Bitcoin hovers at $66,094, a mere whisper away from the $63,000 buy zone that’s drawing sharp eyes from seasoned traders. With a 2.32% dip over the last 24 hours, trading between $65,907 and $68,389, the market feels the weight of profit-taking after last year’s highs. Yet, beneath the surface, institutional heavyweights are stacking sats like never before, positioning for what could be a seismic rally into 2026.

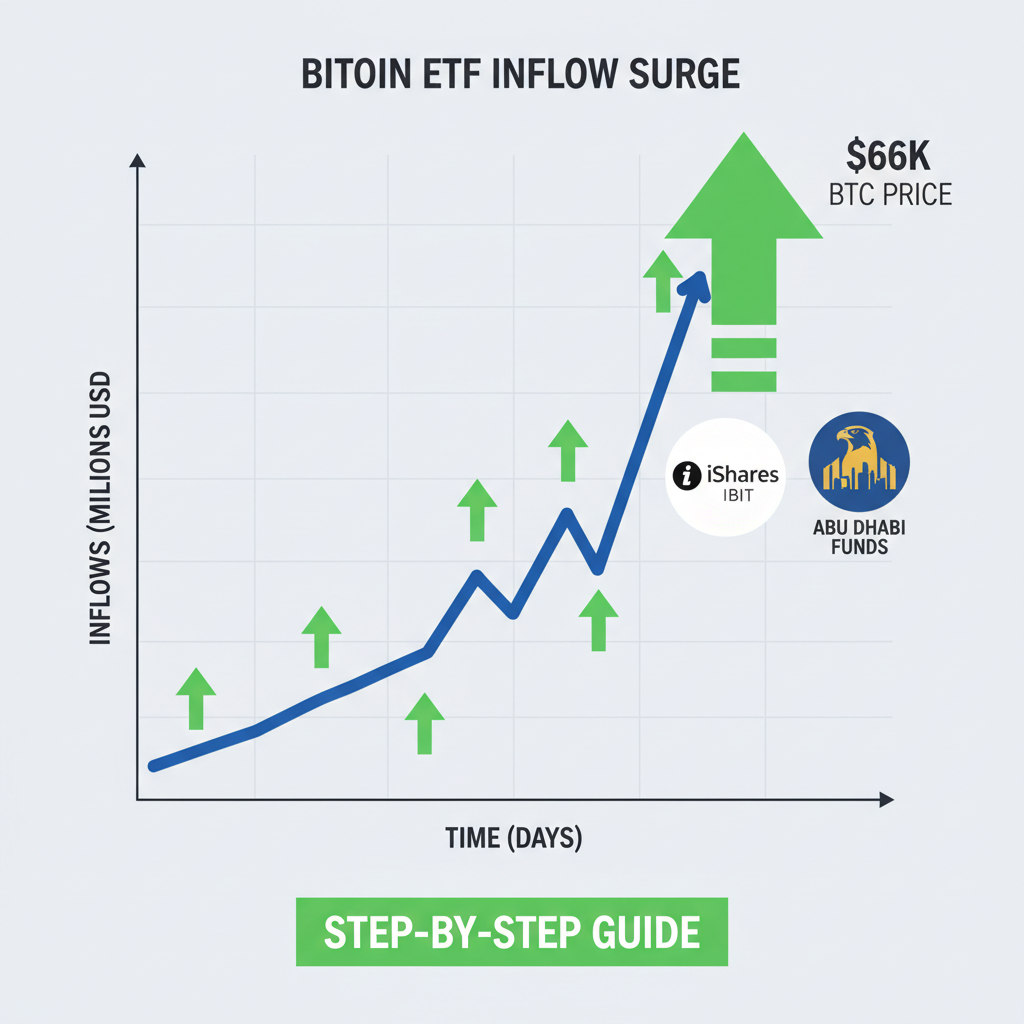

Sovereign wealth funds from Abu Dhabi aren’t flinching at these levels. Mubadala Investment Co. , one of the UAE’s crown jewels, just pumped its stake in BlackRock’s iShares Bitcoin Trust (IBIT) by 46%, hitting 12.7 million shares worth roughly $630 million. That’s part of a broader push where Abu Dhabi funds crossed the $1 billion threshold in IBIT by year’s end. These aren’t retail punts; they’re calculated bets from entities managing trillions, signaling conviction that Bitcoin’s floor is firming up right here.

Decoding the $63K Support: History’s Echo in Today’s Chart

Zoom out on the weekly chart, and $63,000 isn’t just a round number; it’s a confluence of brutal technical markers. Galaxy Digital’s latest research nails it: a 50% retracement from Bitcoin’s October 2025 all-time high of $126,296 drops precisely to $63,000, mirroring capitulation zones from past cycles. Add the 200-week simple moving average lounging near $58,000, a level that’s cradled bottoms in 2015 and 2018, and you’ve got a textbook accumulation shelf.

