In the volatile world of cryptocurrency, few events capture the imagination quite like Bithumb’s staggering $40 billion Bitcoin overpayment blunder in early February 2026. What started as a simple promotional rewards glitch – crediting 695 users with 2,000 BTC each instead of 2,000 Korean won – spiraled into a stark reminder of operational risks in digital asset platforms. As Bitcoin trades at $68,771.00 amid a 2.29% 24-hour dip, this fiasco highlights a prime buying opportunity, provided investors choose platforms with ironclad security and reliability.

The Bithumb Bitcoin Error: A $40 Billion Wake-Up Call

Bithumb, one of South Korea’s largest exchanges, intended to distribute modest incentives worth about $1.40 per user during a routine event. Instead, an internal procedural lapse resulted in the accidental allocation of roughly 620,000 BTC, valued at over $40 billion at prevailing rates. The exchange detected the anomaly within 35 minutes, swiftly halting trading and withdrawals on affected accounts. Remarkably, they clawed back 99.7% of the funds on the same day, averting total catastrophe. Yet, the brief chaos triggered a 17% plunge in Bitcoin’s price on the platform, dipping to $55,000 before stabilizing.

This wasn’t a hack or external breach but a human error amplified by lax internal controls, exposing crypto exchange risks that transcend cybersecurity. South Korean regulators responded decisively, launching a probe to reassess oversight frameworks and address systemic vulnerabilities. Bithumb’s reimbursement plan offers affected users 110% compensation plus zero trading fees, a gesture toward accountability. Still, the incident eroded trust, particularly as global markets grapple with macroeconomic headwinds like persistent inflation and geopolitical tensions.

