Passive investing in cryptocurrency is entering a new era in 2025, thanks to innovative features like Bitget’s Auto-Buy and Recurring Buy. For anyone seeking to build wealth in digital assets without the emotional rollercoaster of manual trading, these tools are game-changers. By automating crypto purchases and integrating them with yield-enhancing savings, Bitget is making it easier than ever to pursue secure crypto investment strategies while managing risk and volatility.

Bitget’s Recurring Buy: Automation Meets Strategy

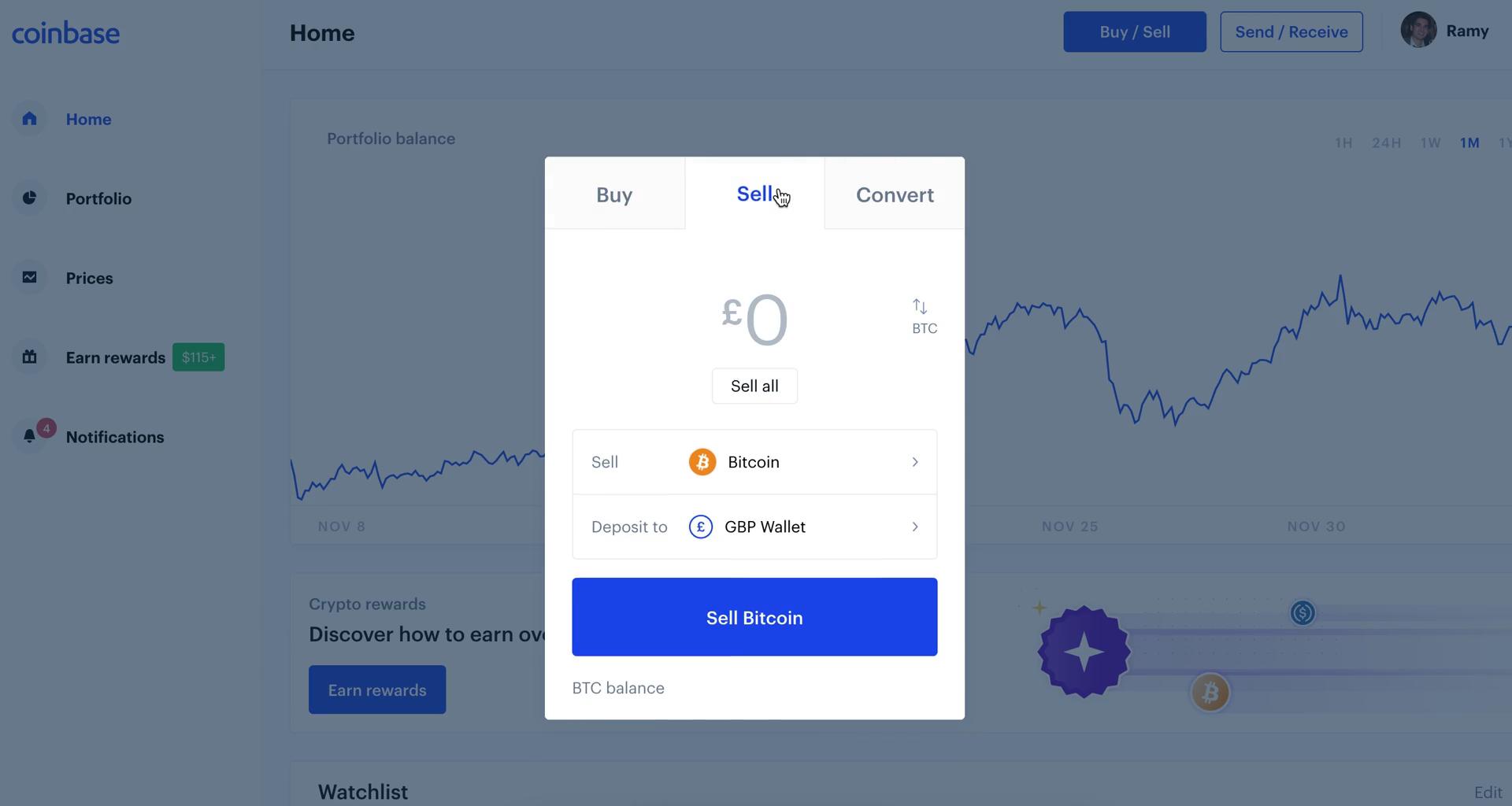

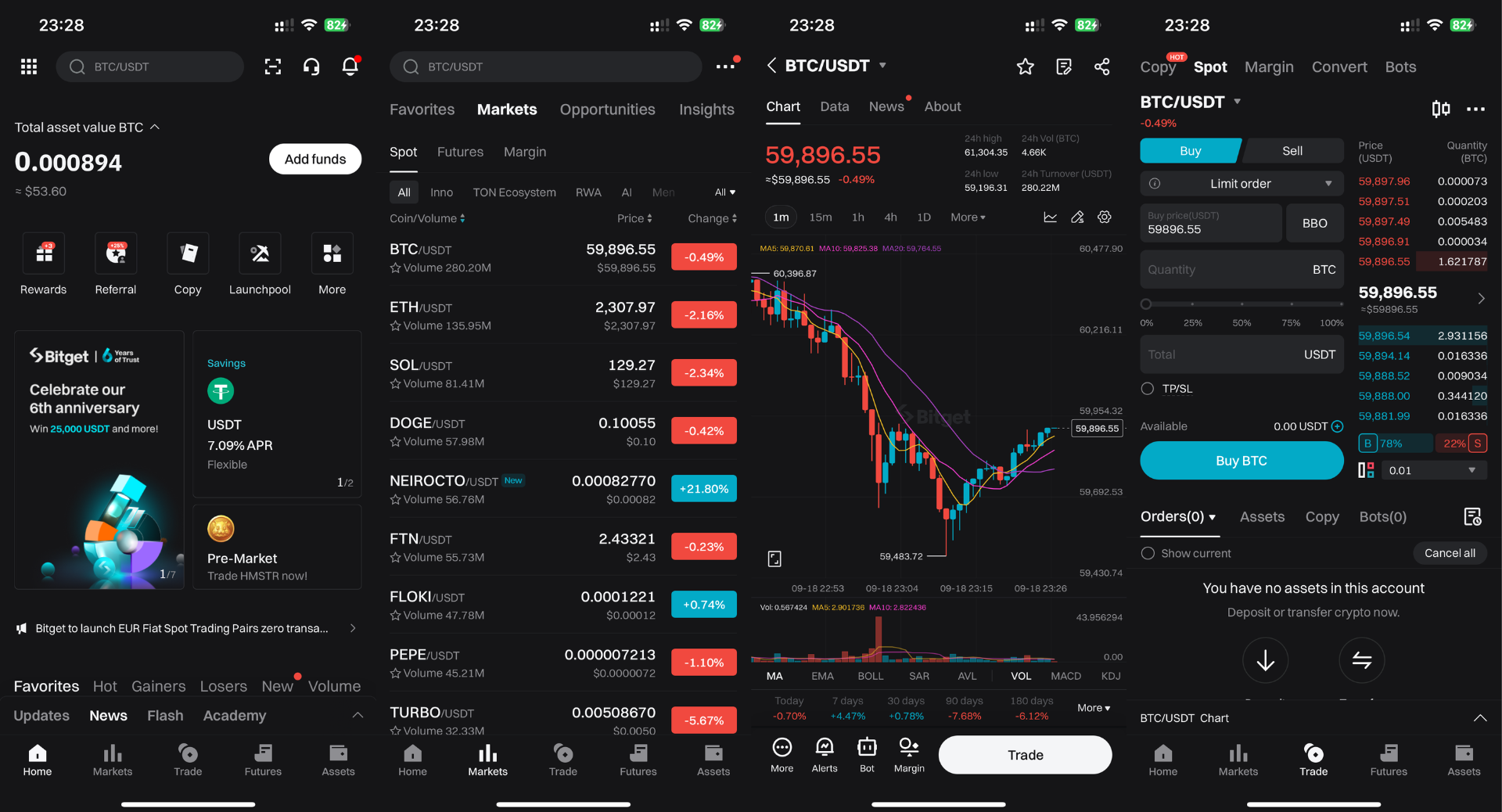

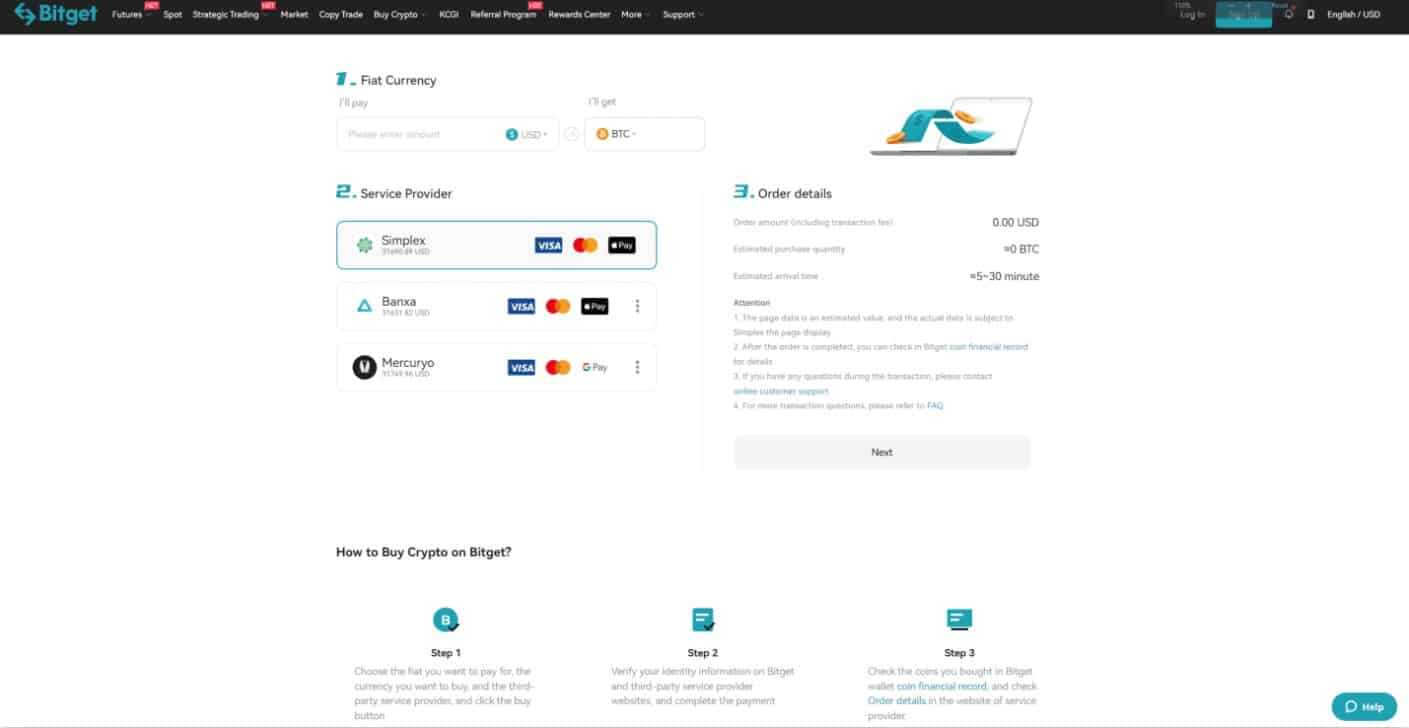

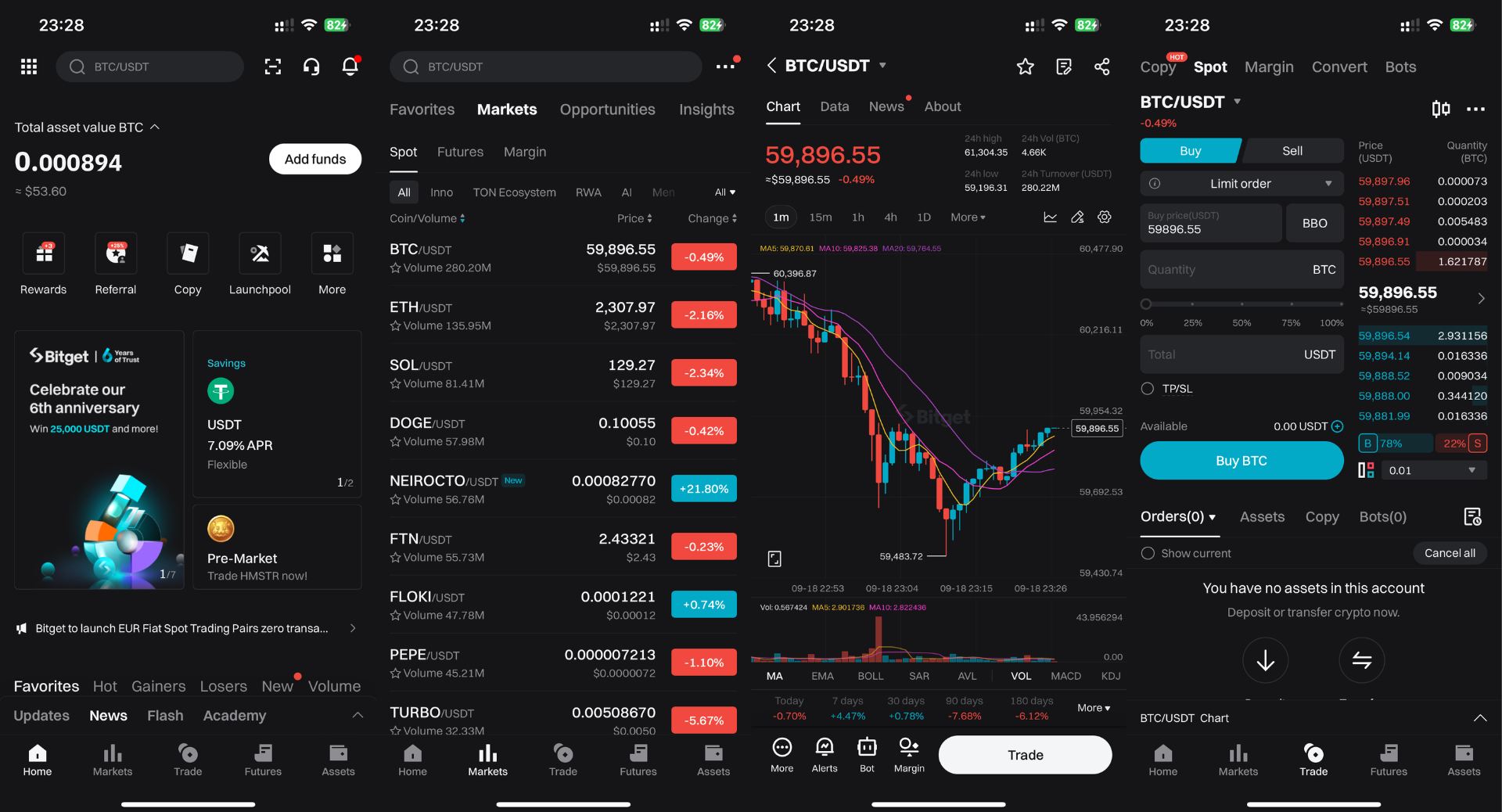

At its core, Bitget’s Recurring Buy feature allows users to schedule automated purchases of leading cryptocurrencies