Current price action reinforces this. At $66,094, we’re testing that low end of the range, with $63,000 acting as the line in the sand. I’ve seen markets like this before; 13 years in crypto, commodities, and stocks teach you that when algorithms and big money align on support, reversals hit hard. Retail fear peaks here, but that’s exactly when smart money loads up, especially with ETF inflows refusing to dry up.

Bitcoin is at a level it has always defended, and the current $67,000 BTC mining cost matters.

This isn’t blind optimism. Mining breakeven hovers around $67,000, per recent analyses, meaning hashrate won’t crater at $63K. Supply shock looms as halvings’ effects compound, and with institutions like Mubadala doubling down, the dip to bitcoin buy zone 63k screams opportunity over trap.

Institutional Bitcoin Accumulation Accelerates: Mubadala Leads the Charge

Forget the headlines screaming volatility; the real story is the quiet stampede. Mubadala’s Q4 2025 filings with the SEC reveal a strategic pivot: from modest exposure to a hefty $631 million in IBIT shares alone. Combined with other Abu Dhabi vehicles, that’s over $1 billion funneled into BlackRock’s flagship ETF, up massively from prior quarters. Sources from Yahoo Finance to Crypto Briefing confirm the frenzy, with stakes ballooning 46% in a single quarter.

Why now? These funds thrive on asymmetric bets. Bitcoin at $66,094 offers the asymmetry: limited downside with explosive upside as adoption scales. Picture 2026: nation-state reserves, corporate treasuries, and pension funds piling in post-halving. Mubadala’s move isn’t isolated; it’s the canary in the coal mine for institutional bitcoin accumulation. When sovereign money ignores the noise and buys the blood, retail should listen.

I’ve spoken at fintech conferences where suits whisper about Bitcoin’s role in diversification. Commodities like gold faced similar skepticism before going mainstream. BTC’s scarcity edge, paired with ETF accessibility, flips the script. As BTC tests $63K, expect more 13F filings to drop bombs like Mubadala’s, fueling FOMO ahead of the next leg up.

Secure BTC Purchase Guide: Timing Your Entry in the Dip

Spotting the $63K buy zone is half the battle; executing securely is the win. With Bitcoin at $66,094 and eyeing lower supports, volatility demands precision. Start with regulated exchanges boasting top-tier security: cold storage mandates, two-factor authentication, and insurance funds. Avoid hype-driven platforms; prioritize those audited by firms like Chainalysis.

