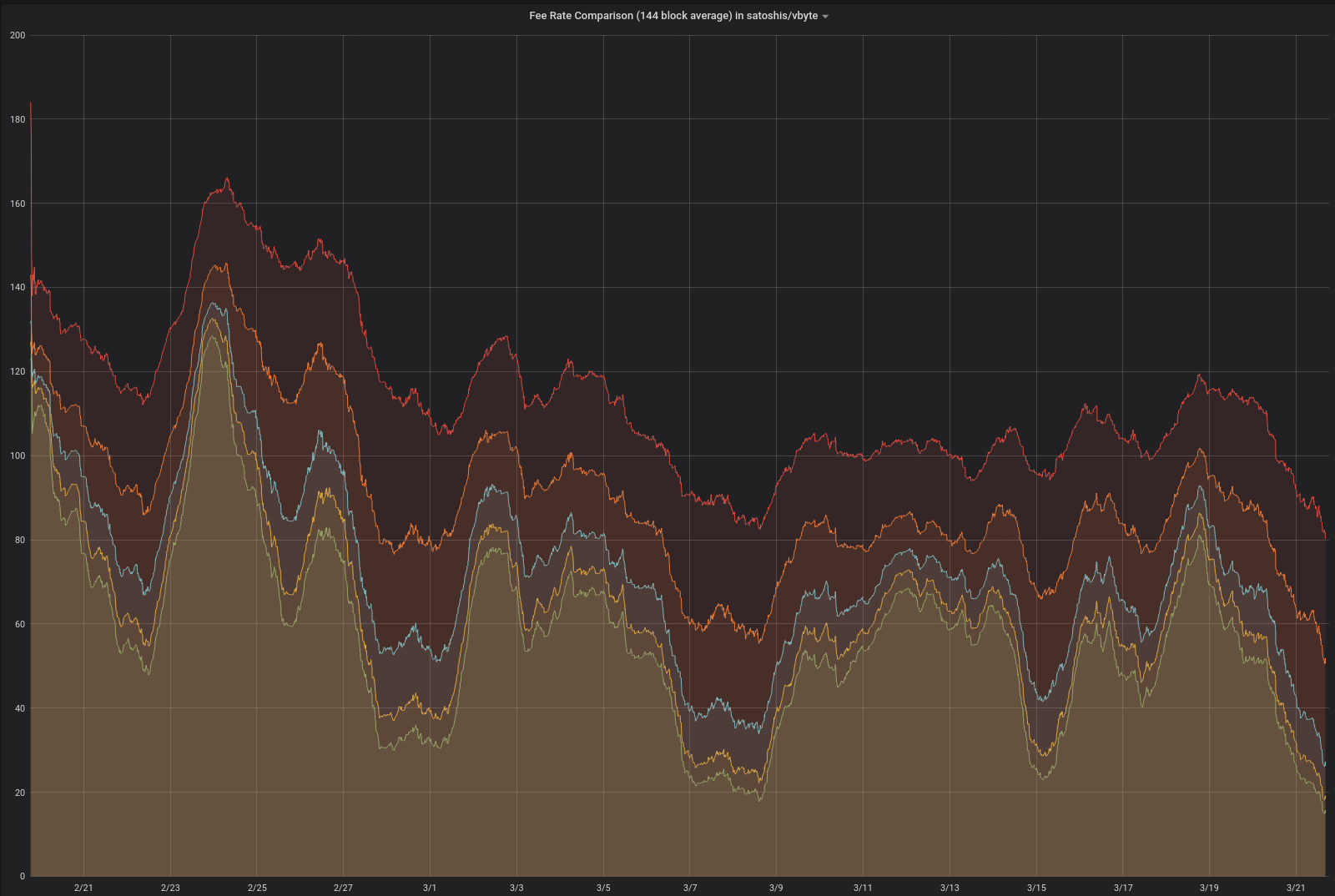

In the shadow of a sharp liquidity crunch that saw the top 12 stablecoins shed $2.24 billion in market cap over ten days, WeChange has stepped in as a beacon for investors eyeing the 2026 market dip. Launching on January 30,2026, this noncustodial fiat-to-crypto platform now spans 190 and countries, offering the easiest secure ways to buy crypto worldwide. With Bitcoin holding steady at $78,221.00 after a modest and $24.00 gain in the last 24 hours, platforms like WeChange make it pragmatic to capitalize on dips without the usual exchange headaches.