such as Bitcoin and Ethereum using Visa or Mastercard. Investors can choose daily, weekly, or monthly intervals, letting the system execute buys on their behalf with zero manual intervention. This isn’t just a convenience upgrade, it’s a fundamental shift in how passive investing cryptocurrency works.

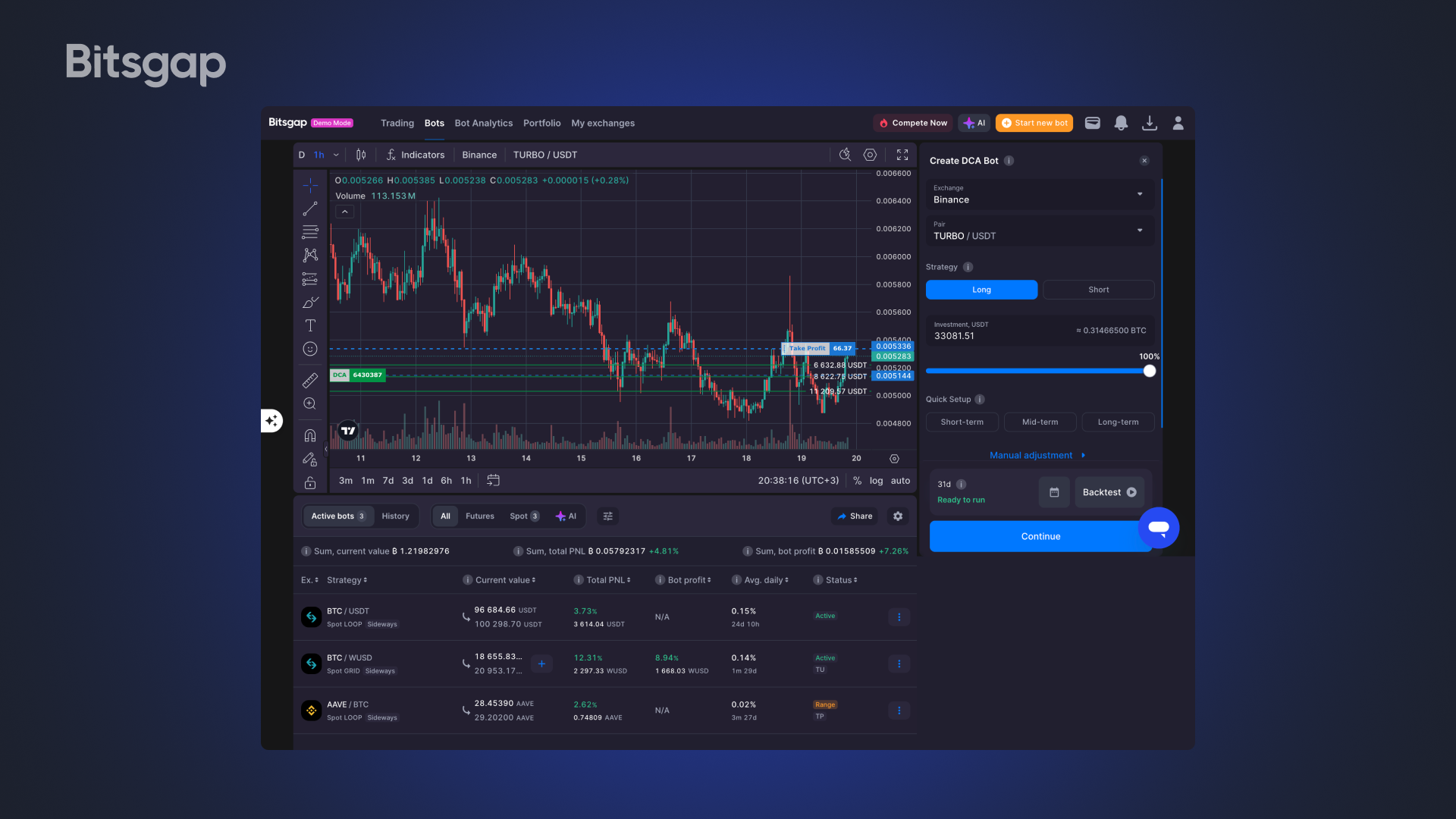

The underlying strategy here is dollar cost averaging (DCA). Instead of trying to time the market (a notoriously difficult feat), DCA involves buying fixed amounts at regular intervals regardless of price. Over time, this smooths out the impact of volatility and reduces the risk of making large purchases at market highs. According to recent data, investors leveraging Bitget’s Recurring Buy with DCA have seen returns as high as 30% during bullish cycles.

