Bitcoin sits at $67,958 today, clawing back from a brutal drop below $64,000 earlier this month. Small wallets holding 0.1 to 1 BTC are leading the charge, hitting a 15-month high in accumulation with over 1% added since October. Mid-sized holders stay sidelined, selling lightly, while big players like Michael Saylor’s outfit scoop up thousands more. This uneven conviction screams opportunity for beginners chasing a buy bitcoin dip 2026 play. As a swing trader who’s ridden these momentum waves, I see small wallets winning by staying disciplined: accumulate low, self-custody tight, ignore the noise.

On-chain data doesn’t lie. Wallets under 1 BTC surged 1.05% since the all-time high, per Phemex and KuCoin reports. Retail’s patient stacking contrasts mid-tier distribution at 38-month lows. Long-term holders trim selectively, but newer capital flows steady. Even as BTC stalls below recent peaks, this dip-buying mirrors past cycles where small holders captured the upside. Forbes notes the 2026 sell-off bruised markets, yet accumulation persists. Large holders grabbed 81,338 BTC in six weeks; small traders offloaded just 290. The signal? Small bitcoin wallets accumulation builds conviction where others falter.

Why This 2026 Dip Favors Aggressive Small Wallet Strategies

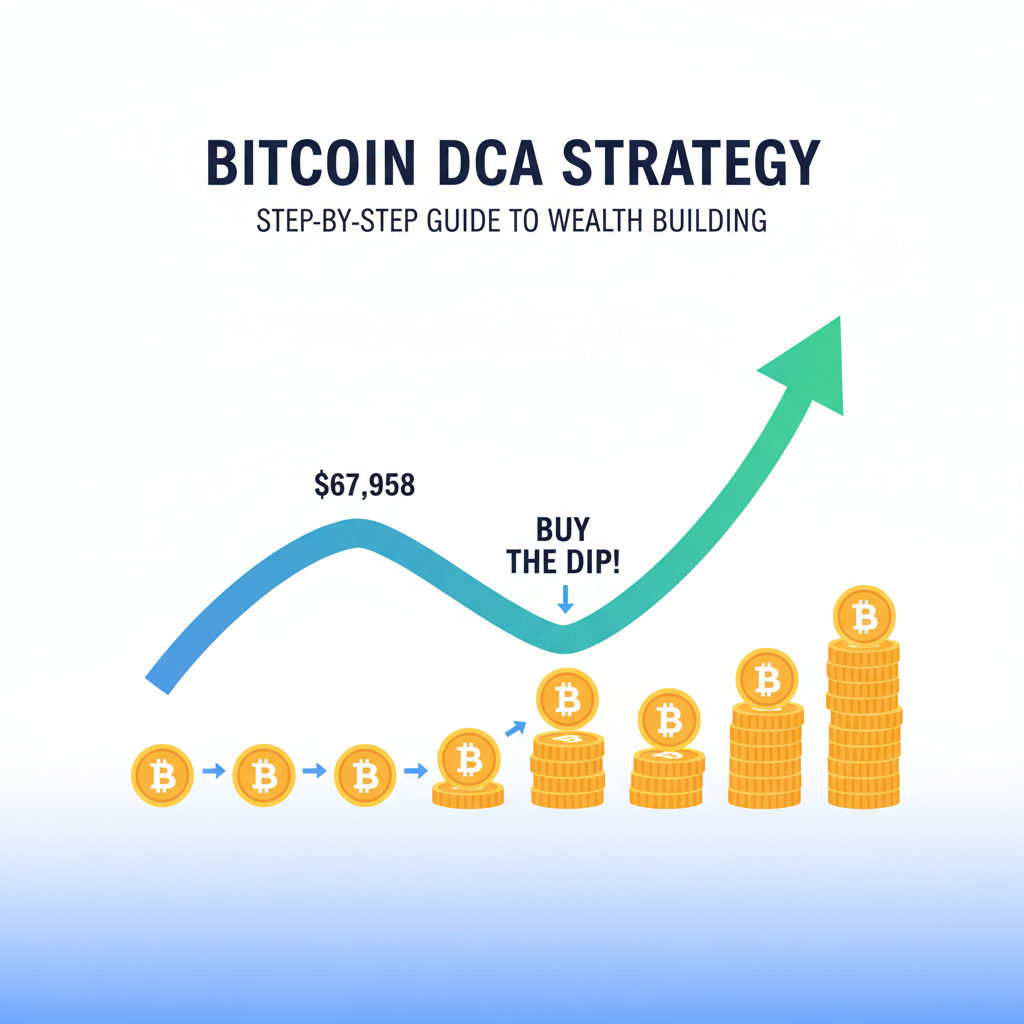

I’ve charted enough BTC swings to spot patterns. At $67,958, we’re testing key support after forced liquidations thinned buyers. Small wallets thrive here because they move fast, risk small, and scale in. No overleveraged bets; just dollar-cost averaging into weakness. Data backs it: MEXC and AMBCrypto highlight steady small-holder buys as BTC weakens. Mid-sized inaction signals weak hands; their 38-month low screams distribution. Contrast that with Saylor’s 2,932 BTC dip purchase at similar levels. Beginners, mimic the pros but scale to your size. This isn’t FOMO; it’s bitcoin dip strategy beginners at its core: buy fear, secure gains.

