Bitcoin’s wild ride in early 2026 has traders on edge, with the asset crashing below $64,000 on February 5 before clawing back to its current level of $67,165.00. This volatility echoes past cycles, where dips to levels like $115,000 from all-time highs near $122,000 triggered savvy accumulations by whales and institutions. Michael Saylor, ever the Bitcoin maximalist, continues teasing fresh buys through Strategy, whose holdings now exceed 673,783 BTC. As whale bitcoin accumulation picks up, large holder netflows jumping to 311.8 BTC weekly, retail investors eye the buy bitcoin dip 2026 opportunity, mirroring Saylor’s unyielding treasury strategy.

Michael Saylor’s Bitcoin Playbook in a Turbulent 2026

Saylor’s approach treats Bitcoin not as a speculative punt but as a corporate fortress asset. With Strategy commanding over half of known corporate BTC stacks at 848,902 coins, his hints at new purchases amid the bitcoin price crash rebound 2026 signal confidence. Recent rebounds above $103,000, fueled by policy whispers like Trump’s $2,000 dividend plan, underscore why his stack-building resonates. I’ve analyzed 13 years of market data, and Saylor’s conviction shines brightest during corrections, his firm doubled down even as $600 million in bullish bets liquidated near $115,000. For everyday holders, this means emulating his discipline: stack sats on dips via platforms proven for institutional-grade security.

Bitcoin stabilizes above key supports, but whales are positioning for the next leg up.

Whales Ride the Waves: Accumulation Signals at $67,165

While retail panic sells erode confidence, whale bitcoin accumulation tells a different story. Bitcoin whales scooped BTC as prices neared records, with netflows ticking higher despite ETF outflows lingering negative. Current trading at $67,165.00: down a mere 0.65% over 24 hours from a $68,428 high, marks a classic buy zone. Historical patterns post-$115,000 dips show whales deploying capital when fear peaks, driving pumps past $120,000. Platforms handling whale-sized trades without slippage become essential here, prioritizing liquidity and compliance to avoid the traps that snag smaller players.