How Does Bitget Auto-Buy Work?

The brilliance of Bitget’s approach lies in its seamless execution. Users simply set up their recurring purchase plan, defining which asset to buy, how much, and how often, and connect their preferred payment method. Once configured, the platform handles everything automatically:

Key Benefits of Bitget Auto-Buy for Passive Investors

-

Automated Dollar Cost Averaging (DCA): Bitget Auto-Buy lets users schedule crypto purchases at fixed intervals, executing the proven DCA strategy to help reduce the impact of market volatility and avoid emotional trading decisions.

-

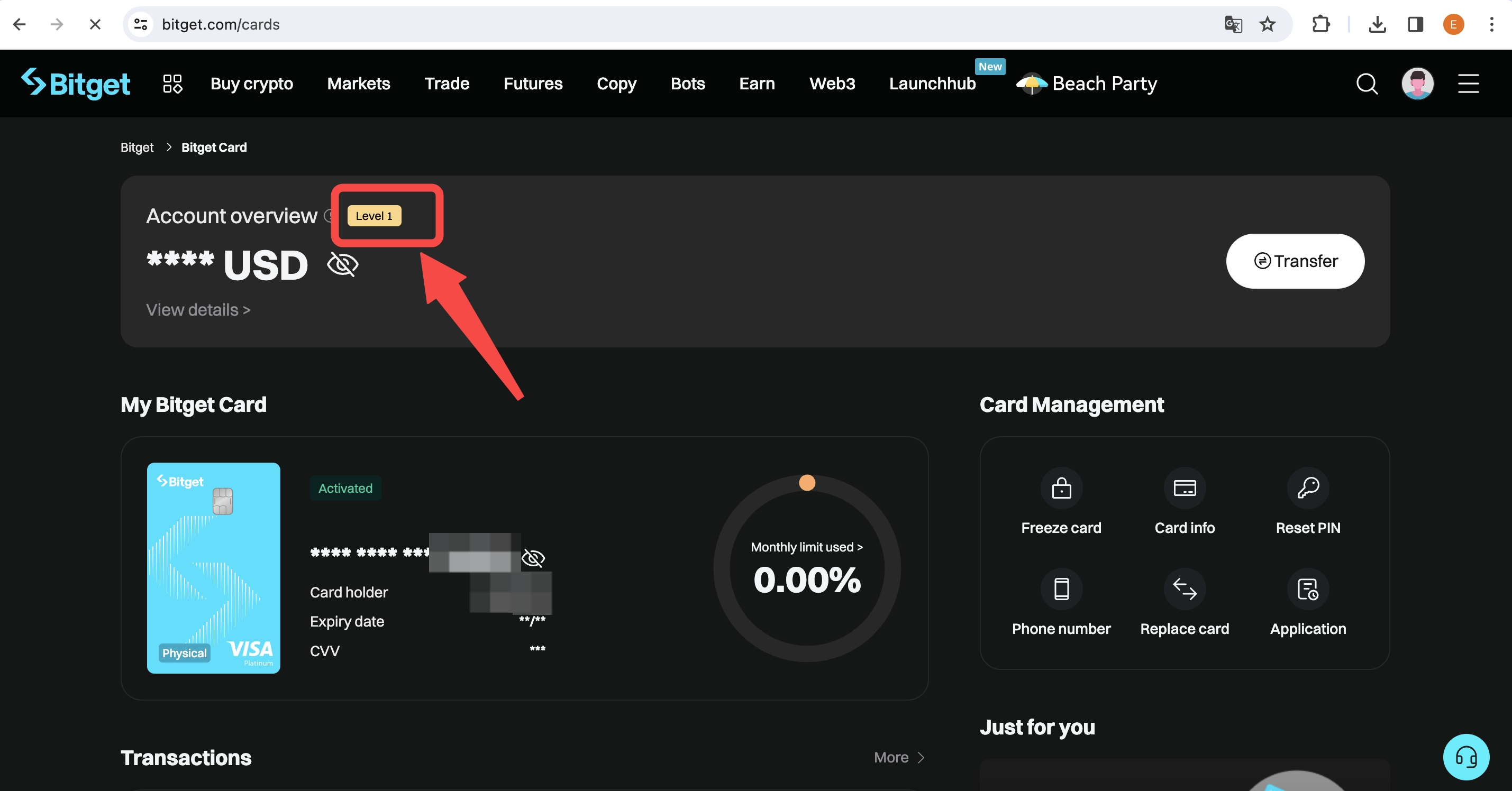

Seamless Card Payments: Investors can fund recurring purchases directly with Visa or Mastercard, eliminating the need for manual bank transfers or deposits and enabling instant execution.

