As Bitcoin maintains its position around $87,563 despite $1.72 billion in ETF outflows over early 2026, the market reveals a classic divergence: retail and institutional jitters clashing with deeper macro resilience. Cathie Wood’s ARK Invest warns of turbulence ahead, yet their recent Coinbase accumulation signals confidence in crypto infrastructure. Whales, too, continue stacking sats quietly, underscoring that these outflows may represent a buy bitcoin etf outflows 2026 moment for the patient. This piece unpacks the dynamics and charts a path for secure bitcoin purchase whales accumulating.

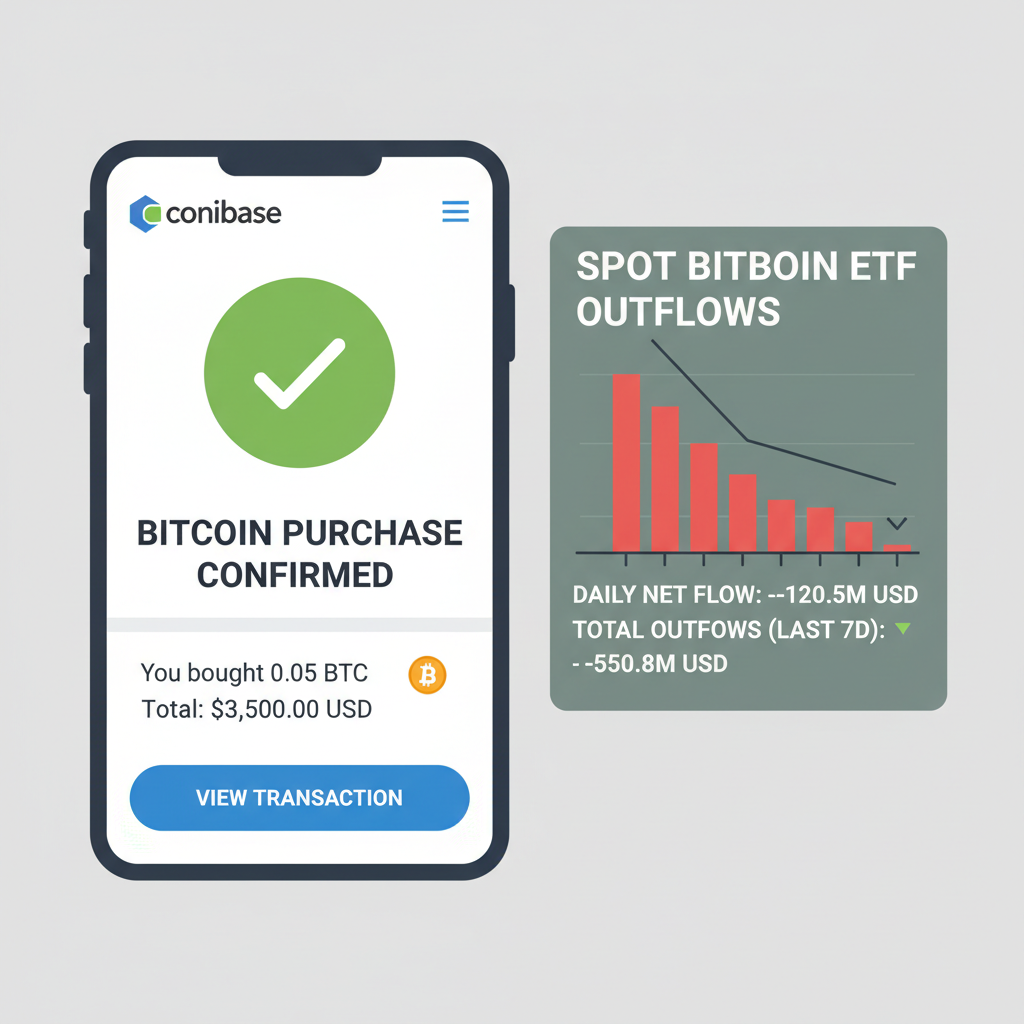

Early 2026 brought a sharp reversal for spot Bitcoin ETFs. After kicking off with $1.168 billion in inflows, the funds hemorrhaged capital, peaking at $483.38 million out on January 20 alone. Grayscale’s GBTC and Fidelity’s FBTC bore the brunt, while even Ethereum ETFs shed $229.95 million. Pundits like Jacob King cry bubble collapse, but dig deeper: BlackRock’s IBIT still netted $888 million year-to-date by mid-January. This volatility ties Bitcoin’s price action ever tighter to institutional flows, per Amberdata insights.