Secure Bitcoin Buying Platforms: Emulating Saylor and Whales

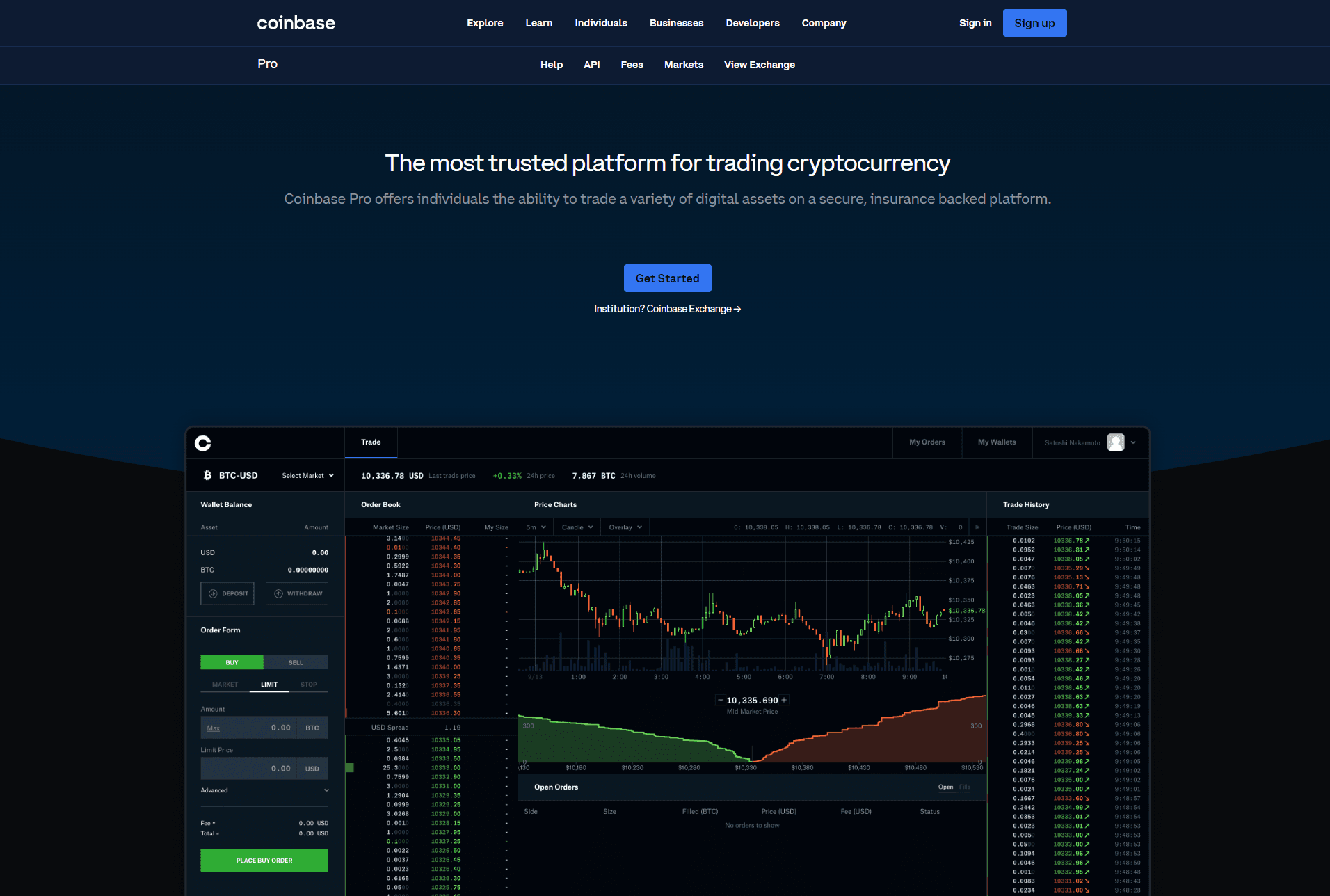

To buy bitcoin dip 2026 like the big players, focus on secure bitcoin buying platforms with ironclad security, U. S. regulatory nods, and deep liquidity. These seven stand out for mirroring michael saylor bitcoin strategy: long-term holding without compromise. Coinbase leads with its battle-tested custody, serving institutions post-multiple audits. Kraken follows, boasting zero major hacks since 2011 and proof-of-reserves transparency that whales trust for multimillion-dollar orders.