-

Hands-Free Investing Experience: Once set up, the system automatically executes scheduled buys, allowing users to invest in Bitcoin, Ethereum, and other supported assets without further intervention.

-

Integrated Flexible Savings for Extra Yield: With Spot Auto-Invest+, purchased assets are deposited into Bitget Flexible Savings, enabling users to earn daily passive income and compound returns while maintaining liquidity.

-

Consistent Portfolio Growth: Automated recurring buys help users steadily build their crypto portfolios over time, regardless of short-term market fluctuations, making passive investing more accessible and strategic.

This frictionless experience eliminates common pain points like manual timing or delayed bank transfers. Notably, direct card payments ensure that investments are executed instantly at each scheduled interval. For those wondering how to automate crypto buying securely in 2025, this is about as streamlined as it gets.

Sophie Mercer says: “Options are opportunities, manage them wisely. With automated tools like Bitget Auto-Buy, even beginners can build disciplined portfolios without second-guessing every market move. “

Beyond Simple Buying: Spot Auto-Invest and and Flexible Savings

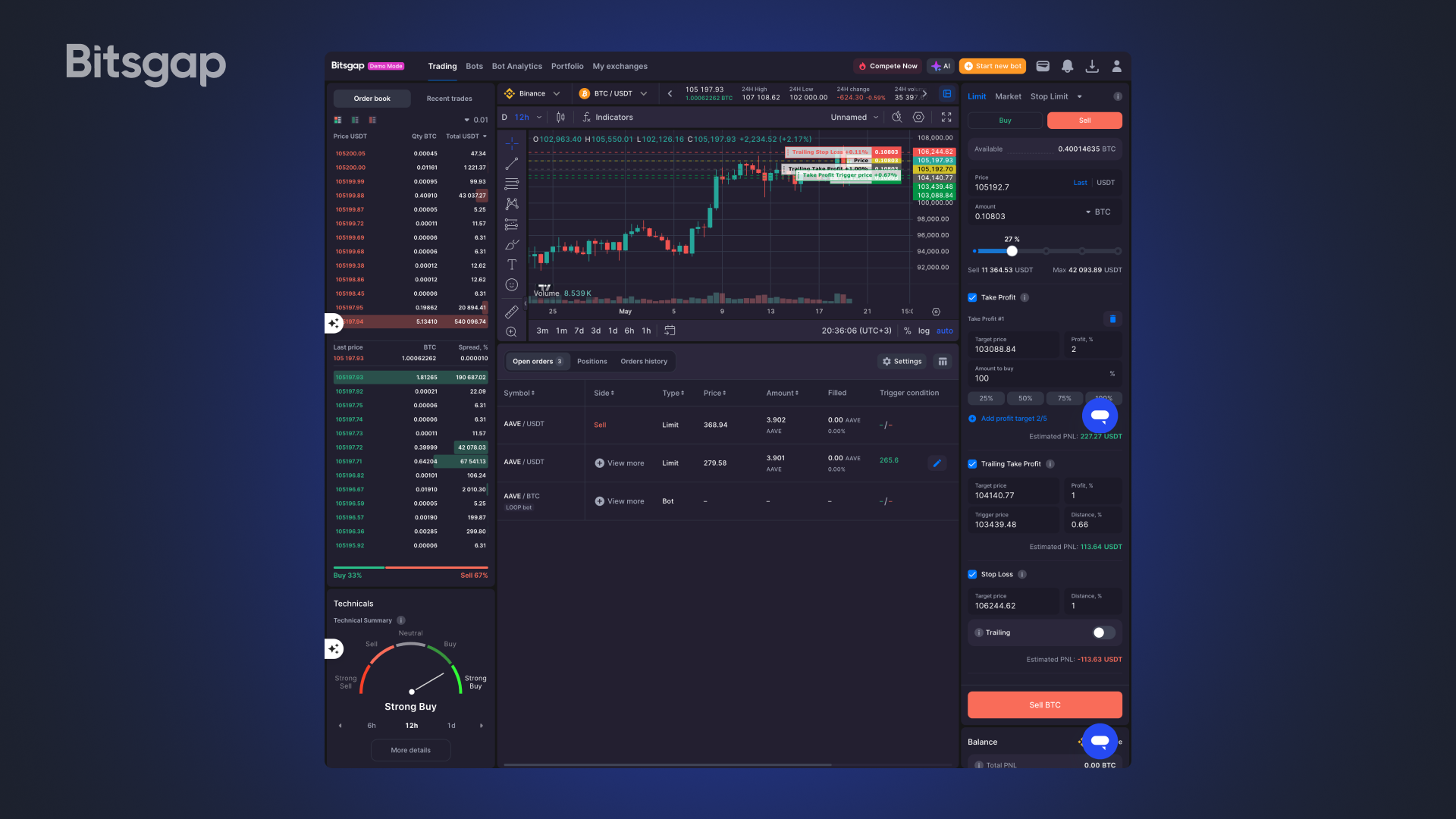

Bitget hasn’t stopped at recurring purchases alone. Its Spot Auto-Invest and feature takes passive investing up a notch by integrating automated buys with Flexible Savings accounts. Here’s how it works: after each scheduled purchase, your newly acquired crypto is automatically deposited into Flexible Savings where it begins earning daily interest, compounding your returns over time while maintaining liquidity.