ETF Outflows as Macro Noise, Not Narrative Shift

Zoom out to the bigger picture. These outflows, while stark, pale against Bitcoin’s maturing role in global finance. ARK’s Big Ideas 2026 report positions BTC and tokenization as drivers of the next economic paradigm, not mere speculation. Cathie Wood, on Fox Business, cautioned Bitcoin could face headwinds from broader market forces, yet her firm’s actions speak louder: snapping up $16.47 million in Coinbase shares amid the dip. This ark invest coinbase dip buy reflects a bet on exchanges thriving through volatility, as retail flight creates wholesale opportunities.

Bitcoin’s price action in 2026 has become inextricably tied to institutional ETF flows.

Consider the macro tailwinds. ETF holdings are projected to swell 19.7% in coming years, boosting market acceptance. Morgan Stanley’s ETF filing and Goldman’s nods signal Wall Street’s deepening embrace. Outflows? Likely profit-taking or rebalancing after 2025’s rally, not abandonment. At $87,563, Bitcoin trades near its 24-hour high of $88,654, shrugging off the noise with just a -0.004450% dip.

Whales Defy the Panic: Accumulation Signals Strength

While ETFs bleed, on-chain data paints a bullish undercurrent. Bitcoin whales – addresses holding 1,000 and BTC – ramped up accumulation through the outflow frenzy. Amberdata notes this counterflow, where large holders absorb supply dumped by shaken institutions. History rhymes: post-2022 capitulation, whale hoarding preceded the bull run. Today, at $87,563, such demand buffers downside, hinting at a floor amid easy safe crypto buying dip setups.

ARK’s playbook amplifies this. Reducing Circle exposure while loading Coinbase underscores a pivot to battle-tested platforms. Wood predicts Bitcoin outpacing gold, fueled by ETF maturation. For everyday investors, this divergence screams opportunity: outflows create discounted entry points, but only if navigated securely.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts amid 2026’s $1.72B ETF outflows, whale accumulation, ARK Invest’s 19.7% ETF growth projection, and Coinbase strategy

| Year | Minimum Price | Average Price | Maximum Price | Est. YoY Growth (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $80,000 | $120,000 | $170,000 | +36% |

| 2028 | $110,000 | $160,000 | $230,000 | +33% |

| 2029 | $140,000 | $210,000 | $310,000 | +31% |

| 2030 | $175,000 | $275,000 | $410,000 | +31% |

| 2031 | $220,000 | $360,000 | $540,000 | +31% |

| 2032 | $280,000 | $470,000 | $710,000 | +31% |

Price Prediction Summary

Despite early 2026 ETF outflows totaling $1.72B and current price at $87,563, Bitcoin is forecasted to recover strongly, with average prices rising progressively from $120,000 in 2027 to $470,000 by 2032. This outlook incorporates bearish minimums for volatility scenarios and bullish maximums driven by institutional inflows, halvings, and adoption surpassing gold.

Key Factors Affecting Bitcoin Price

- Recovery from 2026 ETF outflows via whale demand and selective inflows (e.g., BlackRock IBIT)

- ARK Invest’s 19.7% ETF holdings growth projection and increased Coinbase holdings

- Bitcoin halvings in 2028 and 2032 enhancing scarcity and historical bull cycles

- Institutional adoption positioning BTC to outperform gold as a store of value

- Regulatory developments providing clearer frameworks for crypto ETFs and custody

- Technological advancements in scalability, Layer-2 solutions, and tokenization use cases

- Macroeconomic shifts favoring risk assets amid volatility in traditional markets

- Competition from altcoins tempered by BTC dominance in institutional portfolios

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

ARK’s Coinbase Bet: Infrastructure for the Long Haul

ARK Invest’s moves offer a masterclass in macro positioning. Their $16.5 million Coinbase scoop in late 2025, extended into 2026, bets on trading volumes surging post-dip. Coinbase, as crypto’s premier on-ramp, stands to capture flows rebounding from ETF chaos. Wood’s vision frames Bitcoin not as a trade, but as foundational to tokenized assets – a shift from incremental to transformative.

