In 2025, the landscape for buying cryptocurrency has shifted dramatically, driven by two powerful forces: PayPal’s deepening crypto integration in the United States and Dubai’s emergence as a global crypto hub with robust new regulatory frameworks. These developments are not just technical upgrades or regional quirks, they are fundamentally reshaping how individuals and businesses access, use, and trust digital assets worldwide.

PayPal Crypto Payments 2025: From Niche to Mainstream

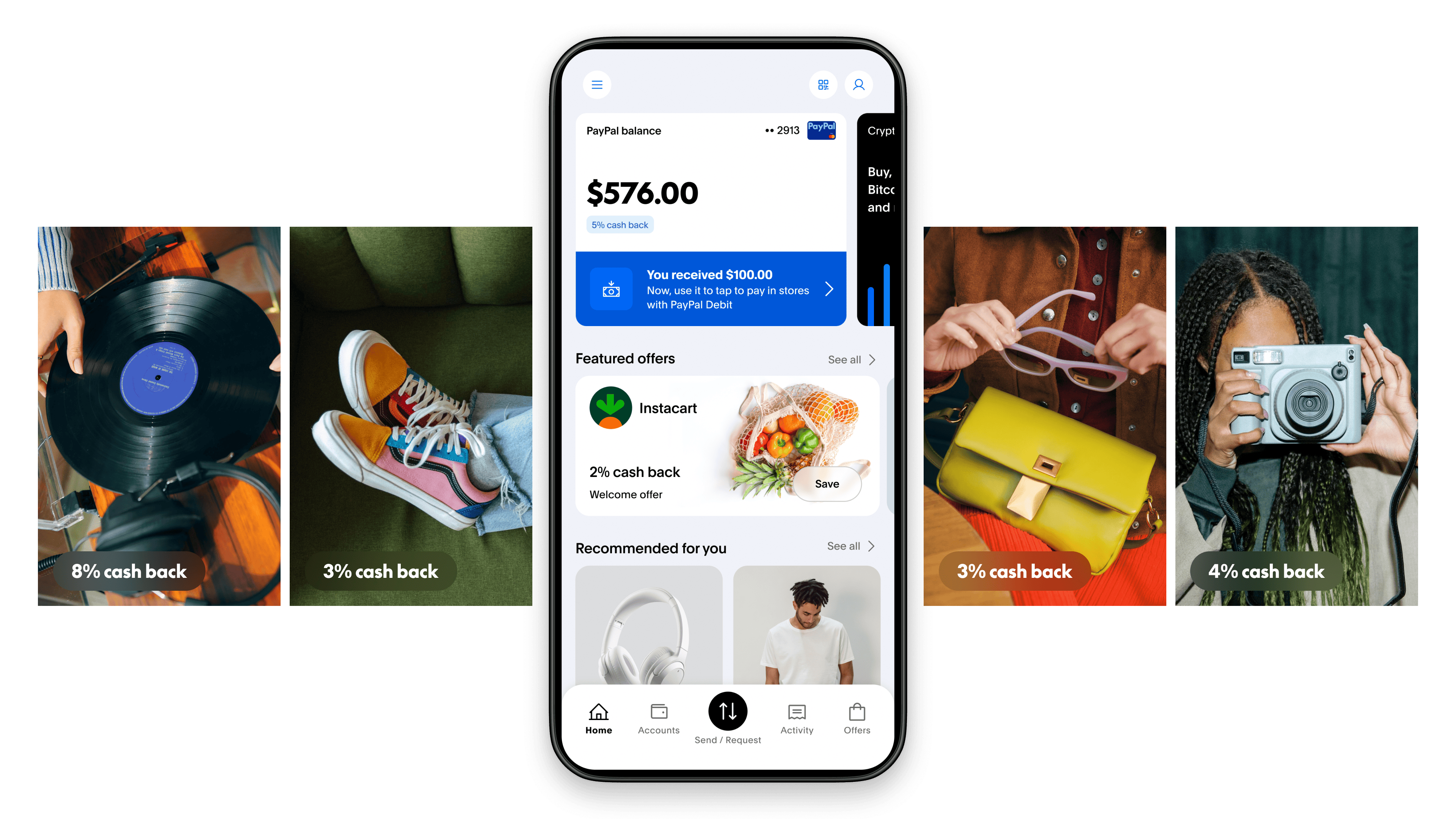

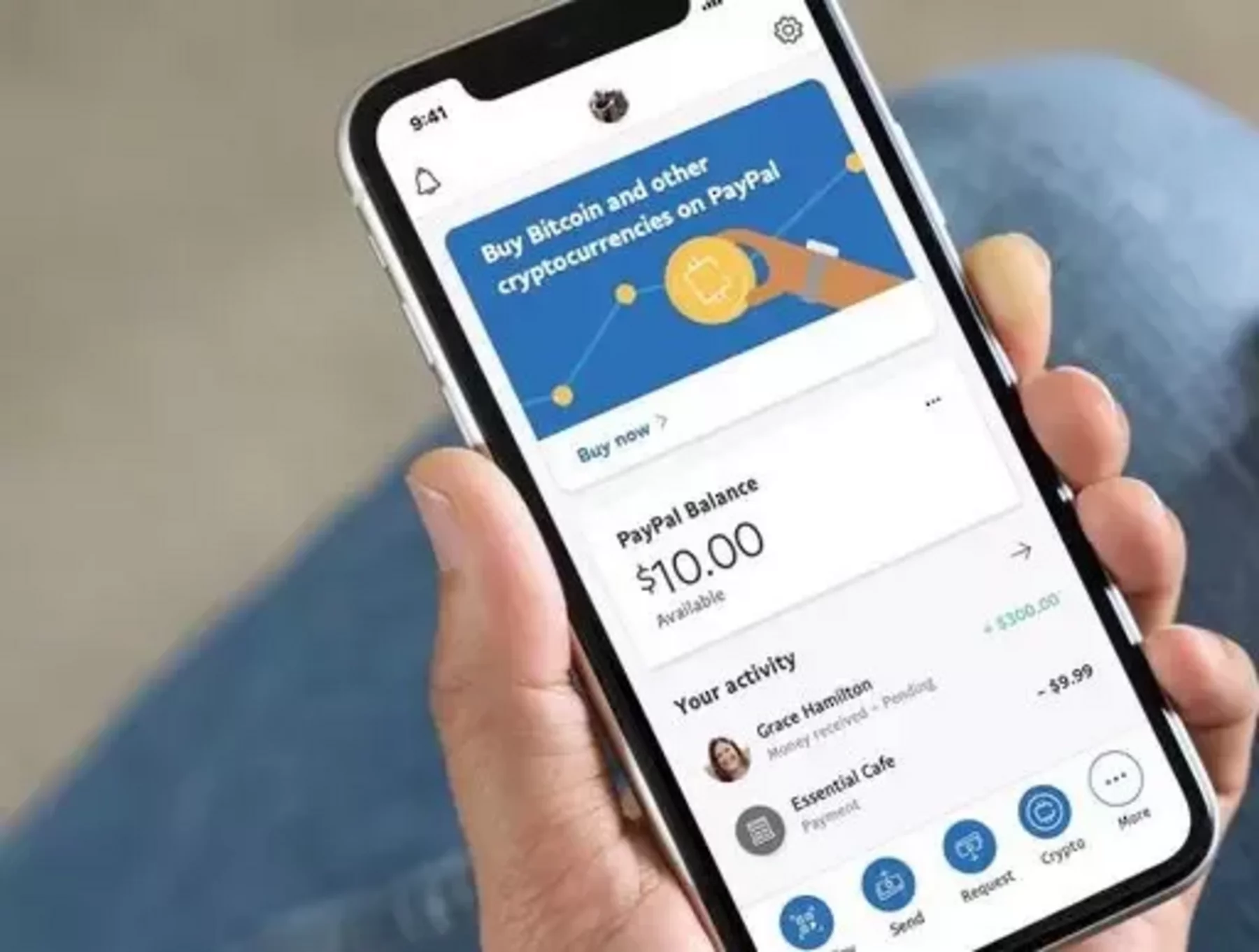

PayPal’s expansion into cryptocurrency has reached a pivotal point in 2025. The company’s ‘Pay with Crypto’ platform now allows U. S. merchants to accept payments in over 100 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), USDT, XRP, BNB, Solana (SOL), and USDC. This is more than just adding a payment button; it’s an infrastructure shift that connects merchants to a $3 and trillion digital asset market.