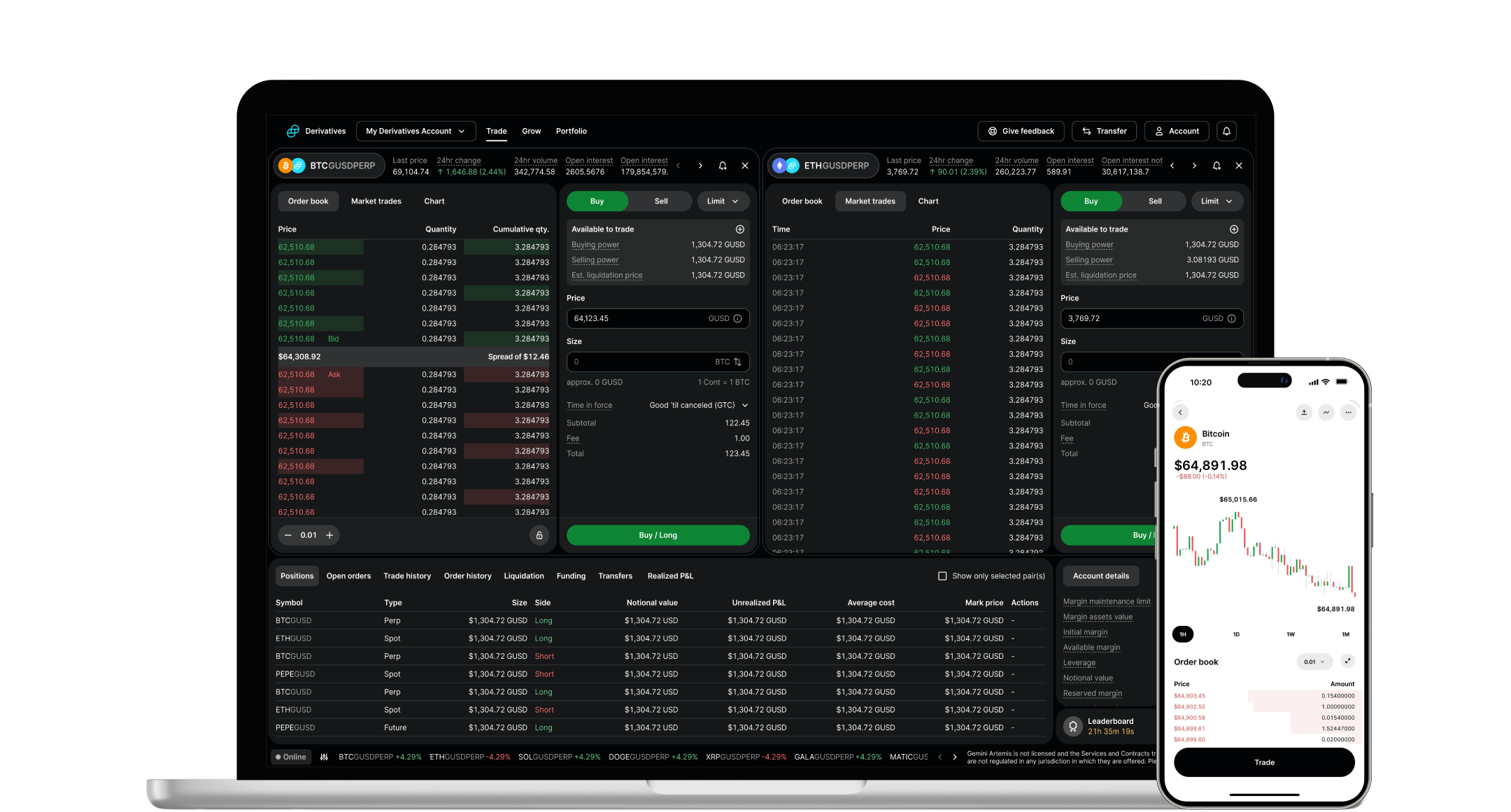

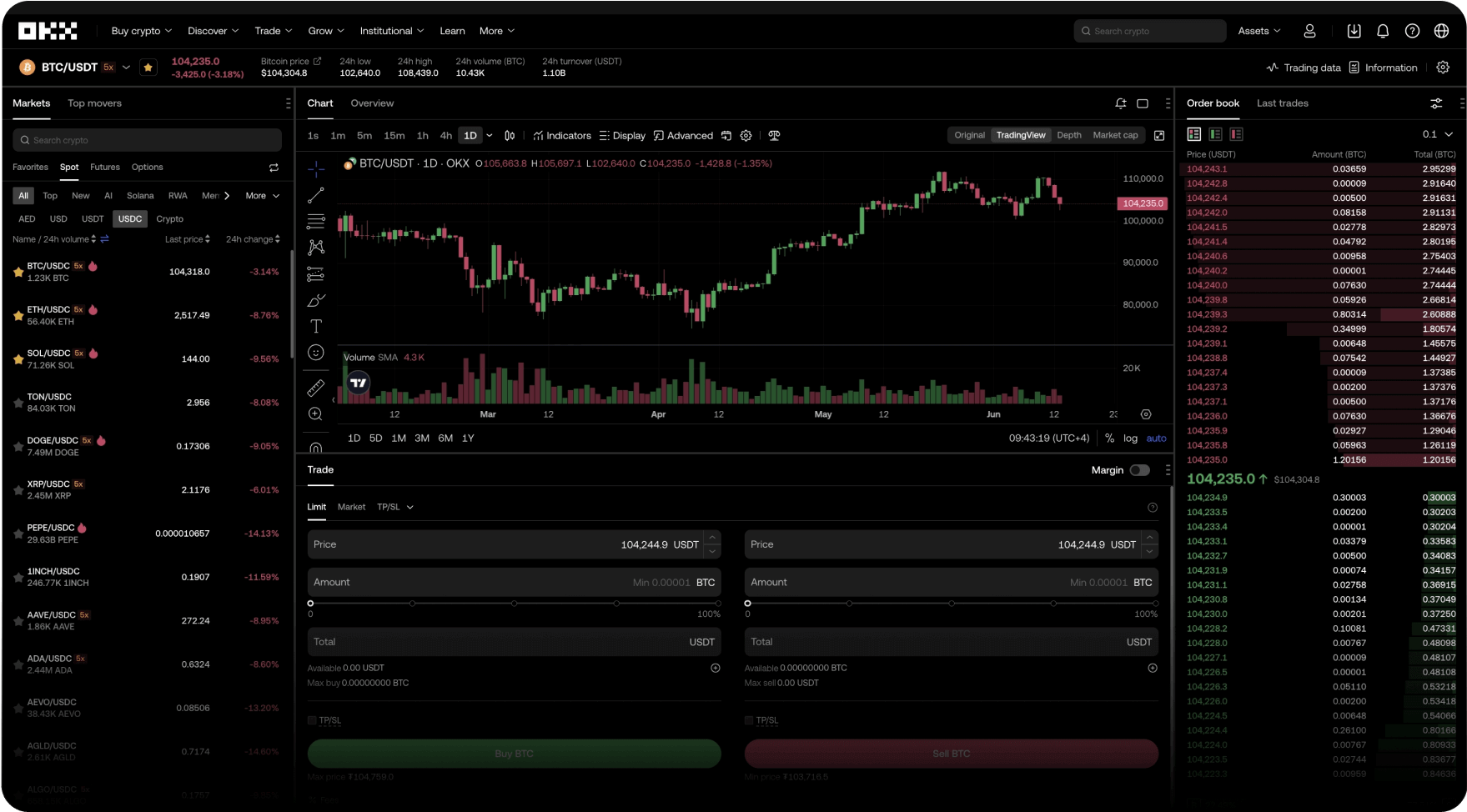

Gemini, founded by the Winklevoss twins, emphasizes NYDFS licensing and SOC 2 compliance, ideal for conservative accumulators. Binance. US offers high liquidity for U. S. users, balancing global depth with local rules. Bitstamp’s 10 and years of clean security record and EU MiCA alignment make it a quiet favorite for steady dips. Crypto. com shines with its insurance fund covering user losses, while OKX delivers top-tier derivatives liquidity for hedging whale-style entries.

Bitcoin (BTC) Price Prediction 2027-2032

Post-2026 Dip Recovery from $67K Support: Bullish Outlook Driven by Institutions and Halvings

| Year | Minimum Price | Average Price | Maximum Price | YoY Avg Growth % |

|---|---|---|---|---|

| 2027 | $80,000 | $140,000 | $220,000 | +108% |

| 2028 | $130,000 | $260,000 | $420,000 | +86% |

| 2029 | $200,000 | $400,000 | $650,000 | +54% |

| 2030 | $280,000 | $550,000 | $900,000 | +38% |

| 2031 | $380,000 | $750,000 | $1,200,000 | +36% |

| 2032 | $500,000 | $1,000,000 | $1,600,000 | +33% |

Price Prediction Summary

Bitcoin is set for a robust recovery after the 2026 crash to $67,165, with average prices projected to surge over 100% in 2027 amid whale accumulation and ETF inflows, reaching $1M by 2032 in a maturing bull market fueled by scarcity and adoption.

Key Factors Affecting Bitcoin Price

- Institutional buying from MicroStrategy (Saylor) and whales holding over 673K BTC

- 2028 Bitcoin halving enhancing supply scarcity