This dual approach empowers users not only to accumulate assets steadily but also to maximize yield on idle balances, a critical edge in today’s competitive landscape for passive investors seeking both growth and income.

DCA vs Recurring Buy: What’s the Real Difference?

A common point of confusion is distinguishing between DCA as a strategy and recurring buy as an automation tool. As outlined in Bitget’s official guide, DCA refers purely to the investment philosophy, regularly buying fixed amounts regardless of price. Recurring buy is simply the mechanism that automates this process for you.

Key Differences: DCA Strategy vs. Recurring Buy Automation

-

Conceptual Approach: Dollar Cost Averaging (DCA) is an investment strategy where investors buy a fixed dollar amount of cryptocurrency at regular intervals, regardless of price. In contrast, Recurring Buy is an automation tool—like Bitget’s new feature—that executes scheduled purchases to implement the DCA strategy automatically.

-

Execution Method: DCA requires investors to manually place orders at set intervals, which can be time-consuming and prone to missed opportunities. Recurring Buy automation (as on Bitget, Binance, or Bybit) automates the process, executing purchases on a preset schedule without manual intervention.

-

Payment Flexibility: Platforms like Bitget allow direct card payments (Visa/Mastercard) for recurring buys, offering a seamless on-ramp. Traditional DCA often relies on manual bank transfers or wallet funding, which can delay execution.

-

Emotional Discipline: Manual DCA can be affected by investor emotions, leading to skipped or mistimed purchases. Recurring Buy automation removes emotional bias, ensuring consistent execution and adherence to the investment plan.

-

Integration with Passive Income Tools: Bitget’s Spot Auto-Invest+ not only automates DCA but also integrates with Flexible Savings, allowing users to earn daily passive income on their holdings—compounding returns over time. Manual DCA does not automatically offer this benefit.

-

Accessibility and User Experience: Automated recurring buy features on leading exchanges like Bitget, Binance, and Bybit provide a user-friendly experience for both beginners and experienced investors, while manual DCA may require more technical know-how and active management.

This distinction matters because automation removes human error from the equation, no more missed buys due to forgetfulness or hesitation during volatile swings. It also frees up mental bandwidth so investors can focus on broader portfolio strategy rather than day-to-day execution.

With Bitget’s Recurring Buy and Auto-Buy features, the days of setting calendar reminders or reacting impulsively to market headlines are fading fast. Instead, investors can rely on a system that executes their chosen strategy with precision and discipline, two qualities that are notoriously hard to maintain in the world of crypto volatility.

Why Passive Investing Cryptocurrency is Thriving in 2025

The surge in popularity for passive investing cryptocurrency options isn’t just about convenience. It’s also a response to the growing sophistication of the crypto market itself. As exchanges like Bitget continue to innovate, they’re making secure crypto investment strategies more accessible for all risk profiles.

In 2025, automation is not a luxury, it’s a necessity. With markets running 24/7 and prices swinging by thousands of dollars in a single session, even seasoned traders can struggle to stay on top of opportunities. Bitget’s tools level the playing field by offering:

Top Reasons Crypto Recurring Purchases Are Surging in 2025

-

Dollar Cost Averaging (DCA) Made Simple: Recurring buy tools automate the DCA strategy, allowing users to invest fixed amounts at regular intervals. This can help mitigate market volatility and smooth out purchase prices over time.

-

Seamless Card Payments for Instant Execution: Bitget’s Recurring Buy enables direct Visa and Mastercard payments, providing a frictionless on-ramp and ensuring timely, hands-free investments without waiting for bank transfers.

-

Compounding Returns with Auto-Invest+ and Flexible Savings: Bitget’s Spot Auto-Invest+ automatically deposits purchased crypto into Flexible Savings, allowing users to earn daily passive income and compound their returns.

-

Wide Platform Support and Token Access: Leading exchanges like Bitget, Binance, OKX, and Bybit support recurring buys for hundreds of cryptocurrencies, making it easy to build a diversified portfolio with minimal effort.

-

Accessibility for All Investors: Automated recurring purchases lower the barrier to entry, making passive crypto investing accessible to both beginners and experienced traders without requiring constant market monitoring.

For those who want to build wealth without being glued to their screens, these features represent a strategic advantage. They allow you to participate in potential upside, such as the 30% ROI reported by users during bullish cycles: while managing downside risk through disciplined accumulation.

How to Automate Crypto Buying with Bitget

Getting started couldn’t be more intuitive. Here’s a quick overview for anyone ready to put their portfolio on autopilot:

Once your plan is active, you can monitor progress through Bitget’s dashboard and adjust parameters at any time, without interrupting your investment flow. This flexibility is especially valuable as your financial goals or market conditions evolve.