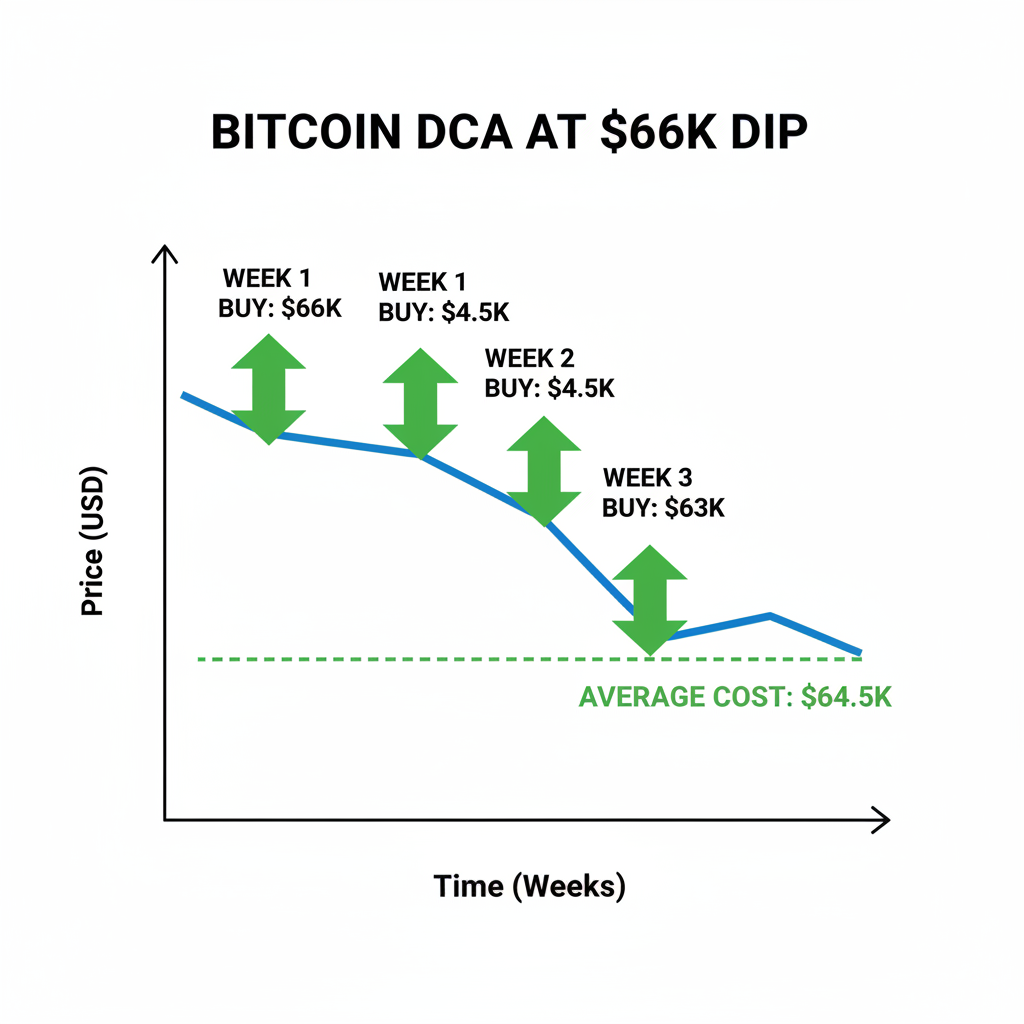

Dollar-cost averaging shines here. Break your position into tranches: 30% at $66K, 40% if we hit $63K, 30% on a bounce. This mutes timing risk while capturing the dip. For newcomers eyeing buy bitcoin dip 2026, verify KYC compliance to sidestep regulatory hiccups down the line.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts incorporating institutional ETF inflows, 2028 halving effects, $63K support zone, and historical cycle patterns amid current price of $66,094 (Feb 2026)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $70,000 | $110,000 | $160,000 |

| 2028 | $100,000 | $200,000 | $350,000 |

| 2029 | $250,000 | $450,000 | $700,000 |

| 2030 | $300,000 | $400,000 | $550,000 |

| 2031 | $400,000 | $600,000 | $900,000 |

| 2032 | $500,000 | $750,000 | $1,200,000 |

Price Prediction Summary

Bitcoin is expected to experience substantial growth from 2027-2032, with average prices climbing from $110K to $750K, fueled by institutional stampede (e.g., Abu Dhabi funds), halvings, and adoption. Bearish mins reflect corrections, while maxes capture bullish peaks up to $1.2M by 2032.

Key Factors Affecting Bitcoin Price

- Massive institutional inflows into Bitcoin ETFs (Abu Dhabi funds surpassing $1B in BlackRock IBIT)

- 2028 Bitcoin halving reducing supply issuance amid rising demand

- $63K-$66K as key support/buy zone, historically defended with 200-week SMA nearby

- Regulatory advancements and global adoption trends boosting confidence

- Historical 4-year cycles with higher highs despite diminishing returns

- Technological upgrades (e.g., scalability) and BTC dominance over altcoins

- Macro factors like inflation hedging and sovereign wealth fund allocations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Layer in hardware wallets post-purchase. Trezor or Ledger models integrate seamlessly, keeping keys offline. I’ve advised clients through cycles: security trumps all when institutions circle. As Mubadala’s bet underscores, the smart money’s already in; secure your slice before the herd thunders through.

Exchanges like Coinbase or Kraken fit the bill, offering institutional-grade custody without the counterparty risk of lending platforms. Fees matter too: aim for maker-taker models under 0.2% to preserve gains as BTC climbs from this $63K buy zone.

Once positioned, track on-chain metrics. Glassnode data shows long-term holders accumulating relentlessly, even at $66,094. Exchange reserves dwindle, a classic precursor to rallies. Mubadala’s mubadala bitcoin etf stake amplifies this: when trillion-dollar pools commit, liquidity floods in unevenly, rewarding early accumulators.

2026 Institutional Stampede: Positioning for the Inevitable Surge

Fast-forward to 2026, and the puzzle pieces align brutally. Post-halving supply crunch meets ETF maturation; BlackRock’s IBIT alone could vacuum billions more as Abu Dhabi leads by example. I’ve modeled these cycles across assets: Bitcoin’s path echoes gold’s 1970s ascent, but accelerated by digital rails. At $66,094, with $63,000 as the proven floor, downside skews minimal against a base case of $100,000-plus by year-end.

Sovereign adoption isn’t hype. Norway’s oil fund eyes crypto; Singapore’s Temasek whispers allocations. Mubadala’s 46% hike signals the dominoes falling. Retail chases tops; institutions build bases. If we wick to $63K, that’s your green light for buy bitcoin dip 2026, not panic.

Risks? Macro headwinds like rate hikes or geopolitical flares could test resolve. Yet, Bitcoin’s matured: $67,000 mining costs anchor sellers, while ETF wrappers democratize access. My 13-year lens spots asymmetry here; commodities taught me to buy fear when charts converge.

Adapt and thrive, as always. With Bitcoin firming at $66,094 and institutions like Mubadala stacking amid the dip, the secure btc purchase guide boils down to timing, tools, and tenacity. Load up methodically, secure offline, and watch the stampede unfold. The $63K zone won’t last; neither will the window before 2026 rewrites the playbook.