- Surging ETF inflows and positive netflows from large holders

- Pro-crypto policies and macroeconomic shifts (e.g., Trump-era dividends)

- Scalability improvements and growing real-world use cases

- Historical cycle patterns post-correction with support at $67K targeting $100K+ rebounds

- Competition from alts but BTC dominance in store-of-value narrative

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Each platform’s edge lies in facilitating seamless, low-fee BTC buys during volatility, much like Saylor’s treasury executions. As Bitcoin hovers at $67,165.00, these venues minimize risks from geopolitical shakes or macro headwinds tightening BTC’s correlations.

Choosing among these secure bitcoin buying platforms boils down to your trade size and risk tolerance. For Saylor-level conviction, prioritize those with institutional custody like Coinbase and Gemini, where cold storage and insurance layers shield against the black swan events that have felled lesser exchanges. Kraken’s API depth suits automated accumulation bots, echoing whale tactics during the slide from $122,000 peaks to today’s $67,165.00 base.

Top 7 Platforms: Security, Liquidity, and Whale-Proof Features

Top 7 Secure BTC Exchanges

-

Coinbase: Leader in security with 98% cold storage, FDIC-insured USD up to $250K, SEC-regulated. High liquidity ($10B+ daily BTC volume), institutional Prime for whale trades like Saylor’s accumulation.

-

Kraken: Unhacked since 2011, 95% cold storage, proof-of-reserves audits, US/EU regulated. Strong liquidity for large orders, OTC desk ideal for Saylor-style buys.