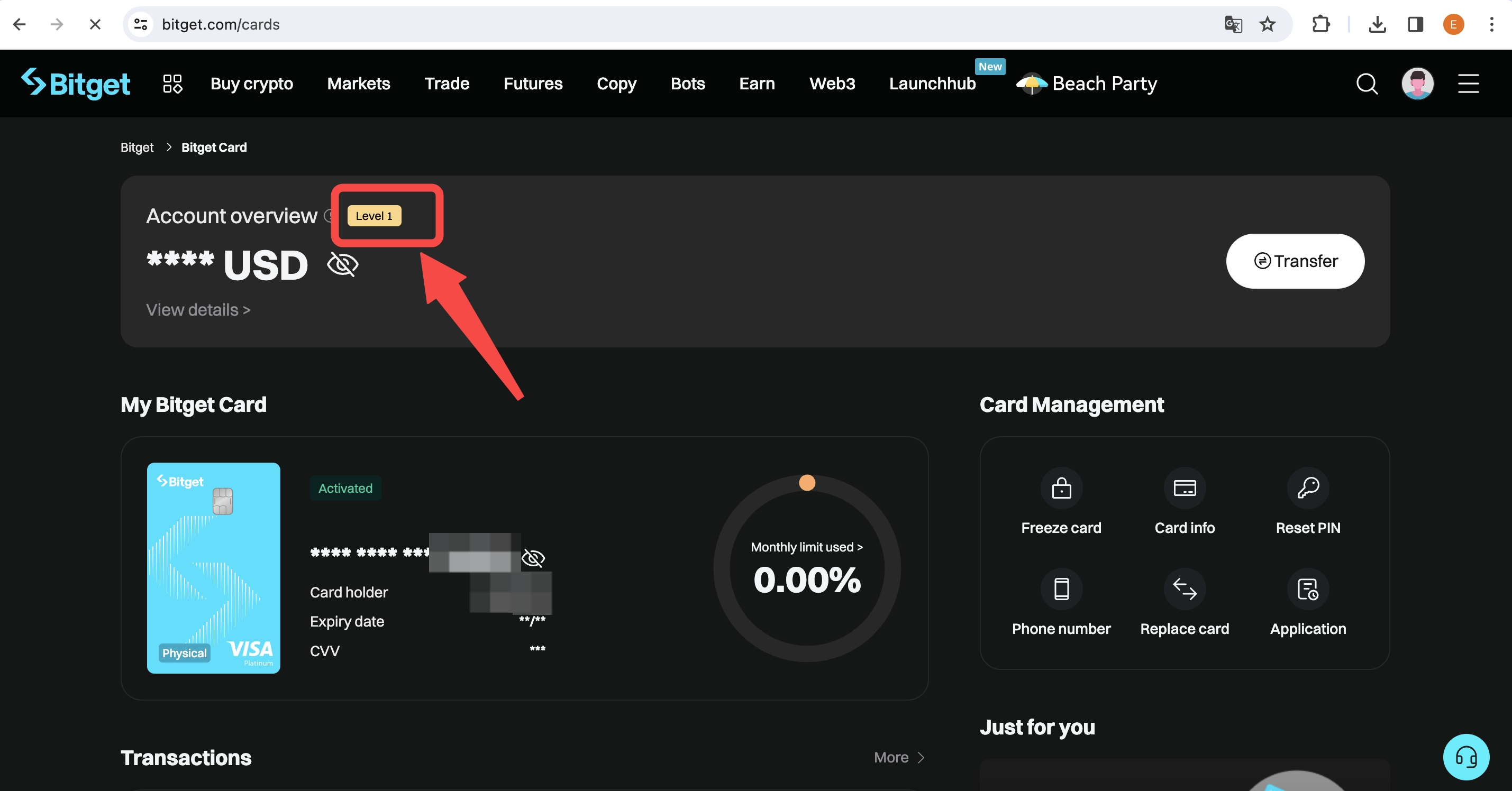

Security and Trust: The Foundation of Passive Crypto Investing

Of course, no discussion about secure crypto investment strategies would be complete without addressing security. Bitget has consistently ranked among the top three global derivatives exchanges for liquidity depth and institutional readiness (source). Their robust infrastructure, combined with transparent processes around recurring buys and flexible savings, gives investors peace of mind that their assets, and their investment plans, are safeguarded.

Sophie Mercer says: “The best passive strategies are built on discipline and automation, not luck or guesswork. Bitget’s Auto-Buy is helping democratize these principles for everyone entering the digital asset space. “

The Future: Compounding Returns Without Compounding Stress

The evolution of passive investing cryptocurrency platforms like Bitget signals a broader shift toward smarter, more resilient wealth-building tactics. By automating both accumulation (via recurring buy) and yield generation (through Flexible Savings), users can enjoy compounding returns without compounding stress.

If you’re seeking hands-off exposure to digital assets, or want to add structure to an existing portfolio, these innovations offer both simplicity and sophistication. The result? More investors are empowered to pursue financial independence through secure, automated crypto investing.