WeChange’s Strategic Global Expansion

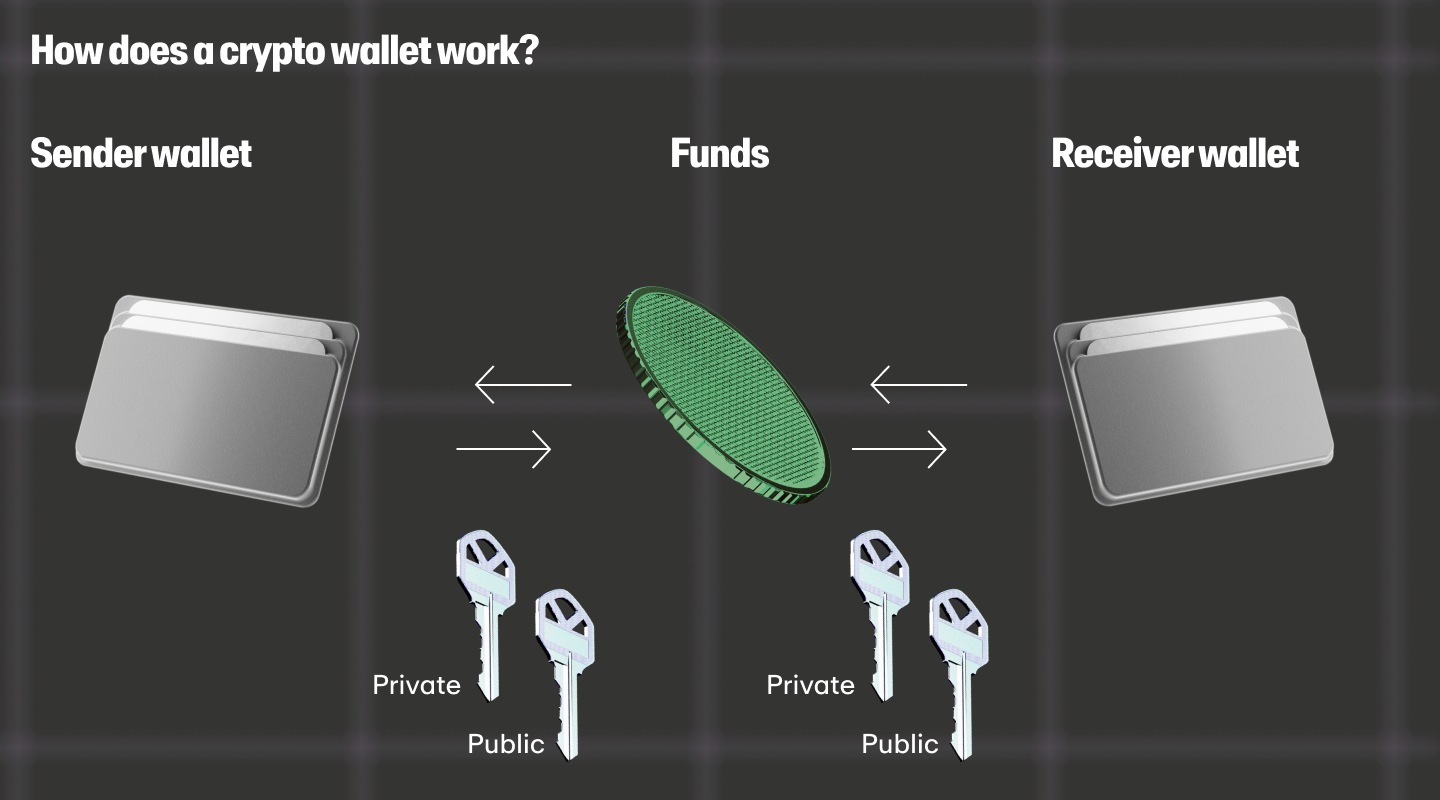

WeChange arrives at a pivotal moment, addressing the pain points that have long plagued crypto newcomers: high fees, custody risks, and regional barriers. Unlike traditional exchanges that custody your funds, WeChange executes transactions straight to your wallet, ensuring you retain full control. This noncustodial model aligns perfectly with my hybrid approach of balancing risk in volatile markets, where self-custody is non-negotiable for long-term holders.

Supporting bank transfer methods like SEPA in Europe, ACH in the US, Faster Payments in the UK, PIX in Brazil, and SPEI in Mexico, the platform starts at just 2.5% fees. Coverage extends across Europe, the Americas, Asia Pacific, and Africa, dictated by local regs. Credit and debit cards from Visa, Mastercard, and Amex are slated for Q2 2026, promising even faster in-app purchases. For those searching WeChange crypto buy 2026, this is the streamlined gateway to assets like Bitcoin amid its current $78,221.00 perch.

Timing the Dip: Liquidity Squeeze Creates Buying Opportunities

The late January contraction wasn’t just numbers on a screen; it signaled capital flight back to fiat banking, dragging total crypto market cap down 0.8% to $3.05 trillion in 24 hours. Bitcoin’s 24-hour range from $77,611.00 low to $79,155.00 high underscores the choppiness, yet its close at $78,221.00 hints at underlying resilience. Savvy portfolio managers like myself see this as a classic setup for buy bitcoin dip WeChange strategies, where reduced liquidity paradoxically offers better entry points before the next leg up.

WeChange’s timing couldn’t be sharper. By sidestepping custodial risks and embracing local payment rails, it lowers the friction for global inflows. In my decade spanning stocks and crypto, I’ve learned that post-dip recoveries favor platforms enabling quick, secure capital deployment. This isn’t hype; it’s a pragmatic shift toward secure global crypto platforms 2026, where accessibility drives adoption.