Navigating the 2026 Market Dip: Macro Insights for BTC Buyers

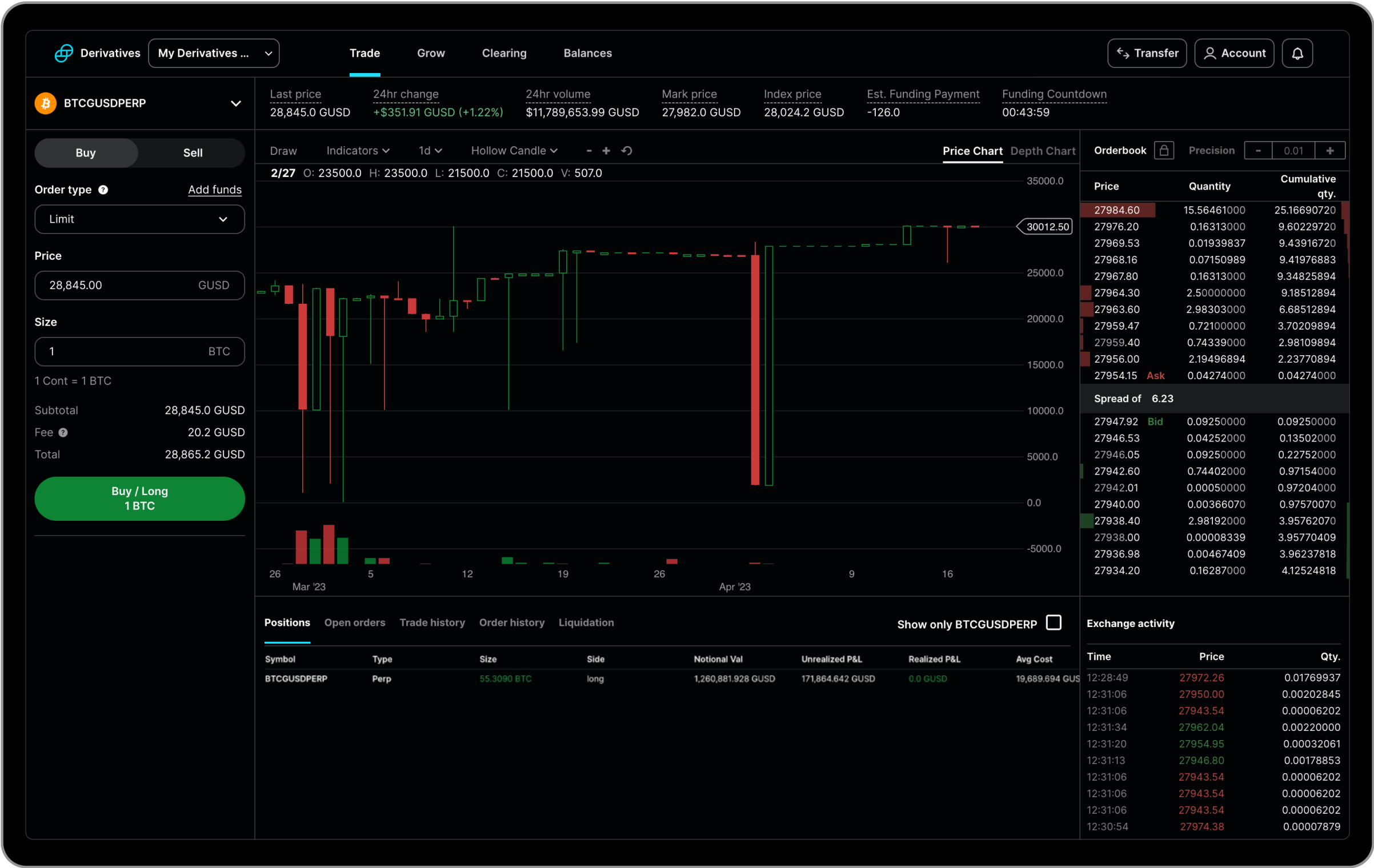

Bitcoin’s current price of $68,771.00 reflects a modest pullback from its 24-hour high of $72,024, with the low touching $68,439. This dip, partly fueled by the Bithumb ripple effects, aligns with broader macro trends: central banks tightening policy amid slowing growth and equity market rotations. Yet, from a fundamental standpoint, such corrections present accumulation zones for long-term holders. Historical patterns show Bitcoin thriving post-crisis, bolstered by institutional adoption and halving cycle dynamics.

In this environment, the key to buy BTC dip safely lies in selecting exchanges that prioritize resilience over promotional gimmicks. Bithumb’s error underscores how even established players can falter, making regulated platforms with proven track records essential. Factors like cold storage protocols, insurance coverage, and compliance with stringent audits separate the secure from the shaky.

Bitcoin (BTC) Price Prediction 2027-2032

Post-Bithumb $40B Incident Recovery Outlook Amid Halving Cycles and Macro Trends

| Year | Minimum Price | Average Price | Maximum Price | Est. YoY Growth (Avg from Prior) |

|---|---|---|---|---|

| 2027 | $85,000 | $110,000 | $150,000 | +46.7% |

| 2028 | $130,000 | $200,000 | $300,000 | +81.8% |

| 2029 | $180,000 | $280,000 | $420,000 | +40.0% |

| 2030 | $250,000 | $380,000 | $550,000 | +35.7% |

| 2031 | $350,000 | $500,000 | $750,000 | +31.6% |

| 2032 | $450,000 | $650,000 | $950,000 | +30.0% |

Price Prediction Summary

Bitcoin is poised for strong recovery from the early 2026 Bithumb overpayment dip (current ~$69K baseline), with average prices projected to climb from $110K in 2027 to over $650K by 2032. Min prices reflect bearish scenarios like prolonged regulatory scrutiny; max prices capture bullish drivers such as halvings and ETF inflows. Projections assume 4-year bull cycles, adoption growth, and macro tailwinds.

Key Factors Affecting Bitcoin Price

- Post-Bithumb stabilization and global regulatory enhancements reducing exchange risks

- 2028 Bitcoin halving tightening supply amid rising demand

- Institutional adoption via ETFs and corporate treasuries (e.g., MicroStrategy expansions)

- Macro trends: inflation hedging, potential Fed rate cuts, and geopolitical safe-haven demand

- Scalability upgrades (Layer 2, Ordinals) expanding real-world use cases

- Competition from Ethereum/Solana but BTC dominance holding at 50%+ market share

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Secure Bitcoin Exchanges 2026: Prioritizing Safety Over Spectacle

As investors eye this dip, turning to secure Bitcoin exchanges 2026 mitigates risks akin to Bithumb’s. Platforms with U. S. or EU regulation, SOC 2 compliance, and substantial user asset insurance stand out. Consider Coinbase, a publicly traded giant with over $250 million in insurance and a spotless operational history. Its Coinbase vs Bithumb security comparison reveals night-and-day differences: multi-signature wallets, 98% cold storage, and real-time monitoring versus Bithumb’s procedural pitfalls.