Transactions are seamless for both buyers and sellers. Consumers can pay using popular wallets such as Coinbase, Binance, Kraken, or MetaMask. Merchants receive near-instant settlement as their crypto is automatically converted into PayPal’s stablecoin PYUSD, earning them a competitive 4% annually while insulating them from volatility.

Notably, transaction fees start at just 0.99% for the first year, a significant reduction compared to traditional credit card processing fees. This cost efficiency is poised to accelerate mainstream crypto adoption, especially among small businesses wary of legacy banking costs.

How to Buy Cryptocurrency with PayPal: Simpler Than Ever

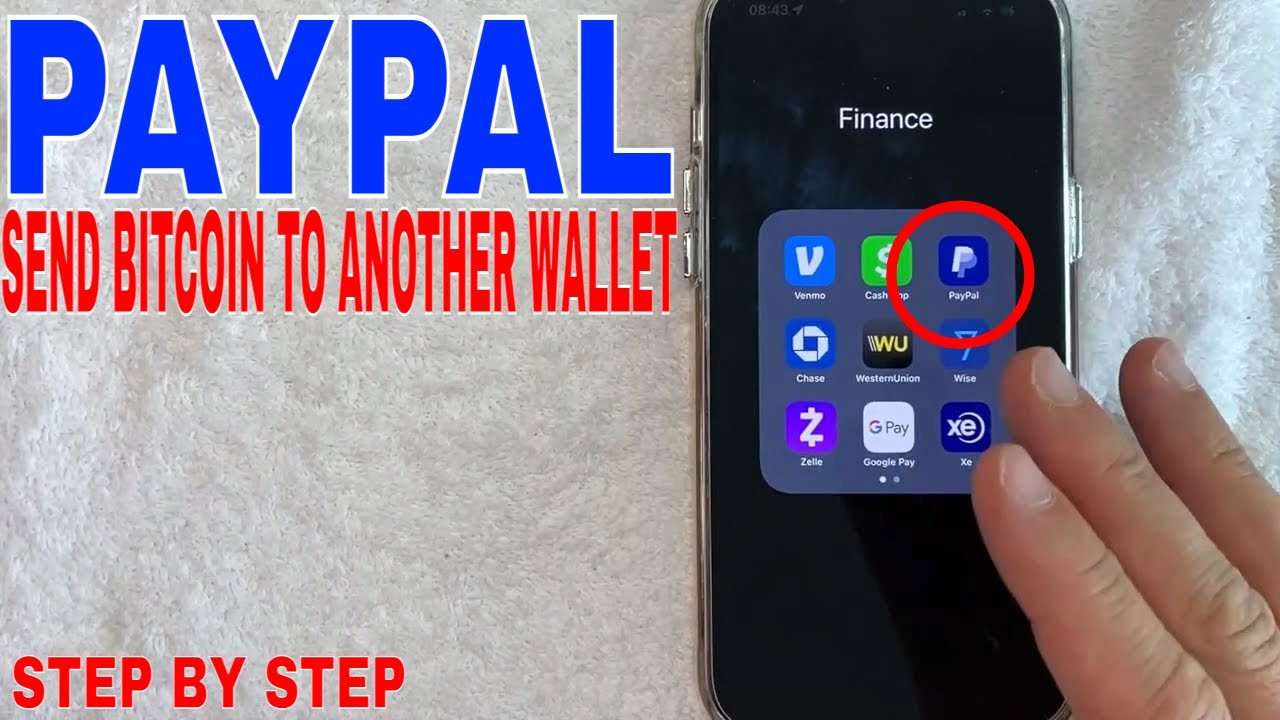

The user experience for buying crypto on PayPal has become nearly frictionless. Whether you’re using the web platform or mobile app, the process is straightforward: navigate to Finances and gt; Buy (web) or Accounts and gt; Crypto and gt; Buy (app), select your desired asset, now including Chainlink (LINK) and Solana (SOL): choose your amount and frequency, pick your payment method, and confirm.