This strategy dovetails with whale tactics: buy the infrastructure and the asset when sentiment sours. Yet, for retail players eyeing $87,563 Bitcoin, the question shifts to execution. Volatility demands precision in sourcing, storage, and timing.

Execution starts with choosing platforms proven resilient, like Coinbase, where ARK’s conviction underscores long-term viability. Amid outflows, these venues offer the easy safe crypto buying dip infrastructure needed, blending user-friendly interfaces with institutional-grade security. But beyond selection lies the art of self-custody and timing, ensuring your stack withstands macro storms.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts Amid 2026’s $1.72B ETF Outflows, Whale Accumulation, and ARK Invest’s Bullish Strategies

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY Change (Avg) |

|---|---|---|---|---|

| 2027 | $75,000 | $115,000 | $160,000 | +31% |

| 2028 | $105,000 | $195,000 | $320,000 | +70% |

| 2029 | $155,000 | $285,000 | $480,000 | +46% |

| 2030 | $225,000 | $415,000 | $700,000 | +46% |

| 2031 | $325,000 | $605,000 | $1,020,000 | +46% |

| 2032 | $425,000 | $865,000 | $1,500,000 | +43% |

Price Prediction Summary

Despite 2026’s significant ETF outflows and market volatility, Bitcoin is projected to rebound strongly from 2027 onward. Average prices are expected to rise progressively from $115,000 to $865,000 by 2032, driven by the 2028 halving, renewed institutional inflows, whale accumulation, and ARK Invest’s optimistic outlook, with maximum targets reaching $1.5M in bullish scenarios.

Key Factors Affecting Bitcoin Price

- 2028 Bitcoin halving enhancing scarcity and supply shock

- Post-2026 recovery in ETF inflows led by BlackRock and ARK 21Shares

- Whale accumulation and ARK’s increased holdings in Coinbase amid dips

- Expanding tokenization, real-world assets, and institutional adoption

- Potential regulatory clarity boosting market confidence

- Macroeconomic shifts and Bitcoin’s outperformance vs. gold as predicted by ARK

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating the Dip: Secure Purchase Blueprint

Whale accumulation thrives because it pairs conviction with caution. Retail investors can mirror this by prioritizing regulated exchanges, hardware wallets, and layered verification. At $87,563, Bitcoin’s shallow 24-hour dip from $88,654 tests resolve, yet on-chain metrics affirm supply tightening. ARK’s Coinbase pivot highlights exchanges as gateways to this strength, capturing rebound volumes as ETFs stabilize.

Layer in macro awareness: Wood’s forecasts eye Bitcoin eclipsing gold, propelled by 19.7% ETF growth. Outflows, led by GBTC’s $160.84 million exit on January 20, reflect rebalancing, not retreat. BlackRock’s IBIT countered with year-to-date gains, proving selective inflows persist. For portfolios, allocate 5-10% to BTC via direct purchase over ETFs during volatility, sidestepping flow whims.