Selective profit-taking by olds meets retail patience. AInvest calls it an on-chain battle medium-term holders might lose. But for you? Generational entry if you nail security. Ignore macro noise like metals stealing safe-haven shine; BTC’s thesis holds. Wallets under 1 BTC now dominate inflows, positioning for the rebound.

Bitcoin (BTC) Price Prediction 2027-2032

Post-2026 Dip Accumulation Outlook for Small Wallet Investors

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $75,000 | $115,000 | $165,000 |

| 2028 | $110,000 | $175,000 | $260,000 |

| 2029 | $140,000 | $225,000 | $340,000 |

| 2030 | $180,000 | $300,000 | $450,000 |

| 2031 | $230,000 | $390,000 | $580,000 |

| 2032 | $290,000 | $490,000 | $740,000 |

Price Prediction Summary

Following the 2026 dip to around $68,000, Bitcoin is expected to recover strongly, driven by small wallet accumulation and the 2028 halving. Average prices projected to grow from $115,000 in 2027 to $490,000 by 2032, with bullish maxima reflecting adoption surges and bearish minima accounting for potential macro downturns.

Key Factors Affecting Bitcoin Price

- Small and institutional holder accumulation amid 2026 dip

- 2028 Bitcoin halving catalyzing bull cycle

- Increasing regulatory clarity and ETF inflows

- Technological upgrades enhancing scalability and use cases

- Macroeconomic trends favoring risk assets

- Market cap expansion amid competition from altcoins and growing global adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Secure Bitcoin Buying Guide: Step 1-3 for Small Wallets

Don’t rush into exchanges blind. First, educate ruthlessly. Grasp BTC basics: decentralized, fixed 21 million supply, inflation hedge. Risks? Volatility, hacks, regulation. Only invest what you can lose; start with $100-500 for that first wallet. Track on-chain via tools like Glassnode for small wallet trends confirming this buy bitcoin dip 2026 wave.

- Pick Reputable Exchanges for the Dip: Go established like Coinbase, Kraken, or Binance. US. Check liquidity for quick fills at $67,958. Fees matter; aim under 0.5%. Verify U. S. compliance if stateside. Avoid hype platforms; stick to audited ones with insurance funds. Deposit fiat via ACH for low costs, then buy spot BTC. Pro tip: use limit orders below ask during volatility to snag better entries.

- Master Self-Custody Immediately: Exchanges hold keys, not you. Withdraw to hardware like Ledger Nano S or Trezor. Software like Electrum works for tiny stacks but upgrade fast. Generate seed offline; never screenshot. Test small sends first. Small wallets shine because self-custody slashes counterparty risk. Data shows accumulators securing offline win long-term.

- Lock Down with 2FA and Best Practices: Enable YubiKey or Authy 2FA everywhere. Use unique passwords via Bitwarden. Avoid public WiFi; VPN up. Multisig for larger stacks later. This secure bitcoin buying guide foundation stops 99% threats. Recent dips saw phishing spikes; don’t be prey.

These steps position your small wallet like the on-chain leaders. At $67,958, every satoshi counts. Next, we’ll dive deeper into timing entries and scaling up safely.

Timing Your Entry: On-Chain Edge for Beginners

Don’t buy blindly. Watch small wallet cohorts; their 15-month high signals bottoming. Pair with RSI under 40 on 4H charts for oversold bounces. I’ve entered dips like this, scaling 20% allocations per support test. Current setup at $67,958? Prime if volume ticks up. Mid-holders’ inaction buys time; their sells fuel your buys. KuCoin notes retail’s resolve strengthens as tiers diverge. Stack sats weekly, not daily; discipline beats timing perfection.

Volume confirmation seals it: inflows to small wallets persist despite the $67,958 stall. Pair this with macro tailwinds like institutional stacking; even Forbes sees the 2026 bruise as temporary. Your edge? Act like those 0.1-1 BTC holders who’ve added 1.05% since highs. Scale in ruthlessly on weakness, but cap exposure at 5% portfolio max. This bitcoin dip strategy beginners turns volatility into velocity.

Secure Bitcoin Buying Guide: Steps 4-6 – Scale and Protect

Steps 1-3 locked your foundation. Now scale like the on-chain winners. Small wallets dominate because they iterate fast without emotion. At $67,958, resistance looms near $68,241 highs; buy breaks or dips to $66,510 lows. Discipline: no revenge trades post-liquidations.