How to Buy Cryptocurrency Securely with PayPal in 2025

-

1. Set Up or Log In to Your PayPal AccountBegin by creating a PayPal account or logging into your existing one. Ensure your account is fully verified with up-to-date personal and financial information for enhanced security.

-

2. Navigate to the Crypto SectionOn the PayPal app, go to Accounts > Crypto > Buy. On the web, select Finances > Buy. This section lists all supported cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Chainlink (LINK), and more.

-

3. Choose Your CryptocurrencySelect the cryptocurrency you wish to purchase from the list. PayPal supports major tokens like BTC, ETH, USDT, XRP, BNB, SOL, USDC, and LINK as of 2025.

-

4. Enter Purchase DetailsSpecify the amount you want to buy, select your payment method (e.g., linked bank account, debit card, or PayPal balance), and choose the purchase frequency (one-time or recurring).

-

5. Review Fees and Confirm the TransactionCarefully review the transaction summary, including real-time exchange rates and fees (starting at 0.99% for the first year). Confirm your purchase to proceed securely.

-

6. Securely Store or Transfer Your CryptoAfter purchase, your crypto will appear in your PayPal wallet. For enhanced security, you can transfer your assets to external wallets like Coinbase, Binance, Kraken, or MetaMask—all supported by PayPal in 2025.

-

7. Enable Two-Factor Authentication (2FA)Activate 2FA in your PayPal security settings to add an extra layer of protection for your account and crypto assets.

-

8. Monitor Transactions and Stay InformedRegularly check your transaction history in PayPal and stay updated on crypto market and regulatory developments, especially if you plan to use crypto for purchases in regions like Dubai with evolving regulations.

This simplicity is matched by robust security measures. PayPal employs advanced fraud detection and works diligently to prevent unauthorized transfers, a key concern for new investors entering the space.

If you want more details on how these features work in practice or want to review their official terms before getting started, you can find up-to-date guidance directly from PayPal’s newsroom announcement.

Dubai’s Crypto Real Estate Revolution: Legal Clarity Meets Global Ambition

While PayPal drives adoption in North America and Europe, Dubai is setting global standards for regulated crypto transactions, especially in real estate. The city-state’s Virtual Assets Regulatory Authority (VARA), established in 2022, now oversees comprehensive licensing for exchanges and brokers. In October 2024, VARA introduced new marketing rules targeting transparency and consumer protection across all digital asset promotions within the UAE.

The big breakthrough? As of August 2025, all property transactions involving stablecoins must be processed through fully licensed entities that comply with anti-money laundering regulations set by the Central Bank of the UAE (CBUAE). This ensures every purchase, whether it’s an apartment downtown or a luxury villa on Palm Jumeirah, is both legal and secure for international buyers using Bitcoin, Ethereum, or stablecoins like USDT.

Key Changes in Dubai’s Crypto Real Estate Rules (Aug 2025)

-

Mandatory Use of Licensed Crypto Platforms: All real estate transactions involving cryptocurrencies must be conducted through fully licensed exchanges or payment processors approved by the Virtual Assets Regulatory Authority (VARA). This ensures compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

-

Stablecoin Transactions Only via Approved Entities: Payments using stablecoins (such as USDT or USDC) for property purchases must be processed through entities licensed by the Central Bank of the UAE (CBUAE). Direct peer-to-peer stablecoin transfers are prohibited for real estate deals.

-

Mandatory Conversion to AED: All cryptocurrency payments for property must be converted to UAE Dirhams (AED) through approved platforms before finalizing the transaction. This ensures price stability and legal compliance with Dubai Land Department (DLD) requirements.