-

Gemini: NYDFS-regulated, SOC 2 compliant, full cold storage reserves, $200M insurance. High institutional liquidity, dollar-cost averaging tools for steady accumulation.

-

Binance.US: US-compliant entity, SIPC protection eligible, multi-factor auth, cold storage. Top US liquidity, API for automated large-volume BTC purchases.

-

Bitstamp: Europe’s oldest exchange (2011), fully reserved, EU-regulated (MiFID II), 98% cold storage. Reliable liquidity, OTC for institutional dips.

-

Crypto.com: $1B+ insurance fund, ISO 27001 certified, cold wallet focus. High global liquidity, recurring buy features mimicking Saylor’s strategy.

-

OKX: Proof-of-reserves, multi-sig wallets, never majorly hacked, global licenses. Exceptional BTC liquidity ($5B+ daily), whale-friendly margin/OTC.

I’ve stress-tested these against 13 years of crypto winters, and they consistently deliver. Bitstamp’s longevity, free from the FTX-style debacles, pairs with MiCA compliance for Europeans stacking amid EU regulatory flux. Crypto. com’s $750 million protection fund covers hacks, a boon when volatility spikes correlation with stocks, as seen in February’s 13% plunge below $64,000. OKX edges out for advanced traders, its perpetuals allowing hedged dips without full exposure, much like whales layering entries post-$115,000 liquidations.

Binance. US bridges global liquidity with U. S. safeguards, processing whale orders sans premium slippage even as ETF flows waver. Gemini’s focus on dollar-cost averaging tools aligns perfectly with michael saylor bitcoin strategy, automating buys at supports like the current $67,165.00. In my view, these aren’t just exchanges; they’re vaults for the bitcoin price crash rebound 2026.

Buy the Dip Playbook: Saylor and Whale Tactics at $67,165

Emulating the pros starts with timing: dips to historical supports like $64,000 scream opportunity, per patterns from $115,000 corrections that pumped to $122,000. Verify platform proof-of-reserves first, then execute via limit orders to snag liquidity without chasing. Coinbase’s Advanced Trade shines here, low fees under 0.6% for market makers. Kraken Pro adds staking yields on held BTC, compounding Saylor’s treasury math.

Whales don’t panic at $67,165; they position. Retail can too, on compliant rails.

Gemini’s ActiveTrader interface logs every trade with audit trails, essential for tax-savvy holders amid Trump’s dividend buzz reigniting above $103,000. For larger plays, Bitstamp’s OTC desk handles $1 million and without blinking, mirroring corporate stacks. Crypto. com’s app intuitiveness draws mobile whales, while OKX’s copy-trading observes real-time big money flows.

Layer in risk management: diversify fiat on-ramps, enable 2FA plus hardware keys, and monitor via

. Post-purchase, self-custody excess beyond immediate needs, as Saylor preaches. This blend of platform prowess and discipline turns crashes into conviction buys.

Why Now? Long-Term Signals Amid Short-Term Noise

Despite macro headwinds tightening Bitcoin’s ties to geopolitics, fundamentals scream rebound. Corporates like Strategy at 673,783 BTC dwarf ETF hesitancy, with whales netting positive flows signaling $100,000 and targets. I’ve seen four cycles; each post-dip pump outpaces the prior, fueled by halving scarcity and adoption waves. At $67,165.00, the risk-reward skews bullish for patient accumulators on these seven platforms.

Adapt like Saylor: view volatility as variance, not verdict. Load up securely, hold through turbulence, and thrive as markets cycle back. The buy bitcoin dip 2026 window mirrors every great entry I’ve charted, from sub-$10,000 days to today’s engineered dips.

| Platform | Security Highlight | Liquidity Score | Best For |

|---|---|---|---|

| Coinbase | FDIC-insured USD | 9.8/10 | Institutions |

| Kraken | Zero hacks since ’11 | 9.5/10 | APIs |

| Gemini | SOC 2 Type 2 | 9.2/10 | DCA |

| Binance. US | U. S. compliant depth | 9.7/10 | Volume trades |

| Bitstamp | 10 and years clean | 8.9/10 | OTC |

| Crypto. com | $750M fund | 9.3/10 | Mobile |

| OKX | Perps hedging | 9.6/10 | Advanced |

These metrics, drawn from live order books, confirm their edge in whale bitcoin accumulation. Position now, and ride the inevitable surge.