Kraken follows suit, boasting a decade-plus of incident-free operations, proof-of-reserves audits, and robust staking infrastructure. Gemini, founded by the Winklevoss twins, emphasizes institutional-grade custody with FDIC-insured USD balances up to $250,000. Bitstamp, Europe’s veteran exchange, offers segregated client funds and full regulatory licensing in multiple jurisdictions. Binance. US rounds out the list, tailored for American users with strict FinCEN compliance and enhanced security post-global scrutiny.

These exchanges collectively represent the gold standard, blending macro reliability with user-centric features. During dips like today’s at $68,771.00, their low-fee spot trading and OTC desks enable efficient BTC accumulation without the drama of overpayment fiascos.

Evaluating these platforms through a macro lens reveals their alignment with sustainable investing principles. In an era where digital assets intersect with traditional finance, exchanges that withstand regulatory scrutiny and economic cycles offer a buffer against crypto exchange risks. Bithumb’s Bithumb Bitcoin error serves as a cautionary tale, prompting investors to prioritize substance over scale.

Top 5 Secure BTC Exchanges

-

#1 Coinbase: Publicly traded US leader with 98%+ cold storage, FDIC-insured USD up to $250K, and $320M+ crime insurance—ideal for safe BTC buys amid dips.

-

#2 Kraken: 13+ years hack-free, monthly proof-of-reserves audits, 95%+ cold storage. Trusted for reliability post-Bithumb errors.

-

#3 Gemini: NYDFS-regulated with FDIC USD insurance up to $250K, SOC 2 compliant, institutional cold storage focus.

-

#4 Bitstamp: EU CSSF-regulated since 2011, air-gapped cold wallets, strong compliance track record.

-

#5 Binance.US: FinCEN-registered, US-compliant with proof-of-reserves, segregated funds for secure trading.

Bithumb Blunder Timeline: Lessons in Rapid Response

The sequence unfolded swiftly: the promotional credit error hit 695 users, platform BTC price cratered 17% to $55,000 internally, then Bithumb locked accounts and reversed nearly all funds. Regulators’ probe underscores evolving oversight in Asia’s crypto hub, potentially influencing global standards. For investors, this timeline emphasizes the value of platforms with automated safeguards and transparent auditing, qualities abundant in our top five.

Diving deeper into Coinbase vs Bithumb security, Coinbase’s public status mandates rigorous disclosures, including quarterly proof-of-reserves and $250 million and insurance against operational failures. Kraken’s unblemished record spans banking partnerships and advanced risk engines, ideal for macro plays like dollar-cost averaging into BTC dips. Gemini’s focus on compliance, with NYDFS BitLicense and SOC 2 Type 2 certification, appeals to conservative allocators eyeing Bitcoin as an inflation hedge amid 2026’s uncertain yield curves.

Bitstamp, with roots in 2011, exemplifies endurance through Europe’s MiCA framework, segregating client assets and conducting regular penetration tests. Binance. US, post-FTX reforms, has fortified its U. S. arm with 1: 1 reserves verification and multi-factor authentication layers, bridging retail access to sophisticated trading tools. Together, they facilitate buy BTC dip safely strategies, from recurring buys to limit orders, without exposure to procedural pratfalls.

Macro tailwinds reinforce this moment’s appeal. Bitcoin’s halving legacy, coupled with ETF inflows exceeding $50 billion since 2024 approvals, positions it as a portfolio diversifier. At $68,771.00, with support near the 24-hour low of $68,439, technicals suggest consolidation before upside resumption, driven by corporate treasuries and emerging market adoption. Yet, purpose-driven investing demands vigilance: allocate no more than 5-10% to crypto, diversify across assets, and rebalance amid volatility.

Choosing secure Bitcoin exchanges 2026 isn’t merely defensive; it’s a proactive stance in an asset class maturing under institutional gaze. Bithumb’s recovery, while commendable, exposed fragilities that top-tier platforms have engineered out. As central banks navigate disinflation and trade frictions, Bitcoin’s scarcity narrative endures, rewarding patient accumulators on trusted venues.

Seize this dip with platforms proven in the crucible of markets. Enable two-factor authentication, store keys offline, and view BTC as tomorrow’s reserve asset. In purposeful investing, security isn’t optional – it’s foundational.