-

Comprehensive Transaction Reporting: Licensed platforms are required to report all crypto property transactions to both the Dubai Land Department and the Central Bank, including buyer, seller, and transaction details, to enhance transparency and traceability.

-

Strict Marketing and Promotion Guidelines: As of October 2024, all crypto-related real estate advertising targeting UAE residents must comply with the latest VARA Marketing Regulations, including clear risk disclosures and pre-approval of promotional content.

This regulatory clarity has fueled an influx of global capital into Dubai’s property market while providing peace of mind for both buyers and sellers navigating high-value transactions with digital assets.

Dubai’s approach stands out for its balance between innovation and compliance. Every crypto-funded property purchase must now be processed through platforms approved by the Dubai Land Department, with funds converted into AED via regulated exchanges. This not only satisfies local legal requirements but also reassures international investors that their assets are protected under a clear legal framework. The city’s ambition is to become the world’s most crypto-friendly real estate market, and in 2025, it is closer than ever to achieving that goal.

Beyond real estate, Dubai’s regulatory clarity is catalyzing broader digital asset adoption across sectors. Emirates airline’s recent partnership with Crypto. com exemplifies this momentum, allowing travelers to book flights using Bitcoin, Ethereum, and stablecoins. These moves are not just about convenience; they reflect a deliberate strategy to attract tech-savvy global citizens who expect seamless, borderless financial experiences.

What This Means for Investors and Everyday Users

For those wondering how to buy cryptocurrency securely in 2025, the answer increasingly lies in these regulated ecosystems. PayPal’s integration offers U. S. consumers an intuitive entry point with robust security and low friction, ideal for first-time buyers or small businesses exploring digital payments. Meanwhile, Dubai’s transparent rules empower international investors to diversify into property or other assets using crypto without fear of regulatory uncertainty.

The interplay between these two markets demonstrates a larger trend: mainstream crypto adoption is no longer speculative, it is operational and growing fast. Merchants benefit from lower fees and instant settlement; consumers gain new ways to transact globally; regulators ensure safety without stifling innovation.

Key Takeaways for 2025

Key Benefits of PayPal’s Crypto Integration & Dubai’s 2025 Rules

-

Seamless Crypto Payments for U.S. Merchants: PayPal’s ‘Pay with Crypto’ platform enables over 100 cryptocurrencies—including Bitcoin (BTC), Ethereum (ETH), USDT, XRP, BNB, Solana, and USDC—to be spent at merchants, with automatic conversion to PYUSD and near-instant fund access.

-

Low Transaction Fees and PYUSD Yield: Merchants benefit from transaction fees starting at 0.99% for the first year and earn 4% annual yield on PYUSD balances, boosting profitability and liquidity.

-

Expanded Crypto Asset Support: Users can now buy, hold, sell, and transfer major tokens like Chainlink (LINK) and Solana (SOL) directly within PayPal and Venmo accounts, increasing portfolio flexibility.

-

Enhanced Security and Compliance: PayPal’s robust fraud prevention and compliance frameworks help protect users from unauthorized crypto transfers, aligning with evolving global standards.

-

Dubai’s Comprehensive Regulatory Framework: The Virtual Assets Regulatory Authority (VARA) ensures licensed, transparent, and secure crypto transactions, giving buyers confidence in legal compliance.

-

Legal Real Estate Purchases with Crypto in Dubai: Buyers can legally purchase property using Bitcoin, Ethereum, or stablecoins, with all transactions routed through licensed entities and converted to AED, streamlining and legitimizing high-value deals.

-

Growing Acceptance in Key Sectors: With Emirates airline integrating crypto payments and more service providers joining, buyers enjoy increased utility and mainstream acceptance of digital assets in Dubai.

The days when buying cryptocurrency felt risky or complicated are fading fast. With major players like PayPal lowering barriers in the West and hubs like Dubai setting global standards for compliance and transparency, digital assets are taking their place alongside traditional finance tools. Whether you’re purchasing your first Bitcoin or closing on a penthouse in the Gulf, the landscape in 2025 is designed to make your experience secure, efficient, and future-proof.