Mastering Easy Crypto Access Across 190 Countries

Picture this: an investor in Nairobi or São Paulo, frustrated by exchange KYC hurdles, now taps familiar bank transfers to own Bitcoin at $78,221.00 without intermediaries holding their keys. WeChange’s design prioritizes transparency and speed, with transactions settling directly to wallets. Fees at 2.5% undercut many competitors, especially for larger buys where spreads eat margins.

From a strategic lens, this rollout complements diversified portfolios. While Bitcoin dominates at $78,221.00, WeChange supports major alts, letting users build positions efficiently. The platform’s regulatory compliance per region mitigates legal gray areas, a must in today’s maturing market. For buy cryptocurrency securely worldwide, it’s hard to beat this blend of reach and reliability.

Staking pools and dApps get a nod in broader crypto discourse, but WeChange focuses on the onramp, the critical first step. As stablecoin outflows reverse, expect inflows via these rails to stabilize prices and fuel upside.

Bitcoin (BTC) Price Prediction 2027-2032

Annual price forecasts in USD, factoring 2026 dip recovery, WeChange global inflows, halving cycles, and adoption trends

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $85,000 | $120,000 | $180,000 |

| 2028 | $120,000 | $200,000 | $350,000 |

| 2029 | $180,000 | $300,000 | $500,000 |

| 2030 | $250,000 | $400,000 | $650,000 |

| 2031 | $350,000 | $550,000 | $850,000 |

| 2032 | $450,000 | $700,000 | $1,000,000 |

Price Prediction Summary

Bitcoin is projected to recover strongly from the early 2026 dip, driven by WeChange’s launch in 190+ countries enhancing fiat onramps and liquidity. Steady growth through halvings and adoption could push averages from $120K in 2027 to $700K by 2032, with bullish maxima reflecting institutional inflows and regulatory clarity.

Key Factors Affecting Bitcoin Price

- WeChange noncustodial platform enabling low-fee bank transfers worldwide, boosting retail inflows post-dip

- 2028 Bitcoin halving expected to ignite bull cycle with supply shock

- Rising institutional adoption via ETFs and corporate treasuries

- Improving regulatory landscape in key markets (US, EU, Asia)

- Scalability advancements (e.g., Layer 2 solutions) expanding real-world use cases

- Macro trends favoring risk assets amid potential rate cuts and global digitization

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Diving deeper, the platform’s noncustodial ethos resonates with fundamentals-first investors. No more fretting over exchange hacks; your funds stay yours from the jump.

That self-sovereignty extends to every transaction, a core tenet in my risk-adjusted playbook. With Bitcoin consolidating around $78,221.00 after dipping to a 24-hour low of $77,611.00, WeChange equips investors to act decisively without the drag of legacy platforms.

Once set up, the interface guides you through selecting your local payment method, inputting the amount, and confirming the wallet address. Transactions process swiftly, often within minutes for supported rails, landing assets directly in your control. This frictionless flow is gold for easy crypto access 190 countries, turning what used to be a multi-day ordeal into a same-day reality.

In regions like Asia Pacific or Africa, where mobile banking dominates, WeChange’s adaptability shines. No need for convoluted VPNs or offshore accounts; just compliant, local pathways to global assets. I’ve tested similar ramps in volatile cycles, and this one’s engineering stands out for reliability.

Key Advantages: Why WeChange Fits Strategic Portfolios

WeChange Key Benefits

-

Noncustodial Security: Users retain full control of funds and private keys; platform never holds assets for maximum transparency and safety.

-

Low 2.5% Fees: Competitive rates starting at 2.5% on supported bank transfers like SEPA, ACH, PIX, and SPEI.

-

190+ Country Support: Available across Europe, Americas, Asia Pacific, and Africa via local bank methods.

-

Direct-to-Wallet Transfers: Buy and sell crypto instantly sent straight to your personal wallet, no intermediaries.

-

Upcoming Card Options: Q2 2026 launch for Visa, Mastercard, and Amex in-app purchases.

These edges compound over time. Low fees preserve capital on frequent rebalances, while broad coverage diversifies sourcing risks. Pair this with Bitcoin’s current stability at $78,221.00, up a precise $24.00 in 24 hours, and you have a setup for measured accumulation.

From a portfolio manager’s vantage, WeChange slots into dollar-cost averaging amid dips. The recent stablecoin exodus trimmed liquidity, but as capital rotates back, platforms like this accelerate the rebound. Expect Q2 card integrations to boost volumes further, aligning with my view that secure global crypto platforms 2026 will define winners.

Addressing Common Hurdles Head-On

Regulatory nuances vary, yet WeChange navigates them per jurisdiction, a pragmatic nod to real-world enforcement. For alts beyond Bitcoin, the platform supports majors, enabling balanced exposure without custodial lock-in.

Looking ahead, this launch recalibrates the onramp landscape post-dip. With market cap at $3.05 trillion and Bitcoin’s resilience through a $79,155.00 high, inflows via efficient rails could spark the next phase. Investors prioritizing control and cost will gravitate here, building positions strategically as volatility normalizes.

In my hybrid analysis, WeChange isn’t just another tool; it’s a structural upgrade for worldwide adoption. Whether scaling in Nairobi or hedging in New York, it delivers the security and simplicity that turn market noise into opportunity.