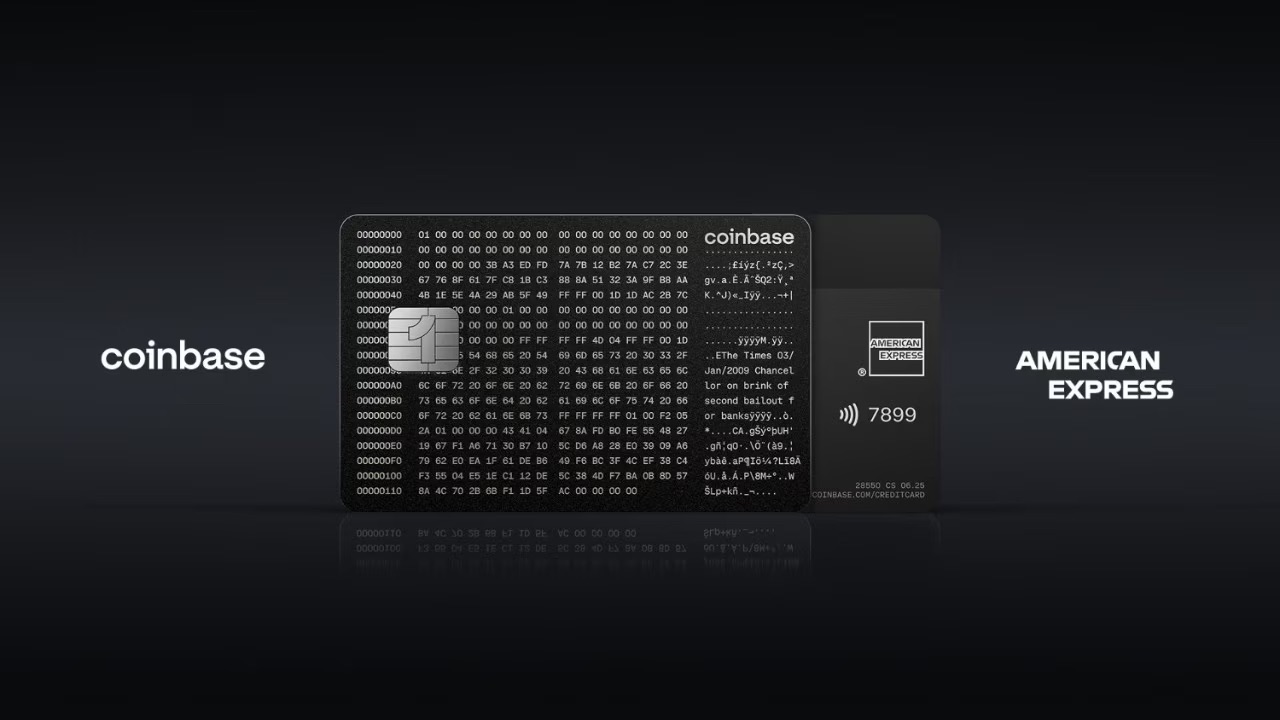

Security First: Coinbase’s Defenses in a Hacker’s World

Coinbase’s security isn’t marketing fluff; it’s engineered rigor. Over 98% of user funds sit in offline cold storage, segmented across geographic vaults to thwart single-point failures. A $320 million insurance policy covers hot wallet breaches, a rarity among peers. Biometric logins, device confirmation, and YubiKey support elevate beyond basic 2FA, while Vault withdrawals impose multi-day delays for high-value moves. Independent audits from SOC 1 and SOC 2 affirm compliance, drawing regulators’ nods amid FTX echoes.

These layers matter now, as phishing surges with market stress. Bernstein’s models implicitly bank on this trust premium, fueling revenue diversification. For investors probing buy bitcoin securely on coinbase, the platform’s track record shines: zero major hacks since inception, versus billions lost industry-wide. Pair this with real-time alerts and address whitelisting, and you’ve got a fortress for dollar-cost averaging into Bitcoin’s rebound.

Coinbase’s Key Security Features

-

98%+ Cold Storage: Coinbase secures the majority of customer assets offline in cold storage, minimizing hacking risks from online hot wallets. Funds are held in geographically distributed, air-gapped facilities. Learn more

-

Hot Wallet Insurance: Up to $255M in third-party insurance covers theft from online hot wallets via Lloyd’s of London policies. USD balances are FDIC-insured up to $250,000 through partner banks. Details here

-

Advanced 2FA Options: Supports authenticator apps (e.g., Google Authenticator, Duo), hardware keys (YubiKey), and biometrics. Whitelisting addresses adds extra protection against unauthorized transfers. Setup guide

-

Regular Third-Party Audits: SOC 1 Type 2 and SOC 2 Type 2 compliant, with annual audits by Deloitte. Publishes quarterly Proof of Reserves attestations verifying 1:1 asset backing. Audit reports

-

Vault Withdrawal Delays: Coinbase Vault requires 48-72 hour delays for withdrawals, giving time to cancel unauthorized attempts. Ideal for long-term holdings with multi-approval options. Vault info

Practical Steps: Accumulate Bitcoin Securely Today

Dips like Bitcoin’s 24-hour drop of $447 to $89,144 flush leverage, leaving pristine charts for patient buyers. Coinbase simplifies entry: fund via ACH or wire for instant trades, or recurring buys to average costs. No KYC headaches for U. S. users under $1,000 daily, scaling seamlessly for larger positions. Integrations with hardware wallets like Ledger export keys privately, closing the self-custody loop without exchange exposure.

Consider the ecosystem perks. Base chain transactions slash fees versus Ethereum mainnet, while Learn-and-Earn modules educate on risks, fostering informed holds. Amid Fed caution and ETF maturation, this setup aligns with Bernstein’s $510 COIN thesis, where platform stickiness drives $14.1 billion revenue by 2027. Oversold signals, from low exchange balances to HODLer conviction, suggest the $89,144 trough won’t linger.

Long-term, clearer U. S. rules could unlock derivatives and lending, amplifying Coinbase’s edge. BlackRock’s ETF custody already funnels billions; expect more as Bitcoin ETFs evolve. For those benchmarking safe crypto exchanges 2025, Coinbase’s blend of usability and fortification trumps alternatives mired in opacity or outages. Check related insights on safest platforms post-2025 rally.

With COIN at $269.73 eyeing 90% gains and Bitcoin consolidating post-$125,000 glory, the convergence of stock upside and asset accumulation screams asymmetric reward. Platforms evolve; winners endure. Coinbase, per Bernstein’s lens, leads both.