- Dollar-Cost Average Through Volatility: Don’t all-in. Split buys: 25% now, 25% on 5% dips, rest weekly. This averages your cost below $67,958, mirroring retail’s steady accumulation. MEXC data shows small holders added over 1% BTC since October; replicate with $50-100 chunks. Avoid leverage; spot only for small stacks.

- Monitor On-Chain and Exit Signals: Track Glassnode for cohort flows. Small wallet highs signal strength; mid-tier lows warn distribution. Set alerts for RSI bounces or volume spikes. Profit-take 20% at 20% gains, trail stops. HODL core, but book wins like selective long-term trimmers. AD HOC NEWS nails it: accumulate, self-custody, ignore noise.

- Advanced Security: Multisig and Inheritance: Once stacked 0.5 BTC, upgrade to multisig wallets like Casa. Split keys geographically. Plan inheritance with dead-man switches. Phishing ate weak hands in past dips; your secure bitcoin buying guide evolves here. Test restores quarterly. Small wallets endure because security scales with stack size.

These steps transform beginners into small wallet accumulators. On-chain battle favors patient retail over shaky mids. Cryptopolitan notes large holders grabbed 81k BTC while smalls sold peanuts; conviction gap widens your window.

Bitcoin Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

To annotate this BTCUSDT chart effectively in my balanced technical style, start by drawing a prominent downtrend line connecting the January 2026 peak around $105,000 on 2026-01-20 to the recent low near $66,500 on 2026-02-20, using ‘trend_line’ with red color for bearish bias. Add horizontal lines at key support $66,500 (strong) and $64,000 (moderate), and resistance at $70,000 (moderate) and $90,000 (strong). Mark the sharp breakdown on 2026-02-05 with a vertical_line and arrow_mark_down. Use fib_retracement from the Oct-Dec 2025 ATH to current low for retracement levels. Highlight accumulation volume with callout on recent bars. Place entry zone rectangle around $67,000-$68,000 for long setups, with stop below $66,000 and PT at $75,000. Add text notes for MACD bearish signal and small wallet accumulation context.

Risk Assessment: medium

Analysis: High volatility post-ATH with on-chain accumulation supporting bounce, but downtrend line and MACD bearish signal cap upside; aligns with my medium tolerance

Market Analyst’s Recommendation: Scale in longs at $67,958 support with tight stops; target $75k partials. Wait for volume/MACD confirmation before full position.

Key Support & Resistance Levels

📈 Support Levels:

-

$66,510 – Recent 24h low and cluster support tested multiple times in Feb 2026

strong -

$64,000 – Feb 5, 2026 breakdown low; key psychological and prior dip bottom

moderate

📉 Resistance Levels:

-

$70,000 – Immediate overhead resistance from early Feb consolidation high

moderate -

$90,000 – Major resistance from Jan 2026 rally pause; ATH retracement level

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$67,958 – Current price $67,958 in accumulation zone with small wallet buying; bounce from support cluster

medium risk

🚪 Exit Zones:

-

$75,000 – Measured move target from recent swing low; fib 38.2% retracement

💰 profit target -

$65,500 – Below strong support at $66,510 and recent 24h low; invalidates long setup

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: accumulation

Rising volume on dip with small wallet inflows (1%+ BTC added); confirms buying interest despite price drop

📈 MACD Analysis:

Signal: bearish

MACD histogram contracting with line below signal; short-term bearish momentum but divergence on lows suggests weakening

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Daily Checklist: Stay Ahead of the 2026 Dip

Discipline separates winners. Run this ritual weekly to mimic the 15-month high accumulators.

I’ve swung these setups six years; checklists enforce edge. At $67,958, mid-holders’ 38-month lows hand you cheap sats. KuCoin confirms retail resolve; stack before conviction evens out.

Common pitfalls kill noobs. Chasing pumps post-dip? Skip it; small wallets buy fear. Exchange-only storage? Hacked in 2026 sell-off. Over-sizing bets? Volatility crushed leveraged retail. AInvest’s on-chain dynamic proves: newer capital wins patient. Phemex data screams small bitcoin wallets accumulation peak timing.

Beginner Dip Doubts: Safely Buying the 2026 Bitcoin Dip

Bitcoin is currently trading at $67,958.00, with small wallets accumulating amid the dip. Test your knowledge on key beginner questions for safely buying this opportunity, based on secure strategies and on-chain trends showing 15-month highs in small holder accumulation.

Execute this guide, and your small wallet joins the leaders. BTC at $67,958 tests resolve; small holders pass with flying colors. Aggressive yet disciplined plays capture asymmetric upside. Saylor stacks billions; you stack sats. Ride the wave.