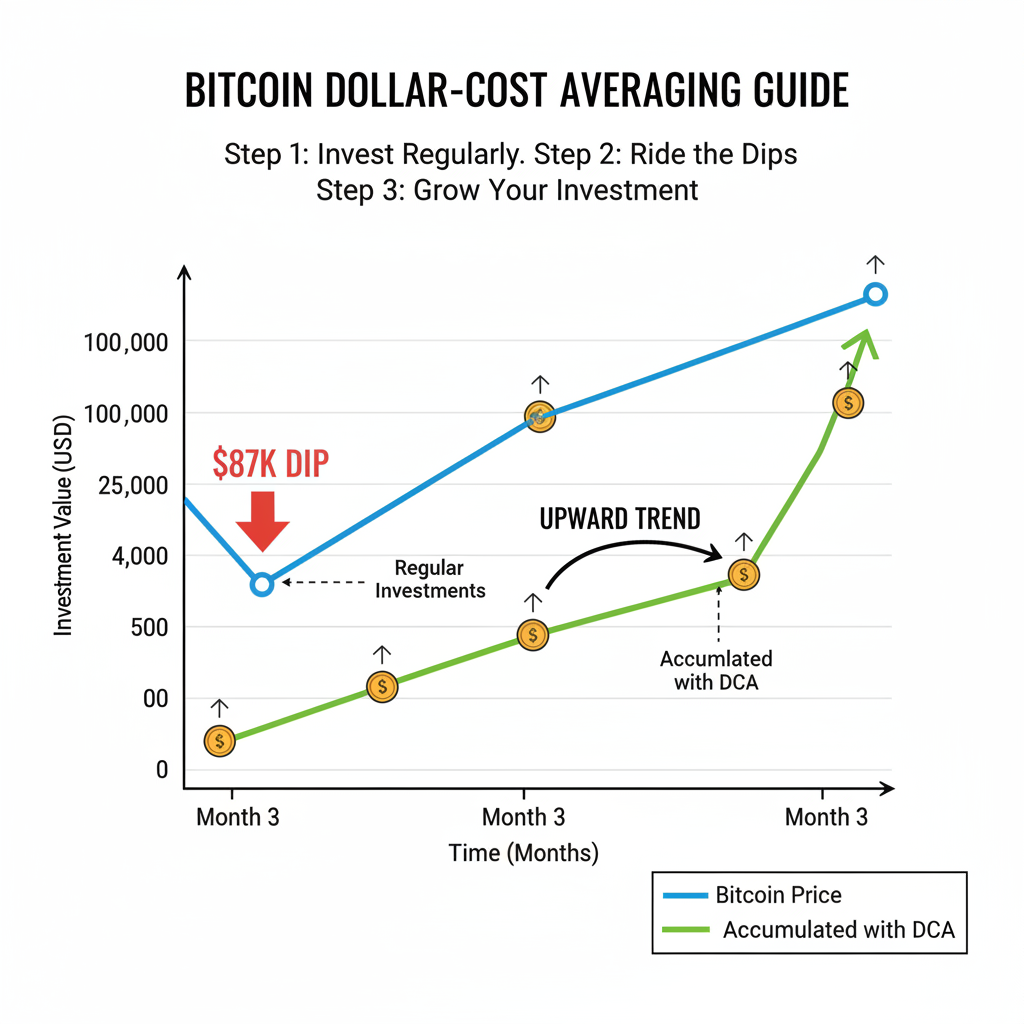

Risks and Rewards: Positioning for Rebound

Outflows amplify short-term risks – liquidity crunches, flash volatility – but reward asymmetry favors holders. Whales, holding steady through $86,126 lows, embody this. ARK’s strategy extends here: infrastructure bets like Coinbase yield alpha as trading surges. Everyday buyers secure edges by dollar-cost averaging, avoiding lump-sum traps in choppy seas.

Tokenization, per ARK’s Big Ideas, elevates Bitcoin beyond store-of-value to economic backbone. This macro arc dwarfs ETF noise, positioning $87,563 as a waypoint, not peak. Sustainable strategies blend whale patience with ARK foresight, turning outflows into foundational buys.

Self-custody seals the deal. Post-purchase, migrate to Ledger or Trezor, enabling control amid uncertainties. Monitor whale wallets via tools like Glassnode for confirmation. This disciplined approach transforms 2026’s turbulence into portfolio fortification.

Bitcoin’s journey reflects broader economic pivots – inflation hedges maturing, institutions recalibrating. Outflows test mettle, yet whale resolve and ARK’s bets illuminate the path. Secure your position thoughtfully, and these dips become the dips that define tomorrow’s gains.